For millions of professionals, the $60,000 salary mark represents a significant milestone. It’s a figure that often feels like the threshold to financial stability, a departure from entry-level wages, and the entry point into a comfortable middle-class life. But in today’s complex and rapidly changing economic landscape, the question "Is $60,000 a good salary?" is far from simple. The real answer, as any seasoned career analyst will tell you, is a resounding and slightly frustrating: *it depends*.

A $60,000 salary can feel like a fortune to a recent graduate in a low-cost-of-living area, yet it can feel distressingly tight for a family in a major metropolitan hub. It can be a fantastic starting salary in one industry and a sign of stagnation in another. Understanding the true value of this income requires a deep, multi-faceted analysis that goes beyond the number itself and examines the context surrounding it.

Early in my career advising young professionals, I worked with a graphic designer who had just received a $60,000 offer for a job in Austin, Texas. He was ecstatic, as it was nearly double what he was making in his small hometown. But within six months, the high rent, transportation costs, and taxes had eroded his perceived wealth, and he found his disposable income was barely higher than before. This experience was a powerful lesson: a salary figure is only one piece of a much larger puzzle of financial well-being and career satisfaction.

This guide is designed to be your definitive resource for dissecting that puzzle. We will move beyond a simple "yes" or "no" to provide you with the data, frameworks, and expert insights needed to evaluate what a $60,000 salary truly means for *you*. We will explore its buying power, compare it to national benchmarks, break down the critical factors that influence its worth, and outline actionable steps to achieve—and surpass—this financial goal.

### Table of Contents

- [Putting $60,000 into Perspective: What Your Lifestyle Could Look Like](#putting-60000-into-perspective-what-your-lifestyle-could-look-like)

- [$60,000 in the National Context: A Deep Dive into Salary Benchmarks](#60000-in-the-national-context-a-deep-dive-into-salary-benchmarks)

- [The Deciding Factor: 6 Variables That Determine if $60,000 is a Good Salary](#the-deciding-factor-6-variables-that-determine-if-60000-is-a-good-salary)

- [The $60,000 Career Landscape: Job Outlook and Growth for Relevant Professions](#the-60000-career-landscape-job-outlook-and-growth-for-relevant-professions)

- [How to Earn a $60,000 Salary (and Beyond): Your Action Plan](#how-to-earn-a-60000-salary-and-beyond-your-action-plan)

- [Conclusion: Your Final Verdict on a $60,000 Salary](#conclusion-your-final-verdict-on-a-60000-salary)

Putting $60,000 into Perspective: What Your Lifestyle Could Look Like

Before we dive into comparative data, let's ground this number in reality. What does a $60,000 annual salary actually translate to in terms of take-home pay and daily living? Understanding the tangible budget this salary supports is the first step in assessing its value.

A gross annual income of $60,000 is equivalent to a monthly income of $5,000. However, you don't take home $5,000. After taxes and deductions, your net pay (or take-home pay) will be significantly less. The exact amount varies by state and your personal filing status, but a reasonable estimate for a single filer after federal, state (in most states), FICA (Social Security and Medicare) taxes, and a modest 401(k) contribution (e.g., 5%) is a total deduction of around 25-30%.

Let's use a conservative 28% total deduction for our example:

- Gross Monthly Income: $5,000

- Estimated Monthly Deductions (Taxes, FICA, 5% 401k): ~$1,400

- Estimated Monthly Take-Home Pay: ~$3,600

This $3,600 per month is the actual amount you have to work with for all your expenses. To assess if this is "good," we can apply a popular budgeting framework like the 50/30/20 rule:

- 50% for Needs (~$1,800/month): This covers your absolute essentials.

- Housing (Rent/Mortgage): This is the biggest variable. In a low-cost city like Omaha, NE, you might find a decent one-bedroom apartment for $1,000. In a high-cost city like Boston, MA, that same $1,800 might only cover a room in a shared apartment. This immediately highlights the critical role of location.

- Utilities (Electric, Gas, Water, Internet): ~$200-$300

- Groceries: ~$300-$400

- Transportation (Car Payment, Insurance, Gas, or Public Transit): ~$200-$400

- 30% for Wants (~$1,080/month): This is your discretionary spending that enhances your quality of life.

- Dining Out & Entertainment: Going to restaurants, bars, concerts, movies.

- Hobbies & Shopping: Gym memberships, subscription services (Netflix, Spotify), clothing, electronics.

- Travel: Setting aside funds for vacations.

