Introduction

Standing at a career crossroads, perhaps at the very beginning of your professional journey or considering a switch into a new field, the first number you often look for is the salary. It’s the foundational figure that dictates your lifestyle, your budget, and your financial planning. For millions in the United Kingdom, that starting point is the National Minimum Wage or the National Living Wage. But what does a "UK minimum wage 2025 annual salary 40 hours per week" actually look like in your bank account? How does it translate to your daily life, and more importantly, what are the pathways to move beyond it? This guide is designed to be your definitive resource, demystifying the numbers and empowering you with the knowledge to not only understand your current earnings but to chart a course for significant career and financial growth.

The conversation around minimum wage is often reductive, focusing solely on the hourly rate. This article goes deeper. We will meticulously break down the annual salary calculation for 2025, explore the realities of living on this income, and—most critically—provide an actionable blueprint for advancement. We’ll delve into the sectors where these roles are prevalent, the skills you gain that are often undervalued, and the strategic steps you can take to build a career that offers greater financial security and professional fulfillment. I remember my first job in a bustling cafe; that initial payslip was a mix of pride and a stark reality check. Understanding how every penny was calculated and what it meant for my budget was the first step I took in taking control of my financial future, a journey this guide aims to facilitate for you.

This is more than just an article about a wage; it's a career manual for anyone starting on the first rungs of the employment ladder. Whether you're a student, a new entrant to the workforce, or someone re-evaluating their options, the insights here will provide clarity, confidence, and a clear direction forward.

### Table of Contents

- [Understanding the Role of the National Minimum Wage and National Living Wage](#what-is-the-uk-minimum-wage)

- [Calculating Your 2025 Minimum Wage Annual Salary: A Deep Dive](#minimum-wage-salary-deep-dive)

- [Key Factors That Influence Your Earnings and Career Progression](#key-factors-influencing-salary)

- [Job Outlook for Minimum Wage Sectors and Pathways to Progression](#job-outlook-and-career-growth)

- [A Practical Guide to Maximizing Your Earnings and Advancing Your Career](#how-to-get-started-in-this-career)

- [Conclusion: Building Your Future Beyond the Minimum Wage](#conclusion)

What is the UK Minimum Wage? Understanding Its Role and Impact

Before we can discuss salary figures and career paths, it's essential to understand exactly what the UK's minimum wage system entails. It’s not a single flat rate but a tiered structure designed to protect workers from exploitation by setting a legal pay floor. Understanding this structure is the first step in ensuring you are being paid correctly and knowing your rights as an employee.

The system is primarily divided into two key components: the National Minimum Wage (NMW) and the National Living Wage (NLW).

- National Living Wage (NLW): This is the highest minimum wage rate and, as of April 2024, it applies to all workers aged 21 and over. Previously, it was for those aged 23 and over, but the age threshold was lowered to broaden its reach. This is the rate most people refer to when discussing the "UK minimum wage" for adult workers.

- National Minimum Wage (NMW): This term covers the rates for younger workers. There are separate, lower hourly rates for workers aged 18-20 and for those aged 16-17. There is also a specific, lower rate for apprentices who are under 19 or in the first year of their apprenticeship.

The rates are reviewed annually by the government, based on the recommendations of the independent Low Pay Commission (LPC). The LPC is comprised of economists, business representatives, and trade unionists who analyze economic data to recommend a rate that increases pay for the lowest earners without significantly harming employment prospects. These new rates typically come into effect on April 1st each year.

### What Kind of Jobs Typically Pay the Minimum Wage?

While any job *can* pay the minimum wage if the role is entry-level, certain sectors are more commonly associated with it. These are often foundational roles that form the backbone of the UK's service economy. Understanding these sectors is key to identifying both the starting points for many careers and the environments where you can build crucial transferable skills.

- Hospitality: This is one of the largest sectors for minimum wage employment. Roles include bar staff, waiting staff, kitchen porters, hotel receptionists, and housekeeping staff.

