Are you analytically minded, detail-oriented, and passionate about employee well-being? A career as a senior benefits analyst could be your ideal path. This strategic role is crucial for attracting and retaining top talent, and it comes with significant earning potential. For experienced professionals in this field, a six-figure salary is not just possible—it's common.

This guide will break down everything you need to know about a senior benefits analyst's salary, from the national average to the key factors that can maximize your earnings.

What Does a Senior Benefits Analyst Do?

Before diving into the numbers, it's important to understand the value a senior benefits analyst brings to an organization. This is far more than an administrative role; it's a strategic function within Human Resources.

A senior benefits analyst is responsible for the research, analysis, implementation, and administration of a company's employee benefits programs. Their work directly impacts every employee and the company's bottom line.

Key responsibilities include:

- Designing and Managing Benefit Plans: Evaluating and recommending health insurance, retirement plans (like 401(k)s), paid time off, life insurance, and wellness programs.

- Cost and Data Analysis: Analyzing plan costs, assessing market trends, and modeling the financial impact of any changes to the benefits package.

- Ensuring Legal Compliance: Navigating the complex web of regulations, including the Affordable Care Act (ACA), ERISA, and COBRA, to ensure all plans are compliant.

- Vendor Management: Acting as the main point of contact for insurance brokers, retirement plan administrators, and other benefits vendors.

- Communication: Clearly communicating benefits information to employees during open enrollment and throughout the year, and training junior staff.

Average Senior Benefits Analyst Salary

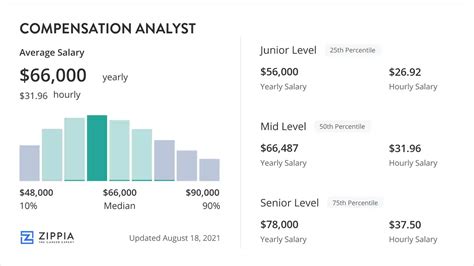

A senior benefits analyst's salary reflects their specialized knowledge and the critical nature of their work. While figures vary, the consensus among leading salary aggregators points to a strong and competitive compensation package.

According to recent data, the average senior benefits analyst salary in the United States typically falls between $90,000 and $100,000 per year.

Let's break this down further with data from reputable sources:

- Salary.com reports that the median salary for a Senior Benefits Analyst in the U.S. is $96,654, with a typical range falling between $87,597 and $106,177 as of early 2024.

- Payscale indicates a similar average base salary of around $90,300, with total pay (including potential bonuses and profit-sharing) extending upwards of $115,000.

- Glassdoor lists the average total pay for a senior benefits analyst at approximately $99,500 per year, combining base salary and additional compensation.

It's important to note that this is for a "senior" role. An entry-level benefits analyst might start in the $60,000 to $75,000 range, while a Benefits Manager or Director can easily command salaries well over $125,000.

Key Factors That Influence Salary

Your specific salary will depend on a combination of factors. Understanding these levers is the key to negotiating better pay and strategically planning your career trajectory.

###

Level of Education

A bachelor's degree is the standard requirement for a benefits analyst role. Degrees in Human Resources, Finance, Business Administration, or a related field are most common. However, higher education and professional certifications can provide a significant salary boost.

- Master's Degree: An MBA or a Master's in Human Resource Management (MHRM) can make you a more competitive candidate for senior and leadership positions, often leading to a 10-15% salary premium.

- Professional Certifications: Holding a recognized certification demonstrates expertise and a commitment to the profession. The most respected credential is the Certified Employee Benefit Specialist (CEBS) designation. Other valuable certifications include the SHRM-CP/SHRM-SCP or PHR/SPHR.

###

Years of Experience

Experience is arguably the single most significant factor in determining your salary. The career path shows clear and rewarding financial progression.

- Entry-Level (0-2 years): As a Benefits Analyst or Coordinator, you'll focus on administration and support, with a salary typically in the $60,000 - $75,000 range.

- Mid-Level (3-5 years): With a few years of experience, you'll take on more analytical tasks and may earn between $75,000 - $90,000.

- Senior-Level (5-8+ years): As a Senior Benefits Analyst, you lead projects, perform complex analyses, and contribute to strategy. This is where salaries cross the $90,000 threshold and head toward $110,000+.

- Manager/Director (10+ years): Benefits Managers and Directors oversee the entire benefits function and staff, with salaries often ranging from $120,000 to $175,000+, depending on the company size.

###

Geographic Location

Where you work matters. Salaries are adjusted for the local cost of living and labor market demand. Major metropolitan areas, particularly those with a high concentration of large corporate headquarters, offer the highest pay.

Here's how salaries can differ by location, according to data from Salary.com:

- High-Cost Cities: Metropolitan areas like San Francisco, CA; San Jose, CA; and New York, NY often offer salaries 15-25% above the national average.

- Average-Cost Cities: Major hubs like Chicago, IL; Dallas, TX; and Atlanta, GA tend to have salaries that align closely with the national average.

- Lower-Cost Areas: Smaller cities and rural regions will typically offer salaries below the national average, but the lower cost of living can offset this difference.

###

Company Type

The size, industry, and structure of your employer play a huge role in your compensation.

- Company Size: Large, multinational corporations (Fortune 500) generally have more complex benefits needs and larger budgets, leading to higher salaries than small or mid-sized businesses.

- Industry: High-paying industries like Technology, Finance, Pharmaceuticals, and Professional Consulting often offer more lucrative benefits packages and higher base salaries for their HR professionals.

- Public vs. Private Sector: The private sector almost always pays more than the public sector (government) or non-profit organizations. However, public sector jobs may offer better job security and more generous pension plans.

###

Area of Specialization

Within the benefits world, developing expertise in a high-demand niche can make you an invaluable and highly compensated asset.

- Health and Welfare: The most common specialization, focused on medical, dental, vision, and life insurance.

- Retirement Plans: Specializing in 401(k), 403(b), and pension plan administration and compliance.

- Executive Compensation: A highly lucrative niche focused on designing stock options, deferred compensation, and other perks for senior leadership.

- International Benefits: A complex and in-demand area for global companies, requiring knowledge of different countries' laws and cultural norms regarding benefits.

Job Outlook

The future for benefits professionals is bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 5 percent from 2022 to 2032, which is faster than the average for all occupations.

The BLS attributes this growth to several factors:

1. Changing Regulations: Healthcare and retirement laws are constantly evolving, requiring expert guidance.

2. Talent Retention: As the war for talent continues, companies are relying on competitive benefits packages to attract and keep skilled employees.

3. Cost Control: Businesses need skilled analysts to help manage the rising costs of healthcare and other benefits.

This steady demand ensures that a career as a benefits analyst offers not only strong compensation but also excellent job security.

Conclusion

A career as a senior benefits analyst is a financially rewarding and professionally stimulating path for data-driven individuals. With an average salary approaching six figures and multiple avenues for growth, it represents a stable and promising profession within the Human Resources field.

To maximize your earning potential, focus on continuous learning through certifications like the CEBS, gain diverse experience across different industries, and consider specializing in a high-demand area like retirement plans or international benefits. For those who can blend analytical prowess with a genuine desire to improve the employee experience, this career offers a direct route to making a tangible impact—and being well-compensated for it.