Table of Contents

- [What Does an Inspector General Do?](#what-does-an-inspector-general-do)

- [Average Inspector General Salary: A Deep Dive](#average-inspector-general-salary-a-deep-dive)

- [Key Factors That Influence an Inspector General's Salary](#key-factors-that-influence-an-inspector-generals-salary)

- [Job Outlook and Career Growth for Inspectors General](#job-outlook-and-career-growth-for-inspectors-general)

- [How to Become an Inspector General or Work in an OIG](#how-to-become-an-inspector-general-or-work-in-an-oig)

- [Conclusion: Is a Career in the Office of the Inspector General Right for You?](#conclusion-is-a-career-in-the-office-of-the-inspector-general-right-for-you)

For those driven by an unwavering commitment to integrity, accountability, and public service, a career within an Office of the Inspector General (OIG) represents one of the most impactful paths available. These roles are not merely jobs; they are positions of immense trust, serving as the independent watchdogs for government agencies, charged with rooting out fraud, waste, and abuse. The allure of this career is twofold: the profound sense of purpose and the substantial financial and professional rewards. While the inspector general salary can be very competitive, often ranging from $90,000 for experienced investigators to well over $220,000 for top-level executives, the true compensation lies in safeguarding taxpayer dollars and reinforcing public trust.

I once had the privilege of consulting on a data analytics project for a federal agency, where I worked alongside a team from their OIG. The lead investigator, a sharp-witted woman with a background in forensic accounting, told me, "We’re not here to make friends; we’re here to make a difference. Every dollar we recover is a dollar that can go back to its intended purpose—helping people." That sentiment perfectly encapsulates the ethos of this demanding yet deeply fulfilling profession. It is a career for the meticulous, the courageous, and the incorruptible.

This comprehensive guide will serve as your definitive resource, whether you are a college student charting your future, a mid-career professional seeking a more meaningful role, or an experienced investigator or auditor aiming for the pinnacle of public oversight. We will dissect every facet of the inspector general salary, explore the factors that shape your earning potential, and provide a clear, actionable roadmap to launching and advancing a career in this vital field.

What Does an Inspector General Do?

An Inspector General (IG) and the office they lead, the Office of the Inspector General (OIG), operate as autonomous oversight entities within federal, state, or even large municipal government agencies. Established by the Inspector General Act of 1978 at the federal level, their core mission is to promote economy, efficiency, and effectiveness in the administration of—and to prevent and detect fraud, waste, and abuse in—the programs and operations of their parent organization.

Think of an OIG as the internal affairs division and an efficiency consulting firm rolled into one, but with complete independence from the agency's leadership. The Inspector General reports directly to the head of the agency and to the legislative body (e.g., U.S. Congress or a state legislature), ensuring their findings are not suppressed or altered.

Their responsibilities are typically divided into two primary functions:

1. Audits and Evaluations: The audit division functions much like a high-level external audit firm. Teams of auditors, evaluators, and analysts conduct performance audits and financial audits to determine if agency programs are meeting their stated goals, if funds are being spent appropriately and in compliance with laws and regulations, and if there are opportunities for greater efficiency. They produce detailed public reports with recommendations for improvement, which the agency is often required to respond to.

2. Investigations: The investigations division operates as a specialized law enforcement unit. It is staffed by credentialed special agents (criminal investigators) who have the authority to carry firearms, make arrests, and execute search warrants. They investigate allegations of criminal, civil, and administrative wrongdoing involving agency employees, contractors, and beneficiaries of agency programs. This can include everything from an employee accepting a bribe to a contractor submitting fraudulent invoices for millions of dollars to complex cyber intrusions.

Typical Projects and Daily Tasks

The work within an OIG is project-based and incredibly varied. One day an auditor might be poring over grant documentation for a multi-billion dollar infrastructure project, while an investigator is conducting surveillance on a subject suspected of healthcare fraud.

- Auditors and Analysts: Reviewing financial statements, analyzing massive datasets to identify anomalies, interviewing program managers, mapping out internal controls, and writing comprehensive, evidence-based reports.

- Criminal Investigators (Special Agents): Developing confidential informants, conducting interviews with subjects and witnesses, writing affidavits for search warrants, analyzing financial records and digital evidence, working with prosecutors from the Department of Justice or State Attorney General's office to build a case, and testifying in court.

