Decoding the Dollars: An In-depth Look at KPMG Partner Salaries

Reaching the rank of Partner at a "Big Four" accounting firm like KPMG is a career-defining achievement. It represents the pinnacle of professional success in the accounting and consulting world, a testament to years of dedication, expertise, and leadership. This prestigious title also comes with a significant financial reward, with compensation packages often reaching well into the six and even seven figures.

If you're an ambitious professional with your sights set on the top, you're likely asking: "How much does a KPMG Partner actually make?" In this detailed analysis, we will break down the compensation structure for KPMG Partners, explore the key factors that influence their earnings, and provide a clear outlook on this demanding but highly rewarding career path.

What Does a KPMG Partner Do?

Before diving into the numbers, it's crucial to understand that a KPMG Partner is much more than a senior accountant. They are business leaders and owners of the firm. Their role transitions from technical execution to strategic oversight, business development, and firm leadership.

Key responsibilities include:

- Driving Business Growth: Partners are expected to generate new business, cultivate a robust client pipeline, and expand the firm's footprint in their respective markets.

- Client Relationship Management: They serve as the primary contact for major clients, providing strategic advice and ensuring the highest level of service quality and satisfaction.

- Team and Practice Leadership: A partner leads large teams of managers, seniors, and associates, mentoring talent and setting the strategic direction for their service line (e.g., Audit, Tax, or Advisory).

- Quality and Risk Management: They hold ultimate responsibility for the quality of work delivered under their name, ensuring compliance with all professional standards and regulations.

In essence, a partner's job is to build and run a profitable business within the larger KPMG network, which directly ties into their compensation.

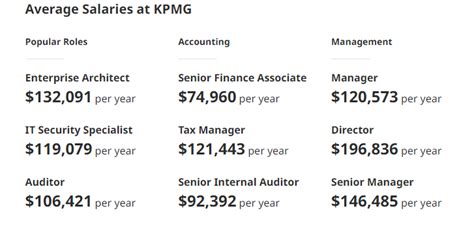

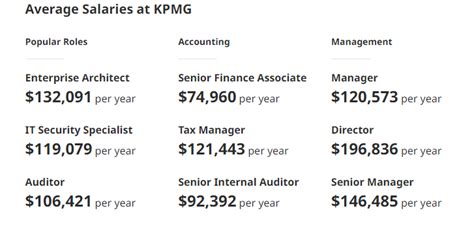

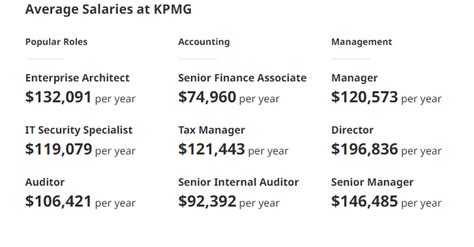

Average KPMG Partner Salary

Dissecting a KPMG Partner's salary is complex because it's not a traditional salary. Total compensation is primarily composed of a base salary and, more significantly, a share of the firm's profits, often called a "partner draw" or "distribution." This profit share is based on a "unit" system, where a partner's seniority and performance dictate how many units of the firm's profits they receive.

While KPMG, as a private partnership, does not publicly disclose its compensation data, we can analyze data from authoritative salary aggregators and industry reports to build a reliable picture.

- According to Glassdoor, the estimated total pay for a Partner at KPMG in the United States is approximately $549,000 per year, with a likely range between $383,000 and $828,000.

- Salary.com data for a generic "Audit Partner" suggests a median salary of $216,793, but this figure often underrepresents the significant profit-sharing component of total compensation.

- Industry discussions and reports frequently place the "all-in" compensation for a first-year partner in the U.S. in the $300,000 to $500,000 range. This figure can grow substantially with seniority, with senior partners in high-demand service lines and major markets earning well over $1,000,000 annually.

It is critical to view partner compensation as a wide spectrum, heavily influenced by the factors below.

Key Factors That Influence Salary

A partner's final take-home pay is not a monolith. It's a dynamic figure influenced by a combination of performance, seniority, and market forces.

### Years of Experience

This is perhaps the most direct factor. A partner's "units" or equity stake in the firm grows over time.

