Table of Contents

- [Introduction](#introduction)

- [What Does an Investment Banking Analyst Do?](#what-analysts-do)

- [Average Investment Banking Analyst Salary: A Deep Dive](#average-salary)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-start)

- [Conclusion](#conclusion)

Introduction

The world of investment banking has long been shrouded in an aura of prestige, intensity, and, most notably, extraordinary financial reward. For ambitious graduates and young professionals, the title "Investment Banking Analyst" represents the pinnacle of entry-level finance—a crucible where long hours and immense pressure are forged into unparalleled experience and a compensation package that dwarfs almost any other field. If you're reading this, you are likely drawn to that potential, wondering if you have what it takes to navigate this demanding world and what the tangible rewards for that effort might be. You're asking the right questions, and the answer is complex, nuanced, and, for the right candidate, incredibly promising.

The pursuit of an accurate investment banking salary analyst figure can be challenging, as compensation is a multi-faceted beast composed of base pay, performance bonuses, and other perks. However, to cut to the chase, a first-year analyst at a reputable firm in a major financial hub can expect a total compensation package well into the six figures, often ranging from $150,000 to over $200,000. This figure grows substantially with each year of experience.

In my years as a career analyst and coach, I've seen countless bright minds chase the Wall Street dream. I once mentored a young economics graduate who was brilliant but intimidated by the industry's reputation. After months of grueling preparation, she landed an analyst role. Her work on a single, pivotal M&A pitch deck—a project that required 100-hour weeks for a month straight—was instrumental in helping the firm land a multi-billion dollar deal. That experience was a stark reminder that while the compensation is a powerful motivator, the real value lies in operating at the highest echelons of corporate finance, where your work can have a tangible, global impact.

This guide is designed to be your definitive resource, pulling back the curtain on the compensation, responsibilities, and career trajectory of an Investment Banking Analyst. We will dissect every component of an analyst's salary, explore the factors that can maximize your earning potential, and provide a clear, actionable roadmap to breaking into this elite profession.

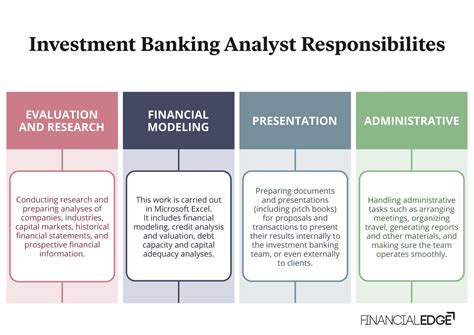

What Does an Investment Banking Analyst Do?

At its core, an Investment Banking Analyst is the foundational pillar of a deal team. They are the engine room of the bank, responsible for the vast majority of the analytical work that underpins every transaction, whether it's a merger, acquisition, initial public offering (IPO), or debt financing. While the television portrayal of banking often focuses on high-stakes negotiations and glamorous client dinners, the reality for an analyst is far more grounded in data, spreadsheets, and presentations. They are masters of Microsoft Excel and PowerPoint, tasked with creating the financial models and marketing materials that senior bankers use to advise clients and execute deals.

The role is typically a two-to-three-year program directly out of undergraduate studies. It is an apprenticeship in its truest form, designed to be an intense, immersive learning experience. Analysts work within specific groups, either Industry Groups (like Technology, Media & Telecom (TMT), Healthcare, or Industrials) which focus on clients within a particular sector, or Product Groups (like Mergers & Acquisitions (M&A), Leveraged Finance (LevFin), or Debt/Equity Capital Markets (DCM/ECM)) which specialize in a type of transaction.

Core Responsibilities and Daily Tasks:

- Financial Modeling: This is the quintessential analyst task. It involves building complex financial models from scratch to value companies (using methodologies like Discounted Cash Flow (DCF), Comparable Company Analysis ("Comps"), and Precedent Transaction Analysis), analyze the impact of a merger (accretion/dilution models), or determine a company's ability to take on debt (LBO models).

- Valuation Analysis: Using the models they build, analysts perform detailed valuation work to determine a company's worth, which is the foundation for advising clients on what price to pay for an acquisition or at what price to sell their company.

- Creating Pitch Books and Presentations: Analysts spend a significant amount of time in PowerPoint, creating lengthy presentations known as "pitch books." These documents are used to pitch ideas to potential clients and provide updates to existing ones. They contain industry overviews, company profiles, valuation analysis, and strategic recommendations.