### A Day in the Life of an OIG Criminal Investigator

To make this tangible, let's imagine a day for "Agent Sarah Chen," a mid-career criminal investigator at the Department of Health and Human Services OIG (HHS-OIG).

- 8:00 AM: Sarah arrives at the office and checks secure emails. She receives an update from an Assistant U.S. Attorney on a Medicare fraud case she’s been working on for six months. They need her to help prepare a key witness for an upcoming grand jury testimony.

- 9:30 AM: She meets with a data analyst on her team. The analyst has identified a suspicious billing pattern from a medical clinic in Miami, showing thousands of claims for expensive procedures on days the clinic was reportedly closed. This is a strong lead for a new investigation.

- 11:00 AM: Sarah spends two hours meticulously drafting an affidavit for a search warrant for the clinic's records, detailing the probable cause she's developed. This requires absolute precision and a deep understanding of legal standards.

- 1:00 PM: Lunch is a quick sandwich at her desk while reviewing bank records obtained via subpoena for another case involving prescription drug diversion.

- 2:00 PM: Sarah and her partner conduct a pre-planned, non-custodial interview with an employee of a large hospital system who has come forward as a whistleblower. They build rapport, listen carefully, and gather critical information about alleged kickbacks between the hospital and a medical device manufacturer.

- 4:30 PM: Back at the office, she spends the last part of her day documenting the interview in a formal report of investigation, ensuring every detail is captured accurately. This report will become official evidence.

This example illustrates the high-stakes, detail-oriented, and mission-critical nature of the work. It is a far cry from a standard desk job, demanding a unique blend of analytical rigor, investigative instinct, and personal integrity.

Average Inspector General Salary: A Deep Dive

Analyzing the inspector general salary requires looking beyond a single national average. Compensation is highly structured, especially at the federal level, and varies significantly based on role, experience, and location. However, we can establish reliable benchmarks using government pay scales and data from reputable aggregators.

The vast majority of professional staff within a federal OIG—including auditors, investigators, analysts, and attorneys—are compensated according to the General Schedule (GS) pay system. The actual Inspector General and their top deputies are typically part of the Senior Executive Service (SES).

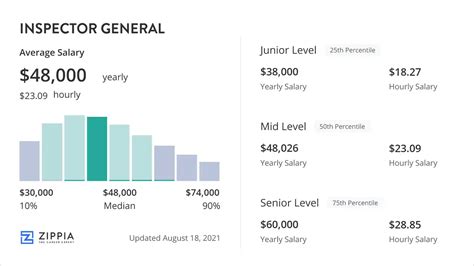

National Average and Salary Range

Across all levels of government (federal, state, local) and various roles within OIGs, the salary landscape is robust.

- Overall Average Salary: Data from sources like Salary.com and Glassdoor suggest a broad average salary for professionals in an OIG context (like "investigator" or "government auditor") falls between $110,000 and $135,000 per year.

- Payscale.com reports that a Criminal Investigator's salary has a wide range, often from $65,000 to over $164,000, which aligns with the GS scale progression.

- Salary.com (as of late 2023/early 2024) places the median salary for a top-level role like "Chief Auditing Executive" in the range of $210,000 to $290,000, which is consistent with the SES pay scale for an actual Inspector General at a large agency.

The most accurate picture, however, comes from the official U.S. Office of Personnel Management (OPM) pay tables.

### Federal OIG Salary Brackets by Experience Level (Using 2024 General Schedule)

The GS scale is divided into 15 grades, with 10 steps within each grade. Your location also adds a "locality pay" adjustment, which can significantly increase the base salary. The following table illustrates a typical career progression within a federal OIG, using the "Rest of U.S." locality pay for a conservative baseline and the Washington, D.C. locality pay (one of the highest) for comparison.

| Career Stage & Typical Role | GS Grade | Base Salary Range (Rest of U.S. Locality, 2024) | High-Cost Area Salary Range (Washington, D.C. Locality, 2024) |

| :--- | :--- | :--- | :--- |

| Entry-Level (Recent Graduate)

