In the world of global finance, few names command as much attention as Jane Fraser, the CEO of Citigroup. Ascending to the role in 2021, she shattered a significant glass ceiling, becoming the first woman to lead a major Wall Street bank. Her position places her at the apex of corporate power, influence, and, of course, compensation. The query "Jane Fraser salary" isn't just a search for a number; it's a search for what's possible at the highest echelon of a professional career.

While Jane Fraser's specific compensation package, which reached a remarkable $24.5 million in 2022, represents the peak for a select few, it serves as a powerful beacon for ambitious professionals. It illuminates a career path defined by strategic leadership, immense responsibility, and extraordinary financial reward. The journey to such a position is not a simple ladder; it's a complex, multi-decade climb requiring a specific blend of education, experience, and an unwavering drive. I recall a mentor early in my career advising me, "Don't chase the title; chase the problems. The biggest, most complex problems carry the biggest responsibilities, and the rewards will follow." This wisdom is the very essence of the path to a C-suite role.

This comprehensive guide will deconstruct the reality behind a "Jane Fraser salary." We will move beyond the headline number to explore the career of a top executive, breaking down the salary components, the factors that drive compensation, the long-term outlook, and the strategic steps you can take to embark on this challenging but potentially life-changing journey. This is your ultimate roadmap to understanding and pursuing a career at the very top.

### Table of Contents

- [What Does a Top Executive Like Jane Fraser Actually Do?](#what-does-a-ceo-do)

- [Deconstructing CEO Compensation: A Deep Dive](#ceo-salary-deep-dive)

- [Key Factors That Influence Executive Salary](#key-factors)

- [Job Outlook and Career Growth for Top Executives](#job-outlook)

- [How to Get Started: The Long Road to the C-Suite](#how-to-get-started)

- [Is a Top Executive Career Right for You?](#conclusion)

---

What Does a Top Executive Like Jane Fraser Actually Do?

Earning a salary in the tens of millions of dollars goes far beyond a standard 9-to-5 job. The role of a Chief Executive Officer (CEO) at a multinational corporation like Citigroup is one of the most demanding and high-stakes positions in the modern world. It is less a job and more a total commitment to the stewardship of a massive, complex organization with stakeholders spanning the entire globe.

At its core, the CEO's primary responsibility is to create, communicate, and execute the long-term strategic vision for the company. This involves a synthesis of market analysis, competitive positioning, financial planning, and organizational culture. They are the ultimate decision-maker, responsible for allocating the company's capital—be it financial, human, or technological—to generate the highest possible return for shareholders over the long run.

The role can be broken down into several key functions:

- Strategic Direction: The CEO, in collaboration with the board of directors and the executive team, sets the overarching goals and strategy for the company. For Jane Fraser, this involves navigating the complexities of global banking regulations, digital transformation in financial services, geopolitical risks, and shifting economic climates.

- Leadership and Culture: The CEO is the chief culture officer. They set the tone for the entire organization, defining its values, ethics, and standards of performance. They are responsible for building, developing, and retaining a high-performing senior leadership team.

- Capital Allocation: This is arguably the most critical function. The CEO decides where to invest the company's resources. Should the company acquire a competitor? Invest heavily in a new technology platform? Divest from an underperforming business line? Return capital to shareholders through dividends or buybacks? These are billion-dollar decisions with far-reaching consequences.

- Stakeholder Management: A CEO answers to multiple groups. This includes the Board of Directors, institutional investors, employees, customers, government regulators, and the public. A significant portion of their time is spent communicating with these stakeholders to maintain confidence and alignment.

- Public Face of the Company: The CEO is the primary spokesperson and brand ambassador. They represent the company at industry conferences, in media interviews, and during investor calls. Their ability to communicate with clarity and conviction is paramount.

### A Day in the Life of a Global CEO

To make this tangible, consider a hypothetical "Day in the Life" for a CEO at this level:

- 5:00 AM: Wake up. Review overnight market reports from Asia and Europe. Read curated news briefings and internal reports.

