The question, "Is $65,000 a good salary?" resonates with millions of professionals across the United States. It's a figure that feels substantial, sitting comfortably above the minimum wage yet not quite touching the coveted six-figure mark. For some, it represents a dream income, a ticket to financial stability. For others, it’s a starting point, a stepping stone on a longer career ladder. The truth is, a salary is never just a number. It's a complex equation of your skills, experience, location, and aspirations. Answering this question requires a deep, nuanced analysis that goes far beyond a simple "yes" or "no."

This comprehensive guide is designed to provide that analysis. We will dissect what a $65,000 salary truly means in today's economy, exploring the jobs that typically pay this amount, the critical factors that influence its value, and the strategic steps you can take to earn it—and surpass it. We will leverage data from authoritative sources like the U.S. Bureau of Labor Statistics (BLS), Payscale, and Salary.com to give you a clear, data-driven picture of your financial and career potential.

As a career analyst who has coached hundreds of professionals, from recent graduates to seasoned executives, I've seen firsthand how context shapes the perception of income. I once advised a marketing coordinator in Columbus, Ohio, who was ecstatic to receive a $65,000 offer; it allowed her to save for a down payment on a house and travel. In the same week, I counseled a junior software developer in San Jose, California, for whom $65,000 would be a financially untenable starting salary due to the region's staggering cost of living. This stark contrast underscores the central theme of this article: the value of your salary is relative, and understanding that relativity is the first step toward true financial empowerment.

This guide will serve as your ultimate resource, whether you're negotiating your first job offer, planning a career change, or aiming for your next promotion.

### Table of Contents

- [What a $65,000 Salary Means in Today's Economy](#what-does-a-65000-salary-mean)

- [Jobs That Pay Around $65,000: A Deep Dive](#jobs-that-pay-65000)

- [Key Factors That Determine If $65,000 Is a Good Salary *For You*](#key-factors)

- [Job Outlook and Career Growth: Moving From $65,000 to Six Figures](#job-outlook-and-growth)

- [How to Secure a Job Paying $65,000 (and Beyond)](#how-to-get-started)

- [The Final Verdict: Is a $65,000 Salary Good?](#conclusion)

What a $65,000 Salary Means in Today's Economy

Before we can determine if $65,000 is a "good" salary, we need to place it in the context of the broader U.S. economy. A number on a paycheck is meaningless without understanding its purchasing power and how it compares to national benchmarks.

According to the most recent data from the U.S. Bureau of Labor Statistics (Q4 2023), the median usual weekly earnings for full-time wage and salary workers in the United States was $1,145, which annualizes to approximately $59,540. This means that a salary of $65,000 puts you comfortably above the national median for an individual earner. You are earning more than half of the full-time working population in the country.

However, individual income is only part of the story. The U.S. Census Bureau reported that the median *household* income was $74,580 in 2022. If you are the sole earner in your household, a $65,000 salary places you slightly below this national median. If you are in a dual-income household, your combined income is likely to be well above it.

But what does this income look like in practice? Let's break down the take-home pay and create a sample budget.

From Gross to Net: A Realistic Look at Take-Home Pay

A $65,000 annual salary breaks down to a gross monthly income of approximately $5,417. However, you don't take all of that home. After federal and state taxes, FICA (Social Security and Medicare), and potential deductions for health insurance and 401(k) contributions, your net (take-home) pay will be significantly lower.

Let's estimate for a single filer in a state with a moderate income tax (e.g., about 5%), contributing 5% to a 401(k):

- Gross Monthly Income: $5,417

- Federal Taxes: ~$650

- FICA Taxes: ~$414

- State Taxes: ~$270

- 401(k) Contribution (5%): ~$271

- Health Insurance Premium: ~$150 (varies wildly)

- Estimated Net Monthly Income: ~$3,662

This take-home pay of around $3,600 per month is the real number you have to work with for your daily life.

### A "Day in the Life" of a $65,000 Budget

To make this tangible, let's create a sample monthly budget for someone earning this salary in a mid-cost-of-living city like Kansas City, Missouri, or Richmond, Virginia. This budget follows the popular 50/30/20 rule (50% for Needs, 30% for Wants, 20% for Savings/Debt).

Net Monthly Income: $3,662

1. Needs (50% = ~$1,831)

- Rent/Mortgage (1 BR Apt): $1,200

- Utilities (Electric, Gas, Water, Internet): $250

- Groceries: $300

- Transportation (Car Payment, Insurance, Gas): $400 (This can break the "Needs" budget, highlighting the importance of managing car costs). Let's assume a more modest $300 to fit.

