Introduction

Landing a job offer with a $70,000 salary can feel like a monumental achievement. For many, it's a figure that represents stability, comfort, and the first real step towards significant financial goals. But in the complex economic landscape of the 21st century, a single number on a contract rarely tells the whole story. Is $70,000 truly a *good* salary? The answer, as you might suspect, is a resounding "it depends." It depends on where you live, what you do, the size of your family, and your personal definition of financial success.

This guide is designed to move beyond a simple yes or no. We will dissect what a $70,000 annual income means in practical, real-world terms. We will explore the lifestyles it can afford in different parts of the country, compare it to national benchmarks, and identify the career paths that lead to this income level and beyond. I remember the first time I crossed a significant salary threshold in my own career; the initial thrill was quickly followed by the practical questions of taxes, budgeting, and whether it truly changed my day-to-day life. That experience taught me that financial well-being isn't just about the gross number, but about the knowledge and strategy you apply to it. This article is the guide I wish I had then.

Our goal is to provide you with the data, context, and expert analysis needed to evaluate a $70,000 salary for yourself. We will leverage authoritative data from sources like the U.S. Bureau of Labor Statistics (BLS), the U.S. Census Bureau, and leading salary aggregators to give you the ultimate resource for understanding your earning potential and financial health.

### Table of Contents

- [Putting $70,000 in Perspective: A National Comparison](#national-comparison)

- [What Kind of Jobs Pay Around $70,000 a Year?](#what-jobs-pay)

- [Key Factors That Determine If $70,000 Is 'Good' for You](#key-factors)

- [Budgeting on a $70,000 Salary: A Practical Breakdown](#budgeting-breakdown)

- [How to Earn $70,000 (or More)](#how-to-earn)

- [Conclusion: Your Final Verdict on a $70,000 Salary](#conclusion)

Putting $70,000 in Perspective: A National Comparison

Before we can analyze your personal situation, we need to establish a baseline. How does a $70,000 salary stack up against the rest of the United States? By looking at national data, we can understand where this income level places you on the economic spectrum.

### Comparison to Median and Average Incomes

It's crucial to distinguish between "median" and "average" income. The average income can be skewed by a small number of extremely high earners. The median income, however, is the exact midpoint of all incomes—half of the population earns more, and half earns less. For this reason, economists consider the median a more accurate representation of the typical person's earnings.

- Median Household Income: According to the most recent data from the U.S. Census Bureau (2022 data released in 2023), the median household income in the United States was $74,580. A "household" can consist of a single person or a family, so this figure includes single-earner and multi-earner households. A salary of $70,000 is slightly below this national median. However, if you are a single person or the primary earner in a single-income household, your $70,000 salary is supporting your household at a level very close to the national median.

- Median Personal Income: Looking at individuals is even more revealing. The Census Bureau reports the median personal income for all workers aged 15 and over was approximately $47,960. For full-time, year-round workers, this figure rises significantly. Based on BLS data for the fourth quarter of 2023, the median weekly earnings for full-time wage and salary workers were $1,145, which translates to an annual income of $59,540.

What does this mean? A salary of $70,000 places you comfortably above the median personal income for a full-time American worker. You are earning more than half of the full-time workforce in the country.

### Your Income Percentile

Where does $70,000 place you in the grand scheme of American earners? Based on 2023 individual income distribution data from sources like the DQYDJ Income Percentile Calculator, a $70,000 gross annual income places an individual at approximately the 65th percentile.

This means you earn more than 65% of all individual workers in the United States. While not in the top tier, you are firmly in the upper-middle portion of the income distribution curve.

### A Look at Total Compensation

Salary is only one part of the equation. Total compensation includes your base salary plus the value of any additional benefits and perks. When evaluating a $70,000 job offer, consider the full package, which often includes:

- Bonuses: Performance-based or annual bonuses can add anywhere from 3% to 15% (or more) to your total earnings. A 5% bonus on a $70,000 salary is an extra $3,500.

- Health Insurance: Employer-sponsored health insurance is a significant financial benefit. The average annual premium for employer-sponsored family coverage was over $23,968 in 2023, according to KFF, with employers covering about 73% of that cost. That's a benefit worth over $17,000 that you don't have to pay for out-of-pocket.

- Retirement Savings (401k/403b Match): A common employer match is 50% of your contribution up to 6% of your salary. On a $70,000 salary, if you contribute 6% ($4,200), your employer adds an additional $2,100 to your retirement account for free. This is a crucial component of long-term wealth building.

- Paid Time Off (PTO): The value of vacation days, sick leave, and paid holidays adds to your overall quality of life and financial security.

