A career at a "Big Four" accounting firm like KPMG is a goal for many ambitious finance and accounting professionals. The title of "Senior Associate" represents a significant milestone—a transition from learning the fundamentals to leading projects, mentoring junior staff, and owning client relationships. But beyond the prestige, what does this role mean for your financial future?

A position as a KPMG Senior Associate offers a highly competitive compensation package, with a typical salary in the United States often ranging from $90,000 to $130,000 or more when including bonuses and other compensation. This article provides a data-driven breakdown of the KPMG Senior Associate salary, the key factors that influence it, and the promising career outlook for this profession.

What Does a KPMG Senior Associate Do?

Before diving into the numbers, it's essential to understand the value and responsibilities of the role. A Senior Associate is the backbone of the engagement team. While an Associate executes assigned tasks, a Senior Associate takes on a layer of project management and technical oversight.

Key responsibilities typically include:

- Leading Fieldwork: Managing the day-to-day execution of audit, tax, or advisory projects.

- Client Communication: Serving as a primary point of contact for clients, answering questions, and managing expectations.

- Review and Mentorship: Reviewing the work of junior associates, providing feedback, and coaching them on technical skills.

- Complex Analysis: Handling more complex and high-risk areas of an engagement, whether it's a difficult audit area, a complex tax provision, or a nuanced financial model.

- Reporting: Assisting managers and partners in preparing final deliverables and reports for clients.

This blend of technical expertise, leadership, and client-facing responsibility is why the role commands a significant salary.

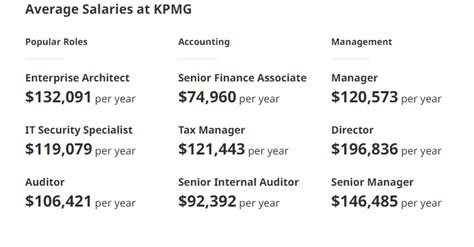

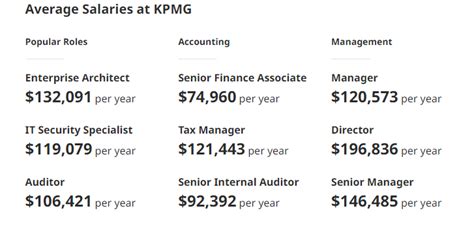

Average KPMG Senior Associate Salary

Salary data shows that KPMG Senior Associates are well-compensated for their advanced skill set. While exact figures vary based on the factors discussed below, we can establish a reliable baseline using data from trusted sources.

- According to Glassdoor, the estimated total pay for a Senior Associate at KPMG in the United States is approximately $105,000 per year, with a likely range between $92,000 and $121,000. This figure includes base salary and additional compensation like cash bonuses.

- Salary.com reports a similar range, with the median base salary for a senior accountant (a comparable role) in a large public accounting firm falling around $98,500, with the top end of the range easily exceeding $110,000.

- Payscale data corroborates this, showing an average base salary for a KPMG Senior Audit Associate around $91,000, with total compensation increasing with bonuses and profit-sharing.

In summary, a professional in this role can confidently expect a total compensation package that breaks the six-figure mark, particularly in major metropolitan areas and high-demand specializations.

Key Factors That Influence Salary

Your final salary offer is not a single number but a calculation based on several critical variables. Understanding these factors will help you maximize your earning potential.

###

Level of Education

While a bachelor's degree in accounting or a related field is the minimum requirement, advanced credentials significantly boost earning power. The most impactful credential is the Certified Public Accountant (CPA) license. Most Senior Associates are expected to have passed or be actively pursuing their CPA exams. Possessing the license not only validates your expertise but is often a prerequisite for promotion to Manager, making it a powerful negotiating tool. Furthermore, a Master's degree in Accounting (MAcc) or Taxation (MST) can lead to a higher starting salary, as it provides specialized knowledge and helps fulfill the 150-credit-hour requirement for CPA licensure.

###

Years of Experience

Experience is a primary driver of salary within the "Senior Associate" band. The role is not a single level but a progression. A "Senior 1" (in their first year as a senior) will earn less than a "Senior 3" who has more experience leading teams and managing complex engagements. Typically, professionals are promoted to Senior Associate after two to three years as an Associate, and each subsequent year in the senior role comes with a merit-based salary increase.

###

Geographic Location

Where you work is one of the most significant factors. KPMG adjusts its salary bands based on the local cost of living. A Senior Associate in a high-cost-of-living (HCOL) area like New York City, San Francisco, or Boston will earn substantially more than a peer in a low-cost-of-living (LCOL) area like Des Moines or Omaha. This location-based premium is designed to ensure a comparable quality of life across different markets. For example, a salary of $115,000 in San Francisco might be equivalent to $90,000 in a smaller Midwestern city.

###

Company Type

While this article focuses on KPMG, it's helpful to understand how its compensation compares to the broader market. As a "Big Four" firm, KPMG's salaries are at the top tier of the public accounting industry. They are generally higher than those offered at mid-tier national firms (e.g., BDO, Grant Thornton) and significantly higher than local or regional firms. However, a "Senior Accountant" or "Senior Financial Analyst" role in the private industry (e.g., a Fortune 500 company) can sometimes be competitive, though it may lack the structured training and rapid career progression found at KPMG.

###

Area of Specialization

Not all service lines within KPMG are compensated equally. Your area of specialization has a direct impact on your salary due to market demand and the complexity of the work.

- Advisory (Consulting): This is typically the highest-paying service line. Roles in Deal Advisory, Strategy, or Technology Consulting command premium salaries because the work is highly specialized and generates high revenue for the firm.

- Tax: Tax is a highly sought-after skill, and specialized areas like International Tax or Mergers & Acquisitions (M&A) Tax often pay more than general compliance roles.

- Audit (Assurance): While essential and highly respected, audit is generally the foundational service line and may have a slightly lower salary ceiling at the Senior Associate level compared to specialized Advisory roles.

Job Outlook

The career outlook for accounting and finance professionals, especially those with Big Four experience, is exceptionally strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for Accountants and Auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

The BLS notes that globalization, a growing economy, and a complex tax and regulatory environment will continue to drive demand for accounting expertise. Professionals with a CPA certification and experience at a globally recognized firm like KPMG will be in the best position to capitalize on these opportunities, whether they choose to stay and pursue a path to Partner or leverage their experience to secure high-level roles in private industry.

Conclusion

The role of a Senior Associate at KPMG is more than just a job title; it is a launchpad for a successful and lucrative career in business. The salary is a direct reflection of the high level of skill, responsibility, and dedication required.

Key Takeaways:

- Strong Earning Potential: Expect a total compensation package in the $90,000 to $130,000+ range, placing you in a strong financial position early in your career.

- Your Choices Matter: Your earnings are directly influenced by your location, specialization (Advisory often pays the most), and educational credentials like the CPA.

- A Secure Future: The demand for skilled accountants and auditors remains robust, ensuring excellent job security and abundant opportunities for growth.

For aspiring professionals, the path to Senior Associate at KPMG is challenging yet highly rewarding. By focusing on continuous learning, obtaining your CPA, and seeking out high-demand specializations, you can not only achieve but exceed the salary expectations for this prestigious role.