- 20% for Savings & Debt Repayment (~$720/month): This is crucial for your long-term financial health.

- Emergency Fund: Building up 3-6 months of living expenses.

- Retirement Savings: This is *in addition* to your 401(k) contributions from your gross pay. You could direct this to a Roth IRA.

- Debt Repayment: Aggressively paying down student loans, credit card debt, or other loans.

### A "Day in the Life" on a $60,000 Salary

Imagine a typical professional, let's call her Alex, earning $60k in a mid-sized city like Richmond, Virginia. Her day is financially comfortable but requires conscious choices. She likely makes her coffee at home to save the $5 a day from a cafe. She meal-preps her lunches most days but can afford to go out with colleagues once or twice a week. Her rent for a nice one-bedroom apartment takes up a significant chunk of her "Needs" budget, so she's mindful of her electricity use.

She can afford a gym membership and a few streaming services without stress. On a Friday night, she can meet friends for dinner and drinks, but she might choose a happy hour to be more budget-conscious. She is diligently putting over $700 a month towards her savings goals and student loan payments, which gives her a strong sense of financial security and progress. She can plan for a modest domestic vacation each year. For Alex, $60,000 is a good salary that enables a comfortable, secure, and enjoyable lifestyle with room for future growth.

Now, place Alex in San Francisco. Her entire "Needs" budget of $1,800 might not even cover her share of the rent for a small apartment with roommates. Her "Wants" and "Savings" categories would be severely squeezed, and her lifestyle would feel much more restrictive.

This initial breakdown makes one thing clear: a $60,000 salary allows for a solid, responsible lifestyle in many parts of the country, but it is by no means a ticket to thoughtless luxury. Its goodness is directly tied to the financial pressures of your environment.

$60,000 in the National Context: A Deep Dive into Salary Benchmarks

To move beyond the personal budget, we need to compare a $60,000 salary to national economic data. How does this figure stack up against what other Americans are earning? This is where we can make a more objective judgment.

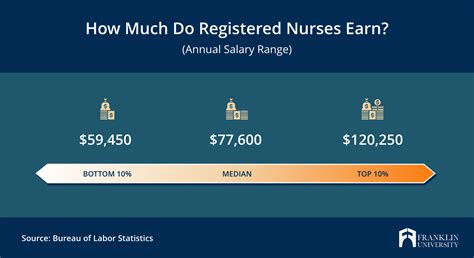

According to the most recent data available from the U.S. Bureau of Labor Statistics (BLS), the median weekly earnings for full-time wage and salary workers was $1,145 in the fourth quarter of 2023. This translates to an annual salary of $59,540.

- Citation: U.S. Bureau of Labor Statistics, "Usual Weekly Earnings of Wage and Salary Workers: Fourth Quarter 2023," January 18, 2024.

This single data point is incredibly illuminating. A salary of $60,000 places you almost exactly at the national median for an individual full-time worker in the United States. In essence, you are earning more than half of the country's full-time workforce and less than the other half. From this perspective, $60,000 is not just a "good" salary; it is the benchmark of a "typical" American salary.

However, individual income is only part of the story. Many people operate in household economic units. The U.S. Census Bureau reported that the median household income was $74,580 in 2022.

- Citation: U.S. Census Bureau, "Income in the United States: 2022," September 12, 2023.

This means that a single person earning $60,000 is below the median *household* income, which often includes dual-income earners. A dual-income household where both partners earn $60,000 (for a total of $120,000) would be well above the national median and considered solidly upper-middle class in most areas.

### How $60,000 Fits into Different Career Stages

The "goodness" of a $60,000 salary is also highly dependent on where you are in your career. The same number can represent tremendous success or a frustrating plateau.

Here is a breakdown of how a $60,000 salary is generally perceived at different experience levels across various professional (non-executive) fields:

| Career Stage | Perception of a $60,000 Salary | Example Scenarios |

| :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Excellent to Very Good | This is a fantastic starting salary for most fields outside of high-paying sectors like tech and finance. It indicates a strong educational background and/or in-demand skills. Examples: A new graduate in engineering, a data analyst with internship experience, a registered nurse. |

| Early-Career (2-5 Years) | Good to Solidly Average | At this stage, professionals are expected to have moved beyond their initial starting salary. $60k represents steady growth and competence. It's a very common salary for professionals with a few years of experience in fields like marketing, HR, and accounting in mid-sized markets. |

| Mid-Career (5-10 Years) | Average to Potentially Low | This is where context becomes critical. For a teacher or a social worker, $60k might be a respectable mid-career salary. For a software developer, project manager, or experienced salesperson, $60k would likely be considered low and might indicate a need for career advancement or skill development. |

| Senior/Experienced (10+ Years) | Low to Very Low | For a professional with over a decade of experience in a skilled field, a $60,000 salary would typically be well below the market rate in most industries. Exceptions might exist in certain non-profit, academic, or government roles, especially in low-cost-of-living areas. |

