Have you ever wondered what it takes to build a career with virtually unlimited income potential, one where your effort directly translates to your earnings, all while providing a vital service that protects families and businesses? If you're driven, entrepreneurial, and enjoy building relationships, the role of an insurance producer might be the high-reward career you've been searching for.

While many see insurance as a complex and perhaps unglamorous industry, the reality for a successful producer is a dynamic career filled with problem-solving, strategic consulting, and significant financial opportunity. The national average insurance producer salary often hovers around $60,000 to $70,000 per year, but this figure is merely the starting point. Top producers in specialized fields regularly earn well into the six-figure range, with many exceeding $250,000 annually. This isn't a typical salaried job; it's a profession where you build a business within a business, and your income reflects the value you create.

I remember when a severe storm caused a massive tree to fall on my childhood home. The sound was deafening, and the damage was terrifying. Amid the chaos, our family's insurance producer, a man named Mr. Henderson, was the first person my parents called after ensuring we were all safe. He wasn't just a salesperson; he was a calm, reassuring presence who guided us through every step of the claims process. Witnessing his expertise and genuine care transform a crisis into a manageable situation taught me that a great insurance producer doesn't just sell policies—they deliver peace of mind and are instrumental in helping people rebuild their lives.

This comprehensive guide will pull back the curtain on the insurance producer profession. We will dissect everything from typical earnings and the factors that drive them to the long-term career outlook and a step-by-step plan to get you started.

### Table of Contents

- [What Does an Insurance Producer Do?](#what-does-an-insurance-producer-do)

- [Average Insurance Producer Salary: A Deep Dive](#average-insurance-producer-salary-a-deep-dive)

- [Key Factors That Influence an Insurance Producer's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Become an Insurance Producer](#how-to-become-an-insurance-producer)

- [Conclusion: Is a Career as an Insurance Producer Right for You?](#conclusion)

What Does an Insurance Producer Do?

At its core, an insurance producer—also commonly known as an insurance agent or broker—is a licensed professional who solicits, negotiates, and sells insurance policies on behalf of an insurance company or multiple companies. However, this definition barely scratches the surface of the role's true function. A successful producer is a trusted advisor, a risk manager, a skilled negotiator, and a dedicated client advocate.

Their primary responsibility is to help individuals, families, and businesses identify their unique risks and then find the most appropriate and cost-effective insurance solutions to mitigate them. This goes far beyond simply quoting a price for an auto or home policy. It involves a deep, consultative process to understand a client's life, assets, business operations, and future goals.

Core Responsibilities and Daily Tasks:

An insurance producer's work is incredibly varied, blending sales, marketing, customer service, and financial analysis. Here’s a breakdown of their key activities:

- Prospecting and Lead Generation: This is the lifeblood of the business. Producers actively seek new clients through various channels: networking events, professional referrals (from real estate agents, mortgage lenders, accountants), cold calling, social media marketing, and community involvement.

- Needs Analysis: This is the crucial consultative phase. A producer sits down with a potential client to conduct a thorough risk assessment. For a family, this might involve discussing life insurance needs based on income and dependents, ensuring adequate liability coverage on their home, or planning for long-term care. For a business, this could involve analyzing risks related to cyber threats, employee liability, or supply chain disruptions.

- Developing and Presenting Proposals: After identifying the client's needs, the producer researches and compares policies from the carrier(s) they represent. They then create a customized proposal that outlines the recommended coverage, explains the benefits and limitations, and details the premiums. Presenting this proposal effectively is a key sales skill.

- Closing the Sale: This involves answering the client's questions, addressing any objections, and guiding them through the application process. It’s about building trust and demonstrating that the proposed solution is in their best interest.

- Policy Servicing and Client Relationship Management: The job doesn't end once the policy is sold. Producers are the primary point of contact for their clients. They handle policy changes (like adding a new car), answer billing questions, and provide support and advocacy during the claims process. Building a long-term relationship based on excellent service is key to retaining clients and generating renewal commissions.