Auditor, Investigator Trainee | GS-7 / GS-9 | $49,024 - $76,984 | $57,887 - $90,899 |

| Mid-Career Professional

Journeyman Investigator/Auditor | GS-11 / GS-12 | $67,573 - $105,487 | $79,777 - $124,561 |

| Senior/Lead Professional

Senior Special Agent, Lead Auditor | GS-13 | $94,199 - $122,459 | $111,241 - $144,611 |

| Expert/Team Leader

Supervisory Agent, Audit Manager | GS-14 | $111,296 - $144,676 | $131,438 - $170,800* |

| Senior Manager/Division Head

Assistant Special Agent in Charge | GS-15 | $130,909 - $170,183 | $154,591 - $186,854* |

| Executive Leadership

Deputy IG, Inspector General | SES | $147,649 - $221,900 | $147,649 - $221,900 |

*\*Note: Some high-cost locality GS-14 and GS-15 salaries are capped by the rate for Level IV of the Executive Schedule ($186,854 in 2024).*

*Source: U.S. Office of Personnel Management (OPM) 2024 Salary Tables.*

As the table clearly shows, a career within a federal OIG offers a structured and highly lucrative progression. A professional can realistically expect to reach the GS-13 or GS-14 level within 7-10 years, putting them well into a six-figure salary, especially in major metropolitan areas.

### Breakdown of Total Compensation

The base salary is only one piece of the puzzle. The total compensation package, particularly in the federal government, is exceptionally strong and adds significant value.

- Locality Pay: As shown above, this is the single most significant addition to base pay. It's designed to make federal salaries competitive with private sector jobs in high-cost-of-living areas. The D.C. locality pay is 33.26%, while San Francisco's is 44.15% (2024 figures).

- Law Enforcement Availability Pay (LEAP): This is a critical component for OIG criminal investigators. LEAP provides an additional 25% of base pay to compensate for the requirement to work, or be available to work, substantial amounts of unscheduled overtime. A GS-13, Step 1 Special Agent in D.C. with a base salary of $111,241 would earn an additional ~$27,810 in LEAP, bringing their total salary to nearly $140,000.

- Bonuses and Performance Awards: While not as common as in the private sector, OIGs do have budgets for performance-based cash awards and Quality Step Increases (QSI), which is an extra step increase on the GS scale awarded for exceptional performance.

- Retirement Benefits (The "Three-Legged Stool"):

1. FERS Basic Benefit (Pension): A defined-benefit pension plan that provides a monthly annuity in retirement. This is increasingly rare in the private sector.

2. Thrift Savings Plan (TSP): A defined-contribution plan, similar to a 401(k). The government provides an automatic 1% contribution and matches employee contributions up to an additional 4%, for a total of 5% in government contributions.

3. Social Security: Standard social security benefits.

- Health and Life Insurance: Access to the Federal Employees Health Benefits (FEHB) Program, with a wide variety of plans and significant government premium subsidies. Access to affordable group life insurance (FEGLI) is also standard.

- Paid Leave: Federal employees receive 13 days of sick leave per year (which accrues indefinitely) and start with 13 days of annual leave (vacation), which increases to 20 days after 3 years and 26 days after 15 years of service.

When you combine the base salary, locality pay, potential LEAP, and the monetary value of the unparalleled benefits package, the total compensation for a career in a federal OIG is among the most competitive and stable available in any profession.

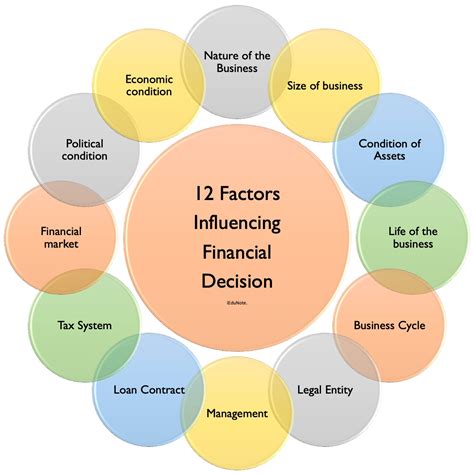

Key Factors That Influence an Inspector General's Salary

While the government pay scales provide a clear framework, several key variables determine an individual's starting salary, earning potential, and career trajectory within an Office of the Inspector General. Understanding these factors is crucial for maximizing your compensation.

###

1. Level of Education and Certifications

Your educational background and professional credentials are the foundation of your career and a primary determinant of your starting GS grade.

- Bachelor's Degree (The Minimum): A bachelor's degree is the standard entry requirement.

- To qualify for GS-7: You typically need a bachelor's degree with "Superior Academic Achievement" (a 3.0 GPA or higher, or standing in the upper third of your class).

- Relevant Fields: Accounting, Finance, Criminal Justice, Public Administration, Computer Science, and Law are highly sought after. A degree in Accounting is often a prerequisite for auditor positions.