- 6:30 AM: Workout with a personal trainer, often used as a time to mentally prepare for the day.

- 7:30 AM: Breakfast meeting with a key government official or regulator.

- 9:00 AM: Lead the weekly Executive Leadership Team meeting. Agenda: review quarterly performance against targets, debate a major technology investment, and address a pressing competitive threat.

- 11:00 AM: One-on-one meeting with the Chief Financial Officer (CFO) to prepare for the upcoming quarterly earnings call with investors.

- 12:30 PM: "Lunch" is a working session with the head of the company's largest business division to discuss their five-year strategic plan.

- 2:00 PM: Media interview with a major financial news outlet.

- 3:00 PM: Call with a top-10 institutional investor to address their concerns about the company's stock performance.

- 4:00 PM: Host a company-wide "town hall" broadcast, answering live questions from employees around the world.

- 5:30 PM: Board of Directors committee call to discuss executive succession planning.

- 7:30 PM: Host a dinner for a delegation of key international clients.

- 10:00 PM: Final check of emails and preparation for the next day, which may involve boarding a corporate jet for a trip to another continent.

This grueling schedule underscores that the role is not a job but a lifestyle. The compensation, while astronomical, is a reflection of this 24/7 responsibility and the immense pressure to deliver results for an organization that employs hundreds of thousands of people and has a market capitalization in the hundreds of billions.

---

Deconstructing CEO Compensation: A Deep Dive

Understanding a "Jane Fraser salary" requires looking far beyond a simple base salary figure. Executive compensation at this level is a complex, performance-driven package designed to align the CEO's interests with those of the shareholders. While headlines often focus on a single large number, this figure is composed of several distinct elements, many of which are "at-risk," meaning they are not guaranteed.

Let's first use Jane Fraser's publicly reported 2022 compensation as a case study. Her $24.5 million package was structured as follows:

- Base Salary: $1.5 million

- Cash Bonus (Short-Term Incentive): $6.375 million

- Long-Term Incentives (Equity Awards): $16.625 million in the form of performance-linked stock units.

As you can see, her fixed base salary makes up only about 6% of her total compensation. The vast majority is variable and tied directly to her and the company's performance. This structure is typical for CEOs of large, publicly traded companies.

### National Averages for Top Executives

While Jane Fraser represents the top end of the scale, we can look at broader data to understand the landscape. The U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for "Top Executives" was $190,420 in May 2023. However, this figure is heavily skewed by the inclusion of executives at much smaller organizations. The BLS notes that the top 10 percent of executives earned more than $239,200, but it does not fully capture the multi-million dollar packages of S&P 500 CEOs.

For a more accurate picture of high-level roles, we turn to specialized salary aggregators and corporate governance data. According to Salary.com, the median total compensation for a Chief Executive Officer in the United States in late 2023 is approximately $835,900. However, the range is enormous:

- 25th Percentile: $629,800

- 75th Percentile: $1,103,400

For CEOs of companies with over $20 billion in revenue, Salary.com reports a median total compensation closer to $4,984,500. This demonstrates the profound impact of company size on pay.

### CEO Compensation by Experience and Company Stage

Compensation grows exponentially as an executive moves up the ladder and proves their ability to manage larger and more complex businesses.

| Career Stage / Company Size | Typical Base Salary Range | Typical Total Compensation Range (incl. equity/bonus) | Notes |

| --------------------------------- | ----------------------------- | ----------------------------------------------------- | -------------------------------------------------------------------------------------------------------- |

| Director / VP at a Large Corp | $180,000 - $350,000+ | $300,000 - $1,000,000+ | Often the final stepping stone to the C-suite. Compensation includes significant annual bonuses and some LTI. |

| CEO of a Small-Cap Public Co. | $300,000 - $500,000 | $800,000 - $3,000,000 | Performance incentives are a major component. Success here can lead to a large-cap CEO role. |

| CEO of a Private Equity-Backed Co. | $400,000 - $700,000 | Varies wildly; equity can be worth $10M+ upon exit | High-pressure role focused on a specific financial outcome (e.g., sale or IPO within 3-7 years). |

| CEO of a Large-Cap S&P 500 Co. | $900,000 - $1,600,000 | $10,000,000 - $30,000,000+ | This is the "Jane Fraser" tier. Base salary is a small fraction of the total potential compensation. |