- Other Benefits: This can include stock options, profit sharing, tuition reimbursement, life insurance, and wellness stipends.

The Bottom Line: A base salary of $70,000 is a strong starting point. When combined with a comprehensive benefits package, the total compensation can easily approach or exceed the equivalent of $85,000-$90,000 in value, placing you in an even stronger financial position.

What Kind of Jobs Pay Around $70,000 a Year?

A $70,000 salary is a common benchmark across a wide array of industries and professions. It often represents the earning potential for a skilled professional with a few years of experience or a highly competent entry-level worker in a high-demand field. Here is a look at some of the jobs where a $70,000 salary is a typical or attainable figure, with data synthesized from the BLS, Glassdoor, and Payscale.

### Technology

The tech industry is known for high salaries, but you don't always need to be a senior software engineer to earn a good living.

- IT Support Specialist (Tier 2-3): Professionals who handle complex technical issues can earn between $60,000 and $80,000.

- Web Developer (Entry to Mid-Level): A front-end or back-end developer with 2-4 years of experience often falls into the $65,000 to $90,000 range.

- UX/UI Designer: As companies prioritize user experience, designers with a solid portfolio can command salaries around $70,000 early in their careers.

- Data Analyst: With the explosion of big data, analysts who can interpret trends and provide business insights are in high demand, with typical mid-level salaries ranging from $68,000 to $85,000.

### Business and Finance

Core business functions offer stable career paths with solid earning potential.

- Accountant (with CPA): A Certified Public Accountant (CPA) with 2-5 years of experience in corporate accounting or at a public firm can expect to earn in the $70,000-$85,000 range.

- Financial Analyst: Responsible for financial planning, analysis, and forecasting for a company, these roles often pay between $65,000 and $90,000 for those with a few years of experience.

- Marketing Manager: In charge of marketing campaigns and strategy, marketing managers at small-to-midsize companies or mid-level managers at larger corporations frequently earn around $70,000.

- Human Resources (HR) Generalist: An experienced HR professional handling recruitment, employee relations, and benefits administration can earn a salary in the mid-$60,000s to high-$70,000s.

### Healthcare (Non-Physician Roles)

The healthcare industry is vast, with many well-paying roles that don't require a medical doctorate.

- Registered Nurse (RN): The median pay for RNs was $81,220 per year in 2022, according to the BLS. In many states and metropolitan areas, a nurse with a few years of experience can easily earn $70,000 or more.

- Diagnostic Medical Sonographer: These skilled technicians operate imaging equipment. The BLS reports a median pay of $78,210 per year.

- Occupational Therapist: With a median pay of $93,180 per year (BLS), even those in the earlier stages of their career can approach or exceed a $70,000 salary.

### Skilled Trades and Engineering

A four-year college degree isn't the only path to a great income. Skilled trades are in high demand.

- Electrician or Plumber (Licensed/Journeyman): Experienced and licensed tradespeople often run their own businesses or work for established contractors. Earnings can vary widely by location but frequently exceed $70,000, with the BLS citing a median pay of $60,240 for electricians, with the top 10% earning over $100,000.

- Construction Manager: Overseeing construction projects requires significant skill and experience. The median pay for this role is $101,480 per year (BLS), so a salary of $70,000 would be typical for someone in a junior management or assistant role.

- Civil or Mechanical Engineer: An engineer with a bachelor's degree and a few years of experience can comfortably earn in the $70,000 to $95,000 range. The BLS notes the median pay for mechanical engineers is $96,310.

This list demonstrates that a $70,000 salary is an achievable target in dozens of professions, from creative fields to technical ones, underscoring its status as a benchmark for a skilled American professional.

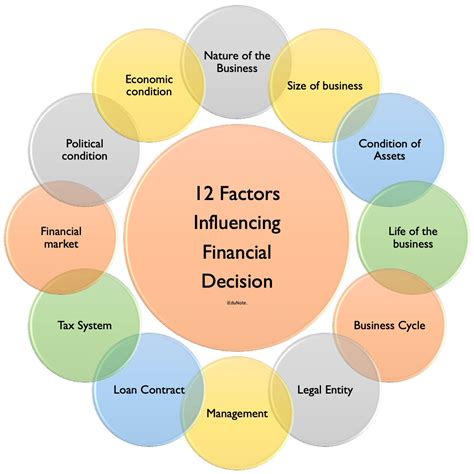

Key Factors That Determine If $70,000 Is 'Good' for You

This is the most critical section of our guide. A salary is not just a number; it's a tool to build a life. Whether $70,000 is "good" is entirely dependent on your unique circumstances. Let's break down the six factors that have the biggest impact on the real value of your income.

