Introduction

Have you ever looked at your paycheck and wondered about the complex system that determined that exact number? You’re not alone. The way we are paid—whether an hourly wage or an annual salary—is one of the most fundamental aspects of our professional lives, yet the strategic decisions behind it often remain a mystery. What if you could be the person behind the curtain, the expert who designs fair, competitive, and strategic pay structures that attract top talent and motivate a workforce? Welcome to the world of the Compensation Analyst.

This isn't just a background HR function; it's a critical strategic role that directly impacts a company's bottom line and its culture. A skilled Compensation Analyst is a master of data, a keen observer of market trends, and a crucial advisor to executive leadership. The career is both intellectually stimulating and financially rewarding, with the U.S. Bureau of Labor Statistics reporting a median pay of $74,730 per year for Compensation, Benefits, and Job Analysis Specialists, and senior roles easily reaching well into the six figures.

I remember my first major project as a junior analyst. A mid-sized tech company was struggling with high turnover in their customer support department. After digging into the data, I discovered their rigid hourly wage structure didn't reward high performers and was below the market rate for the skills they needed. I helped design a new system with competitive salaried tiers and a performance bonus structure. Six months later, turnover had dropped by 40%, and employee satisfaction scores soared. It was a powerful lesson in how strategic compensation isn't just about numbers; it's about valuing people and building a better business.

This guide will demystify the career of a Compensation Analyst. We will explore everything from daily responsibilities and salary expectations to the specific skills and steps you need to take to enter and excel in this dynamic field.

### Table of Contents

- [What Does a Compensation Analyst Do?](#what-does-a-compensation-analyst-do)

- [Average Compensation Analyst Salary: A Deep Dive](#average-compensation-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Compensation Analyst Do?

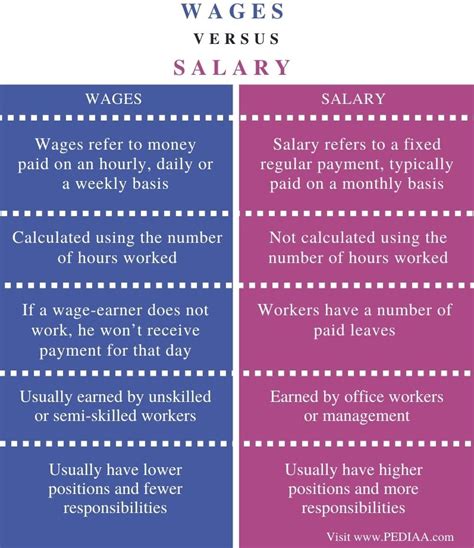

At its core, a Compensation Analyst is the architect of an organization's pay philosophy. They answer the critical question that the title of this article poses: "What is the difference between a wage and a salary?"—and more importantly, *why* and *when* should a role be one or the other?

A wage is typically an hourly rate paid for time worked. It's common in roles with variable hours, such as retail, manufacturing, or food service. Wage earners are usually classified as "non-exempt" under the Fair Labor Standards Act (FLSA) in the United States, meaning they are entitled to overtime pay for hours worked beyond 40 in a week.

A salary is a fixed amount paid to an employee on a regular schedule (e.g., weekly, bi-weekly, monthly), regardless of the specific number of hours worked. Salaried employees are often "exempt" from overtime pay, a classification that depends on their job duties and salary level meeting specific FLSA criteria.

A Compensation Analyst’s job is to manage this distinction and build the entire compensation framework around it. They don't just assign numbers; they create a logical, equitable, and legally compliant system that supports the company's goals.

Core Responsibilities and Daily Tasks:

- Job Analysis and Evaluation: They analyze the duties, responsibilities, and requirements of every job in the organization. They then use established methodologies (like point-factor or job ranking) to determine the relative value of each job.

- Market Pricing and Salary Surveys: Analysts are constantly researching the external market. They purchase, conduct, and analyze salary surveys from third-party vendors (like Radford, Mercer, or Willis Towers Watson) to benchmark their company's pay against competitors. This ensures their salaries are competitive enough to attract and retain talent.

- Designing Pay Structures: This is a cornerstone of the role. They create salary ranges or "bands" for different job levels. Each band has a minimum, midpoint, and maximum pay level, providing a clear framework for hiring, promotions, and raises.