*(Sources: Synthesized from data by Salary.com, Glassdoor, Willis Towers Watson executive compensation reports, and public SEC filings.)*

### The Key Components of Executive Compensation

To fully grasp the numbers, you must understand the components:

1. Base Salary: This is the only fixed, guaranteed portion of pay. It is determined by the scope of the role, the executive's experience, and market benchmarks. For top CEOs, it is often capped around $1-2 million to signal a pay-for-performance philosophy.

2. Short-Term Incentives (STI) / Annual Bonus: This is a cash payment awarded based on the achievement of specific, pre-defined goals over a one-year period. These goals are typically tied to financial metrics like revenue growth, profitability (EBITDA), and earnings per share (EPS), as well as strategic objectives.

3. Long-Term Incentives (LTI): This is the largest component of CEO pay and the primary driver of wealth creation. LTI is designed to align the executive's focus with long-term shareholder value. It usually comes in the form of equity, which doesn't become fully available to the executive for several years (a "vesting period"). Common forms include:

- Restricted Stock Units (RSUs): The executive is granted a certain number of company shares, which vest (i.e., become theirs to keep or sell) over a set period, typically 3-4 years.

- Performance Share Units (PSUs): These are similar to RSUs, but the number of shares that ultimately vest depends on the company achieving specific long-term performance targets, such as Total Shareholder Return (TSR) compared to a peer group. This is the most direct link to shareholder experience.

- Stock Options: These give the executive the right to buy company stock at a pre-set price (the "strike price") in the future. They only have value if the company's stock price increases above the strike price, creating a powerful incentive to grow the share price.

4. Perquisites ("Perks") and Other Benefits: While less significant than in the past due to public scrutiny, these still exist. They can include personal use of the corporate aircraft for security reasons, a car and driver, home security systems, financial planning services, and enhanced retirement and health benefits.

Understanding this breakdown is critical. It shows that earning a "Jane Fraser salary" is not about cashing a massive paycheck each month. It's about being entrusted with a significant ownership stake in the company, with the ultimate value of that stake being directly tied to the success and growth you can deliver over many years.

---

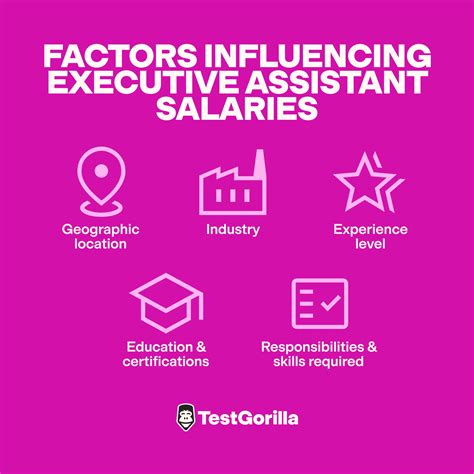

Key Factors That Influence Executive Salary

The journey to a multi-million-dollar compensation package is influenced by a confluence of factors. While performance is the ultimate arbiter, several foundational elements determine an executive's earning potential throughout their career. This section provides an in-depth analysis of the variables that shape compensation, from the classroom to the boardroom.

### 1. Level of Education: The Price of Admission

For C-suite and executive roles, a bachelor's degree is the absolute minimum requirement. However, the type of degree and, more importantly, the prestige of the institution can have a significant impact, particularly early in a career.

- The MBA Premium: The Master of Business Administration (MBA) remains the gold standard for aspiring senior leaders, especially in fields like finance, consulting, and technology. An MBA from a top-tier ("M7") school like Harvard, Stanford, Wharton, Kellogg, Booth, Columbia, or MIT Sloan acts as a powerful signaling mechanism to employers. It indicates a high level of analytical rigor, a strong foundational knowledge of business principles, and access to an elite professional network. Graduates of these programs often command starting salaries well over $200,000 (including signing bonuses) in industries that serve as primary feeder pools for future executives. A 2023 report from the Graduate Management Admission Council (GMAC) confirmed that median starting salaries for graduates of top-ranked U.S. business schools remain exceptionally high, validating the ROI of these programs.