- Due Diligence: When a deal is in motion, analysts are heavily involved in the due diligence process. This involves meticulously combing through a company's financial statements, internal data, legal documents, and business operations to verify information and identify potential risks.

- Market Research: Staying abreast of market trends, recent transactions, and industry news is crucial. Analysts are often tasked with compiling research and summarizing key developments for the team.

- Administrative & Logistical Support: This "unglamorous" but critical part of the job includes setting up conference calls, managing data rooms, and coordinating with various parties involved in a deal (lawyers, accountants, etc.).

### A Day in the Life of a First-Year Analyst

To make this more concrete, here's a snapshot of a "typical" busy day for an analyst working on a live deal:

- 9:00 AM: Arrive at the office. Scan emails that came in overnight from senior bankers or clients. Read the Wall Street Journal and other financial news to catch up on market movements.

- 9:30 AM: Team meeting with the Associate and Vice President (VP) to discuss the day's priorities for the live M&A deal. The VP needs updated valuation figures for the client presentation tomorrow.

- 10:00 AM - 1:00 PM: Dive into Excel. Pull the latest financial data from public filings and data services like Bloomberg or FactSet. Update the DCF model with new projections and run sensitivity analyses.

- 1:00 PM: Quick lunch, usually eaten at the desk while reviewing work.

- 1:30 PM - 5:00 PM: Transfer the updated valuation summary from Excel into the PowerPoint pitch book. This is a painstaking process that requires perfect formatting and absolute attention to detail—every number, comma, and logo must be precise.

- 5:30 PM: The VP reviews the presentation slides and provides feedback—"the comments." This usually involves multiple revisions to wording, formatting, and the underlying analysis.

- 7:00 PM: Another deal team pulls you onto a new project: an urgent pitch for a potential client. You're tasked with creating a company profile and a list of comparable transactions by tomorrow morning.

- 7:30 PM: Order dinner to the office, paid for by the bank.

- 8:00 PM - 12:00 AM: Juggle both projects. Revise the slides for the live deal based on the VP's comments while simultaneously building out the new company profile and transaction list for the pitch.

- 12:30 AM: Send the revised presentation to the VP for a final check. Begin building out the initial valuation "football field" chart for the new pitch.

- 2:00 AM: Receive a final "looks good, please print" email from the VP on the live deal presentation. Send the materials to the 24-hour print shop in the building. Send a draft of the new pitch materials to the other team's associate.

- 2:30 AM: Take a car service (paid for by the bank) home, knowing you need to be back in the office in less than seven hours.

This schedule illustrates the high-pressure, deliverable-focused nature of the job. While not every day is this intense, during active deal periods, such hours are the norm, not the exception.

Average Investment Banking Analyst Salary: A Deep Dive

The compensation for an investment banking analyst is arguably the single biggest draw to the profession. It's structured to be highly competitive and rewarding, but it's crucial to understand its components to see the full picture. The salary is not just a single number; it's a package consisting of a base salary and a significant performance-based bonus.

For clarity, the analyst program is typically a two- or three-year cycle post-undergrad. Compensation increases significantly with each year of experience.

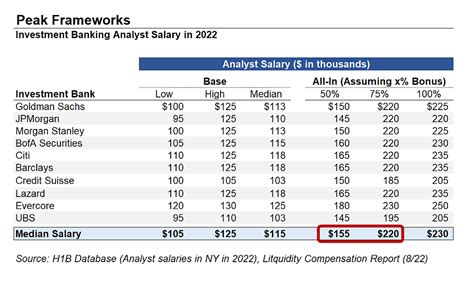

National Averages and Typical Ranges

According to a compilation of recent 2023 and early 2024 data from authoritative sources like Wall Street Oasis (WSO), Salary.com, and Glassdoor, the compensation structure for analysts in major U.S. financial hubs (like New York City) is as follows:

- First-Year Analyst (Analyst 1):

- Base Salary: $100,000 - $120,000

- Year-End Bonus: $60,000 - $100,000+

- Total All-In Compensation: $160,000 - $220,000+

- Second-Year Analyst (Analyst 2):

- Base Salary: $110,000 - $135,000

- Year-End Bonus: $80,000 - $130,000+

- Total All-In Compensation: $190,000 - $265,000+

- Third-Year Analyst (Analyst 3):