- Retail: Another major employer, with roles like sales assistant, stockroom assistant, cashier, and customer service representative often starting at the NLW/NMW.

- Social Care: Care assistants and support workers, who provide essential services to vulnerable individuals, are frequently paid at or near the minimum wage, a point of significant national debate regarding fair compensation for vital work.

- Cleaning and Facilities Management: Commercial and domestic cleaners, as well as maintenance staff, often begin their careers on the minimum wage.

- Agriculture and Horticulture: Seasonal workers involved in farming, picking, and packing produce are typically paid according to minimum wage regulations.

- Leisure and Tourism: Roles in attractions, cinemas, and holiday parks, such as ride operators, ticket sellers, and events staff, often fall into this category.

- Administration: Entry-level administrative assistants or office juniors may start on the minimum wage as they gain experience.

### A Day in the Life: The Retail Assistant

To make this more tangible, let's imagine a "Day in the Life" of a full-time retail assistant, "Alex," working in a high-street clothing store and earning the National Living Wage.

8:30 AM: Alex arrives at the store, clocks in, and joins the morning team huddle. The manager discusses the day's sales targets, new promotions, and which product lines to focus on.

9:00 AM - 1:00 PM: The doors open. Alex's morning is a whirlwind of activity. They greet customers, help a shopper find the right size, and offer style advice. They operate the till, processing payments, returns, and exchanges, ensuring accuracy in every transaction. In between customers, they are responsible for tidying their section, refolding clothes, and ensuring the displays look pristine. They also assist with restocking shelves from the morning's delivery.

1:00 PM - 2:00 PM: Lunch break. This is an unpaid hour where Alex can rest and recharge before the afternoon rush.

2:00 PM - 5:30 PM: The afternoon is often busier. Alex handles a customer complaint with patience and professionalism, escalating it to a manager when necessary. They spend an hour in the fitting rooms, managing the flow of customers and returning unwanted items to the shop floor. They also receive a quick training session on a new inventory system being rolled out on the store's handheld devices.

5:30 PM: Alex's shift ends. They complete end-of-day tasks, cash up their till, and clock out. Throughout the day, Alex has demonstrated customer service, cash handling, inventory management, communication, and problem-solving skills—all valuable assets for any future career.

This example highlights that while the pay may be at the legal floor, the work itself is demanding and skill-building. The key is learning how to recognize, articulate, and leverage these skills for your next career move.

Calculating Your 2025 Minimum Wage Annual Salary: A Deep Dive

This is the central question: what does the "uk minimum wage 2025 annual salary 40 hours per week" actually amount to? To answer this accurately, we need to look at the most current data and make an informed projection for 2025.

### Projecting the 2025 National Living Wage (NLW)

The government sets the minimum wage rates annually based on recommendations from the Low Pay Commission (LPC). While the exact rate for April 2025 - March 2026 will not be confirmed until late 2024, the LPC has been operating with a clear target: to have the NLW reach two-thirds of median hourly earnings by 2024. Having achieved this with the April 2024 increase, the LPC's new remit for 2025 is to recommend a rate that maintains this two-thirds target.

Based on wage growth forecasts from bodies like the Office for Budget Responsibility (OBR), we can project the April 2025 NLW. The current NLW (for those 21 and over) as of April 1, 2024, is £11.44 per hour. Economists and analysts project the 2025 rate will likely increase to somewhere between £11.85 and £12.15 per hour, depending on the economic climate and wage inflation over the coming months.

For the purpose of this guide, we will use a conservative and realistic projection of £11.90 per hour for the National Living Wage from April 2025.

*Disclaimer: This £11.90 figure is a projection for illustrative purposes. The final, official rate will be announced by the UK Government in late 2024. Always refer to the official GOV.UK website for the confirmed rate applicable to you.*

### Calculating the Gross Annual Salary

With our projected hourly rate, we can now calculate the gross annual salary for someone working a standard 40-hour week.

