For ambitious professionals in the finance world, securing a Vice President (VP) title at a powerhouse institution like J.P. Morgan represents a significant career milestone. It signifies expertise, leadership, and a gateway to substantial financial rewards. A common question on the minds of aspiring financiers is, "What does a J.P. Morgan VP actually earn?"

The answer is complex, with total compensation often reaching well into the six-figure range, potentially between $350,000 and over $550,000 annually. However, this figure is not a simple paycheck; it's a dynamic package influenced by a host of factors. This article will break down the components of a J.P. Morgan VP's salary, explore the key variables that dictate earnings, and provide a clear outlook on this prestigious career path.

What Does a J.P. Morgan VP Do?

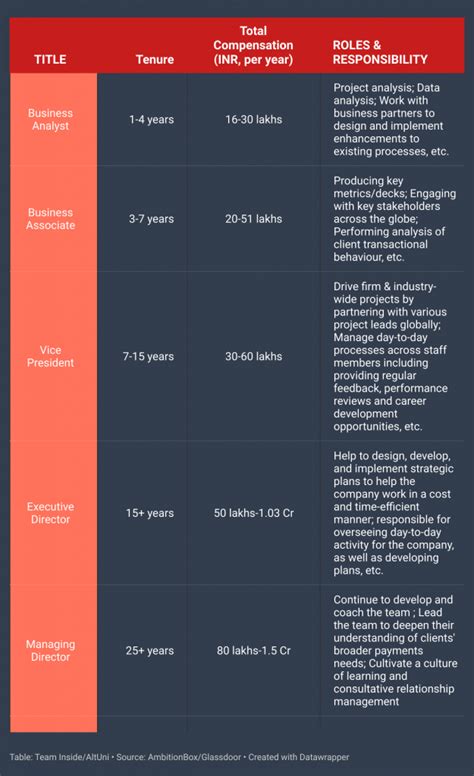

First, it’s crucial to understand the VP role within the unique hierarchy of an investment bank. Unlike a traditional corporate structure where a VP is a senior executive, a Vice President at J.P. Morgan is a mid-to-senior level professional. The typical investment banking track progresses from Analyst to Associate, and then to Vice President, before advancing to Executive Director and Managing Director.

A VP transitions from the analytical-heavy work of an Associate to a role with greater responsibility, client interaction, and management duties. Key responsibilities often include:

- Managing Deal Execution: Leading the day-to-day execution of transactions like mergers and acquisitions (M&A), IPOs, or debt financing.

- Team Leadership: Supervising and mentoring junior bankers (Analysts and Associates) on the team.

- Client Relationship Management: Serving as a key point of contact for clients, building trust, and ensuring their needs are met.

- Financial Modeling and Valuation: Overseeing and validating complex financial models and valuation analyses prepared by the team.

- Developing New Business: Assisting senior bankers in pitching new ideas and generating business for the firm.

Average J.P. Morgan VP Salary

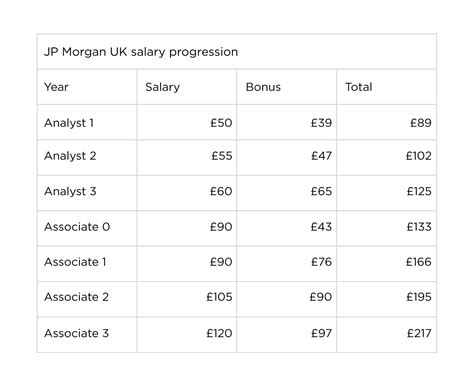

The compensation for a VP at J.P. Morgan is typically broken down into two main components: a base salary and a performance-based bonus. This structure is standard across Wall Street.

- Base Salary: According to data from salary aggregators like Glassdoor and Salary.com, the base salary for a Vice President at J.P. Morgan typically falls within the range of $225,000 to $275,000 per year as of 2023-2024. This base provides a stable, predictable income.

- Performance Bonus: The bonus is the highly variable—and most lucrative—part of the compensation. It is tied to the performance of the individual, their team, their division, and the firm as a whole. For a VP, this bonus can range from 50% to well over 100% of their base salary.

- Total Compensation: When combined, the total annual compensation package for a J.P. Morgan VP can realistically range from $350,000 to $550,000+. Top performers in lucrative divisions during a strong market year can potentially exceed this range.