- Continuing Education: The insurance industry is constantly evolving with new regulations, products, and risks. Producers are required to complete ongoing education courses to maintain their licenses and stay current on industry trends, ensuring they can provide the best possible advice.

### A Day in the Life of a Commercial Lines Producer

To make this tangible, let's follow "Maria," a mid-career commercial lines insurance producer.

- 8:00 AM - 9:30 AM: Maria starts her day at the office. She spends the first 90 minutes on "power hour" activities: responding to urgent client emails, following up on two new business leads from a networking event last week, and making a few cold calls to local construction companies, her area of specialization.

- 9:30 AM - 10:00 AM: She has a quick huddle with her team's underwriter to discuss a complex liability policy for a manufacturing client. They need to ensure the application is flawless before submitting it to the carrier.

- 10:00 AM - 12:00 PM: Maria drives to meet the owner of a growing logistics company. This is a fact-finding mission. She tours their warehouse, asks detailed questions about their fleet of vehicles, employee safety protocols, and cybersecurity measures. She takes extensive notes to prepare a comprehensive risk analysis.

- 12:00 PM - 1:00 PM: Lunch with a real estate attorney who is a key referral partner. They discuss market trends and exchange potential leads. Nurturing these relationships is critical for her business pipeline.

- 1:00 PM - 4:00 PM: Back at the office, Maria focuses on "desk work." She analyzes the notes from her morning meeting and begins building a proposal for the logistics company, which involves quoting General Liability, Commercial Auto, Workers' Compensation, and a Cyber Liability policy from three different carriers to find the best combination of coverage and price.

- 4:00 PM - 5:00 PM: She calls an existing client to conduct an annual policy review, ensuring their coverage is still adequate after a recent expansion. This proactive service strengthens the relationship and heads off potential coverage gaps.

- 5:00 PM Onward: Twice a month, Maria attends an evening event, such as a local Chamber of Commerce mixer or a trade association meeting, to network and build her professional presence in the community.

As you can see, the role is far from a simple 9-to-5 desk job. It requires discipline, excellent time management, and the ability to switch between analytical, social, and sales-oriented tasks seamlessly.

Average Insurance Producer Salary: A Deep Dive

Understanding the salary of an insurance producer is complex because, for most, it isn't a fixed number. It's a dynamic figure heavily influenced by commissions, bonuses, and the producer's own efforts. While this can seem daunting, it also represents the incredible opportunity for high earnings.

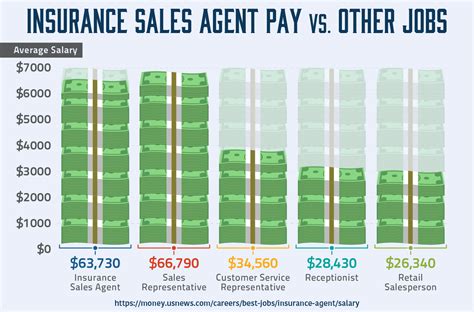

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for "Insurance Sales Agents" was $57,860 in May 2022. The BLS data indicates that the lowest 10 percent earned less than $30,810, and the highest 10 percent earned more than $131,880. It is crucial to note that the BLS often groups various types of agents together, and this figure can be skewed by salaried customer service roles or entry-level captive agents. *[Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Insurance Sales Agents, data as of September 2023]*.

To get a clearer picture that better reflects the commission-driven reality, we can look at data from major salary aggregators, which often capture a wider range of compensation structures.

- Salary.com reports the median salary for an Insurance Producer in the United States is $68,892 as of November 2023, with a typical range falling between $58,746 and $82,311. However, their data shows that top producers can reach well over $100,000.

- Payscale.com indicates a similar average base salary of around $52,190, but highlights that total pay, including bonuses and commissions, can range from $34,000 to $184,000. This wide range is a testament to the performance-based nature of the role.

- Glassdoor lists a national average salary of $72,551 for an Insurance Producer, based on user-submitted data as of December 2023.

The key takeaway is this: the "average" salary is just a midpoint. The real story lies in the compensation structure and the vast potential for growth as a producer builds experience and a client base.