The calculation is:

[Hourly Rate] x [Hours per Week] x [Weeks per Year] = Gross Annual Salary

Using our projected rate:

£11.90 x 40 hours x 52 weeks = £24,752

So, the projected gross annual salary for a full-time worker aged 21 or over on the National Living Wage in 2025 is approximately £24,752.

### Salary Table by Age and Experience (Based on a 40-Hour Week)

The wage you are entitled to is dependent on your age. Below is a table showing the gross annual salary for a 40-hour week based on the confirmed April 2024 rates and our 2025 projection.

| Age Bracket / Category | April 2024 Hourly Rate | April 2024 Gross Annual Salary | Projected April 2025 Hourly Rate | Projected April 2025 Gross Annual Salary |

| --------------------------- | ---------------------- | ------------------------------ | --------------------------------- | -------------------------------------------- |

| 21 and over (NLW) | £11.44 | £23,795 | £11.90 | £24,752 |

| 18-20 Year Olds | £8.60 | £17,888 | £9.00 (est.) | £18,720 (est.) |

| 16-17 Year Olds | £6.40 | £13,312 | £6.70 (est.) | £13,936 (est.) |

| Apprentice Rate | £6.40 | £13,312 | £6.70 (est.) | £13,936 (est.) |

*Source: GOV.UK for 2024 rates. 2025 rates are author projections based on LPC targets and economic forecasts.*

### From Gross to Net: Understanding Your Take-Home Pay

Your gross salary of £24,752 is not what you will see in your bank account. You must account for deductions, primarily Income Tax and National Insurance Contributions (NICs). This is your Net Salary or "take-home pay."

Let's break down the deductions for the 2024/2025 tax year, as the 2025/2026 thresholds are not yet set. This provides a very close estimate.

- Personal Allowance: In the UK, you can earn a certain amount before you start paying Income Tax. For 2024/25, this is £12,570.

- Income Tax: You pay tax on earnings *above* your Personal Allowance. The basic rate is 20%.

- Taxable Income: £24,752 - £12,570 = £12,182

- Income Tax Payable: 20% of £12,182 = £2,436.40 per year

- National Insurance (NI): You pay NI to qualify for certain state benefits, including the State Pension.

- You start paying NI on earnings above £12,570 per year. The rate for employees (Class 1) is 8% on earnings between £12,570 and £50,270.

- NI Payable: 8% of (£24,752 - £12,570) = 8% of £12,182 = £974.56 per year

Total Deductions: £2,436.40 (Tax) + £974.56 (NI) = £3,410.96 per year

Calculating Net Salary:

- Net Annual Salary: £24,752 - £3,410.96 = £21,341.04

- Net Monthly Salary: £21,341.04 / 12 = £1,778.42

- Net Weekly Salary: £21,341.04 / 52 = £410.40

This deep dive shows that a projected 2025 gross salary of nearly £25,000 translates to a monthly take-home pay of just under £1,800. This figure is the realistic starting point for budgeting and financial planning. Other deductions, like student loan repayments or pension contributions (which are highly recommended), would reduce this amount further.

### Other Compensation Components

While roles paid at the minimum wage are typically light on traditional bonuses or profit sharing, there are other forms of compensation to be aware of:

- Tips and Gratuities: In hospitality roles, tips can significantly supplement income. It's crucial to understand your employer's policy (a "tronc" system vs. cash in hand) as it affects how tips are taxed.

- Overtime Pay: If you work more than your contracted hours, you must be paid at least the minimum wage for that extra time. Some employers offer an enhanced rate (e.g., "time and a half"), which can be a valuable way to boost earnings.

- Employee Discounts: A common perk in retail and hospitality, offering significant savings on company products or services.

- Pension Contributions: By law, employers must auto-enrol eligible staff into a workplace pension scheme. While this is a deduction from your pay, your employer also has to contribute, which is essentially a form of deferred compensation—free money for your retirement.