- FLSA and Legal Compliance: A huge part of the job is ensuring all pay practices comply with federal, state, and local laws, including minimum wage, overtime regulations (FLSA), and emerging pay transparency laws. Misclassifying an employee as salaried (exempt) when they should be hourly (non-exempt) can lead to massive legal penalties.

- Incentive and Bonus Plan Administration: They help design and manage short-term and long-term incentive plans, such as annual bonuses, sales commissions, and stock options, ensuring they motivate the desired behaviors.

- Reporting and Analytics: They provide data and reports to leadership on compensation metrics like compa-ratio (an employee's salary divided by the salary range midpoint), payroll costs, and the effectiveness of compensation programs.

### A Day in the Life of a Compensation Analyst

To make this tangible, let's follow "Maria," a Compensation Analyst at a 2,000-employee healthcare technology company.

- 9:00 AM: Maria starts her day by checking emails. A hiring manager has submitted a request for a new "Senior Data Scientist" role. The manager wants to know the appropriate salary range.

- 9:30 AM: Maria opens her compensation analytics software and the latest tech industry salary survey data. She cross-references the job description provided by the manager with benchmark roles from the survey data, looking at factors like required skills (Python, machine learning), years of experience, and educational requirements.

- 11:00 AM: She prepares a report for the hiring manager. She recommends a salary range of $145,000 - $190,000, explaining that the midpoint of $167,500 is aligned with the 75th percentile of the market, which is the company's stated pay philosophy for critical tech roles. She also confirms the role qualifies as "exempt" under the FLSA.

- 1:00 PM: Maria attends a meeting with the HR Director and the VP of Sales to discuss the Q3 sales commission payouts. She presents a dashboard showing which sales representatives met their targets and calculates the total payout amount for payroll processing. They also discuss potential tweaks to the commission plan for the next fiscal year.

- 3:00 PM: She dedicates the afternoon to a major project: the company's annual merit increase cycle. She runs reports from the HRIS (Human Resources Information System) to analyze employee performance ratings and current positions within their salary ranges. She begins modeling different merit budget scenarios (e.g., a 3% vs. 4% overall budget) to present to the finance department next week.

- 4:30 PM: Before logging off, she reviews new pay transparency legislation passed in another state where the company has remote employees, flagging potential compliance issues for the legal team to review.

As you can see, the role is a blend of deep analytical work, strategic collaboration, and meticulous attention to legal detail.

---

Average Compensation Analyst Salary: A Deep Dive

The financial rewards for being the gatekeeper of pay are significant and grow substantially with experience. Compensation is a specialized skill set, and companies are willing to pay a premium for professionals who can design programs that save them from overspending while keeping them competitive.

According to Salary.com, as of late 2023, the median base salary for a Compensation Analyst in the United States is approximately $70,100, with a typical range falling between $63,000 and $78,000. However, this is just a starting point. Your actual earnings will be a composite of your base salary, bonuses, and the overall value of your benefits package.

Let's break down the compensation structure at various stages of the career, sourcing data from multiple reputable platforms to provide a comprehensive view.

### Salary by Experience Level

The career path for a Compensation Analyst offers clear and substantial financial growth. As you move from executing tasks to designing strategy, your value—and your paycheck—increases accordingly.

| Experience Level | Job Titles | Typical Salary Range (Base Pay) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Compensation Analyst I, HR Analyst (Comp Focus) | $60,000 - $75,000 | Job description review, participating in salary surveys, basic market analysis, data entry, report generation. |

| Mid-Career (3-7 years) | Compensation Analyst II, Senior Compensation Analyst | $75,000 - $110,000 | Managing survey participation, leading job evaluation projects, administering incentive plans, providing direct consultation to business leaders. |

| Senior/Lead (8-15 years) | Lead/Principal Analyst, Compensation Manager | $110,000 - $160,000+ | Designing new salary structures and bonus plans, managing a team of analysts, presenting to senior leadership, managing executive compensation programs. |

| Executive/Director Level (15+ years)| Director of Compensation, VP of Total Rewards | $160,000 - $250,000+ | Setting the overall global compensation and benefits strategy, aligning total rewards with business objectives, presenting to the Board of Directors. |

*Sources: Data compiled and averaged from Payscale, Glassdoor, and Salary.com (as of late 2023). Ranges are illustrative and can vary significantly based on factors discussed in the next section.*

For instance, Payscale.com notes that a Senior Compensation Analyst earns an average of $91,500, while a Compensation Manager averages around $112,000. This demonstrates the clear financial incentive for career progression.