- *Note: Many analysts leave after two years for roles in private equity or hedge funds. Those who stay for a third year often do so with a direct promotion to Associate track.*

- Base Salary: $125,000 - $150,000

- Year-End Bonus: $100,000 - $160,000+

- Total All-In Compensation: $225,000 - $310,000+

*(Sources: Data synthesized from Wall Street Oasis 2023 Investment Banking Compensation Report, Salary.com Analyst data for New York, NY, and Glassdoor salary submissions for Investment Banking Analysts, as of Q1 2024.)*

It is critical to note that the bonus component is highly variable and dependent on three main factors: firm performance, group performance, and individual performance. In a boom year with high deal flow, bonuses can be exceptional. In a lean year, they can be significantly lower, though they still constitute a major portion of total pay.

### Compensation Components Breakdown

Understanding the pieces that make up the total compensation package is essential.

| Compensation Component | Description | Typical Amount (First-Year Analyst) |

| :--- | :--- | :--- |

| Base Salary | The fixed, bi-weekly or monthly paycheck an analyst receives. This portion has seen significant increases in recent years as banks compete for top talent. | $100,000 - $120,000 |

| Signing Bonus (Sign-On) | A one-time bonus paid upon signing a full-time offer, typically after a successful summer internship. It's meant to cover relocation costs and serve as an incentive. | $10,000 - $25,000 |

| Stub Bonus | For analysts who start in the summer, this is a smaller, pro-rated bonus they receive at the end of their first calendar year (after ~6 months of work). | $30,000 - $50,000 |

| Year-End Bonus | The largest variable component, paid out in January or February of the following year. This is the performance-based bonus that reflects the analyst's, their group's, and the bank's success over the full calendar year. | $60,000 - $100,000+ |

| Benefits & Perks | While not direct cash, these have significant value. They include premium health insurance, 401(k) matching, paid-for late-night meals, paid-for car services after a certain hour (e.g., 9 PM), and sometimes gym memberships or other wellness stipends. | Varies, but can be valued at $10,000 - $20,000+ annually. |

### The "All-In" Number

In banking parlance, compensation is almost always discussed as an "all-in" number, which means Base Salary + Year-End Bonus. When a first-year analyst says they made "$190k," they are referring to their all-in compensation for their first full year.

This aggressive salary structure is designed for a specific purpose: to attract the most driven, intelligent, and resilient individuals and compensate them for the immense personal and professional sacrifices required by the role. The long hours, high stress, and steep learning curve are traded for front-loaded earnings and a career trajectory that can lead to seven-figure incomes within a decade for those who excel and remain in the industry.

Key Factors That Influence Salary

While the figures above provide a strong baseline, the actual investment banking salary analyst compensation can vary significantly based on a confluence of factors. Aspiring analysts who understand these levers can strategically position themselves to maximize their earning potential from day one. This section provides an exhaustive breakdown of the variables that dictate pay in the world of investment banking.

###

Level of Education & Pedigree

Your educational background is the first and most important filter in the recruiting process, and it has a direct, albeit indirect, impact on salary by determining which tier of firm you can access.

- Undergraduate Institution (Target vs. Non-Target Schools): This is perhaps the most significant educational factor. Investment banks have a list of "target schools"—prestigious universities (e.g., Ivy League schools, MIT, Stanford, NYU, UChicago, Michigan, UVA) where they focus their recruiting efforts. Graduating from a target school grants you direct access to on-campus recruiting, alumni networks, and a higher probability of landing interviews at top-tier firms, which pay the most. Students from "semi-target" or "non-target" schools can still break in, but it requires significantly more networking and effort. While two analysts at the same bank will earn the same base salary regardless of their alma mater, the student from the target school has a much higher chance of being at that high-paying bank in the first place.

- Major and GPA: A high GPA (typically 3.7+) is a non-negotiable prerequisite for top firms. While Finance and Economics are traditional majors, banks are increasingly recruiting students from STEM fields (Engineering, Computer Science, Math) who possess strong quantitative and problem-solving skills. The major itself doesn't directly set salary, but a high GPA in a rigorous program is a powerful signal to recruiters.

- The MBA Path (The "Associate" Role): It's important to distinguish the undergraduate-to-Analyst path from the MBA-to-Associate path. Associates are hired after completing a top MBA program. They manage analysts and have a different compensation structure. A first-year Associate at a major bank can expect a base salary of around $175,000 and an all-in compensation package of $300,000 - $400,000. Therefore, an advanced degree like an MBA serves as a major inflection point for a massive salary increase, though it comes after a few years of work experience and significant tuition costs.

