Universal Banker Salary: A Complete 2024 Guide

Are you a people-person with a sharp mind for finance? The role of a Universal Banker could be your ideal entry point into the banking industry, offering a dynamic environment and solid earning potential. This position, which blends customer service with sales and financial operations, is a cornerstone of modern retail banking.

But what can you expect to earn? A Universal Banker's salary in the United States typically ranges from $37,000 to over $55,000 annually, with the national average hovering around $44,000. However, this figure is just the beginning. With bonuses, commissions, and career advancement, your total compensation can be significantly higher.

This guide will break down everything you need to know about a Universal Banker's salary, the factors that influence it, and the future of this evolving career.

What Does a Universal Banker Do?

Think of a Universal Banker as the multi-tool of a bank branch. Gone are the days of a simple transaction-focused teller. A Universal Banker does that and much more. They are the primary point of contact for customers, building relationships and handling a wide array of needs.

Key responsibilities include:

- Core Banking Transactions: Processing deposits, withdrawals, and payments with accuracy.

- Customer Service & Problem-Solving: Answering account inquiries, resolving issues, and ensuring a positive customer experience.

- New Account Opening: Assisting customers with opening checking, savings, and other deposit accounts.

- Sales and Referrals: Proactively identifying customer needs and recommending relevant bank products, such as credit cards, personal loans, mortgages, or investment services.

- Digital Banking Support: Educating customers on how to use online and mobile banking tools.

Essentially, they are relationship builders who handle day-to-day needs while also looking for opportunities to help customers achieve their broader financial goals.

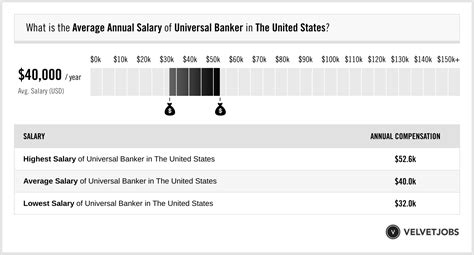

Average Universal Banker Salary

To provide a clear picture of earning potential, we've compiled data from several authoritative sources.

As of early 2024, the average base salary for a Universal Banker in the United States falls between $42,000 and $46,000 per year.

Here’s a closer look at the data:

- Salary.com reports that the median annual salary for a Universal Banker is $43,924, with the typical range falling between $37,458 and $50,229.

- Glassdoor lists a similar national average base pay of around $45,100 per year, with total pay (including potential bonuses and commission) often reaching higher.

- Payscale estimates the average base salary at $43,500 per year, with an overall range of $35,000 to $53,000 before additional compensation.

It's crucial to remember that Universal Bankers often earn incentive-based pay. Bonuses for meeting sales goals or commissions for product referrals can add several thousand dollars to your annual income, rewarding high-performers.

Key Factors That Influence Salary

Your salary isn't just one number; it's a reflection of your unique background, skills, and environment. Here are the five key factors that will have the biggest impact on your earnings as a Universal Banker.

###

Level of Education

While a high school diploma or GED is the standard minimum requirement for a Universal Banker position, further education can give you a significant advantage. An Associate's or, even better, a Bachelor's degree in fields like Finance, Business Administration, or Economics can lead to a higher starting salary. Employers see this as a sign of dedication and foundational knowledge, which often translates to a faster learning curve and quicker advancement to more senior roles or branch management positions.

###

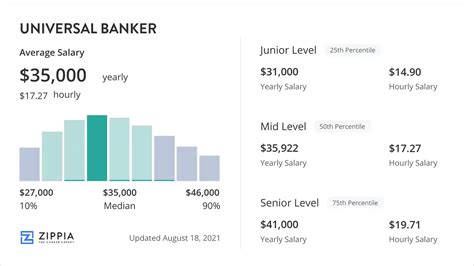

Years of Experience

Experience is one of the most powerful drivers of salary growth in this field. As you build your skills in customer relations, product knowledge, and regulatory compliance, your value to the institution increases.

- Entry-Level (0-2 years): New Universal Bankers can expect to start at the lower end of the pay scale, typically between $35,000 and $42,000. The focus at this stage is on mastering core functions and building customer trust.

- Mid-Career (3-6 years): With a few years of experience, you become more efficient and effective in your role. Salaries often climb to the $43,000 to $48,000 range. You may take on mentoring new hires or handling more complex customer issues.

- Senior/Experienced (7+ years): Seasoned Universal Bankers with a proven track record of sales and service excellence can command salaries from $49,000 to $55,000+. Many at this level transition into roles like Senior Universal Banker, Assistant Branch Manager, or specialize in areas like small business banking.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted to reflect the local cost of living and the demand for financial professionals in that market. Metropolitan areas with a higher cost of living almost always offer higher pay.

For example, a Universal Banker working in major financial hubs like San Francisco, New York City, or Boston can expect to earn 15-25% above the national average. Conversely, salaries in smaller towns or rural areas in states with a lower cost of living will likely be closer to the lower end of the national range.

###

Company Type

The type of financial institution you work for also plays a role in your compensation package.

- Large National Banks (e.g., JPMorgan Chase, Bank of America): These institutions often offer highly competitive base salaries and structured, performance-based bonus programs. The environment can be fast-paced with a strong emphasis on meeting sales targets.

- Regional and Community Banks: These banks may offer salaries that are close to the national average. They often pride themselves on a strong community focus and may provide a more personal work environment.

- Credit Unions: As non-profit, member-owned organizations, credit unions might offer slightly lower base salaries but often compensate with excellent benefits packages, better work-life balance, and a strong, service-oriented culture.

###

Area of Specialization

While a Universal Banker is a generalist, those who develop expertise in high-value areas can significantly boost their income through commissions and bonuses. Excelling in referring or selling specific products is key. For instance, a Universal Banker who is highly successful at identifying mortgage leads, referring clients for investment services, or opening business banking accounts will almost always earn more than one who sticks to basic transactions. Obtaining certifications, such as the NMLS (Nationwide Multistate Licensing System & Registry) for mortgage lending, can also directly increase your earning potential.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) provides a nuanced picture of the future for this profession. The BLS groups Universal Bankers with Tellers, for whom it projects a 12% decline in employment from 2022 to 2032.

However, this statistic requires critical context. The decline is largely due to the automation of routine transactions through online banking, mobile apps, and advanced ATMs. This is precisely why the Universal Banker role was created. Banks need fewer people for simple cash handling and more skilled professionals who can build relationships, solve complex problems, and provide financial advice.

The future belongs to the Universal Banker, not the traditional teller. The skills you develop in this role—sales, customer relationship management, and broad financial product knowledge—are becoming more valuable, not less. This position is the evolutionary response to changes in the banking industry.

Conclusion

A career as a Universal Banker offers a stable and rewarding path with a competitive salary and clear opportunities for growth. While the national average provides a solid baseline, your ultimate earning potential is in your hands.

Key Takeaways:

- Solid Starting Point: Expect an average salary in the mid-$40,000s, with significant upside through performance-based incentives.

- Growth is Key: Your earnings will grow substantially with experience, specialized skills, and a strong sales record.

- Location & Employer Matter: Your salary will be influenced by your local job market and the type of bank you work for.

- A Career of the Future: Despite automation, the relationship-building and advisory aspects of the Universal Banker role are more critical than ever.

If you are a motivated individual looking for a dynamic career that serves as an excellent gateway to the wider world of finance, the Universal Banker role is an opportunity worth exploring.