From the Author: As a career analyst who has spent over a decade dissecting career trajectories and compensation structures, I've seen countless individuals seek roles that offer a blend of human interaction, tangible results, and financial stability. The leasing agent career is a fascinating intersection of all three. It's more than just showing apartments; it's about building communities and being the first point of contact for someone's new home. I once mentored a young professional who transitioned from a low-paying retail job into a leasing consultant role. Within two years, through sheer drive and a focus on performance, she doubled her income and was on the fast track to becoming a property manager. Her story is a testament to the fact that in this field, your effort, skill, and ambition directly shape your success and your salary. This guide is designed to give you that same clear-eyed view of the potential that awaits.

Table of Contents

- [What Does a Leasing Agent Do?](#what-does-a-leasing-agent-do)

- [Average Leasing Agent Salary: A Deep Dive](#average-leasing-agent-salary)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Become a Leasing Agent](#how-to-become-a-leasing-agent)

- [Is This Career Right for You? (Conclusion)](#conclusion)

---

What Does a Leasing Agent Do? A Look Beyond the Tours

At its core, a leasing agent—often called a leasing consultant or leasing specialist—is the primary sales and customer service representative for a rental property. They are the face of the apartment community, commercial building, or residential property, responsible for attracting, qualifying, and signing new tenants to fill vacancies. However, the role extends far beyond simply unlocking doors and pointing out amenities.

A successful leasing agent is a dynamic blend of a salesperson, a marketing guru, a community ambassador, and an administrative expert. Their work directly impacts the property's financial health, as occupancy rates are a primary driver of revenue. Without skilled leasing agents, even the most beautiful properties would sit empty.

### Core Responsibilities and Daily Tasks

While every day can bring new challenges and interactions, a leasing agent's work revolves around a consistent set of core responsibilities:

- Marketing and Lead Generation: They are actively involved in marketing vacant units. This includes creating and posting online listings on platforms like Zillow, Apartments.com, and Zumper; managing social media accounts for the property; and sometimes participating in local outreach and corporate housing programs.

- Responding to Inquiries: They are the first point of contact for prospective renters. This involves answering phone calls, responding to emails, and engaging with leads through the property's website or CRM (Customer Relationship Management) software.

- Conducting Property Tours: This is the most visible part of the job. It’s not just a walk-through; it's a sales presentation. An effective tour highlights the property's unique value proposition, tells a story about the lifestyle, and addresses the specific needs and desires of the prospect.

- Screening Applicants: Leasing agents are responsible for guiding applicants through the rental application process. This includes collecting applications, verifying income, checking credit and background reports, and ensuring all actions comply strictly with Fair Housing laws.

- Preparing and Executing Leases: Once an applicant is approved, the agent prepares the legal lease agreement, reviews all terms and conditions with the new resident, and secures the necessary signatures and deposits.

- Resident Relations: The job doesn't end once the lease is signed. Agents often assist with the move-in process, answer current resident questions, help mediate minor issues, and play a crucial role in encouraging lease renewals, which are vital for maintaining stable occupancy.

- Market Research: To stay competitive, agents must be aware of the local rental market. This involves regularly checking competitors' pricing, amenities, and concessions (specials) to ensure their property remains attractive.

### A Day in the Life of a Leasing Agent

To make the role more tangible, here’s what a typical Tuesday might look like for a leasing agent at a 250-unit apartment community:

> 9:00 AM - 9:30 AM: Arrive, check the office voicemail and email for any overnight inquiries. Review the property’s CRM (like Yardi or Entrata) for new internet leads that came in.

>

> 9:30 AM - 10:00 AM: Walk the "tour path." This means walking the route you take with prospects, ensuring the model apartment is pristine, amenities are clean, and the grounds look their best.

>

> 10:00 AM - 11:00 AM: First scheduled tour of the day. A young couple is looking for their first apartment together. You listen to their needs, showcase the two-bedroom model, highlight the fitness center and proximity to public transit, and build rapport.

>

> 11:00 AM - 12:00 PM: Follow-up calls and emails. You reach out to prospects who toured over the weekend, answer any lingering questions, and create a sense of urgency.

>

> 12:00 PM - 1:00 PM: A walk-in prospect arrives without an appointment. You adapt, give them a warm welcome and a professional tour, and provide them with an application packet.

>

> 1:00 PM - 1:30 PM: Lunch.

>

> 1:30 PM - 3:00 PM: Administrative block. The couple from the morning tour submitted their application online. You begin the screening process: running credit and background checks and sending out employment/rental verifications.

>

> 3:00 PM - 4:00 PM: Marketing tasks. You update the property's listings on Apartments.com with new photos and adjust the advertised rent for one unit based on the property manager's instructions. You might also create a quick post for the property's Instagram page.