- Certifications (CFA, etc.): For the Analyst role, certifications like the Chartered Financial Analyst (CFA) are generally not required or expected. The intense work schedule makes studying for the exams nearly impossible. While passing CFA Level I can be a good resume builder for those from non-target schools trying to prove their financial acumen, it will not result in a higher starting salary. Its value becomes more relevant later in one's career, particularly in roles like equity research or asset management.

###

Years of Experience: The Analyst to Associate Promote

Investment banking compensation is designed to scale rapidly with experience, especially in the first few years. The structure is built to reward those who stay and perform.

- First-Year Analyst: This is the baseline. As established, total compensation is typically in the $160k - $220k range. The focus is on learning the ropes, mastering technical skills, and proving reliability.

- Second-Year Analyst: After one full bonus cycle, analysts receive a bump in base salary and are expected to perform at a higher level. They are more efficient, require less supervision, and may begin to mentor first-year analysts. This increase in responsibility and value is reflected in their pay, which pushes into the $190k - $265k range. The bonus spread widens here, with top-bucket (top-performing) analysts being rewarded handsomely.

- Third-Year / Associate "Promote": This is a critical juncture. High-performing analysts are often offered a "third-year" role with a significant pay increase or a direct promotion to Associate, skipping the need for an MBA. An "A2A" (Analyst to Associate) promote is highly coveted. An Associate 0 (a newly promoted analyst) can see their base salary jump to ~$150k-$175k, and their all-in compensation can approach or exceed $300,000. This demonstrates a steep and rapid salary growth trajectory for those who excel within the first 24-36 months on the job. The alternative path is the "two-and-out," where analysts leave after two years for lucrative roles in the "buy-side" (private equity, hedge funds), which we will discuss later.

###

Geographic Location

Where you work is a massive determinant of your salary. Compensation is not uniform across the country or the world; it is adjusted for the cost of living, market competitiveness, and deal flow.

- Tier 1: New York City: NYC is the undisputed epicenter of finance in the U.S. It has the highest concentration of bank headquarters and the largest deal volume. Consequently, it sets the benchmark for salaries and offers the highest compensation. The salary figures quoted throughout this article are primarily based on the NYC market.

- Tier 1.5: San Francisco & Other Major Hubs: San Francisco (and Silicon Valley) is a major hub, especially for technology banking. Salaries here are comparable to NYC to compete for talent and offset the extremely high cost of living. Other major U.S. hubs like Chicago, Los Angeles, and Boston also offer very competitive salaries, though they may be a slight step down (5-10%) from NYC at some firms.

- Tier 2: Rising Financial Centers: Cities like Charlotte, Houston (especially for energy banking), and Atlanta are growing as financial centers. Bulge-bracket and middle-market banks have significant offices in these locations. Compensation is lower than in NYC, but so is the cost of living, potentially leading to a higher disposable income. An analyst might earn a base of $95k instead of $110k, with a proportionally smaller bonus.

- International Hubs: London and Hong Kong are the other two global financial capitals. London compensation has historically trailed NYC, particularly on the bonus side, though base salaries are becoming more aligned. Hong Kong salaries can be very high, often on par with NYC, and may come with additional expatriate benefits or housing stipends.

###

Company Type & Size: The Bank Hierarchy

Not all banks are created equal. The type and prestige of the firm you work for is one of the most significant drivers of your compensation package.

- Bulge Bracket (BB) Banks: These are the largest, most well-known global banks (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley, Bank of America). They generally work on the largest, most complex deals and have a global presence. They are typically the trendsetters for compensation and pay at the top of the market for both base and bonus.

- Elite Boutique (EB) Banks: These are smaller, highly specialized firms that focus almost exclusively on advisory services (primarily M&A) without the lending or sales & trading arms of the bulge brackets (e.g., Evercore, Lazard, Centerview Partners, PJT Partners). EBs are known for offering compensation that can meet or even *exceed* the bulge brackets, especially in good years. Because they have lower overhead, a larger portion of firm revenue can be paid out as bonuses. They are arguably the highest-paying firms for top-performing analysts.

