You’ve put in the years as an analyst or associate. You’ve mastered the fundamentals, proven your worth on countless projects, and are now looking toward the next major milestone in your professional journey: the Senior Associate role. This title isn't just a step up; it's a launchpad. It signifies a transition from doing the work to leading the work, from following a playbook to helping write it. But with greater responsibility comes a crucial question that every ambitious professional asks: *What is a Senior Associate salary, and what can I realistically expect to earn?*

The answer is both exciting and complex. A Senior Associate position can unlock a substantial six-figure income, with top performers in high-demand fields earning well over $250,000 when bonuses and other compensation are factored in. However, the term "Senior Associate" is not a monolith. Its meaning, responsibilities, and, most importantly, its salary, vary dramatically across industries like law, consulting, finance, and technology. Navigating this landscape without a map can be disorienting. I once mentored a bright young professional who was offered two "Senior Associate" roles in the same city—one in marketing and one in finance—with a staggering $70,000 difference in base salary. This experience drove home a critical lesson: understanding the nuances of your specific field is paramount to maximizing your earning potential.

This guide is designed to be that map. We will dissect the Senior Associate salary from every conceivable angle, providing you with the data, insights, and strategies needed to not only understand your worth but to confidently negotiate and achieve it. We will move beyond simple averages to explore the key factors that command salary premiums, from your geographic location and area of specialization to the in-demand skills that make you indispensable.

Whether you are an associate planning your promotion, a professional considering a career change, or a student charting your future, this comprehensive analysis will equip you with the knowledge to navigate your path to a successful and lucrative career as a Senior Associate.

### Table of Contents

- [What Does a Senior Associate Do?](#what-is-a-senior-associate)

- [Average Senior Associate Salary: A Deep Dive](#average-salary)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#how-to-get-started)

- [Conclusion: Charting Your Path Forward](#conclusion)

What Does a Senior Associate Do?

Before we dive into the numbers, it’s essential to understand what the "Senior Associate" title truly represents. It's less of a specific job and more of a *level of seniority* within a professional hierarchy, typically situated between an Associate and a Manager. While an Associate is focused on execution and learning, a Senior Associate takes on a hybrid role of practitioner, mentor, and emerging leader.

At its core, the Senior Associate is an experienced individual contributor who has demonstrated mastery of their domain. They are trusted to handle complex tasks with minimal supervision, manage significant components of larger projects, and often serve as the primary point of contact for certain clients or stakeholders. Their role is pivotal; they are the engine room of professional services firms, corporate departments, and legal practices.

The daily responsibilities can vary significantly by industry, but several core themes are universal:

- Project Leadership: While a Manager or Director sets the overall strategy, the Senior Associate is often responsible for executing a major workstream. This includes creating project plans, managing timelines, delegating tasks to junior associates, and ensuring the quality of the final deliverables.

- Mentorship and Training: Senior Associates are expected to guide and develop junior team members. This involves reviewing their work, providing constructive feedback, and helping them navigate the technical and political complexities of the organization.

- Complex Analysis and Problem-Solving: This is where a Senior Associate truly shines. They are tasked with the most challenging analytical work, whether it's building a complex financial model, conducting deep-dive legal research for a high-stakes case, or architecting a critical piece of a client's IT infrastructure.

- Client and Stakeholder Management: They begin to own relationships. A Senior Associate in a consulting firm might lead client workshops, while a Senior Associate in a law firm might be the main point of contact for day-to-day case matters. They must communicate complex ideas clearly and build trust with external parties.

To make this more concrete, let's explore what the role looks like in different contexts.

In Management Consulting: A Senior Associate (often called a "Consultant" post-MBA) is the backbone of the case team. They conduct expert interviews, analyze vast datasets to uncover insights, build strategic frameworks, and create the slides that will be presented to C-suite executives.

In a Law Firm ("BigLaw"): A mid-level to senior associate is a seasoned lawyer, typically 3-6 years post-law school. They manage key aspects of a deal or case, draft critical documents (like merger agreements or major court motions), take and defend depositions, and supervise junior associates' research.

In Finance (Investment Banking): An Associate (often a post-MBA role, but a Senior Analyst might hold similar responsibilities) builds the valuation models, manages the due diligence process for mergers and acquisitions, and prepares the pitch books and marketing materials for deals.