>

> 4:00 PM - 5:00 PM: A current resident stops by to report a non-emergency maintenance issue (a leaky faucet). You create a work order in the system and assure them it will be addressed promptly.

>

> 5:00 PM - 5:30 PM: Plan for tomorrow. Review scheduled tours, prepare "move-in packets" for new residents arriving this week, and send a final round of follow-up emails.

This "day in the life" illustrates the dynamic nature of the role—a constant juggle between sales, customer service, and administrative duties where no two days are exactly the same.

---

Average Leasing Agent Salary: A Deep Dive

Understanding the compensation structure is critical for anyone considering this career. A leasing agent's salary is rarely just a flat hourly rate or annual figure; it's a dynamic package composed of a base salary, commissions, bonuses, and other benefits. This performance-based component is what allows driven individuals to significantly increase their earnings.

### National Averages and Salary Ranges

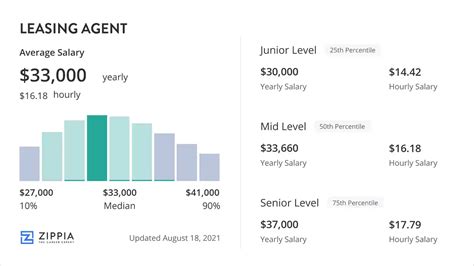

To get a clear picture, it's best to consult several authoritative sources. As of late 2023 and early 2024, the data provides a consistent range:

- Salary.com reports that the median leasing agent salary in the United States is $40,320, with a typical range falling between $35,744 and $47,759.

- Payscale.com shows a similar average base salary of around $38,200 per year, but importantly notes that bonuses can add up to $7,000 and commissions can add another $11,000 annually for high performers.

- Glassdoor.com aggregates user-submitted data and reports a total pay estimate of $51,699 per year, which includes a base salary of approximately $42,392 and additional pay (commissions, bonuses) of around $9,307.

- The U.S. Bureau of Labor Statistics (BLS) groups leasing agents under the broader category of "Real Estate Brokers and Sales Agents." The median pay for this group was $52,030 per year in May 2022. While this category includes residential and commercial agents who often earn higher, fully commission-based incomes, it provides a valuable upper-end benchmark. For a closer comparison, "Property, Real Estate, and Community Association Managers," a common next step for leasing agents, had a median pay of $60,650 per year.

Key Takeaway: A reasonable expectation for a leasing agent's total annual compensation is between $38,000 and $55,000, with top performers in high-cost-of-living areas or luxury properties exceeding $65,000 or more.

### Salary by Experience Level

Your earning potential grows significantly as you gain experience, master the art of closing, and take on more responsibility. Here’s a typical progression:

| Experience Level | Typical Base Salary Range | Typical Total Compensation (with bonuses/commissions) | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | $32,000 - $38,000 | $35,000 - $45,000 | Learning the ropes, conducting tours, processing applications, focusing on customer service, understanding Fair Housing laws. |

| Mid-Career (2-5 years) | $38,000 - $45,000 | $45,000 - $60,000 | High closing ratio, strong resident retention skills, training new agents, handling more complex tenant issues, deep market knowledge. |

| Senior/Lead (5+ years) | $45,000 - $52,000 | $55,000 - $70,000+ | May hold a title like "Senior Leasing Specialist" or "Leasing Manager." Oversees the leasing team, sets leasing goals, analyzes market data, develops marketing strategies, handles difficult negotiations. |

*Source: Data synthesized from Salary.com, Payscale, and industry observations.*

### Deconstructing the Compensation Package: Beyond the Base Salary

The base salary or hourly wage is just the foundation. The real opportunity lies in the variable pay components.

- Commissions: This is the most common form of performance pay. Structures vary widely:

- Flat Fee Per Lease: A fixed amount for each new lease signed (e.g., $100 - $300 per lease). This is straightforward and easy to track.

- Percentage of Rent: A commission based on a percentage of the first month's rent or the total lease value. This is more common in high-end luxury or commercial properties.

- Tiered Commissions: The commission per lease increases after hitting certain goals (e.g., $100 for the first 5 leases, $150 for leases 6-10, etc.).

- Bonuses: Bonuses are typically tied to broader property or team goals.

- Renewal Bonuses: A smaller bonus (e.g., $50 - $100) for each existing resident who renews their lease. This incentivizes excellent customer service throughout the resident lifecycle.

- Occupancy Bonuses: A quarterly or annual bonus paid to the team if the property maintains a certain occupancy level (e.g., 95% or higher).

- Performance Bonuses: Discretionary bonuses awarded by the property manager or corporate office for outstanding individual or team performance.

- Other Benefits & Perks:

- Rental Discounts: This is a significant and highly valued perk. Many property management companies offer their employees a substantial discount (often 20-50%, sometimes more) to live on-site. In a high-cost-of-living area, this can be worth thousands of dollars a year.

