For many ambitious professionals and bright-eyed graduates, the name J.P. Morgan Chase & Co. represents more than just a bank—it's the pinnacle of a career in global finance, a symbol of prestige, and a gateway to immense professional and financial opportunities. The title "Associate" within this storied institution is a coveted position, often seen as a key milestone on the path to Wall Street success. But what does this role truly entail, and what is the real story behind a J.P. Morgan Associate salary? The answer is far more complex and rewarding than a single number can convey.

While headlines often flash eye-watering six-figure sums, the reality of compensation at this level is a sophisticated blend of base salary, performance-based bonuses, and a host of other factors. For an Investment Banking Associate, the most sought-after of these roles, total first-year compensation can realistically range from $300,000 to over $400,000, according to recent industry reports. However, this figure is not a monolith; it varies dramatically based on division, location, performance, and the economic climate.

I once coached a brilliant young economics major who was singularly focused on becoming a "J.P. Morgan Associate." The first and most crucial conversation we had was to define which *kind* of Associate he wanted to be. Was it the 100-hour-a-week deal-maker in Investment Banking, the quantitative strategist in Sales & Trading, the client advisor in Asset Management, or the system architect in Technology? Understanding this distinction is the first step toward demystifying the compensation and building a viable career plan.

This guide will serve as your definitive resource, pulling back the curtain on the J.P. Morgan Associate role. We will dissect salary data from authoritative sources, explore the myriad factors that influence your earning potential, and provide a clear, actionable roadmap for aspiring professionals. Whether you're an undergraduate dreaming of Wall Street or a seasoned professional considering a career pivot, this article will equip you with the knowledge to navigate your journey.

### Table of Contents

- [What Does a J.P. Morgan Associate Do?](#what-does-a-jp-morgan-associate-do)

- [Average J.P. Morgan Associate Salary: A Deep Dive](#average-jp-morgan-associate-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a J.P. Morgan Associate Do?

Before we can analyze the salary, we must first understand the role. The title "Associate" at J.P. Morgan is not a single, uniform job description. It signifies a specific level of seniority—typically post-MBA or for individuals promoted after 2-3 years as an Analyst—that exists across the firm's various lines of business, or "divisions." An Associate's responsibilities, lifestyle, and compensation are defined almost entirely by the division they work in.

While there are dozens of different Associate roles, they can be broadly categorized into several key areas:

- Investment Banking (IB) Associate: This is the quintessential, high-pressure, high-reward role most people envision when they think of Wall Street. IB Associates are the engine room of deal-making. They work in either industry groups (like Technology, Media & Telecom, Healthcare, or Financial Institutions) or product groups (like Mergers & Acquisitions (M&A), Leveraged Finance, or Equity Capital Markets). Their primary responsibility is to support senior bankers (Vice Presidents, Executive Directors, and Managing Directors) in executing transactions for corporate clients. This involves a heavy dose of financial modeling, valuation analysis, and presentation creation.

- Sales & Trading (S&T) Associate: These Associates operate on the trading floor, a dynamic and fast-paced environment. Their role is split between "Sales," which involves managing relationships with institutional clients (like hedge funds and pension funds) and pitching trade ideas, and "Trading," which involves managing the bank's risk by buying and selling financial securities. The work is highly quantitative, market-driven, and requires quick decision-making under pressure.

- Asset & Wealth Management (AWM) Associate: Associates in this division focus on managing money for institutions and high-net-worth individuals. In Asset Management, they might work as research associates, analyzing stocks and bonds to include in the firm's mutual funds. In the Private Bank, they act as junior advisors, helping to build and maintain relationships with wealthy clients, understand their financial goals, and construct investment portfolios.

- Corporate & Commercial Banking Associate: These professionals work with large corporations and mid-sized businesses, providing traditional banking services like loans, cash management, and trade finance. The role is a mix of credit analysis (assessing the risk of lending to a company) and relationship management.

- Technology Associate / Software Engineer: In the modern era, J.P. Morgan is as much a technology company as it is a bank. Tech Associates are responsible for building and maintaining the sophisticated software that powers everything from high-frequency trading platforms to the Chase mobile app. They work in agile teams, writing code, designing systems architecture, and ensuring the firm's technological edge.

### A "Day in the Life" of an Investment Banking Associate

To make the role more tangible, let's walk through a typical weekday for an Associate in the M&A group. This example highlights the intensity and core tasks that define the position.

- 7:30 AM: Arrive at the office in New York. Scan overnight emails from European and Asian colleagues. Read the Wall Street Journal, Financial Times, and DealBook to get up to speed on market news and any developments related to current deals.