- Other Advanced Degrees: While the MBA is most common, other advanced degrees are prevalent. A Juris Doctor (JD) is common for CEOs who rise through the legal or compliance departments. Degrees in Finance, Economics, or Engineering from respected universities also provide a strong quantitative foundation that is highly valued. Jane Fraser herself holds an MA in Economics from Cambridge and an MBA from Harvard Business School, a classic combination for a leader in global finance.

- The Diminishing Return: It's crucial to note that as a professional's career progresses, the specific degree becomes less important than their track record of accomplishments. A 20-year veteran with a history of successfully running billion-dollar business units will be judged on their P&L (Profit and Loss) performance, not the name on their diploma. However, the elite education often provides the initial opportunities to gain that critical experience.

### 2. Years of Experience: The Proven Trajectory

Experience is perhaps the single most important factor in determining executive compensation. The path to the CEO chair is a marathon, not a sprint, with salary and responsibility growing at each stage.

- Entry-Level (Analyst/Associate, 0-5 years): At this stage, professionals are building foundational skills. In investment banking or management consulting, total compensation can range from $150,000 to $250,000, heavily weighted towards performance bonuses. This is the "boot camp" where future leaders develop analytical prowess and an immense work ethic.

- Mid-Career (Manager/Director, 5-15 years): This is where leadership potential begins to be tested. Professionals take on management of teams and small projects. Compensation can range from $250,000 to $500,000+ in total comp. The key differentiator here is moving from being an individual contributor to a leader who can deliver results through others. Taking on roles with P&L responsibility becomes critical.

- Senior Leadership (Vice President/Managing Director, 15-25 years): At this level, executives are often running entire business units or geographic regions with significant revenue and headcount. They are part of the senior leadership team. Total compensation regularly enters the $500,000 to $2,000,000+ range, with a substantial portion coming from annual bonuses and initial LTI grants.

- C-Suite (CEO, CFO, COO, 20+ years): This is the pinnacle. Executives have a proven, multi-decade track record of strategic leadership and financial performance. As detailed previously, compensation becomes heavily weighted towards equity and can range from $3 million to over $30 million, depending on the size and performance of the company.

### 3. Geographic Location: The Headquarters Premium

Where a company is headquartered significantly impacts executive pay, driven by the cost of living, talent competition, and the concentration of corporate power.

- Top-Tier Hubs (New York City, San Francisco Bay Area): These locations command the highest salaries in the world. The intense competition for top executive talent, coupled with the extremely high cost of living, pushes compensation packages upwards. According to Salary.com, a CEO in New York City can expect to earn approximately 19.8% more than the national average, while a CEO in San Francisco earns a premium of 25.4%. For a role with a national median total compensation of $835,900, this translates to over $1,000,000 in these cities.

- Major Metro Areas (Chicago, Los Angeles, Boston, Dallas): These cities also offer above-average compensation due to the presence of numerous large corporations. The premium might be in the 5-15% range over the national average.

- Lower-Cost Regions: A CEO of a similarly sized company located in a city like Omaha, Nebraska, or Des Moines, Iowa, will likely have a lower total compensation package. However, the lower cost of living can mean their purchasing power remains extremely high.

CEO Salary Variation by Major U.S. City (vs. National Average):

- San Francisco, CA: +25.4%

- New York, NY: +19.8%

- Boston, MA: +10.6%

- Washington, D.C.: +9.5%

- Dallas, TX: +2.8%

- Miami, FL: -1.7%

*(Source: Salary.com, December 2023 data for Chief Executive Officer)*

### 4. Company Type, Size, and Industry

The context of the company is a massive driver of compensation.

