For ambitious professionals and top-tier students, a career in investment banking in New York City represents the pinnacle of finance. It's a world defined by high-stakes deals, immense intellectual challenges, and, most famously, extraordinary compensation. But what does an investment banker in the financial capital of the world actually earn? The answer is complex, with total compensation often soaring into the high six and even seven figures.

This guide breaks down the salary and bonus structure for NYC investment bankers, explores the key factors that drive earnings, and provides a clear-eyed view of what it takes to succeed in this demanding yet highly rewarding field.

What Does an Investment Banker Do?

At its core, investment banking is the financial engine that powers corporate growth. Investment bankers act as strategic advisors and capital-raising agents for corporations, governments, and other large entities. Their primary responsibilities are multifaceted and include:

- Raising Capital: They help companies raise money by issuing and selling securities in the capital markets. This includes underwriting initial public offerings (IPOs), where a private company first offers its shares to the public, or facilitating debt offerings through bonds.

- Mergers & Acquisitions (M&A): Bankers advise companies on buying, selling, or merging with other companies. This involves complex financial modeling, valuation analysis, negotiation, and deal structuring.

- Advisory Services: They provide strategic financial advice to corporate clients on everything from restructuring their finances to defending against hostile takeovers.

It's a career characterized by long hours, intense pressure, and a demand for analytical perfection, but the rewards are structured to match the high expectations.

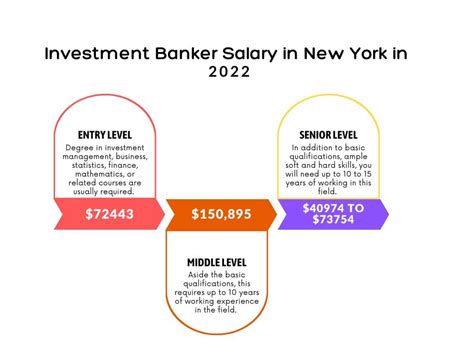

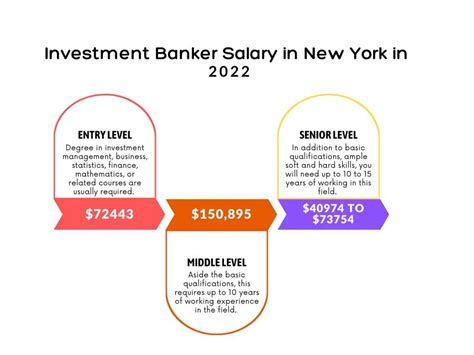

Average Investment Banker Salary in NYC

When discussing compensation in investment banking, it's crucial to look beyond the base salary. The bulk of an investment banker's earnings comes from their annual performance bonus. Total Compensation = Base Salary + Annual Bonus.

Salaries in NYC are the highest in the world for this profession, reflecting the city's status as a global finance hub and its high cost of living. Here’s a typical breakdown of total compensation by experience level, based on data from industry reports and salary aggregators like Salary.com and Glassdoor.

- First-Year Analyst (Undergraduate Level):

- Base Salary: $100,000 - $125,000

- All-In Compensation (with bonus): $170,000 - $225,000+

- First-Year Associate (Post-MBA Level):

- Base Salary: $175,000 - $225,000

- All-In Compensation (with bonus): $275,000 - $450,000+

- Vice President (VP):

- Base Salary: $250,000 - $300,000+

- All-In Compensation (with bonus): $500,000 - $800,000+

- Managing Director (MD) / Partner:

- Base Salary: $400,000 - $600,000+

- All-In Compensation (with bonus): Highly variable, but typically $1,000,000 - $10,000,000+ depending on the firm's and individual's performance.

*Sources: Salary.com, Glassdoor, Wall Street Oasis Compensation Reports, eFinancialCareers.*

Key Factors That Influence Salary

Your exact salary is determined by a combination of critical factors. Understanding these will help you navigate your career path and maximize your earning potential.

###

Years of Experience

Experience is the single most significant driver of compensation in investment banking. The career path is highly structured, with clear title progressions that come with substantial pay increases.

- Analyst (0-3 years): The entry-point for undergraduates. Analysts perform the bulk of the financial modeling, pitch book creation, and analytical grunt work.