Key Factors That Influence Your Earnings and Career Progression

Earning the minimum wage is often a starting point, not a destination. Your ability to earn more is not a matter of luck; it's a direct result of strategic decisions and actions. Several key factors influence your salary growth, and understanding them is the first step toward architecting a more lucrative career path. This section explores how to leverage these factors to move from the legal pay floor to a salary that offers greater financial freedom.

### 1. Years of Experience and Proving Your Value

This is the most fundamental driver of salary growth. In almost every field, experience is a proxy for competence, efficiency, and reliability. However, simply "serving time" in a role is not enough. The key is to actively build and demonstrate your increasing value.

- Entry-Level (0-2 years): At this stage, you are typically paid the National Minimum/Living Wage. Your focus should be on mastering the core functions of your job, demonstrating an excellent work ethic (punctuality, reliability), and developing a positive reputation with colleagues and managers. An employee who masters their role within the first year is already building a case for more responsibility.

- Salary Impact: Base rate of NLW/NMW. E.g., ~£24,752 (projected 2025 NLW).

- Mid-Level (2-5 years): By this point, you should be moving beyond the basics. This is where progression to a supervisory or team leader role becomes possible. You might be trusted to train new starters, handle more complex customer issues, or take responsibility for cashing up at the end of the day. In a retail setting, this could be the leap from Sales Assistant to Supervisor or Key Holder. This transition almost always comes with a pay rise that takes you above the NLW.

- Salary Impact: Roles like Team Leader or Supervisor in retail or hospitality typically pay between £26,000 and £30,000 per year, according to data from Glassdoor and Payscale. This represents a 5-20% increase over the NLW.

- Senior-Level (5+ years): With significant experience, you can aim for management positions. An Assistant Store Manager, a Restaurant Manager, or a Care Team Manager has significant responsibilities, including staff scheduling, budget management, and performance reviews. These roles require a proven track record of leadership and commercial acumen.

- Salary Impact: Assistant and Store Manager roles often command salaries from £30,000 to £45,000+, depending on the size and turnover of the location. This is a significant jump, often doubling your initial earning potential.

How to Leverage Experience: Proactively seek out new responsibilities. Ask your manager if you can help with the stock take, learn how to do the staff rota, or shadow a supervisor. Keep a personal log of your achievements: "Resolved a complex customer complaint that led to a positive online review," "Trained three new team members who are now fully proficient." This log becomes your evidence when asking for a promotion or in a job interview.

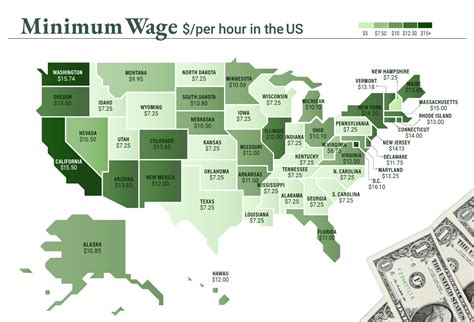

### 2. Geographic Location and Cost of Living

Where you work in the UK has a profound impact on your real and nominal earnings. The legally mandated NLW is the same nationwide (excluding a potential London weighting in some public sector jobs), but the cost of living varies dramatically.

- The "Real Living Wage": This is a crucial concept. The Living Wage Foundation is an independent organization that calculates a voluntary minimum wage based on what people actually need to live on. It is always higher than the government's NLW. For 2023/24, their rates are:

- UK Rate: £12.00 per hour

- London Rate: £13.15 per hour

- Impact: Actively seeking out "Living Wage Accredited" employers is one of the quickest ways to secure a higher-than-mandatory wage. Their salary floor is legally committed to being higher.

- Major Cities vs. Rural Areas: Large cities, particularly London and the South East, have significantly higher costs for housing, transport, and daily life. While the NLW is the same, your £24,752 annual salary will stretch much further in a city like Liverpool or Newcastle than it will in London or Brighton. Some companies in high-cost-of-living areas may offer a slightly higher wage to attract staff, but it often doesn't compensate fully for the difference.

- Example: A net monthly salary of £1,778 might be manageable in a region with lower rent, but in London, where the average room rent can exceed £950 per month (source: SpareRoom), it leaves very little disposable income.