- 8:00 AM: Check the latest financial data for a client company using a Bloomberg Terminal. Update a valuation model (likely a Discounted Cash Flow or "DCF" model) with the new information.

- 9:00 AM: Join an internal team call with the VP and Managing Director to discuss the status of a live M&A transaction. The Associate's role is to provide precise details on the financial analysis and take notes on key action items.

- 10:00 AM - 1:00 PM: "Turn comments" from the VP on a 100-page PowerPoint presentation, known as a "pitch book," for a potential new client. This is a meticulous process of revising slides, double-checking every number, and ensuring the formatting is flawless.

- 1:00 PM: Grab a quick lunch at the desk while managing a data request from the client's legal team.

- 2:00 PM - 5:00 PM: Build a new Leveraged Buyout (LBO) model from scratch for a potential private equity acquisition target. This requires deep financial acumen and expert-level Excel skills.

- 5:00 PM: The Managing Director returns from a client meeting with an urgent request: "We need a one-page summary of potential acquisition targets for Company X by tomorrow morning." The Associate begins researching companies, pulling financial data, and running preliminary valuation analyses.

- 7:00 PM: Order dinner to the office, paid for by the firm. Briefly chat with fellow Associates while continuing to work on the target summary.

- 7:30 PM - 11:00 PM: Continue working on the urgent request while also managing tasks for the live M&A deal. The Associate acts as a project manager, coordinating with junior Analysts to divide the workload.

- 11:30 PM: Send the first draft of the acquisition target summary to the VP for review. Receive feedback ("comments") within the hour.

- 12:30 AM: Finalize the summary, incorporating the VP's feedback. Send the finished product to the team.

- 1:00 AM: Pack up and take a car service home, already mentally preparing for the next day.

This grueling schedule is most typical of Investment Banking, but it underscores the level of dedication, analytical rigor, and resilience required to succeed in a front-office Associate role at a top-tier bank.

Average J.P. Morgan Associate Salary: A Deep Dive

Analyzing the salary for a J.P. Morgan Associate requires looking far beyond a single base pay figure. Compensation in elite finance is structured to heavily reward performance and is comprised of several key components. The most lucrative of these roles is, by far, the Investment Banking Associate.

For the sake of clarity and to address the most common user intent, we will focus primarily on the Investment Banking Associate compensation structure, while providing comparative context for other divisions. All data is based on the most recent reports from trusted industry sources like Wall Street Oasis, Litquidity, and institutional salary surveys.

### The Anatomy of an Investment Banking Associate's Compensation

For a first-year Investment Banking Associate (either a direct promote from Analyst or a new hire from an MBA program), compensation is broken down as follows. Note that these figures are primarily for major financial hubs like New York City.

Typical First-Year Investment Banking Associate Compensation (New York)

| Component | Description | Estimated Amount (2023-2024) | Source/Note |

| :--- | :--- | :--- | :--- |

| Base Salary | The fixed, predictable portion of your annual pay. | $175,000 - $225,000 | Industry-wide standardization among bulge bracket banks. J.P. Morgan is typically at the top of this range. |

| Signing Bonus | A one-time bonus paid upon signing your offer (for new MBA hires). | $50,000 - $75,000 | Varies by school and year. Intended to cover MBA tuition and relocation costs. |

| Stub Bonus | A pro-rated, year-end bonus for the first partial year of work. | $60,000 - $100,000 | Paid at the end of the calendar year for those starting in the summer. Highly dependent on individual, group, and firm performance. |

| Relocation Bonus| One-time payment to help cover the cost of moving. | $10,000 | Often offered to MBA hires. |

| Total Year 1 "All-In" | Sum of all components. | ~$300,000 - $410,000+ | This is the key metric. The high end is achieved through a top-tier performance bonus. |

*Sources: Data compiled and synthesized from Wall Street Oasis (WSO) 2023 Investment Banking Compensation Report, Litquidity's compensation surveys, and reports from eFinancialCareers.*

It is critical to understand each component:

1. Base Salary: In recent years, base salaries for Associates at top banks have become largely standardized. J.P. Morgan, along with its competitors like Goldman Sachs and Morgan Stanley, has steadily increased base pay to attract and retain talent. As of 2023-2024, a first-year Associate can expect a base salary starting at $175,000, with top-tier MBA hires or exceptional promotes starting at $200,000 or even $225,000. This base salary increases with each year of experience.

2. Performance Bonus (The "Bonus"): This is the variable—and most significant—part of the compensation. It is paid out once a year (typically in the summer) and is based on a combination of factors:

- Individual Performance: Your personal review, ratings, and feedback from seniors.

- Group Performance: The performance of your specific industry or product group (e.g., how many deals your M&A team closed).