### 1. Geographic Location & Cost of Living

This is, by far, the most important factor. The same $70,000 salary can provide a comfortable, upper-middle-class lifestyle in one city and feel like a struggle in another. The primary driver of this difference is the Cost of Living (COL), which includes housing, transportation, food, taxes, and healthcare.

Let's illustrate this with a concrete example using a Cost of Living calculator (data from sources like Payscale or NerdWallet). We'll compare living on $70,000 in a high-cost city (San Francisco, CA) versus a low-cost city (Omaha, NE).

Scenario: You earn $70,000 in Omaha, Nebraska.

- Median Home Price (Zillow, early 2024): ~$250,000

- Median Rent (1-bedroom): ~$1,000/month

- Your salary provides a comfortable living. A mortgage on a median-priced home would be manageable, and saving for a down payment is realistic. You have significant discretionary income after covering necessities.

Scenario: You move to San Francisco, California and need to maintain the same lifestyle.

- Cost of Living: Approximately 117% higher than Omaha.

- Equivalent Salary Needed: To maintain the same standard of living you had in Omaha, you would need to earn approximately $151,900 in San Francisco.

- Median Home Price (Zillow, early 2024): ~$1.3 million

- Median Rent (1-bedroom): ~$2,800 - $3,200/month

On a $70,000 salary in San Francisco, your entire financial picture changes. Your rent alone could consume over 50% of your take-home pay, leaving very little for savings, debt repayment, or other goals.

High-Cost vs. Low-Cost States (Cost of Living Index - National Average = 100):

| High-Cost States/Districts | Index | Low-Cost States | Index |

| :--- | :---: | :--- | :---: |

| Hawaii | 184.0 | Mississippi | 85.3 |

| District of Columbia | 152.2 | Oklahoma | 85.8 |

| Massachusetts | 149.7 | Alabama | 87.8 |

| California | 137.6 | Arkansas | 88.0 |

| New York | 125.1 | Kansas | 89.2 |

*(Source: MERIC, Q3 2023)*

The Takeaway: Before accepting a $70,000 salary, meticulously research the cost of living in that specific city or region. A seemingly lower salary in a low-cost area often provides a higher quality of life than a higher salary in an expensive metropolitan hub.

### 2. Years of Experience & Career Stage

Context is king. A $70,000 salary means very different things at different points in your career.

- Entry-Level (0-2 years): For a recent graduate in many professional fields (e.g., marketing, non-profit, liberal arts, teaching), $70,000 is an *excellent* starting salary. It's significantly above the typical entry-level range for these roles, placing you on a fast track for future earnings growth. In high-paying fields like tech or engineering, it may be closer to a standard, solid starting salary.

- Mid-Career (5-10 years): At this stage, $70,000 can be considered average or slightly below average, depending on the industry. For a teacher or social worker, it might be a hard-won and respectable income. For a software engineer or a corporate lawyer, it would likely be considered significant underpayment, indicating a potential career stall.

- Senior/Experienced (15+ years): For a seasoned professional with deep expertise and a track record of success, a $70,000 salary is likely a sign of underemployment in most professional fields. Exceptions might include those who have intentionally downshifted their careers, work in public service, or live in very low-cost-of-living areas.

Salary Growth Trajectory: The more important question is not just what you earn now, but what your potential is. A job that starts at $70,000 but has a clear path to six figures within 3-5 years is vastly different from a role where $70,000 is the long-term salary cap.

### 3. Household Size & Personal Circumstances

Your personal life dictates your financial needs. A salary is not just for you; it's for everyone who depends on it.

- Single Individual: For a single person with no dependents, a $70,000 salary is often more than enough to live comfortably, even in many mid-to-high cost of living areas (outside of extreme outliers like NYC or SF). It allows for aggressive saving, investing, and significant discretionary spending.

- Couple (Dual Income, No Kids): If your partner also works, a combined household income that includes your $70,000 salary puts you in a very strong financial position. A household income of, for example, $130,000 ($70k + $60k) is well above the national median and allows for a high standard of living.

- Single-Income Household with Dependents: This is where a $70,000 salary is stretched the thinnest. Supporting a spouse and one or more children on this income can be challenging, especially in a moderate-to-high cost of living area. Childcare costs alone can consume a massive portion of the budget. In this scenario, meticulous budgeting is not just advisable; it's essential for survival. According to the MIT Living Wage Calculator, a living wage for two adults (one working) with two children exceeds $70,000 in nearly every major metropolitan area in the U.S.

### 4. Level of Education & Student Loan Debt

Your educational background sets expectations for your earning potential and can come with significant financial burdens.