- High-Paying vs. Low-Paying Areas: According to data from the ONS, median earnings are highest in London and the South East, and lowest in the North East and Wales. This trend extends to many non-salaried roles. However, when viewed through the lens of cost of living, the "best" place to be on an entry-level wage is often a city with a strong job market but a more affordable cost of living, such as Manchester, Leeds, or Glasgow.

How to Leverage Location: When job searching, use the Living Wage Foundation's website to find accredited employers in your area. If you are mobile, research the cost of living in different cities against the job opportunities available. A job in a mid-sized city might offer a better quality of life on an entry-level salary than the same job in London.

### 3. Education, Certifications, and Training

While many minimum wage jobs do not require formal education beyond GCSEs, acquiring specific qualifications is one of the most reliable ways to increase your earning potential.

- Vocational Qualifications (NVQs/SVQs): These are work-based qualifications that prove your competence in a specific role. Completing an NVQ in Customer Service, Retail Operations, or Health and Social Care can make you a more attractive candidate for supervisory roles and demonstrate a commitment to your professional development.

- Apprenticeships: An apprenticeship is a game-changer. It combines a paid job with formal training, resulting in a recognized qualification. While the apprentice wage is lower in the first year, it allows you to "earn while you learn." Upon completion, qualified apprentices often see a significant pay jump and have a clear career path. The government's "Find an apprenticeship" service is the central hub for opportunities in England.

- Industry-Specific Certifications:

- Hospitality: A Personal Licence Holder qualification is essential for anyone wanting to manage a venue that sells alcohol. A food safety or first aid certificate also adds value.

- Care: The Care Certificate is the industry standard for new starters. Progressing to a Level 2 or 3 Diploma in Health and Social Care is a prerequisite for more senior care roles.

- IT/Admin: Gaining certifications like the Microsoft Office Specialist (MOS) can demonstrate proficiency that justifies a higher starting salary in an administrative role.

How to Leverage Education: Talk to your employer about training opportunities. Many larger companies have internal development programs or will support staff in gaining relevant qualifications. Explore free online courses on platforms like Coursera, edX, or Google's Digital Garage to build skills in areas like digital marketing, data analysis, or project management, which can help you transition into a new, higher-paying sector.

### 4. Company Type & Size

The type of company you work for can influence your pay and progression opportunities.

- Large Corporations (e.g., major supermarkets, chain restaurants):

- Pros: Often have structured pay bands, clear paths for promotion, formal training programs, and better benefits (pensions, sick pay, staff discounts). Many large retailers like Tesco, Sainsbury's, and Lidl now pay well above the government's NLW as a standard.

- Cons: Can be more bureaucratic and less flexible.

- Small and Medium-sized Enterprises (SMEs) / Independents:

- Pros: You may have a closer relationship with the owner/manager, offering more opportunities to take on varied responsibilities quickly. A successful small business may offer greater flexibility.

- Cons: Pay may stick closer to the legal minimum. Benefits and formal training may be less comprehensive. Progression might be limited if the management structure is small.

- Living Wage Accredited Employers: As mentioned, these companies have formally committed to paying the higher, voluntary Real Living Wage. This is a clear signal that they value their employees and can be a significant immediate boost to your income.

How to Leverage Company Type: When applying for jobs, specifically target companies known for investing in their staff. Research a company's pay policies on sites like Glassdoor and look for the Living Wage Employer mark. A job at a large supermarket paying £12.50 an hour is a better financial proposition than a similar job at an independent shop paying the legal minimum of £11.44.

### 5. In-Demand Skills

The skills you develop in a minimum wage job are often highly transferable and valuable. The key is to recognize them and learn how to articulate them on your CV and in interviews. Furthermore, acquiring new, in-demand skills can be your ticket to a different career path entirely.

Skills Often Gained in Minimum Wage Roles:

- Customer Service & Communication: Handling diverse customers, resolving complaints, active listening