### A Day in the Life: Senior Financial Associate at a Fortune 500 Company

To paint a clearer picture, let's follow "Alex," a Senior Financial Planning & Analysis (FP&A) Associate:

- 8:30 AM: Alex starts the day by reviewing overnight sales data and updating the weekly forecast model. They notice a negative variance in a key product line and flag it for investigation.

- 9:30 AM: Alex joins the weekly FP&A team meeting. Instead of just presenting numbers, Alex provides a narrative, explaining *why* the variance occurred and proposing a few questions for the regional sales director. The Manager asks Alex to lead the follow-up.

- 11:00 AM: Alex spends two hours working on a major project: building the financial model for a potential new product launch. This involves complex assumptions about market size, pricing, and operational costs.

- 1:00 PM: After lunch, Alex meets with a junior analyst to review their Q3 budget variance report. Alex doesn't just correct errors; they explain the underlying principles of accrual accounting to help the analyst grow.

- 2:30 PM: Alex has a call with the marketing department's director to understand their budget needs for the next fiscal year. This requires translating marketing's strategic goals into concrete financial figures and challenging assumptions where necessary.

- 4:00 PM: Alex dedicates the last part of the day to preparing a presentation for the VP of Finance on the new product launch model. This involves simplifying complex financial data into clear, actionable insights for an executive audience.

This example highlights the key shift: a Senior Associate doesn't just analyze data; they interpret it, build narratives around it, and use it to influence business decisions while simultaneously developing the next generation of talent.

Average Senior Associate Salary: A Deep Dive

Now for the central question: what does this level of responsibility command in terms of compensation? The salary for a Senior Associate is highly attractive but also highly variable. It's crucial to look beyond a single national average and examine the figures within the context of specific industries, which have vastly different pay scales.

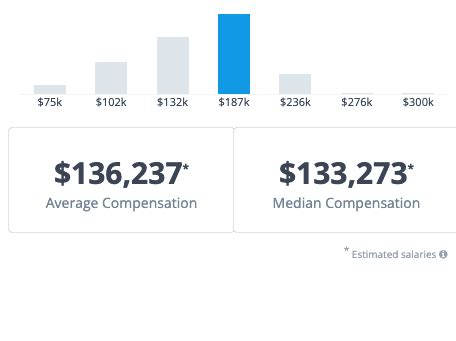

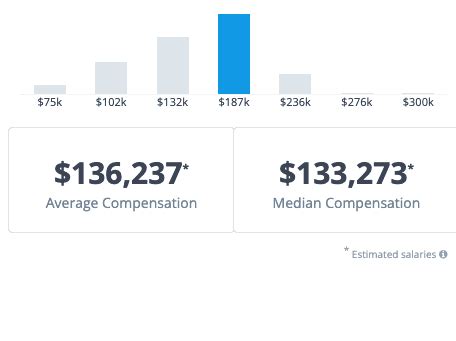

According to Salary.com, as of late 2023, the median national salary for a "Senior Associate" in the United States is approximately $96,550. The typical salary range falls between $87,880 and $106,690. However, this figure is a broad aggregate across many industries and job functions, some of which pay significantly more or less.

More specialized data from Payscale shows a similar average base salary of around $91,000, while Glassdoor reports a higher average base pay of $111,000, with total pay (including bonuses and other compensation) reaching $124,000 on average.

The real story emerges when we dissect these numbers by industry. The title "Senior Associate" in a field like investment banking or corporate law represents a compensation package that is worlds apart from one in a non-profit or a regional marketing agency.

### Senior Associate Salary by Industry (Base Salary + Typical Bonus)

Here is a more detailed breakdown of what you can expect in some of the most common and high-paying fields. Note that these are typical ranges and can be influenced by the many factors discussed in the next section.