- First-Year Partners: Start at the lower end of the compensation spectrum as they have the fewest units. Their focus is on proving their ability to manage client portfolios and begin building their own book of business.

- Mid-Level Partners (5-10 years): Have demonstrated consistent performance, grown their client base, and accumulated more units, placing them in the middle-to-upper-middle range of earnings.

- Senior Partners (10+ years): These individuals often hold major leadership roles within the firm, manage the largest client relationships, and have the highest number of units. They are the top earners, often reaching seven-figure compensation packages.

### Area of Specialization

The service line a partner leads has a massive impact on their earning potential, as it's tied to the fees the firm can charge for those services.

- Audit (Assurance): While the bedrock of the firm, audit services are often seen as a commodity, leading to significant fee pressure from clients. Consequently, Audit partners typically have the lowest (though still very high) compensation relative to other service lines.

- Tax: Tax partners, especially those specializing in high-demand areas like International Tax, Mergers & Acquisitions (M&A) Tax, or Transfer Pricing, can command higher fees and thus earn more than their audit counterparts.

- Advisory (Consulting): This is consistently the most lucrative service line. Partners in Advisory—specializing in areas like Deal Advisory, Management Consulting, Technology Transformation, and Cybersecurity—charge premium fees for their services. Their compensation potential is significantly higher and often has the highest ceiling.

### Geographic Location

Where a partner is based matters. Compensation is adjusted based on the cost of living and, more importantly, the size and sophistication of the local market. A partner in New York City or San Francisco will almost certainly earn more than a partner in a smaller, regional office like Omaha or St. Louis. This is because major metropolitan areas are home to larger, more complex clients who pay higher fees, directly fueling the profit pool for that office.

### Level of Education

By the time an individual reaches the partner level, their performance far outweighs their educational background. However, education is a critical gateway.

- A Bachelor's degree in accounting or a related field is the minimum entry point.

- The Certified Public Accountant (CPA) license is a non-negotiable requirement for partners in the Audit and Tax practices.

- Advanced degrees like a Master of Business Administration (MBA), Juris Doctor (JD), or a specialized master's degree (e.g., in Taxation or Data Science) are highly advantageous, particularly for entering and ascending the ranks in the high-paying Advisory practice.

### Company Type

While we are specifically discussing KPMG, the concept of "company type" can be applied internally to the type of business unit a partner leads. A partner who leads a fast-growing, high-margin practice focused on emerging technology will have a greater impact on firm profitability than one leading a stable but low-growth practice. Furthermore, the overall performance of the firm itself dictates the size of the profit pool available for distribution. In a banner year for KPMG, all partners will see a rise in their compensation.

Job Outlook

The path to partner is long and highly competitive, but the demand for the high-level services that partners oversee is robust.

The U.S. Bureau of Labor Statistics (BLS) provides relevant projections. For Top Executives, the BLS projects a growth rate of 3% from 2022 to 2032. More specifically for the field, employment for Accountants and Auditors is projected to grow 4% over the same period.

The most promising outlook is tied to the Advisory/Consulting space. As businesses grapple with digital transformation, cybersecurity threats, environmental, social, and governance (ESG) reporting, and complex transactional markets, the need for expert guidance will continue to surge. This ensures a strong and sustained demand for the leadership and expertise that KPMG Partners provide.

Conclusion

Aspiring to become a partner at KPMG is a goal that promises immense professional and financial rewards. The journey is a marathon, not a sprint, requiring exceptional performance, political savvy, and an unwavering commitment to client service and business development.

For those considering this path, the key takeaways are:

- Compensation is High but Variable: Expect total compensation to start in the $300k-$500k range and grow significantly with seniority and performance.

- It's More Than a Salary: Partner pay is directly tied to the firm's profits, making every partner an owner with a stake in the company's success.

- Your Specialization Matters: The path through the Advisory practice generally offers the highest earning potential.

- Performance is Everything: Ultimately, a partner's value—and their compensation—is determined by the business they can generate and the client relationships they can build.

For dedicated professionals who thrive on challenge and leadership, the role of a KPMG Partner remains one of the most sought-after and rewarding destinations in the business world.