### Salary Progression by Experience Level

An insurance producer's income trajectory is one of the most compelling aspects of the career. Unlike many professions with fixed salary bands, a producer's earnings can grow exponentially as they build their "book of business."

| Experience Level | Typical Timeframe | Average Total Compensation Range | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level Producer | 0-2 Years | $35,000 - $60,000 | Often starts with a base salary or draw plus lower commission rates. Focus is on learning, licensing, and prospecting. Income is primarily from new business. |

| Mid-Career Producer| 3-9 Years | $65,000 - $120,000 | A significant book of business has been built. Renewal commissions provide a stable income base, supplemented by ongoing new business commissions. May begin to specialize. |

| Senior/Top Producer| 10+ Years | $125,000 - $250,000+ | Possesses a large, mature book of business generating substantial renewal income. Recognized as an expert in a specific niche. May have agency ownership or leadership responsibilities. |

*(Salary ranges are estimates compiled from industry reports and aggregator data, and can vary significantly based on the factors discussed below.)*

### Deconstructing the Compensation Package

To truly understand an insurance producer's salary, you must look beyond a single number. The total compensation is a blend of several components:

1. Base Salary or Draw: Many producers, especially when starting out or working for a large brokerage, receive a modest base salary. This provides a safety net while they build their commission pipeline. A "draw" is similar—it's an advance against future commissions. For example, an agency might give a new producer a $3,000 monthly draw. If the producer earns $4,000 in commission, they receive the extra $1,000. If they only earn $2,000, they owe the agency $1,000, which is deducted from future earnings.

2. Commissions on New Business: This is the primary driver of income for new producers. When a producer sells a new policy, they earn a percentage of the premium. This percentage varies dramatically by product line. For example, Property & Casualty (P&C) policies might pay a 10-15% commission, while Life Insurance and Annuity policies can pay 50-100% or more of the first year's premium due to their complexity and long-term nature.

3. Renewal Commissions: This is the golden goose of the insurance industry and the key to long-term, high-level income. For each year a client keeps their policy, the producer receives a renewal commission. While the percentage is lower than the initial commission (e.g., 5-10% for P&C, 1-5% for life/health), it creates a stable, recurring revenue stream. A producer with a large book of business can earn a substantial income from renewals alone, providing a foundation that allows them to focus on acquiring larger, more profitable new clients.

4. Bonuses and Profit Sharing: Many agencies and carriers offer bonuses for hitting certain production goals, client retention targets, or profitability metrics. Some independent agencies also offer profit sharing, allowing successful producers to share in the overall success of the firm.

5. Contingency Bonuses: These are year-end bonuses paid by insurance carriers to agencies based on the overall performance (profitability and growth) of the book of business the agency placed with them. A portion of this contingency bonus is often passed down to the producers who contributed to that profitable growth.

This multi-faceted structure means that a producer's income is a direct reflection of their ability to sell, service, and retain clients. The first few years can be a grind, but the long-term rewards for those who persevere are significant.

Key Factors That Influence an Insurance Producer's Salary

While effort and sales acumen are paramount, several structural factors can dramatically impact a producer's earning potential. Aspiring producers should carefully consider these elements when planning their career path, as strategic choices early on can lead to much higher long-term income.

###

1. Area of Specialization and Product Lines

This is arguably the most significant factor determining income. Not all insurance is created equal in terms of complexity or commission.

- Personal Lines (P&L): This includes auto, homeowners, renters, and umbrella insurance for individuals. It is a volume-based game. While commissions per policy are relatively low, successful personal lines producers build a massive book of business through referrals and efficiency. It's an excellent entry point into the industry but generally has a lower income ceiling than commercial lines unless one owns a large agency.

- Commercial Lines / Property & Casualty (P&C): This involves insuring businesses against risks like property damage, general liability, workers' compensation, and commercial auto. Premiums are much larger than in personal lines, leading to significantly higher commission dollars per sale. Specializing in high-risk industries like construction, manufacturing, or technology can be particularly lucrative. A top commercial producer handling multi-million dollar accounts can easily earn deep into the six figures.