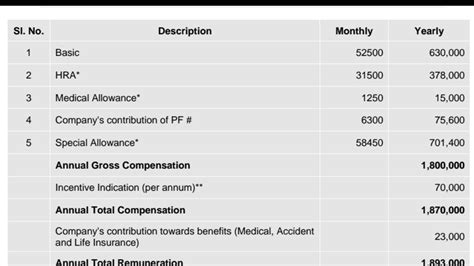

| Industry | Typical Base Salary Range | Typical Annual Bonus / Additional Comp | Estimated Total Compensation Range | Key Considerations |

| ------------------------ | ------------------------- | -------------------------------------- | ---------------------------------- | ---------------------------------------------- |

| Law (BigLaw) | $250,000 - $435,000+ | $40,000 - $115,000+ | $290,000 - $550,000+ | Follows the "Cravath Scale"; highly dependent on class year. |

| Management Consulting | $190,000 - $220,000 | $40,000 - $80,000+ | $230,000 - $300,000+ | Post-MBA roles at MBB (McKinsey, Bain, BCG) are at the top end. |

| Finance (Investment Banking) | $175,000 - $225,000 | 50% - 100%+ of Base Salary | $260,000 - $450,000+ | Bonus is a huge component; highly variable based on firm and individual performance. |

| Accounting (Big Four) | $95,000 - $150,000 | $10,000 - $25,000 | $105,000 - $175,000 | Specialized advisory roles (e.g., transaction services) pay more. |

| Technology (Corporate) | $110,000 - $170,000 | $15,000 - $40,000 + Stock Options/RSUs | $140,000 - $250,000+ | Total compensation is heavily influenced by equity (RSUs). |

| Marketing / Advertising | $85,000 - $125,000 | $5,000 - $15,000 | $90,000 - $140,000 | Varies greatly between agency and client-side roles. |

*Sources: Data compiled and synthesized from reports by Glassdoor, Payscale, Salary.com, Wall Street Oasis, and industry-specific reports like the Cravath Scale for law.*

### Beyond the Base Salary: Understanding Total Compensation

For high-earning Senior Associate roles, especially in finance, consulting, and law, the base salary is only part of the story. Total compensation is a much more important metric. Here’s a breakdown of the components you need to consider:

- Performance Bonus: This is the most significant variable component. In finance and consulting, the annual bonus can be 50-100% or even more of your base salary, tied directly to your individual performance, your team's success, and the firm's overall profitability for the year.

- Signing Bonus: Often offered to attract top talent, especially for post-MBA hires in consulting and finance. This can range from $20,000 to $50,000 or more.

- Profit Sharing: Some firms, particularly in law and smaller consulting groups, may offer a share of the firm's profits to senior employees.

- Stock Options / Restricted Stock Units (RSUs): This is a huge factor in the technology industry. Senior Associates at publicly traded tech companies often receive a significant portion of their compensation in RSUs, which vest over a period of several years (typically four). This can add tens of thousands of dollars to your annual compensation. In startups, stock options offer the potential for a massive payout if the company is successful.

- Retirement Contributions: Look beyond a simple 401(k) match. Many top firms offer generous profit-sharing contributions to your retirement account, which can be equivalent to 10-15% of your salary, deposited automatically without any required contribution from you.

- Other Benefits: While not direct cash, the value of premium health insurance, wellness stipends, generous paid time off, and tuition reimbursement for continuing education can be substantial.

When evaluating an offer for a Senior Associate position, it is critical to look at the entire package. A role with a slightly lower base salary but with a substantial, reliable bonus and excellent benefits might be more lucrative in the long run than a role with a higher base but little else.

Key Factors That Influence a Senior Associate Salary

Two people with the exact same title of "Senior Associate" can have wildly different salaries. Understanding the levers that control compensation is the key to maximizing your own. Your salary is not a fixed number; it's a dynamic figure determined by a combination of your personal background, your employer's characteristics, and broader market forces. Let's break down the most impactful factors.

### 1. Area of Specialization and Industry

This is, without question, the single most significant factor. As shown in the previous section, the industry you work in sets the baseline for your earning potential. A Senior Associate in M&A at a bulge-bracket bank operates in a different financial stratosphere than a Senior Communications Associate at a non-profit.

Even within a single industry, specialization is key.

- Within Finance: A Senior Associate in Private Equity or Venture Capital will typically out-earn their counterpart in corporate banking or FP&A. Those working in quantitative finance ("quants") who can blend finance with advanced mathematics and programming often command the highest salaries of all.

- Within Law: A Corporate Law associate specializing in high-stakes M&A or a Litigation associate working on bet-the-company cases at a top New York firm will earn significantly more than an associate specializing in trust and estates at a regional firm, even with the same years of experience.