- Associate (3-6 years): The entry-point for MBA graduates or promoted analysts. Associates manage analysts, take on more client-facing responsibilities, and oversee the deal execution process.

- Vice President (6-10 years): VPs are the primary project managers on deals, leading communication with clients and driving the deal process forward.

- Director / Managing Director (10+ years): At this senior level, the focus shifts from deal execution to business generation. MDs are responsible for sourcing new deals, building client relationships, and generating revenue for the firm. Their bonuses are directly tied to the business they bring in, leading to the highest compensation levels.

###

Company Type

Not all investment banks are created equal. The type of firm you work for has a major impact on your pay and the type of work you do.

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley): These are the largest, most globally recognized firms. They typically work on the biggest deals and offer some of the highest and most consistent compensation packages, especially at the junior levels.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These firms specialize in advisory services, particularly M&A, and do not have the massive sales and trading arms of the bulge brackets. They are known for offering extremely competitive, and sometimes even higher, total compensation than bulge brackets, as their leaner structure can lead to larger bonuses per banker.

- Middle-Market Banks (e.g., Baird, Jefferies, William Blair): These firms focus on deals for smaller companies (typically under $1 billion in value). While still offering very lucrative salaries, their compensation is generally a step below bulge bracket and elite boutique firms.

###

Area of Specialization

Within a bank, the group you work in matters. Some divisions are consistently more profitable and therefore pay higher bonuses.

- Mergers & Acquisitions (M&A): Historically viewed as one of the most prestigious and lucrative groups.

- Leveraged Finance (LevFin): This group structures debt to finance leveraged buyouts (LBOs) and other acquisitions, and is also known for high compensation.

- Industry Groups (e.g., Technology, Media & Telecom (TMT), Healthcare, Financial Institutions Group (FIG)): Your performance is tied to the health of your industry. A banker in a "hot" sector like technology or healthcare during a boom year may see a larger bonus due to a higher volume of deals.

###

Level of Education

Your educational background determines your entry point into the industry.

- Bachelor's Degree: Graduates from top-tier "target schools" (like Ivy League institutions, MIT, Stanford, NYU, and UChicago) are recruited for Analyst positions. The prestige of your undergraduate institution plays a significant role in securing interviews.

- Master of Business Administration (MBA): An MBA from a top business school (like Wharton, Harvard, Booth, or Columbia) is the primary pathway to enter investment banking at the Associate level. This allows for a career change and starts you on a higher compensation trajectory than an Analyst.

###

Geographic Location

While this article focuses on NYC, it's worth noting that location is a key factor. New York City is the undisputed leader in investment banking compensation worldwide. Other financial hubs like San Francisco, London, and Hong Kong also offer high salaries, but NYC generally sets the benchmark due to the sheer concentration of bulge bracket headquarters and elite boutiques.

Job Outlook

The career of an investment banker is demanding and highly competitive. The U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banker" as a distinct profession, but the related category of "Securities, Commodities, and Financial Services Sales Agents" provides a strong proxy.

According to the BLS, employment in this field is projected to grow 10 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this growth to an increasing number of companies going public and a growing need for expertise in managing financial investments and navigating complex regulations.

While the industry is cyclical and can be impacted by economic downturns, the fundamental need for capital raising and strategic corporate advice ensures that skilled investment bankers will remain in high demand.

Conclusion: Is a Career as an NYC Investment Banker Right for You?

The path to becoming a high-earning investment banker in New York City is undeniably challenging, requiring exceptional academic credentials, an incredible work ethic, and resilience. However, for those who thrive in a fast-paced, data-driven environment, the rewards are immense.

Key Takeaways:

- Total Compensation is Key: Always consider the combination of a strong base salary and a significant annual bonus, which together can result in starting compensation approaching or exceeding $200,000.

- Experience Drives Earnings: Your salary will grow exponentially as you climb the ladder from Analyst to Managing Director.

- Firm and Group Matter: Where you work (Bulge Bracket vs. Elite Boutique) and what you specialize in (M&A vs. Industry Coverage) will directly influence your compensation.

- NYC is the Epicenter: For maximum earning potential in this field, New York City remains the ultimate destination.

If you are driven by a passion for finance and the ambition to be at the center of the corporate world, a career in investment banking offers a path to financial success and professional influence that is nearly unmatched.