### Beyond the Base Salary: Total Compensation

A Compensation Analyst's total earnings are often significantly higher than their base salary. It's crucial to understand the other components that make up a "total rewards" package. As an analyst yourself, you'd be the expert in evaluating these!

- Annual Bonuses/Short-Term Incentives (STI): This is the most common addition. Based on individual and company performance, bonuses can add a significant percentage to your base pay. For a mid-career analyst, this could be 5-15% of their salary. For a Director, it could be 20-40% or more.

- Profit Sharing: Some companies, particularly in finance or professional services, distribute a portion of their annual profits to employees. This can be a substantial, though variable, part of compensation.

- Long-Term Incentives (LTI) & Equity: Especially prevalent in publicly traded companies and tech startups, LTIs align your interests with the company's long-term success. This can come in the form of:

- Restricted Stock Units (RSUs): You are granted shares of company stock that vest (become yours) over a period of time, typically 3-4 years.

- Stock Options: The right to buy company stock at a predetermined price in the future. If the stock price rises, these can be very valuable.

- Comprehensive Benefits: While not direct cash, the value of a strong benefits package is immense. Compensation professionals are keenly aware of this. Key benefits include:

- Health Insurance: Premium medical, dental, and vision plans. A company that covers 100% of your premium is offering thousands of dollars in value per year compared to one that covers only 70%.

- Retirement Savings: A 401(k) or 403(b) plan with a generous company match is essentially free money. A common match is 50% of your contributions up to 6% of your salary, which is an instant 3% raise.

- Paid Time Off (PTO): Generous vacation, sick leave, and holiday policies contribute to work-life balance and overall job satisfaction.

- Other Perks: These can include tuition reimbursement (highly valuable for this career), wellness stipends, parental leave, and flexible work arrangements.

When evaluating a job offer, a savvy Compensation Analyst looks at the entire package. A $90,000 base salary with a 15% bonus target, excellent 401(k) match, and fully paid health insurance could be worth more than a $105,000 salary at a company with poor benefits and no bonus potential.

---

Key Factors That Influence Salary

Two Compensation Analysts with the same job title can have vastly different salaries. The market for this talent is nuanced, and compensation is determined by a confluence of factors. Understanding these variables is not only key to negotiating your own salary but is the very essence of the job itself. Here’s an in-depth look at what drives earnings in this profession.

### ### Level of Education

While hands-on experience often trumps formal education later in one's career, your educational background is a critical determinant of your starting salary and early-career trajectory.

- Bachelor's Degree: This is the standard entry requirement. The most relevant majors are Human Resources, Business Administration, Finance, Economics, or Mathematics/Statistics. A degree in one of these fields signals to employers that you have the foundational quantitative and business acumen required for the role. Candidates with these degrees can expect to start at the baseline of the entry-level salary range.

- Master's Degree: An advanced degree can provide a significant salary boost and open doors to leadership roles more quickly.

- Master's in Human Resource Management (MHRM): This degree provides specialized knowledge in all areas of HR, including compensation theory and practice.

- Master of Business Administration (MBA): An MBA, particularly with a concentration in finance or strategy, is highly valued. It equips you with a broader understanding of business operations, making you a more strategic partner to leadership. An analyst with an MBA may command a starting salary 10-20% higher than one with only a bachelor's degree.

- Professional Certifications: In the world of compensation, certifications are the gold standard for demonstrating expertise and can lead directly to higher pay. They are often a prerequisite for senior and managerial roles. The most prestigious is:

- Certified Compensation Professional (CCP®): Offered by WorldatWork, the leading professional association for compensation professionals. The CCP requires passing a series of exams on topics like base pay administration, market pricing, variable pay, and job analysis. Earning your CCP can result in a salary premium of up to 10% and signifies a deep commitment to the profession.

- SHRM-CP or SHRM-SCP: While more generalist HR certifications, they are still highly respected and demonstrate a broad understanding of the HR landscape in which compensation operates.