- Firm-Wide Performance: The overall profitability of J.P. Morgan for that year.

- Market Conditions: The health of the global economy and deal-making environment.

For a first-year Associate, the bonus paid out after their first full year of work (in their second year at the firm) can range from 80% to over 150% of their base salary. This means an Associate on a $200,000 base could see a bonus of $160,000 to $300,000+, pushing their second-year "all-in" compensation towards the $500,000 mark.

3. Signing Bonus: This is standard for Associates hired out of MBA programs. It serves as an incentive to accept an offer and helps offset the immense cost of a top-tier business school education.

### Salary Progression by Experience Level (Investment Banking)

Compensation grows rapidly in the initial years. The table below illustrates a typical trajectory for an IB Associate at a firm like J.P. Morgan.

| Level | Years at Firm | Typical Base Salary | Typical All-In Compensation Range |

| :--- | :--- | :--- | :--- |

| Associate Year 1 | 0-1 | $175,000 - $225,000 | $300,000 - $410,000 (includes signing/stub bonus) |

| Associate Year 2 | 1-2 | $200,000 - $250,000 | $350,000 - $500,000 |

| Associate Year 3 | 2-3 | $225,000 - $275,000 | $400,000 - $600,000+ |

| Vice President 1 | 3-4 | $275,000 - $300,000 | $500,000 - $800,000+ |

*Note: These are estimates based on public reports and can fluctuate significantly based on the factors discussed in the next section.*

### How Do Other Divisions Compare?

While still highly competitive, salaries for Associates in other divisions have a different structure, with lower, though still substantial, bonuses.

- Sales & Trading Associate: Base salaries are very similar to Investment Banking. Bonuses are also highly variable but can be slightly lower on average unless the individual is a top-performing trader on a highly profitable desk. Total compensation might be 10-20% less than their IB counterparts in a typical year.

- Asset & Wealth Management Associate: Base salaries may be slightly lower, perhaps in the $150,000 - $175,000 range. Bonuses are significantly lower and less volatile, often falling in the 30-60% range of base salary. Total compensation is excellent but generally not in the same stratosphere as Investment Banking.

- Technology Associate: A Tech Associate at J.P. Morgan is paid competitively with top tech firms (like Google or Meta), not just other banks. According to data from Glassdoor and Levels.fyi, an Associate-level Software Engineer at J.P. Morgan in New York can expect a base salary of approximately $140,000 - $165,000, with a total compensation package (including bonus and stock) reaching $170,000 - $220,000. This is a fantastic salary, but it highlights the significant premium placed on the revenue-generating roles in Investment Banking.

Key Factors That Influence Salary

The vast salary ranges discussed above are not arbitrary. A multitude of factors interact to determine an individual's precise compensation package. Understanding these levers is crucial for anyone aiming to maximize their earning potential at a firm like J.P. Morgan. This section, the most detailed of our guide, breaks down each of these critical factors.

###

Level of Education and Entry Path

The path you take to become an Associate is one of the most significant initial determinants of your salary. There are two primary entry points, each with distinct compensation implications.

1. The Post-MBA Hire: This is the traditional route. Candidates attend a top-tier MBA program (often referred to as the "M7" schools like Harvard, Stanford, Wharton, etc.) and are recruited directly into the Associate role. These candidates typically receive the highest starting packages. Their compensation includes:

- A Top-Tier Base Salary: Banks compete fiercely for top MBA talent, often offering base salaries at the upper end of the spectrum ($200,00 a year or more).

- A Substantial Signing Bonus: As mentioned, this can be upwards of $75,000, designed to make a dent in student loan debt and secure their commitment.

- Firms view the MBA as a rigorous two-year training program that produces candidates with a more mature business perspective, extensive network, and foundational finance knowledge. This perceived value translates directly into higher pay.

2. The Analyst-to-Associate (A2A) Promote: This path involves joining the firm as an undergraduate Analyst and, after two to three years of exceptional performance, being promoted directly to the Associate level. This route has its own financial nuances:

- Lower Initial Base (Historically): Traditionally, A2A promotes started with a slightly lower base salary than their MBA counterparts. However, this gap has narrowed significantly as banks fight to retain their homegrown talent.

- No Signing Bonus: Since they are internal promotes, they do not receive a signing bonus. This can make their first-year "all-in" compensation appear lower than an MBA hire's, even if their year-end bonus is comparable.

- Faster to the "Promote": A key advantage is speed. A top Analyst can become a Vice President (the next level) a year or two earlier than their MBA colleagues, potentially leading to higher lifetime earnings despite a lower starting Associate package.