- Company Size (Revenue & Market Cap): This is the most direct correlation. Leading a $100 billion global bank is an exponentially more complex job than leading a $500 million regional company. Compensation committees explicitly benchmark pay against a "peer group" of similarly sized companies. As company revenue and complexity grow, so does the CEO's pay package.

- Public vs. Private:

- Publicly Traded Companies: (e.g., Citigroup) These companies offer the highest potential cash and total compensation packages. Pay is highly scrutinized by shareholders and disclosed in public SEC filings. The structure is heavily weighted towards performance-based equity to align with shareholder interests.

- Private/PE-Backed Companies: Base salaries and bonuses are competitive, but the real prize is the equity stake. A CEO brought in by a private equity firm to turn around a company might receive a smaller cash package but could earn tens or even hundreds of millions of dollars if the company is successfully sold or taken public (an "exit event").

- Industry: The industry dictates the specific performance metrics and overall pay levels.

- Financial Services & Technology: These industries traditionally offer the highest executive compensation, driven by high profitability, rapid growth, and the global scale of the companies.

- Healthcare & Pharmaceuticals: Compensation is also very high, linked to the long and expensive R&D cycles and the immense profitability of successful drugs.

- Manufacturing & Consumer Goods: While still very high at the top, median executive pay can be slightly lower than in finance or tech, with metrics often tied to operational efficiency and market share.

- Non-Profit: Leaders of large non-profits (e.g., major universities, hospital systems, or foundations) can earn substantial salaries, often in the high six-figures or even over $1 million, but it does not reach the levels of the for-profit sector.

### 5. In-Demand Skills: The Intangible Differentiators

Beyond the resume and the track record, certain skills and competencies command a premium in the executive search market.

- Strategic Vision: The ability to see beyond the next quarter and articulate a compelling vision for the company's future in a rapidly changing world.

- Financial Acumen: Deep understanding of financial statements, capital markets, and shareholder value creation. This is non-negotiable.

- Digital Transformation & AI Literacy: In today's economy, leaders must be able to guide their companies through technological disruption. Experience leading large-scale digital initiatives is now a prerequisite for many top roles.

- Crisis Management: A proven ability to lead calmly and decisively through a major crisis (e.g., a financial crisis, a cyberattack, a PR disaster) is invaluable and highly sought after.

- ESG Expertise: A growing number of boards are looking for leaders who understand how to integrate Environmental, Social, and Governance (ESG) factors into corporate strategy, as these are increasingly important to investors and customers.

- Global Leadership Experience: For multinational corporations, having lived and worked in different regions and managed cross-cultural teams is a massive advantage. Jane Fraser's extensive international career at McKinsey and Citi in Latin America and Europe was a key part of her preparation for the top job.

---

Job Outlook and Career Growth for Top Executives

While the compensation is astronomical, the path to the C-suite is one of the most competitive career tracks in the world. Understanding the long-term outlook requires looking at both the quantitative data and the qualitative trends shaping the future of corporate leadership.

### The Statistical Outlook: Slow Growth, Intense Competition

The U.S. Bureau of Labor Statistics (BLS) projects that employment for "Top Executives" will grow by 3 percent from 2022 to 2032. This is on par with the average growth rate for all occupations. The BLS anticipates about 215,700 openings for top executives each year, on average, over the decade. However, it's crucial to understand what this number represents. Most of these openings will result from the need to replace executives who retire or move to different occupations, not from the creation of new positions.

The raw number can be misleading. The number of CEO positions at S&P 500 companies is, by definition, fixed at 500. The competition for these elite roles is exceptionally fierce. For every individual who reaches the level of a Jane Fraser, thousands of other highly qualified, ambitious, and successful Vice Presidents and Managing Directors will not. Success is far from guaranteed and is often dependent on a combination of stellar performance, strategic career moves, mentorship, and a degree of luck.

### Emerging Trends and Future Challenges Shaping the Role

The job of a top executive is not static; it is constantly evolving. Professionals aspiring to these roles must be aware of the trends that will define leadership in the coming decade.

1. **The Rise of