- Master's Degree or Juris Doctor (J.D.): An advanced degree is a significant advantage and can allow you to enter at a higher grade.

- To qualify for GS-9: A master's degree (or equivalent graduate degree) or two full years of progressively higher-level graduate education is often sufficient. A J.D. also typically qualifies an applicant for the GS-9 level.

- Impact: A Master's in Public Administration (MPA), Master of Business Administration (MBA), or Master of Science in Accounting/Forensics demonstrates specialized knowledge that is directly applicable to OIG work and signals a capacity for senior-level analysis. A J.D. is invaluable for investigators and attorneys within the OIG.

- Professional Certifications (The Salary Multipliers): Certifications are critical for advancement and can make you a far more competitive candidate.

- Certified Public Accountant (CPA): The gold standard for auditors. Possessing a CPA can be a prerequisite for promotion to supervisory audit roles and demonstrates an elite level of financial expertise.

- Certified Fraud Examiner (CFE): Highly valued for both auditors and investigators. The CFE credential shows proficiency in fraud prevention, detection, and investigation. It is often a preferred qualification on job announcements.

- Certified Internal Auditor (CIA) / Certified Government Auditing Professional (CGAP): Offered by The Institute of Internal Auditors (IIA), these are globally recognized certifications that validate expertise in internal audit principles and government auditing practices, respectively.

- Certified Information Systems Auditor (CISA): For those specializing in IT audits and cybersecurity oversight, the CISA is essential. This specialization is in high demand and can lead to faster promotions and higher starting salaries due to the technical skills involved.

An applicant with a Master's degree and a CFE or CPA certification is in a prime position to negotiate for a higher step within their starting grade (e.g., GS-9, Step 5 instead of Step 1) and will be fast-tracked for promotions to the GS-12 and GS-13 levels.

###

2. Years and Type of Experience

Experience is the single most important factor in progressing up the GS scale. The government values demonstrated, relevant experience above all else.

- Entry-Level (0-3 Years): Typically hired at the GS-7 or GS-9 level. This stage is focused on learning the fundamentals under close supervision, whether it's basic audit procedures or investigative techniques.

- Mid-Career (4-10 Years): This is where significant salary growth occurs. Professionals progress from GS-11 to GS-12 and then to the crucial GS-13 grade. At this stage, you are expected to be a fully independent, journeyman-level professional capable of leading components of a complex audit or investigation.

- GS-13 Salary (Washington, D.C.): $111,241 - $144,611

- GS-13 with LEAP (Washington, D.C.): ~$139,051 - ~$180,763

- Senior/Supervisory (10-15+ Years): Promotion to GS-14 and GS-15 marks the transition into management. These roles involve supervising teams, managing multi-million dollar audit projects, or overseeing complex, multi-jurisdictional criminal investigations as a Supervisory Special Agent.

- GS-14 Salary (Washington, D.C.): $131,438 - $170,800

- GS-15 Salary (Washington, D.C.): $154,591 - $186,854

- Executive Level (15+ Years): The pinnacle of the OIG career path is appointment to the Senior Executive Service (SES). This includes roles like Assistant Inspector General for a major directorate (e.g., Audits or Investigations), Deputy Inspector General, and the Inspector General themselves (who are often presidentially appointed and Senate-confirmed).

- SES Salary Range (Nationwide, 2024): $147,649 - $221,900. An IG at a large cabinet-level agency will earn at the top of this range.

The *type* of prior experience is also critical. Experience as an investigator with the FBI, DEA, or IRS-CI, or as an auditor with a "Big Four" accounting firm (Deloitte, EY, PwC, KPMG) is considered highly valuable and can allow a candidate to be hired "laterally" at a higher GS grade, such as GS-12 or GS-13, rather than starting at the bottom.

###

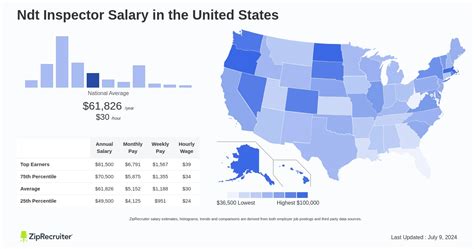

3. Geographic Location

As highlighted in the salary table, where you work has a dramatic impact on your take-home pay due to OPM's locality pay system.

- High-Cost Areas: Major metropolitan areas with high costs of living and competitive private sector markets receive the largest locality adjustments.