### ### Years of Experience

This is arguably the most significant factor. As detailed in the salary table above, compensation for this role scales dramatically with experience. Here’s a more granular look at the growth trajectory:

- Analyst I (0-2 years): You are learning the ropes. Your primary value is in your ability to execute tasks accurately under supervision. Salary: $60,000 - $75,000.

- Analyst II / Senior Analyst (3-7 years): You now operate with more autonomy. You can manage complex projects like annual survey submissions or administering a bonus plan. You are a trusted advisor to mid-level managers. Salary: $75,000 - $110,000. Your salary growth in this phase is rapid as you prove your competence.

- Compensation Manager (8-15 years): You have transitioned from "doer" to "designer" and "leader." You are responsible for designing compensation programs, managing a team, and handling more sensitive issues like executive pay or pay equity audits. Salary: $110,000 - $160,000+.

- Director/VP of Total Rewards (15+ years): You are a key strategic leader in the organization. Your focus is on global strategy, aligning all rewards programs (compensation, benefits, equity, wellness) with the company's long-term financial and talent goals. You interact directly with the C-suite and the Board of Directors. Salary: $160,000 - $250,000+, often with a very significant portion of compensation coming from LTI and executive bonuses.

### ### Geographic Location

Where you work matters—a lot. Salaries for Compensation Analysts are adjusted for the local cost of labor and cost of living. A high salary in a low-cost city might provide more purchasing power than an even higher salary in an expensive metropolitan area.

- High-Paying Metropolitan Areas: These are typically major tech and finance hubs where the demand for skilled analysts is intense and the cost of living is high.

- San Jose, CA: Average base salary can be 25-40% above the national average.

- San Francisco, CA: Similar to San Jose, with a significant premium.

- New York, NY: A major financial center with high demand and salaries 20-35% above average.

- Boston, MA: A hub for biotech and tech, commanding a 15-25% premium.

- Seattle, WA: Home to major tech giants, driving salaries up 15-25%.

- Average-Paying Areas: Most major cities and suburban areas will fall closer to the national average. Think cities like Chicago, IL; Dallas, TX; Atlanta, GA; or Phoenix, AZ.

- Lower-Paying Areas: Rural areas and smaller cities with a lower cost of living will typically have salaries that are 5-15% below the national average.

The Rise of Remote Work: The shift to remote work has complicated geographic pay. Some companies have adopted a location-agnostic pay strategy (paying the same regardless of where the employee lives), while others adjust pay based on the employee's location. This is a hot topic and an active area of strategy that Compensation Analysts themselves are helping to shape.

### ### Company Type & Size

The type and size of your employer create different opportunities and pay scales.

- Large Corporations (Fortune 500): These companies typically have the most structured compensation departments and offer the highest base salaries and most comprehensive benefits. They have complex global needs, leading to highly specialized and well-compensated roles. Think companies like Google, Johnson & Johnson, or JPMorgan Chase.

- Tech Startups (Pre-IPO): Base salaries might be slightly lower than at large corporations. However, the potential for high-value equity (stock options or RSUs) can be enormous if the company is successful. The work is often more fast-paced and less structured.

- Mid-Sized Companies: These offer a great balance. Pay is competitive, and analysts often get broader exposure to all areas of compensation, as teams are smaller. This can be an excellent environment for learning and growth.

- Non-Profits and Government: These sectors typically pay less than the for-profit world. A Compensation Manager at a large non-profit might earn 15-25% less than their counterpart at a for-profit company. However, they often offer excellent work-life balance, job security, and strong benefits like pensions.

- Consulting Firms: Working for a compensation consulting firm (like Mercer, Aon, or Willis Towers Watson) can be a very high-earning path. Consultants advise multiple clients on their compensation strategies. While the hours can be demanding, the exposure to different industries is unparalleled, and compensation is often higher than in-house corporate roles at a similar level.

### ### Area of Specialization

As you advance in your career, you may choose to specialize. Niche expertise is highly valued and can lead to a significant pay bump.

- Executive Compensation: This is one of the most lucrative specializations. These professionals design the complex pay packages for C-suite executives, including base salary, annual bonuses, long-term equity awards, and perks. This requires deep knowledge of SEC regulations and tax law. Senior specialists in this area can easily earn over $200,000.