- Total Needs: $1,750 (Just under the 50% target)

2. Wants (30% = ~$1,098)

- Restaurants/Bars/Entertainment: $350

- Shopping (Clothes, Hobbies): $200

- Subscriptions (Streaming, Gym): $75

- Travel Fund: $200

- Miscellaneous/Buffer: $273

- Total Wants: $1,098

3. Savings & Debt Repayment (20% = ~$732)

- Retirement (401k pre-tax): Already accounted for ($271 gross)

- Additional Savings (Emergency Fund, Investments): $400

- Student Loan or Credit Card Debt Payment: $332

- Total Savings/Debt: $732

As this budget demonstrates, on a $65,000 salary in a typical American city, you can live a reasonably comfortable life. You can afford a decent apartment, cover all your necessities, enjoy hobbies and social activities, and—critically—still dedicate a significant portion of your income to savings and debt repayment. However, there isn't a massive margin for error. A large unexpected expense, like a major car repair, could easily strain this budget.

Therefore, we can establish a baseline: $65,000 is a solid, middle-class salary that allows for a comfortable lifestyle in most of the United States. The crucial follow-up question is, in which specific jobs and locations does this hold true?

Jobs That Pay Around $65,000: A Deep Dive

A $65,000 salary is not tied to a single profession but represents a common pay benchmark across numerous industries and experience levels. For some roles, it's an entry-level salary; for others, it's the compensation for a professional with 3-5 years of experience.

Here is a detailed look at various common professions where a $65,000 salary is typical, with data synthesized from Payscale, Glassdoor, and the BLS.

| Job Title | Typical Experience Level | Industry | Job Description & Context |

| :--- | :--- | :--- | :--- |

| Marketing Manager | Entry- to Mid-Career (2-5 years) | Business/Marketing | Responsible for developing and executing marketing campaigns. At $65k, this is often for a smaller company or a junior manager role at a larger one. |

| HR Generalist | Mid-Career (3-5 years) | Human Resources | Handles a wide range of HR tasks including recruiting, onboarding, benefits administration, and employee relations. A SHRM-CP certification often helps reach this level. |

| Registered Nurse (RN) | Entry-Level to Mid-Career | Healthcare | Varies heavily by location. In many Midwest and Southern states, $65k is a common salary for an RN with a few years of experience. In high-cost coastal states, starting salaries are much higher. |

| Financial Analyst | Entry-Level (0-2 years) | Finance | Analyzes financial data to help a company make business decisions. This is a typical starting salary at many corporations outside of high-finance hubs like NYC. |

| High School Teacher | Mid-Career (5-10 years) | Education | Salary is highly dependent on the state and district's pay scale. In many parts of the country, a teacher with a Master's degree and several years of experience will earn around $65k. |

- IT Support Specialist (Tier 2/3) | Mid-Career (3-6 years) | Information Technology | Solves more complex technical issues than entry-level help desk staff. Often requires certifications like CompTIA A+ or Network+. |

| Graphic Designer | Mid-Career (4-7 years) | Creative/Design | Creates visual concepts for websites, advertisements, and logos. Freelance rates can vary, but for a full-time in-house role, $65k reflects solid experience. |

| Construction Manager | Entry- to Mid-Career (2-5 years) | Construction | Oversees and directs construction projects. An associate's or bachelor's degree in construction management is common. The field has high earning potential with experience. |

| Skilled Tradesperson (Electrician, Plumber) | Experienced/Licensed | Trades | Highly dependent on union status and location. An experienced, licensed electrician or plumber can easily earn $65,000, and often much more, especially with overtime. |

| Content Manager / Strategist | Mid-Career (3-5 years) | Marketing/Media | Plans, develops, and manages a company's content (blogs, videos, social media). Requires strong writing, SEO, and project management skills. |

### Understanding Total Compensation

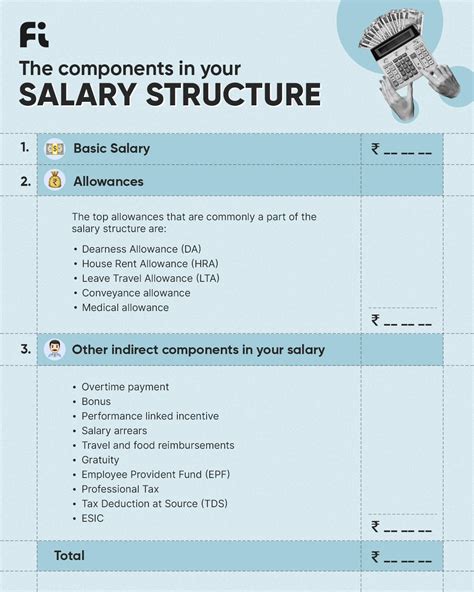

One of the biggest mistakes a professional can make is focusing solely on the base salary. A $65,000 salary can be part of a much larger financial package. When evaluating an offer, you must consider the Total Compensation.