### The Total Compensation Package

Finally, it's a mistake to evaluate a salary in isolation. A $60,000 salary offer can become significantly more or less attractive based on the total compensation package. When evaluating an offer, consider:

- Bonuses: Is there a performance-based annual bonus? A 10% bonus adds an extra $6,000 to your annual earnings.

- Health Insurance: A company that covers 100% of your health insurance premiums is saving you hundreds of dollars each month compared to a company with a high-deductible plan where you pay a significant portion of the premium. This can be worth thousands of dollars a year.

- Retirement Contributions: A company offering a 6% 401(k) match is giving you an extra $3,600 per year in "free money" for your retirement. A company with no match puts the entire burden on you.

- Paid Time Off (PTO): A generous PTO policy (e.g., 4 weeks + holidays) has a real quality-of-life value that a standard 2-week policy lacks.

- Other Perks: Commuter benefits, wellness stipends, professional development funds, and stock options can all add significant financial value.

A $60,000 salary with an excellent benefits package can be far superior to a $65,000 salary with a poor one.

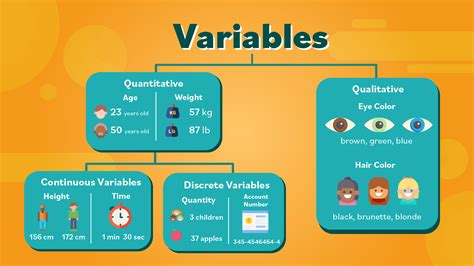

The Deciding Factor: 6 Variables That Determine if $60,000 is a Good Salary

This is the most critical section of our analysis. The abstract value of $60,000 is less important than its practical value, which is determined by a handful of key personal and environmental factors. Understanding how these variables apply to your situation will give you the definitive answer you're seeking.

### 1. Geographic Location & Cost of Living

This is, without a doubt, the single most influential factor. The purchasing power of $60,000 can vary dramatically from one city to another. The primary driver of this difference is housing costs, but it also includes taxes, groceries, transportation, and healthcare.

To illustrate, let's use a cost of living calculator (data often sourced from platforms like Payscale or the Council for Community and Economic Research) to compare how a $60,000 salary in a baseline city like Kansas City, Missouri feels in other locations.

| To Maintain the Same Lifestyle as $60,000 in Kansas City, MO, You Would Need... |

| :--- | :--- |

| High Cost of Living Cities | |

| San Francisco, CA | $108,600 (+81%) |

| New York City (Manhattan), NY | $148,200 (+147%) |

| Boston, MA | $93,000 (+55%) |

| San Diego, CA | $88,200 (+47%) |

| Washington, D.C. | $84,000 (+40%) |

| Low Cost of Living Cities | |

| Birmingham, AL | $53,400 (-11%) |

| Indianapolis, IN | $56,400 (-6%) |

| Omaha, NE | $57,000 (-5%) |

*(Note: These are estimates based on aggregated 2023-2024 data and can fluctuate.)*

The takeaway is stark. A $60,000 salary provides a very comfortable lifestyle in Birmingham, but it would require a nearly impossible budget in Manhattan, where you would need more than double that income to live similarly. Therefore:

- In a Low-Cost of Living (LCOL) area: $60,000 is an excellent salary that allows for significant savings, homeownership possibilities, and a high quality of life.

- In a Medium-Cost of Living (MCOL) area: $60,000 is a solid, middle-class salary. It's the national median for a reason—it works well in the majority of "average" American cities.

- In a High-Cost of Living (HCOL) area: $60,000 is a challenging, often insufficient salary for a single person and extremely difficult for a family. It often requires roommates, strict budgeting, and limits long-term savings potential.

### 2. Level of Education and Certifications

Your educational attainment sets the baseline expectation for your earning potential. A $60,000 salary can be viewed very differently depending on the degree you hold.

- High School Diploma / Associate's Degree: Earning $60,000 is a significant achievement and well above the median for this group. It typically indicates a skilled trade, significant experience, or a high-performing sales role.