- Sales Compensation: Another highly specialized and high-paying area. These analysts design and administer commission and quota-based incentive plans for sales teams. It requires a deep understanding of sales cycles and what motivates sales professionals.

- Global/International Compensation: For large multinational corporations, managing pay across different countries with varying currencies, laws, and cultural norms is a major challenge. Experts in this area who can navigate this complexity are in high demand.

- Equity Compensation: Specialists who manage a company's stock plans (RSUs, options, ESPPs) possess a highly technical skill set and are well-compensated, particularly in the tech industry.

### ### In-Demand Skills

Beyond your formal qualifications, possessing specific technical and soft skills will make you a more effective analyst and a more valuable candidate.

High-Value Technical Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a power user, proficient in VLOOKUP/HLOOKUP/XLOOKUP, pivot tables, complex formulas, and data modeling.

- HRIS (Human Resources Information System) Proficiency: Experience with systems like Workday, SAP SuccessFactors, or Oracle HCM is critical. These are the systems of record from which you'll pull all your data.

- Data Visualization Tools: The ability to present complex data in a clear, compelling way is a huge asset. Skills in tools like Tableau or Power BI can set you apart and command a higher salary.

- Statistical Analysis: A foundational understanding of statistics (mean, median, percentiles, regression analysis) is essential for interpreting data accurately.

Essential Soft Skills:

- Analytical Mindset: You must be able to see the story behind the numbers and translate data into actionable business insights.

- Discretion and Ethical Judgment: You will be handling highly sensitive and confidential information. Impeccable integrity is paramount.

- Communication and Influence: You need to be able to explain complex compensation concepts to non-experts, from new hires to senior executives, and influence their decisions.

- Attention to Detail: A small error in a spreadsheet can lead to significant financial and morale issues. Meticulous accuracy is a hallmark of a good analyst.

---

Job Outlook and Career Growth

For those considering a career as a Compensation Analyst, the future is bright. The demand for professionals who can strategically manage an organization's largest expense—its payroll—is robust and expected to grow.

The U.S. Bureau of Labor Statistics (BLS) projects that employment for Compensation, Benefits, and Job Analysis Specialists will grow by 7 percent from 2022 to 2032. This growth rate is faster than the average for all occupations. The BLS anticipates about 8,600 openings for these specialists each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This steady demand is driven by several key trends and ongoing challenges that organizations face.

### Emerging Trends Shaping the Profession

- Pay Equity and Transparency: This is perhaps the biggest driver of demand. An increasing number of states and cities are enacting pay transparency laws that require employers to disclose salary ranges in job postings. Furthermore, there is intense societal and regulatory pressure on companies to conduct pay equity audits to ensure they are not discriminating based on gender, race, or other protected characteristics. Compensation Analysts are on the front lines of this movement, performing the complex statistical analyses required for these audits and developing strategies to close any identified pay gaps.

- The Rise of Data Analytics: The role is becoming less about data entry and more about data science. Companies are investing heavily in HR technology and analytics platforms. The Compensation Analyst of the future will be a "people analytics" expert, using predictive modeling to forecast compensation costs and data visualization to tell compelling stories that drive strategic decisions.

- Remote and Hybrid Work Models: The shift to remote work has created immense complexity in compensation. Companies need experts to help them answer tough questions: Should we pay a San Francisco salary to an employee who moves to Boise? How do we adjust salary bands for a fully remote workforce? How do we ensure equity between in-office and remote employees? Compensation Analysts are tasked with creating the new playbook for geographic pay strategies.

- The War for Talent: In a competitive job market, compensation is a primary weapon. Companies rely on their compensation teams to provide real-time market data and creative solutions (like sign-on bonuses, retention bonuses, and unique perks) to attract and keep top performers, especially in high-demand fields like technology and healthcare.

### How to Stay Relevant and Advance

To thrive in this evolving landscape and maximize your career growth, you must be a continuous learner.

1. Embrace Technology: Don't just be a user of Excel; become a master. Proactively learn data visualization tools like Tableau or Power BI. Take online courses in basic statistical analysis or even an introductory course in a language like Python or R, which are becoming increasingly valuable in people analytics.

2. Stay on Top of Legislation: Pay laws are changing constantly. Set up alerts, read industry blogs, and actively follow news about pay transparency, minimum