- Base Salary: The fixed $65,000 you earn annually.

- Performance Bonuses: Many roles, especially in sales, marketing, and finance, offer annual or quarterly bonuses based on individual or company performance. A 10% bonus could add another $6,500 to your annual earnings.

- 401(k) or 403(b) Matching: This is essentially free money. A company that matches 100% of your contributions up to 5% of your salary is giving you an extra $3,250 per year toward your retirement.

- Health Insurance: The value of an employer-sponsored health plan cannot be overstated. A comprehensive plan with low premiums and deductibles can be worth over $10,000 per year compared to purchasing a similar plan on the open market.

- Paid Time Off (PTO): A generous PTO policy (e.g., 20 days vs. 10 days) has a real monetary value and significantly impacts work-life balance.

- Stock Options or RSUs: Particularly common in tech companies and startups, equity can become a significant part of your net worth over time, though it carries more risk than guaranteed salary.

- Other Perks: Commuter benefits, wellness stipends, tuition reimbursement, and professional development budgets all add to the overall value of your compensation package.

Example Comparison:

- Company A offers: $68,000 base salary, no 401(k) match, high-deductible health plan.

- Company B offers: $65,000 base salary, 5% 401(k) match ($3,250/year), excellent low-premium health insurance (saving you $2,000/year in premiums), and an annual bonus target of 5% ($3,250).

In this scenario, Company B's total compensation package is worth over $73,500, making it a far superior financial offer despite the lower base salary.

Key Factors That Determine If $65,000 Is a Good Salary *For You*

This is the most critical section of our analysis. The "goodness" of a $65,000 salary is not universal; it is intensely personal and contextual. Here, we break down the five key factors that multiply or divide the value of your income.

### 1. Geographic Location: The Great Equalizer

Location is, without a doubt, the single most important factor in determining the real-world value of your salary. The difference in cost of living between major metropolitan areas and smaller cities or rural towns is immense. A $65,000 salary that affords a spacious home in one state might barely cover rent for a small studio apartment in another.

The Cost of Living Index (COLI) is a helpful tool for understanding this. The national average is benchmarked at 100. A city with a COLI of 120 is 20% more expensive than the national average, while a city with a COLI of 85 is 15% cheaper.

Let's compare the purchasing power of a $65,000 salary in several U.S. cities, using a cost-of-living calculator from a reputable source like Payscale or NerdWallet.

How Far Does $65,000 Go? A City-by-City Comparison

| City | Cost of Living Index (Approx.) | Salary Needed to Maintain Same Lifestyle | Analysis |

| :--- | :--- | :--- | :--- |

| New York, NY (Manhattan) | 228 | $148,200 | In Manhattan, $65,000 is a very challenging salary. Housing costs alone would consume the majority of take-home pay, making it extremely difficult to live without roommates or significant financial strain. |

| San Francisco, CA | 194 | $126,100 | Similar to NYC, $65k in San Francisco is considered a low income. It falls far short of what's needed for a comfortable, independent lifestyle in the city proper. |

| Boston, MA | 148 | $96,200 | While not as extreme as NYC or SF, $65k in Boston is still a tight squeeze. It would be considered a junior or entry-level salary, requiring careful budgeting. |

| Austin, TX | 108 | $70,200 | In a trendy, growing city like Austin, $65k is a livable but increasingly average salary. It was considered very good a decade ago, but rising costs have diminished its power. |

| Chicago, IL | 105 | $68,250 | $65,000 in Chicago is a solid, functional salary. It allows for a comfortable lifestyle, access to big-city amenities, and the ability to save, making it a "good" salary for many. |

| Kansas City, MO | 87 | $56,550 | Here, $65,000 is an *excellent* salary. Its purchasing power is equivalent to over $90k in Boston. It can afford a high quality of life, including potential homeownership and robust savings. |

| Birmingham, AL | 76 | $49,400 | In a low-cost-of-living city like Birmingham, a $65,000 salary is exceptionally strong, placing you firmly in the upper-middle class for the area and providing significant financial freedom. |

Key Takeaway: If you have a remote job paying $65,000, your choice of where to live will have a more significant impact on your financial well-being than a $20,000 raise would in a high-cost city.

### 2. Industry and Area of Specialization

Your field of work dramatically frames the perception of a $65,000 salary. What is considered a ceiling in one industry might be the floor in another.

- Technology: In the tech industry, $65,000 is generally viewed as an entry-level salary for roles like junior developer, IT support, or QA tester. For a software engineer in a major tech hub, a starting salary would typically be much higher, often exceeding $100,000. Therefore, a tech professional might see $65k as a temporary, early-career figure.