- Bachelor's Degree: A $60,000 salary is a very common and respectable income for someone with a bachelor's degree, especially in the first 5-7 years of their career. It aligns perfectly with median earnings for college graduates.

- Master's Degree / Ph.D.: For those with advanced degrees (e.g., MBA, MS, Ph.D.), $60,000 would generally be considered a low starting salary. Many master's programs are pursued specifically to break into higher income brackets ($80,000+). Exceptions exist in fields like social work or academia, where pay scales are lower across the board.

Certifications can also dramatically shift the value proposition. For an IT professional, earning $60,000 with a basic CompTIA A+ certification is decent. However, adding an in-demand cloud certification like AWS Solutions Architect – Associate could quickly boost their market value to $80,000 or more. Similarly, a project coordinator earning $55,000 can often jump to a project manager role earning $70,000+ after obtaining their Project Management Professional (PMP) certification.

### 3. Years of Experience and Career Trajectory

As outlined in our earlier table, experience is paramount. A salary isn't a static number; it's a point on a long-term trajectory.

- Is $60,000 a good *starting* salary? For most professions, absolutely. It provides a strong foundation from which to grow.

- Is $60,000 a good salary after 10 years? This is much less likely. In a healthy career, your salary should grow to reflect your accumulated skills, wisdom, and contributions. If you've been at the same company for a decade and are still at or near $60k, it may be a sign of wage stagnation. Data from salary aggregators like Payscale consistently shows that employees who switch jobs every 2-3 years in the first decade of their career tend to have a higher overall earnings trajectory than those who stay put, as external offers are the most effective way to reset your market value.

### 4. Industry, Company Type, and Size

The industry you work in has a massive impact on pay scales. A $60,000 salary for a talented Marketing Associate is standard, but the same salary for a Software Engineer would be exceptionally low.

- High-Paying Industries: Technology, Finance, Pharmaceuticals, Consulting, Engineering. In these fields, $60,000 is often an entry-level salary, and mid-career professionals typically earn well into the six figures.

- Average-Paying Industries: CPG (Consumer Packaged Goods), Manufacturing, Media, HR, Marketing. A $60k salary is a very common mid-level benchmark in these sectors.

- Lower-Paying Industries: Non-profit, Education, Social Services, Hospitality, Retail (non-corporate). In these fields, $60,000 can be a mid-to-senior level salary and is considered very good.

Company type and size also play a role:

- Large Corporations (Fortune 500): Tend to have more structured pay bands. A $60k salary might be a rigid salary for a specific job "level," but it often comes with robust benefits, bonuses, and clear paths for promotion.

- Startups: A $60k salary might be accompanied by stock options, which could be worthless or incredibly valuable in the future. The base pay might be lower than at a large corporation, but the potential upside (and risk) is higher.

- Government (Federal, State, Local): Government jobs are known for salary transparency, excellent benefits (pensions, healthcare), and job security, but often have lower base pay than the private sector. A $60k salary for a government role might be equivalent to a $70k+ role in the private sector once you factor in the value of the benefits and stability.

### 5. Area of Specialization

Within a single industry, specialization is key to increasing your earning potential. A generalist role will almost always pay less than a specialist role.

Consider the field of Marketing:

- A Marketing Generalist or Marketing Coordinator might have an average salary range of $50,000 - $65,000.

- A Content Marketing Specialist who focuses on writing and content strategy might earn a similar range, $55,000 - $70,000.

- An SEO (Search Engine Optimization) Specialist who understands the technical aspects of search and analytics commands a higher salary, often $60,000 - $80,000.

- A Marketing Automation Specialist who can manage complex platforms like HubSpot or Marketo is even more specialized and can earn $65,000 - $90,000+.

If you are earning $60,000 as a generalist, you have a clear path to higher earnings by developing a deep, in-demand specialization.

### 6. High-Value, In-Demand Skills

Regardless of your industry or title, certain skills are universally valued and can help you command a higher salary. If your job at $60,000 allows you to build these skills, it is a great stepping stone. If it doesn't, you may want to seek opportunities that do.

Examples of High-Value Skills:

- Data Analysis & Visualization: The ability to interpret data and communicate insights using tools like Excel, SQL, Tableau, or Power BI.

- Project Management: Formally managing projects, timelines, budgets, and stakeholders.

- Digital Marketing & SEO: Understanding how to attract customers online is vital for nearly every business.

- Sales & Negotiation: The ability to persuade, build relationships, and close deals is always in high demand.

- Coding & Technical Literacy: Even basic knowledge of HTML/CSS, Python