- Within Technology: A Senior Associate specializing in a high-demand field like Artificial Intelligence/Machine Learning, Cybersecurity, or Cloud Architecture will have a much higher salary band than one in a more generalized IT support or project management role. According to Glassdoor data, a Senior Data Scientist can easily command a base salary upwards of $150,000, not including stock, which is significantly higher than a general IT Associate.

- Within Consulting: While general strategy consulting pays extremely well, those who can specialize in digital transformation, data analytics, or specific high-growth industries (like life sciences or fintech) can become even more valuable and command higher pay, particularly when they move to industry roles.

### 2. Geographic Location

Where you work matters—a lot. Salaries are adjusted based on the cost of labor and the cost of living in a particular metropolitan area. Companies in high-cost-of-living (HCOL) cities like New York, San Francisco, and Boston must pay a premium to attract and retain talent.

A recent analysis using Salary.com's calculator illustrates this point clearly. A hypothetical "Senior Strategy Associate" with five years of experience might see the following salary variations:

- San Francisco, CA: ~25-35% above the national average.

- New York, NY: ~20-30% above the national average.

- Boston, MA: ~10-15% above the national average.

- Chicago, IL: ~5-10% above the national average.

- Dallas, TX: Approximately at the national average.

- Kansas City, MO: ~5-10% below the national average.

This means a role that pays $150,000 in Dallas might need to pay $180,000 in New York and over $195,000 in San Francisco for the company to remain competitive.

The Rise of Remote Work: The post-pandemic shift to remote and hybrid work has complicated this a bit. Some companies, particularly in tech, have adopted location-agnostic pay scales, paying all employees based on a high-cost market like San Francisco, regardless of where they live. However, many others (including major players like Google and Meta) have implemented location-based pay tiers, adjusting salaries downward if an employee moves from an HCOL area to a lower-cost one. When considering remote roles, it is crucial to clarify the company's compensation philosophy.

### 3. Years of Experience and Career Trajectory

The "Senior Associate" title itself often spans a range of experience, typically from 3 to 6 years post-undergraduate or 1 to 3 years post-MBA/JD. Your position within that range directly impacts your pay. A firm's compensation structure is rarely flat; it's a ladder.

- First-Year Senior Associate (or Post-MBA Associate): You are at the entry point for this level. Your salary is at the bottom of the Senior Associate band.

- Mid-Level Senior Associate (4-5 years total experience): You have proven yourself at the senior level. You are leading larger project streams and have likely received at least one or two merit-based raises since your promotion. Your salary and bonus potential are higher.

- Senior-Most Associate (Pre-Manager/VP): You are at the top of the band, operating with significant autonomy. You are actively being groomed for a promotion to the next level (Manager, Vice President, Counsel). Your compensation reflects this, and you may receive a significant "promotion" bonus upon moving up.

In a highly structured environment like BigLaw, this is formalized. The "Cravath Scale" dictates a lockstep salary increase for each year of experience (e.g., a 4th-year associate makes more than a 3rd-year, and so on). In 2023, for example, a 3rd-year associate at a top firm earned a base salary of $295,000, while a 6th-year associate earned $390,000. This demonstrates the powerful and predictable impact of experience in certain fields.

### 4. Level of Education and Professional Certifications

Your educational background sets the foundation for your career and can significantly influence your starting salary and long-term trajectory.

- Bachelor's Degree: This is the standard entry requirement for most associate-track roles. Your major (e.g., STEM, Economics, Finance) can give you an edge.

- Master of Business Administration (MBA): An MBA from a top-tier program (e.g., M7 or T15 schools) is a golden ticket for high-paying Senior Associate roles in management consulting and investment banking. It effectively acts as a career accelerator, allowing individuals to enter directly at the post-MBA Associate/Consultant level, which often pays nearly double what a pre-MBA Senior Analyst earns. Post-MBA total compensation packages frequently exceed $250,000 in the first year.

- Juris Doctor (JD): Essential for a career in law. The prestige of your law school (e.g., T14 schools) has a major impact on your ability to land a high-paying BigLaw job, which puts you on the lucrative lockstep salary scale.

- Professional Certifications: In many fields, professional certifications are a clear signal of expertise and can lead to higher pay and more senior roles.