- High School Diploma / Associate's Degree: Earning $70,000 with a high school diploma or an associate's degree is a major accomplishment. This is most common in the skilled trades, sales, or entrepreneurship. In this case, $70,000 is an excellent salary, as it was achieved without the high cost (and debt) of a traditional four-year degree.

- Bachelor's Degree: For someone with a bachelor's degree, $70,000 is a solid, respectable salary a few years post-graduation. The key variable is student loan debt. If you have $80,000 in student loans, a significant portion of your income will be dedicated to repayment, reducing your disposable income.

- Master's Degree / Ph.D. / Professional Degree: For those with advanced degrees (MBA, JD, MD, Ph.D.), salary expectations are much higher. A $70,000 salary would typically be considered low, especially if the degree led to substantial debt. An exception might be for those in academic or research positions where passion and non-monetary rewards play a larger role.

### 5. Industry and Area of Specialization

Your choice of industry has a profound impact on your earning potential.

- High-Paying Industries: Fields like Technology, Finance, Pharmaceuticals, and Engineering have high salary ceilings. A $70,000 salary in these fields is often an entry-point or early-career benchmark.

- Lower-Paying Industries: Fields like Education, Non-Profit, Social Services, and the Arts traditionally have lower pay scales. In these industries, a $70,000 salary can represent a significant achievement, often for a mid-career or senior-level professional.

Within an industry, specialization matters. A "Marketing" professional's salary can vary wildly:

- Content Writer: Median salary might be around $65,000.

- Marketing Analytics Manager: Median salary could be closer to $95,000 due to the quantitative and data-driven skills required.

### 6. In-Demand Skills

Your specific skills can add a premium to your salary. If you have abilities that are high-demand, low-supply, you have immense leverage. Skills that can help you command a salary well above $70,000 include:

- Technical Skills: Cloud Computing (AWS, Azure), Cybersecurity, AI/Machine Learning, Software Development (Python, Java), and Data Science.

- Business Skills: Project Management (PMP certification), Sales and Business Development, Financial Modeling, and Digital Marketing (SEO/SEM).

- Soft Skills: While harder to quantify, skills like leadership, complex problem-solving, negotiation, and effective communication are what separate a $70,000 employee from a $120,000 team lead.

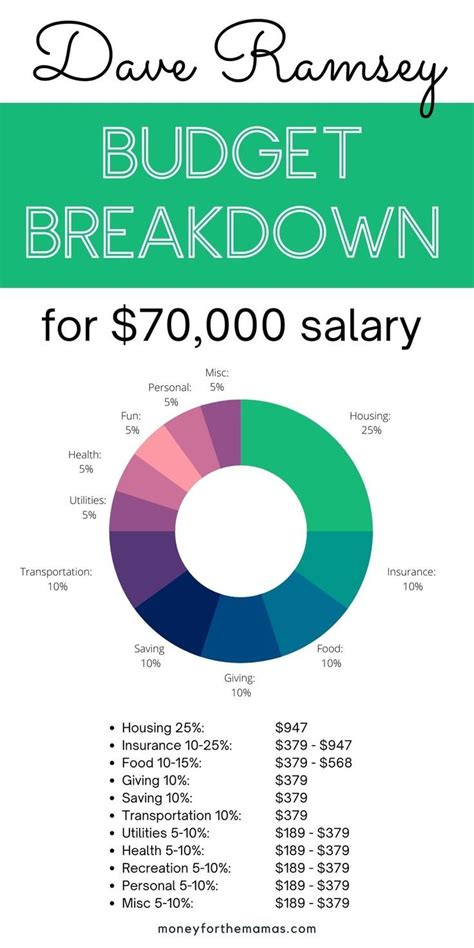

Budgeting on a $70,000 Salary: A Practical Breakdown

Let's translate $70,000 into tangible numbers. What does your monthly budget actually look like? The biggest variable is taxes, which differ by state.

First, let's calculate the approximate monthly take-home pay. A $70,000 gross annual salary is $5,833 per month.

- Assumptions for Calculation: We'll assume a single filer with standard deductions. This includes Federal income tax, FICA taxes (Social Security and Medicare), and state income tax.

Scenario 1: Low-Cost State (Texas - No State Income Tax)

- Approximate Total Tax Rate: ~22%

- Monthly Take-Home Pay: ~$4,550

Scenario 2: High-Cost State (California - High State Income Tax)

- Approximate Total Tax Rate: ~28%

- Monthly Take-Home Pay: ~$4,200

That difference of $350 per month ($4,200 per year) is significant and highlights the impact of state taxes alone. Now, let's apply a popular budgeting framework, the 50/30/20 rule, to these scenarios. This rule allocates 50% of take-home pay to Needs, 30% to Wants, and 20% to Savings & Debt Repayment.