- Life and Health (L&H): This includes life insurance, disability insurance, long-term care insurance, and health insurance. Life insurance and annuity sales often carry the highest commission rates (sometimes over 100% of the first-year premium) because of the complexity and long-term nature of the sale. Producers specializing in high-net-worth estate planning or business succession planning are among the highest earners in the entire industry.

- Employee Benefits: A sub-specialty of L&H, this involves working with businesses to design and manage their employee health insurance and retirement plans. This creates a strong, sticky client relationship and significant renewal income. Producers in this space often act as high-level HR consultants for their clients.

The Bottom Line: While you can be successful in any line, specializing in more complex, higher-premium areas like commercial P&C or life insurance for business/estate planning offers a direct path to a higher insurance producer salary.

###

2. Geographic Location

Where you live and work plays a major role in your earning potential. This is driven by two main factors: cost of living and the concentration of high-value clients (both businesses and affluent individuals).

- High-Paying Metropolitan Areas: Major cities and their affluent suburbs typically offer the highest salaries. Areas with strong economies, numerous corporate headquarters, and a high concentration of wealth present more opportunities for large commercial accounts and high-net-worth personal clients. According to data from salary aggregators and industry reports, cities like New York, NY; San Francisco, CA; Boston, MA; and Stamford, CT consistently rank among the top-paying locations for insurance professionals.

- Average and Lower-Paying Regions: Salaries tend to be lower in rural areas and states with a lower cost of living. While the competition may be less fierce, the size and number of potential accounts are also smaller. States in the South and Midwest often report median salaries closer to the lower end of the national average.

Illustrative Salary Variation by State (Median Estimates):

- Massachusetts: ~$75,000

- New York: ~$74,000

- California: ~$71,000

- Texas: ~$65,000

- Florida: ~$62,000

- Mississippi: ~$54,000

*(Note: These are estimates for illustrative purposes, compiled from various data sources. Actual salaries will vary.)*

A producer in Manhattan focusing on financial institutions will have a vastly different income potential than a personal lines agent in rural Montana.

###

3. Company Type: Captive vs. Independent Broker

The structure of the agency you work for is a fundamental career choice with profound implications for your income and autonomy.

- Captive Agent: A captive agent works for a single insurance company, such as State Farm, Allstate, or Farmers Insurance.

- Pros: Strong brand recognition, extensive training and support, leads may be provided, and often a more structured path with a starting salary.

- Cons: You can only sell that one company's products, which may not always be the best fit for the client. Commission splits are generally lower than at an independent agency. There is less long-term flexibility and ownership of your book of business can be restricted.

- Salary Impact: More predictable income early on, but a lower long-term ceiling.

- Independent Agent / Broker: An independent agent works for an agency that represents multiple insurance carriers.

- Pros: Ability to shop the market and find the absolute best coverage and price for the client, which builds trust. Higher commission splits. You often have more ownership over your book of business, which becomes a saleable asset.

- Cons: You are typically responsible for your own lead generation. There is more administrative overhead and less brand-name support. The first few years can be a "feast or famine" cycle.

- Salary Impact: Lower initial stability but a significantly higher long-term income potential. The most successful and highest-earning producers are typically found in the independent channel.

- Direct Writer: Some companies like GEICO or Progressive primarily employ salaried agents in call centers. These roles offer stability and benefits but lack the commission-driven upside of a traditional producer role.

###

4. Years of Experience and Book of Business

As highlighted in the salary progression table, experience is directly correlated with income. This isn't just about "time served"; it's about the tangible asset a producer builds: their book of business.

- Years 1-2: The "grind" years. Income is almost entirely from new business commissions. The focus is on activity: prospecting, learning, and closing first sales.

- Years 3-5: The turning point. Renewal commissions start to form a noticeable, stable base of income. The producer has gained confidence, product knowledge, and a referral network.

- Years 10+: The "harvest" years. A mature book of business can generate a six-figure income from renewals alone. The senior producer can now be more selective, focusing their time on large, complex, and highly profitable new accounts, or on mentoring junior producers for an override commission. Their reputation generates a steady stream of high-quality referrals.