- Standard Benefits: Most full-time leasing agents at reputable companies receive standard benefits packages, including health insurance (medical, dental, vision), paid time off (PTO), and access to a 401(k) retirement plan.

When evaluating a job offer, it's crucial to look at the Total Compensation Package, not just the hourly wage. A lower base pay with a strong commission structure and a generous rental discount in an expensive city could be far more lucrative than a higher base pay with no performance incentives.

---

Key Factors That Influence a Leasing Agent Salary

Your earning potential isn't set in stone. It's a fluid figure influenced by a combination of your location, experience, skills, and the type of property you work for. Understanding these factors is the key to maximizing your income in this field.

### `

`Geographic Location: The Power of Place`

`Where you work is arguably the single most significant factor determining your base salary and overall earning potential. Salaries are closely tied to the local cost of living and the competitiveness of the rental market. A leasing agent in San Francisco, CA, will have a much higher base salary and larger commissions than an agent in Springfield, MO, simply because the rents and property values are exponentially higher.

High-Paying States and Metropolitan Areas:

According to data from Zippia and Salary.com, the states and cities that offer the highest compensation for leasing agents are typically those with booming tech or finance sectors and high rental costs.

| State/Metro Area | Average Annual Salary (Total Comp) | Why It's High |

| :--- | :--- | :--- |

| California (esp. San Francisco, San Jose, Los Angeles) | $55,000 - $75,000+ | Extremely high cost of living, massive and competitive rental markets, high property values lead to higher commission potential. |

| New York (esp. New York City Metro) | $52,000 - $70,000+ | Similar to California, with one of the most expensive and dynamic rental markets in the world. |

| Massachusetts (esp. Boston) | $50,000 - $68,000+ | Strong economy driven by biotech, education, and tech, leading to high demand for rental housing. |

| Washington D.C. Metro Area | $48,000 - $65,000+ | Stable government employment base, high concentration of young professionals, and a robust rental market. |

| Washington State (esp. Seattle) | $48,000 - $65,000+ | Tech hub with high wages and a corresponding high cost of living and rent. |

Lower-Paying States and Regions:

Conversely, states with a lower cost of living and less competitive rental markets will offer more modest compensation packages.

| State/Region | Average Annual Salary (Total Comp) | Why It's Lower |

| :--- | :--- | :--- |

| Southern States (e.g., Mississippi, Alabama, Arkansas) | $30,000 - $40,000 | Lower cost of living, less dense urban populations, lower average rental rates. |

| Midwestern States (e.g., Oklahoma, Missouri, Indiana) | $32,000 - $42,000 | More affordable housing markets, stable but less explosive economies compared to coastal hubs. |

*Note: While the nominal salary is lower in these areas, the purchasing power may be comparable or even better than in a high-cost city. A $40,000 salary goes much further in Omaha, Nebraska, than a $55,000 salary in Boston.*

### `

`Years of Experience and Career Progression`

`As detailed in the previous section, experience is a direct driver of income. But it's not just about time served; it's about the expertise you accumulate.

- 0-2 Years (The Foundation): The focus is on learning. You master the leasing process, Fair Housing laws, and the company's software. Your value is in your enthusiasm, customer service skills, and ability to follow a proven system. Your income is primarily base salary plus modest commissions.

- 2-5 Years (The Professional): You're no longer just following a script. You've developed a professional sales style, can overcome objections with ease, and have a deep understanding of your local market. You likely have a high closing ratio and are a key contributor to the team's success. Your commission earnings become a much more significant portion of your total pay.

- 5+ Years (The Expert/Leader): You are a market expert. Senior agents often take on mentorship roles, assist with marketing strategy, and may handle high-value corporate clients or difficult renewals. Some transition to a "Leasing Manager" role, overseeing the team's performance, which comes with a higher base salary and team-based bonuses. This experience is the launching pad for roles like Assistant Property Manager or Property Manager.

### `

`Property Type and Area of Specialization`

`Not all leasing agent jobs are created equal. The type of property you lease for dramatically impacts your daily tasks, the skills required, and your compensation structure.

- Conventional/Market-Rate Properties (Class B/C): This is the most common type of leasing job. These are standard apartment communities for the general public. Compensation is typically a mix of hourly pay and a flat-fee commission per lease.

- Luxury/Class A Properties: These are high-end buildings with premium finishes, extensive amenities, and high rents. The clientele is more discerning, and the sales process is more consultative. This is often the most lucrative specialization for a leasing agent. Base salaries may be higher, and commissions are often a percentage of the very high first month's rent, leading to significant earning potential.

- Affordable Housing (LIHTC, Section 8): Leasing for these properties is highly specialized and compliance-driven. The role is less about sales and more about meticulous paperwork and adherence to strict government regulations for income verification. Compensation is typically a stable hourly wage or salary with minimal, if any, commission. It offers high job security but a lower ceiling on earnings.