- Healthcare: As noted, this salary is highly variable for a Registered Nurse depending on location. For other roles like a Medical Assistant or a Pharmacy Technician, $65,000 would be a very high, senior-level salary achieved after many years of experience.

- Education: For K-12 teachers, $65,000 is often a mid-to-late career salary in many states, representing years of dedication and potentially a master's degree. In higher education, it might be the salary for a non-tenure track lecturer or an administrative staff member.

- Non-Profit: In the non-profit sector, a $65,000 salary is often considered very respectable, typically held by Program Managers or Development Coordinators with significant experience. For many in this passion-driven field, this salary represents a comfortable and sustainable income.

- Government: For federal government employees, salary is determined by the General Schedule (GS) pay scale. A $65,000 salary typically falls within the GS-9 or GS-11 bands, depending on the location's locality pay adjustment. These roles require a bachelor's or master's degree and/or specialized experience and come with excellent job security and benefits.

### 3. Level of Education and Years of Experience

Salary growth is rarely linear. It's a curve that steepens with experience and is often accelerated by education and certifications. A $65,000 salary fits differently at various points along this curve.

- Entry-Level (0-2 Years): Securing a $65,000 salary right out of college is an excellent outcome. It's most common for graduates with in-demand degrees like computer science, engineering, finance, or nursing, especially those who have completed internships. For someone with a liberal arts degree, landing a $65k starting salary is possible but often requires landing a role in a higher-paying field like tech sales or marketing analytics.

- Mid-Career (3-8 Years): For many professionals, this is the stage where they first cross the $65,000 threshold. It reflects a proven track record of competence and growing responsibility. At this stage, a salary of $65k is solid but should come with a clear path for further growth. If you have 8 years of experience in a professional field and are still at $65k, it may be time to evaluate your career trajectory, industry, or negotiation skills.

- Senior/Experienced (8+ Years): In most professional white-collar fields, a salary of $65,000 would be considered low for someone with over a decade of experience, particularly in a medium- or high-cost-of-living area. Exceptions exist in certain fields like education, social work, or some administrative roles. At this stage, professionals in business, tech, and healthcare should be aiming for significantly higher compensation.

The Impact of Advanced Degrees and Certifications:

- Master's Degree: An MBA, Master's in Data Science, or Master's in Engineering can significantly increase starting salaries and accelerate mid-career earnings, often pushing professionals well past the $65k mark much faster.

- Certifications: Industry-recognized certifications can provide a direct and immediate boost to earning potential. For example, a project manager earning $60,000 could see their salary jump to $70,000+ after obtaining the Project Management Professional (PMP) certification. Similarly, a SHRM-CP for HR professionals or a Salesforce Administrator certification for those in tech/sales can command higher pay.

### 4. Company Type and Size

The type of organization you work for has a profound impact on compensation structure.

- Large Corporations (Fortune 500): These companies typically offer well-defined salary bands, competitive benefits, and structured career progression. A $65,000 salary at a large corporation is often a formal grade level and comes with a strong total compensation package (excellent health insurance, 401k match, etc.).

- Startups: A startup might offer a base salary of $65,000 but supplement it with potentially lucrative stock options. This is a higher-risk, higher-reward proposition. The salary might be lower than a large corporation's, but the potential for a massive payout if the company succeeds is the main draw. Work-life balance can also be more demanding.

- Small to Medium-Sized Businesses (SMBs): Compensation at SMBs can be highly variable. They may not be able to match the benefits of a large corporation, but they can sometimes offer more flexibility, faster growth opportunities, and performance bonuses that are more directly tied to your individual contributions.

- Government & Non-Profit: As discussed, these sectors often trade higher salaries for other benefits like job security, pensions (in government), a strong sense of mission, and better work-life balance. A $65,000 salary in these sectors is often considered very good.

### 5. In-Demand Skills

In today's dynamic job market, your specific, demonstrable skills are a direct lever on your earning potential. Two candidates with the same job title and years of experience can have vastly different salaries based on their skill sets. If you are aiming for or want to move beyond a $65,000 salary, cultivating high-value skills is non-negotiable.

Skills That Command a Salary Premium:

- Data Analysis & Visualization: Proficiency in tools like SQL, Python (with pandas/NumPy), R, and data visualization platforms like Tableau or Power BI is in extremely high demand across all industries. A marketing analyst who can write their own SQL queries will earn more than one who cannot.

- Software Development & Cloud Computing: Knowledge of programming languages (Python, JavaScript, Java), frameworks (React, Angular), and cloud platforms (AWS,