###

5. Level of Education and Professional Designations

While a bachelor's degree is not strictly required to become a producer (a high school diploma is the minimum), it is highly recommended and can influence career trajectory.

- Education: A degree in Business, Finance, Marketing, or Risk Management can provide a strong foundation and may be a prerequisite for joining elite training programs at large national brokerages like Marsh, Aon, or Gallagher.

- Professional Designations/Certifications: This is a powerful way to increase expertise and earning potential. Earning advanced designations signals a commitment to the profession and specialized knowledge. Key designations include:

- Chartered Property Casualty Underwriter (CPCU): The premier designation in P&C insurance. Often called the "PhD of insurance," it requires passing eight rigorous exams and demonstrates a deep understanding of risk management and insurance principles. CPCUs often hold leadership roles and command higher salaries.

- Certified Insurance Counselor (CIC): A highly respected designation focusing on the practical application of insurance knowledge for all lines.

- Chartered Life Underwriter (CLU): The equivalent of the CPCU for life insurance professionals, focusing on estate planning, business succession, and personal financial planning.

- Certified Risk Manager (CRM): A designation that positions the producer as a true risk management consultant, not just a policy salesperson.

Producers with these designations are better equipped to handle complex accounts, which naturally leads to higher commissions and greater client trust.

###

6. In-Demand Skills

Beyond formal qualifications, a specific set of skills separates top earners from the average producer.

- Masterful Communication and Interpersonal Skills: The ability to listen actively, explain complex topics simply, and build genuine rapport.

- Resilience and a Strong Work Ethic: The insurance sales cycle can be long, and rejection is common. The ability to persevere through tough months is essential.

- Negotiation and Persuasion: Skillfully advocating for clients with underwriters and persuasively presenting solutions.

- Financial Acumen: Understanding balance sheets, financial statements, and the economic drivers of a client's business or personal life.

- Technological Proficiency: Expertise in using Customer Relationship Management (CRM) software to manage pipelines, quoting platforms, and digital marketing tools for lead generation.

- Networking Prowess: The ability to build and nurture a professional network that consistently generates high-quality referrals.

Developing these skills is an ongoing process that directly translates to a higher and more stable insurance producer salary.

Job Outlook and Career Growth

For anyone considering a long-term career as an insurance producer, the future outlook is a critical piece of the puzzle. The industry is undergoing significant transformation, but the forecast for skilled, advisory-focused producers remains strong.

According to the U.S. Bureau of Labor Statistics (BLS), employment of insurance sales agents is projected to grow 6 percent from 2022 to 2032, which is faster than the average for all occupations. The BLS anticipates about 49,200 openings for insurance sales agents each year, on average, over the decade. Many of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire. *[Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Insurance Sales Agents, data as of September 2023]*.

This steady growth is underpinned by a fundamental reality: as long as people buy homes, drive cars, start businesses, and plan for the future, there will be a need for insurance. An aging population will continue to drive demand for life insurance, long-term care policies, and retirement annuities. Furthermore, a growing economy means more new businesses that require commercial insurance coverage.

### Emerging Trends and Future Challenges

The role of the insurance producer is not static. Technology, changing consumer expectations, and new types of risk are reshaping the landscape.

1. The Rise of Insurtech and Automation:

Technology is the most significant disruptive force. AI and algorithms can now instantly quote simple policies like auto or renters insurance online. This has led to a fear that agents will become obsolete.

- Challenge: Producers who only compete on price for simple, commoditized policies will struggle. They cannot beat the efficiency of a direct-to-consumer website.

- Opportunity: This technological shift elevates the role of the producer from a transactional salesperson to a sophisticated risk advisor. AI cannot replicate the empathy, critical thinking, and tailored advice needed for complex situations—a business owner's succession plan, a high-net-worth family's intricate asset protection strategy, or navigating a new risk like cyber liability. The future belongs to the producer who embraces technology to handle the simple tasks, freeing up their time to focus on high-value, consultative work.

**2. Increasing Risk