### Sample Monthly Budget: Living in Austin, TX (Mid-Cost City in a Low-Tax State)

Monthly Take-Home Pay: $4,550

NEEDS: 50% (~$2,275)

- Housing: Rent for a 1-bedroom apartment (~$1,500). *This is 33% of take-home pay, slightly over the ideal 30%, showing how housing costs can strain even a good budget.*

- Utilities (Electric, Water, Gas): ~$150

- Internet: ~$65

- Groceries: ~$350

- Transportation (Car Payment, Insurance, Gas): ~$210 (assuming a paid-off or modest car)

WANTS: 30% (~$1,365)

- Restaurants & Bars: ~$350

- Shopping (Clothes, Gadgets, etc.): ~$250

- Subscriptions (Streaming, Gym): ~$100

- Hobbies & Entertainment (Concerts, Trips): ~$400

- Miscellaneous: ~$265

SAVINGS & DEBT: 20% (~$910)

- 401(k) Contribution (to get full employer match): $350 (6% of gross)

- Roth IRA Contribution: ~$300

- Extra Debt Payment (Student Loans): ~$100

- General Savings (Emergency Fund, Travel): ~$160

Verdict for Austin: A $70,000 salary is very livable. You can cover all your needs, enjoy a vibrant social life, and still save aggressively for the future. You are building wealth.

### Sample Monthly Budget: Living in Los Angeles, CA (High-Cost City in a High-Tax State)

Monthly Take-Home Pay: $4,200

NEEDS: 50%... or more (~$2,100... realistically higher)

- Housing: Rent for a 1-bedroom apartment (~$2,200). *This alone is 52% of your take-home pay.* This immediately breaks the 50/30/20 budget.

- Utilities: ~$150

- Internet: ~$65

- Groceries: ~$400 (higher cost)

- Transportation: ~$250 (higher gas prices and insurance)

- Total Needs: ~$3,065 (or 73% of take-home pay)

The Reality Check:

With 73% of your income going to needs, you are left with only $1,135 for *both* wants and savings. The 50/30/20 rule is no longer feasible. A more realistic, constrained budget might look like this:

- WANTS (15%): ~$630

- This category must be significantly curtailed. Fewer restaurant meals, less shopping, and finding cheaper hobbies.

- SAVINGS & DEBT (12%): ~$505

- You can still contribute enough to your 401(k) to get a match ($350).

- This leaves only ~$155 for all other savings goals or debt repayment. Building an emergency fund will be slow, and paying off debt aggressively is difficult.

Verdict for Los Angeles: A $70,000 salary is a struggle. While technically possible to live on, you would likely need roommates, a very tight budget, and would have minimal ability to save for major life goals like a down payment on a house. Your financial progress would be slow and precarious.

How to Earn $70,000 (or More): Your Action Plan

Whether you're aiming for $70,000 as your next career milestone or see it as a stepping stone to a six-figure income, the strategies to get there are the same. This requires a proactive, strategic approach to your career development.

### Step 1: Choose the Right Field and Location

As our analysis has shown, industry and geography are paramount.

- Research High-Growth Fields: Use the BLS Occupational Outlook Handbook (OOH) to identify professions with strong growth projections and solid median salaries. Fields like healthcare, technology, renewable energy, and logistics are currently booming.

- Target "Sweet Spot" Locations: Look for cities with a strong job market but a cost of living that hasn't skyrocketed. Cities in the Sun Belt (e.g., Raleigh, NC; Austin, TX; Atlanta, GA) or Midwest (e.g., Columbus, OH; Madison, WI) often offer a great balance of high-paying jobs and reasonable living expenses.

- Leverage Remote Work: The rise of remote work is a game-changer. You can potentially secure a job with a company based in a high-cost city (and paying a competitive salary) while living in a low-cost area. This is the ultimate form of salary arbitrage.

### Step 2: Acquire High-Value Skills and Credentials

Your salary is a reflection of the value you bring to an employer. Increase your value by acquiring skills that are in demand.

- Certifications: In IT, certifications like CompTIA A+, Network+, Security+, or more advanced certs like AWS Certified Solutions Architect can directly lead to higher pay. In business, a PMP (Project Management Professional) or a CPA (Certified Public Accountant) are gold standards.

- Online Courses and Bootcamps: Platforms like Coursera, edX, and specialized bootcamps (for coding, UX/UI, data science) offer structured paths to learn job-ready skills in a matter of months. A certificate from a reputable program can