- San Francisco-Oakland-San Jose, CA: 44.15% adjustment

- Los Angeles-Long Beach, CA: 35.53% adjustment

- New York-Newark, NY-NJ-CT-PA: 37.24% adjustment

- Washington-Baltimore-Arlington, DC-MD-VA-WV-PA: 33.26% adjustment

- Lower-Cost Areas: The "Rest of U.S." locality pay is the baseline, currently 16.82%. A GS-13, Step 1 salary in Huntsville, Alabama ($94,199) is significantly different from the same position in San Francisco ($118,574).

- Impact on Career: Many OIG headquarters are located in Washington, D.C., meaning a high concentration of GS-14, GS-15, and SES positions are there. However, most large OIGs have field offices across the country, providing opportunities for high-paying careers in cities like Chicago, Atlanta, Denver, and Dallas. When applying, always check the OPM locality pay table for the specific location of the job.

###

4. Agency Type and Size

Not all OIGs are created equal. The size, budget, and mission of the parent agency directly influence the complexity of the work and the number of senior-level positions available.

- Large Cabinet-Level Federal OIGs: These are the largest and most well-funded offices. Examples include the Department of Health and Human Services (HHS) OIG, Department of Defense (DoD) OIG, and Department of Justice (DOJ) OIG.

- HHS-OIG: With a budget over $400 million and over 1,600 employees, it oversees trillions in healthcare spending. This scale creates numerous opportunities for specialization (e.g., hospital fraud, drug diversion) and a deep bench of GS-14, GS-15, and SES positions.

- DoD-OIG: Oversees the largest discretionary budget in the federal government, tackling massive contract fraud, cybersecurity vulnerabilities, and global logistics.

- Smaller Federal OIGs: Agencies like the National Science Foundation (NSF) OIG or the Small Business Administration (SBA) OIG are much smaller but offer unique opportunities. While there may be fewer GS-15 positions, the ability to work on a wider variety of cases and have a more direct impact can be very appealing.

- State and Municipal OIGs: Many states (like New York and Florida) and large cities (like Chicago and New Orleans) have their own OIGs.

- Salary Variation: Compensation at the state/local level can be more variable and may not always follow a rigid pay scale like the federal GS system. Salaries are often competitive for the local market but may not reach the peaks of the federal SES. For example, the Inspector General for the City of Chicago has a salary set by ordinance, which can be around $190,000-$200,000.

- Experience Transfer: Experience in a state or local OIG is highly respected and can be a great stepping stone to a federal OIG position.

###

5. Area of Specialization

Within the broad fields of auditing and investigations, developing a niche specialization can significantly accelerate your career and earning potential.

- Cybersecurity/IT Audits: This is arguably the most in-demand specialty. OIGs are mandated to audit their agency's information security programs. Professionals with skills in network security, penetration testing, digital forensics, and FedRAMP (Federal Risk and Authorization Management Program) are in short supply and high demand. They may be hired at higher steps or on special salary rates.

- Data Science and Analytics: OIGs are increasingly using advanced data analytics to proactively identify fraud. Auditors and investigators who can use tools like Python, R, SQL, and data visualization software (like Tableau) to analyze vast datasets are invaluable. This skillset is a major differentiator for promotion.

- Healthcare Fraud: With programs like Medicare and Medicaid representing trillions in spending, healthcare fraud is a massive focus for HHS-OIG and the DOJ. Investigators and auditors with a clinical background (e.g., former nurses) or deep knowledge of medical billing codes are highly sought after.

- Contract and Procurement Fraud: At agencies like DoD, Department of Energy, and NASA, overseeing multi-billion dollar contracts is a primary function. Experts in the Federal Acquisition Regulation (FAR), cost accounting standards, and defective pricing are critical.

- Financial Institution Fraud: OIGs at the Treasury, FDIC, and Federal Reserve Board specialize in complex financial crimes, requiring a deep understanding of banking regulations and financial markets.

###

6. In-Demand Skills

Beyond formal qualifications, a specific set of hard and soft skills directly translates to higher performance, faster promotions, and thus a higher salary over your career.

High-Value Hard Skills:

- Forensic Accounting

- Data Analytics (SQL, Python, R)

- E-Discovery and Digital Forensics (EnCase, FTK)

- Public-Key Infrastructure (PKI) and Cybersecurity Analysis

- Federal Acquisitions and Contract Law (FAR)

- Advanced statistical modeling

**Essential