- Chartered Financial Analyst (CFA): Highly respected in investment management and equity research. Passing all three levels can provide a significant salary boost and is often a prerequisite for senior roles.

- Certified Public Accountant (CPA): Essential for a career in accounting. It is a requirement for promotion to Manager and beyond at the Big Four firms and is highly valued in any corporate finance role.

- Project Management Professional (PMP): Valuable for Senior Associates in IT, construction, and operations, demonstrating a formal understanding of project management methodologies.

### 5. Company Type and Size

The type of organization you work for has a profound effect on your compensation structure.

- Large, Publicly Traded Corporations (Fortune 500): These companies offer competitive salaries, solid bonuses, and excellent benefits, including valuable RSUs and robust 401(k) plans. Compensation is often highly structured with clear salary bands for each level.

- Elite Professional Services Firms (BigLaw, MBB Consulting, Big Four Accounting): These are often the highest-paying employers for Senior Associates. They operate on an "up or out" model, demanding long hours but providing top-of-the-market compensation and unparalleled exit opportunities.

- Boutique Firms: A smaller, specialized consulting or investment firm may offer a salary competitive with larger players, and potentially a better work-life balance or a faster path to partner. However, brand recognition may be lower.

- Startups: Compensation at a startup is a different calculation. The base salary for a Senior Associate role may be lower than at a large corporation. The real allure is equity (stock options). If the startup is successful and has a major exit (IPO or acquisition), those options could be worth a life-changing amount of money. This is a high-risk, high-reward proposition.

- Government and Non-Profit: These sectors will almost always have the lowest salary bands. A Senior Associate at a federal agency or a large foundation will earn significantly less than their private sector counterpart. The trade-off is often better work-life balance, job security (in government), and a mission-driven work environment.

### 6. In-Demand Skills

Beyond your title and years of experience, your specific, demonstrable skills can make you a more valuable asset and give you leverage in salary negotiations.

- Hard Skills:

- Financial Modeling: The ability to build complex, three-statement financial models from scratch is a highly-paid skill in finance and corporate development.

- Data Analysis & Visualization: Proficiency in tools like SQL, Python (with Pandas), R, and Tableau/Power BI is no longer just for data scientists. Senior Associates in consulting, marketing, and finance who can manipulate and interpret large datasets are in high demand.

- Industry-Specific Software: Expertise in platforms like Salesforce (for sales/ops), SAP (for finance/ERP), or specific legal e-discovery software can make you more efficient and valuable.

- Soft Skills (at a Senior Level):

- Client Relationship Management: Moving beyond simple communication to truly managing client expectations, building rapport, and identifying new opportunities for the firm.

- Leadership and Mentorship: A proven ability to successfully guide junior team members, delegate effectively, and contribute to a positive team culture.

- Persuasive Communication & Presentation: The skill of taking complex information and presenting it as a clear, compelling narrative to senior leadership or clients. This is the core of a consultant's job and is highly valued everywhere.

- Strategic Thinking: The ability to see the bigger picture, understand how your work connects to the company's overall goals, and proactively identify risks and opportunities.

By cultivating a strong combination of these factors, you can position yourself at the absolute top end of the salary range for a Senior Associate in your field.

Job Outlook and Career Growth

Investing years to reach the Senior Associate level is only worthwhile if the role offers a promising future. Fortunately, for the core professions where this title is common, the long-term outlook is robust, and the opportunities for advancement are significant. The Senior Associate position is not a final destination; it is a critical springboard to leadership.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) does not track "Senior Associate" as a distinct category. However, we can analyze the outlook for the primary professions that use this title to get a clear and authoritative picture of future demand.

- Management Analysts (Consultants): The BLS projects employment for management analysts to grow by 10% from 2022 to 2032, which is much faster than the average for all occupations. This translates to about 103,500 new jobs over the decade. The BLS attributes this strong growth to the continued need for organizations to improve efficiency and control costs in an increasingly competitive global marketplace. Demand for consultants with expertise in digital transformation, data analytics, and sustainability (ESG) is expected to be particularly high.

- Lawyers: Employment of lawyers is projected to grow 8% from 2022 to 2032, also faster than the average. This will result in about 39,100 new job openings each year, on average. The BLS notes that