- Student Housing: This is a fast-paced, cyclical environment. The "leasing season" is intense (typically fall through spring), with a huge volume of leases signed in a short period. It requires excellent organizational skills and the ability to connect with students and their parents. Pay often includes high-volume bonus potential during the peak season.

- Commercial Leasing: This is a different career path altogether, but it's an important distinction. Commercial leasing agents lease office, retail, or industrial space. This role almost always requires a state real estate license, involves complex and lengthy negotiations, and is typically 100% commission-based. The deals are fewer but much larger, and the income potential is significantly higher—often well into six figures—but it comes with higher risk and no guaranteed income.

### `

`Company Type and Size`

`The structure of your employer also plays a part in your paycheck.

- Large National Property Management Firms (REITs): Companies like Greystar, AvalonBay Communities, or Equity Residential are Real Estate Investment Trusts (REITs). They offer highly structured career paths, excellent training programs, and comprehensive benefits packages. Their pay scales are often standardized across their portfolio, with adjustments for market location. There is often a clear ladder for promotion.

- Small to Mid-Sized Regional Companies: These firms may manage a few dozen properties in a specific state or region. They can offer a more familial culture and potentially more flexibility in commission structures. There may be less red tape but also fewer structured opportunities for advancement to corporate roles.

- Individual "Mom-and-Pop" Owners: Working directly for the owner of one or two small buildings can be a mixed bag. The relationship is very direct, but pay, benefits, and professional standards can vary wildly. This is often a less stable environment with a lower salary ceiling.

### `

`Education and Professional Certifications`

`While a four-year college degree is not typically required to become a leasing agent, it can provide a competitive edge and influence starting salary.

- High School Diploma/GED: This is the minimum requirement for most entry-level positions.

- Associate's or Bachelor's Degree: A degree in Marketing, Business, Communications, or Hospitality can be very attractive to employers. It demonstrates a foundational knowledge of relevant principles and a higher level of commitment. Some larger companies may require a degree for advancement into management positions.

More impactful than a general degree are industry-specific certifications. These demonstrate a commitment to the profession and a verified level of expertise.

- National Apartment Leasing Professional (NALP): Offered by the National Apartment Association (NAA), this is the gold standard certification for leasing agents. The curriculum covers everything from sales techniques and resident relations to Fair Housing laws and market analysis. Earning your NALP can directly lead to a higher salary, better job opportunities, and is often a prerequisite for promotion.

- State Real Estate License: While not required for leasing apartments on behalf of a direct employer (the property owner), it is mandatory if you work for a third-party brokerage firm that manages leasing for multiple owners. It is also required for commercial leasing. Holding a license can increase your credibility and open up more career avenues, potentially leading to higher pay.

### `

`In-Demand Skills That Boost Your Paycheck`

`Beyond formal qualifications, a specific set of skills can make you a top earner.

- Sales and Closing Acumen: This is the #1 skill. The ability to build rapport, identify needs, overcome objections ("the rent is too high," "the closet is too small"), create urgency, and ask for the lease is what separates an average agent from a great one.

- Exceptional Customer Service: Happy residents renew their leases, and renewals are often bonused. Going above and beyond to ensure a positive resident experience directly impacts your income and the property's bottom line.

- Knowledge of Fair Housing Laws: This is non-negotiable. A deep, practical understanding of the Fair Housing Act and local ordinances is essential for avoiding costly lawsuits. Experts in this area are highly valued.

- Tech Proficiency (CRM Software): Expertise in industry-standard property management software like Yardi Voyager, Entrata, or RealPage is a huge plus. The ability to efficiently manage leads, process applications, and run reports in these systems makes you a more effective and valuable employee.

- Digital Marketing Skills: In today's market, agents who can effectively use social media (Instagram, Facebook), create compelling online listings, and even shoot and edit quality video tours are in high demand. These skills directly contribute to lead generation and can command a higher salary.

- Bilingualism: In diverse metropolitan areas, the ability to speak a second language (especially Spanish) is a massive advantage. It opens up a wider pool of prospective renters and can come with a pay differential.

---

Job Outlook and Career Growth

Choosing a career isn't just about the starting salary; it's about long-term stability and the potential for advancement. The outlook for leasing agents and the broader property management industry is positive, offering a clear and attainable career ladder for ambitious individuals.

### A Stable and Growing Field

The U.S. Bureau of Labor Statistics (BLS) provides a strong forecast for the industry. While they don't have a separate category for leasing agents, we can look at the closely related and often subsequent role of Property, Real Estate, and Community Association Managers.

According to the BLS's Occupational Outlook Handbook (2022-2032 projections):

- Job Growth: Employment in this field is projected to grow 3 percent from 2022 to 2032, which is about as fast