Key Factors That Influence Salary

Your specific compensation as a VP is not one-size-fits-all. Several critical factors will determine where you fall on the pay scale.

###

Level of Education

While a bachelor's degree in finance, economics, or a related field is the minimum requirement, a Master of Business Administration (MBA) plays a pivotal role. Many professionals enter investment banking at the Associate level after completing an MBA from a top-tier business school. This advanced degree not only provides the necessary network and skills but essentially acts as a prerequisite for the post-MBA career track that leads to the VP position, commanding a higher starting salary than for those promoted internally without an MBA.

###

Years of Experience

Experience is a primary driver of salary. The path to VP is structured: typically 2-3 years as an Analyst followed by 3-4 years as an Associate. Therefore, a newly promoted VP (a "VP1") will be on the lower end of the pay scale. As they gain experience and move to their second or third year as a VP ("VP2" or "VP3"), both their base salary and, more significantly, their bonus potential increase as they demonstrate a track record of success and greater autonomy.

###

Geographic Location

Where you work matters immensely. Salaries at J.P. Morgan are benchmarked to the cost of living and market competition in a specific city.

- New York City: As the financial capital of the world, NYC-based VPs command the highest salaries.

- Other Major Hubs: Locations like London, Hong Kong, and San Francisco also offer top-tier compensation packages, though they may vary slightly from the New York standard.

- Regional Offices: VPs in cities like Chicago, Houston, or Charlotte will still earn very competitive salaries, but they are generally adjusted downward to reflect the lower cost of living and different market dynamics.

###

Company Type

This factor is more accurately described as the division within the company. This is perhaps the most significant factor influencing a VP's salary at a diversified firm like J.P. Morgan.

- Investment Banking Division (IBD): VPs in M&A, capital markets, or industry coverage groups (like Technology or Healthcare) generate direct revenue from deals and consistently earn the highest compensation packages.

- Sales & Trading (Markets): VPs in this division also have very high earning potential, with bonuses tied directly to trading performance and revenue generation.

- Asset & Wealth Management: Compensation is strong but generally lower than in IBD. Bonuses are tied to assets under management (AUM) and investment performance.

- Corporate & Commercial Banking: These roles are crucial to the bank but carry lower risk and, consequently, lower compensation than the investment banking arm.

- Corporate Functions (Tech, Operations, HR): VPs in these support roles have a salary structure more aligned with traditional corporations. Their base salaries are competitive, but their bonus potential is significantly smaller than in client-facing, revenue-generating divisions.

###

Area of Specialization

Even within the high-paying Investment Banking Division, specialization can impact earnings. A VP in a "hot" sector like Technology, Media, and Telecom (TMT) or Healthcare may see larger bonuses during years with high deal flow in those industries. Furthermore, individual and team performance is paramount. A VP who played a key role on several successfully closed, high-profile deals will be rewarded far more generously than one on a team with a slower year.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track data for "Investment Banking VP" specifically, we can look at a broader, related category: Financial Managers.

According to the BLS, employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS notes that services from financial managers will remain in high demand as they are needed to manage cash, reduce risk, and develop strategies for growth.

However, it is essential to be realistic. While the industry is growing, competition for roles at elite, "bulge bracket" firms like J.P. Morgan is exceptionally fierce. Success requires not only a stellar academic and professional background but also immense dedication and resilience.

Conclusion

A career as a Vice President at J.P. Morgan is both demanding and incredibly rewarding. While the title itself represents a significant achievement, the financial compensation reflects the high stakes and deep expertise required.

Here are the key takeaways for anyone considering this path:

- Think Total Compensation: Focus on the entire package (base + bonus), as the bonus is where true earning potential is unlocked.

- Performance is Paramount: Your annual bonus will be directly tied to your individual, team, and firm performance.

- Your Division Defines Your Pay: The most significant factor influencing your salary is the division you work in, with Investment Banking and Markets leading the pack.

- It's a Marathon, Not a Sprint: The path to VP is a multi-year journey requiring exceptional work ethic and a commitment to continuous learning.

For those with the ambition and ability to navigate its challenges, a VP role at J.P. Morgan offers a career that is not only financially lucrative but also places you at the very center of the global economy.