- Middle Market (MM) Banks: These firms focus on deals for mid-sized companies (typically with enterprise values between $50 million and $1 billion). Examples include Baird, Houlihan Lokey, William Blair, and Jefferies. Compensation at top MM firms is very competitive and can approach bulge-bracket levels. However, the median pay is generally slightly lower. The work-life balance can sometimes be marginally better, but this is not a guarantee.

- Regional Boutiques: These are much smaller, localized firms that focus on smaller deals within a specific geographic area. Compensation here is significantly lower than at the other tiers, but they can be a great place to start a career and gain experience, especially for candidates from non-target schools.

###

Area of Specialization: Product vs. Industry Groups

Within a bank, the group you join can influence your bonus potential and exit opportunities.

- Product Groups (M&A, LevFin): Groups like Mergers & Acquisitions (M&A) and Leveraged Finance (LevFin) are often considered the most prestigious and technically demanding. They work on the most complex transactions and are central to the bank's revenue. As a result, analysts in these groups often receive "top-bucket" bonuses and have the best exit opportunities to private equity.

- Industry Groups (TMT, Healthcare): Industry groups advise companies within a specific sector. Their performance is tied to the health and deal activity of that sector. A group like Technology, Media & Telecom (TMT) or Healthcare might be incredibly busy and lucrative during a tech or biotech boom, leading to massive bonuses. Conversely, a group like Oil & Gas might suffer during a downturn in energy prices. Joining a "hot" sector can directly impact your bonus size.

- Capital Markets Groups (ECM/DCM): Equity Capital Markets (ECM) and Debt Capital Markets (DCM) focus on IPOs and debt issuances, respectively. These roles can be less technically intensive in terms of complex modeling compared to M&A but require a deep understanding of the markets. Compensation is still excellent but can sometimes have a lower ceiling than top M&A or LevFin groups, as the work is more commoditized.

###

In-Demand Skills

While all analysts are expected to have a baseline skill set, developing certain high-value skills can distinguish you as a top performer, leading to a higher bonus ranking and better career opportunities.

- Advanced Financial Modeling: Going beyond the basic templates. Analysts who can build complex, flexible, and error-free LBO, DCF, and M&A models from a blank spreadsheet are invaluable. Mastery of Excel shortcuts and functions is a given.

- Attention to Detail: In a world where a misplaced comma or a formatting error in a pitch book can damage the firm's reputation, meticulous attention to detail is paramount. This "soft skill" is a direct driver of a positive performance review and, thus, a higher bonus.

- Work Ethic and "Attitude": Banking culture values resilience, a positive attitude under pressure, and unwavering reliability. An analyst who is always willing to take on more work, stays late without complaining, and proactively seeks to help the team will be ranked higher than a more talented but less committed peer.

- Communication and Interpersonal Skills: While analysts are primarily analytical, the ability to clearly articulate the results of their analysis to associates and VPs is crucial. Being coachable and responsive to feedback is a key differentiator.

By understanding these intricate factors, an aspiring analyst can see that maximizing salary is not just about getting any job in banking; it's about strategically targeting the right schools, firms, locations, and groups to align with the highest compensation tiers.

Job Outlook and Career Growth

For those considering the demanding entry into investment banking, the long-term career prospects and job security are as important as the immediate salary. The outlook is a tale of two parts: the stability of the profession itself and the unparalleled exit opportunities it provides.

Job Growth and Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banking Analysts" as a distinct category. However, we can use the outlook for "Financial Analysts" and "Securities, Commodities, and Financial Services Sales Agents" as a reasonable proxy for the broader financial industry.

The BLS projects that employment for Financial Analysts will grow by 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS states, "Growth is expected to be driven by an increase in the complexity of financial products and the need for in-depth knowledge of geographic regions." (Source: BLS Occupational Outlook Handbook, Financial Analysts). Similarly, employment for Securities, Commodities, and Financial Services Sales Agents is projected to grow 8 percent over the same period.

While these statistics are positive, they apply to the entire financial sector. Investment banking is a highly cyclical industry. Hiring and bonuses are heavily dependent on the health of the economy and capital markets. During economic expansions, M&A activity and IPOs flourish, leading to robust hiring and massive bonuses. During recessions, deal flow dries up, hiring freezes are common, and in some cases, layoffs occur.

Therefore, while the long-term *need* for financial expertise is growing, the number of analyst positions at top banks is highly competitive and does not expand dramatically year-over