Certifications: While not mandatory, the Chartered Financial Analyst (CFA) designation is highly respected, particularly in Asset Management and Equity Research. While it may not provide an immediate, specified salary bump in Investment Banking, it demonstrates a serious commitment to the industry and a deep understanding of financial analysis, which can be a key differentiator during recruiting and performance reviews, indirectly influencing bonus potential.

###

Years of Experience and Career Trajectory

In the structured hierarchy of an investment bank, experience is directly and formulaically tied to compensation. Your title (Associate Year 1, 2, 3) dictates your base salary bracket.

- Associate Year 1 (Assoc 1): As established, base salary typically starts at $175k-$225k. This is the "learning" year, where you transition from Analyst-level tasks to taking on more project management responsibilities.

- Associate Year 2 (Assoc 2): After a successful first year and a full performance cycle, you receive a bump in base salary (e.g., to $200k-$250k). More importantly, your first full-year bonus is paid out, which can be a massive increase over the "stub" bonus. This is often the largest single-year percentage jump in compensation.

- Associate Year 3 (Assoc 3): Base salary increases again (e.g., to $225k-$275k). At this stage, you are a seasoned Associate, capable of managing most aspects of a deal's execution and supervising Analysts effectively. Your bonus potential is at its peak for the Associate level, reflecting your value to the team.

The expectation is that after 3 to 3.5 years, a strong Associate will be promoted to Vice President (VP). This promotion comes with another significant step-up in base salary (to ~$275k-$300k) and an even larger bonus potential, marking the next major milestone in a banking career.

###

Geographic Location

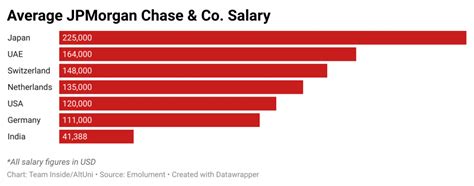

While J.P. Morgan is a global firm, compensation is not uniform across the world. It is heavily skewed by the cost of living and, more importantly, the concentration of deal flow in major financial centers.

- New York City (Headquarters): This is the epicenter of global finance and offers the highest compensation, setting the benchmark for all other locations. The figures cited throughout this article are primarily reflective of the New York market.

- Other Major U.S. Hubs (San Francisco, Chicago, Houston): These offices also handle significant deal flow, particularly in specific sectors (Tech in SF, Industrials in Chicago, Energy in Houston).

- Salaries: According to data from Salary.com, which allows for geographic adjustments, a Financial Associate role in San Francisco often commands a salary 5-10% higher than the national average to account for the exorbitant cost of living. Chicago might be slightly below the New York benchmark, while Houston is comparable.

- Bonuses: Bonuses are generally tied to the New York scale but can be adjusted based on the office's and group's specific performance.

- London: As the primary European financial hub, London compensation is highly competitive. Base salaries are often paid in GBP and are roughly equivalent to the U.S. dollar figures when converted. However, bonus pools can sometimes be slightly smaller than in New York, and tax rates are higher, affecting net take-home pay.

- Hong Kong & Singapore: These are the key hubs for Asia. Compensation is very strong, designed to attract top global talent. While base salaries are comparable to New York, bonuses can be highly volatile and dependent on the health of the Asian markets, particularly China's economic activity.

- Regional Offices (e.g., Charlotte, Dallas, Salt Lake City): J.P. Morgan has been expanding its presence in lower-cost-of-living cities. While roles in these offices are still highly paid relative to the local market, the base salaries and especially the bonuses for front-office Associate roles are typically lower than in the Tier 1 hubs. According to Glassdoor, an Associate-level salary in a non-hub location can be 15-25% lower than in New York.

###

Division and Group Performance

This is arguably the most powerful variable, especially for the bonus component. Even within the same title and city, compensation can vary wildly.

- Investment Banking vs. Other Divisions: As we've detailed, the revenue-generating nature of Investment Banking places its compensation in a league of its own compared to Technology, Operations, or even Asset Management.

- "Hot" Groups vs. "Cold" Groups: Within Investment Banking, performance is everything. An Associate in a top-performing M&A group that closed several multi-billion dollar deals will receive a significantly higher bonus than an Associate in a group that had a slow year. The same applies to industry groups; if the technology sector is booming with IPOs and acquisitions, the TMT (Technology, Media, & Telecom) group's bonus pool will be much larger than that of a group in a less active sector. This creates a "feast or famine" dynamic where your fortunes are tied directly to your team's success.

This factor is what makes blanket salary statements so difficult. Two Associates with the exact same title, experience, and education at J.P. Morgan can have a $100,000+ difference in their annual take-home pay based solely on the performance of their specific desk or team.

###

Area of Specialization

Expanding on