Leasing Manager Salary: A Comprehensive Guide for 2024

Thinking about a career in real estate management? The role of a Leasing Manager is a dynamic and pivotal position that combines sales, marketing, and customer service. For those with the right skills, it offers a rewarding career path with significant earning potential. A leasing manager's salary can range from approximately $50,000 for entry-level positions to well over $125,000 annually for senior roles in high-demand markets.

This guide will break down what you can expect to earn as a leasing manager, the key factors that influence your salary, and the long-term outlook for this essential profession.

What Does a Leasing Manager Do?

Before diving into the numbers, it's important to understand the scope of the role. A Leasing Manager is the strategic mind behind a property's occupancy rates and tenant satisfaction. They are responsible for more than just showing units and signing paperwork; they oversee the entire leasing process from start to finish.

Key responsibilities typically include:

- Marketing and Advertising: Creating and implementing strategies to attract prospective tenants for vacant units.

- Tenant Acquisition: Managing inquiries, conducting property tours, and guiding applicants through the screening and approval process.

- Lease Negotiation: Drafting, negotiating, and executing lease agreements, ensuring compliance with all local, state, and federal laws.

- Market Analysis: Monitoring local market trends, rental rates, and competitor activity to ensure the property remains competitive.

- Team Management: Often, they supervise a team of leasing agents or consultants, setting goals and providing training.

- Financial Reporting: Tracking leasing metrics, occupancy rates, and contributing to budget forecasts.

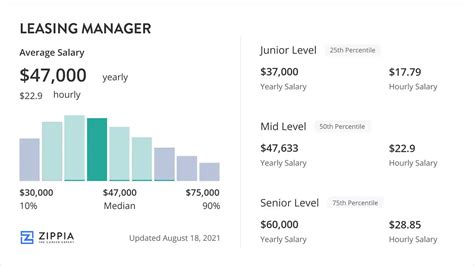

Average Leasing Manager Salary

A leasing manager's salary is composed of a base salary plus, in many cases, performance-based bonuses or commissions. This structure means that total compensation can vary significantly. Here’s how the numbers break down according to leading salary data providers:

- The U.S. Bureau of Labor Statistics (BLS) groups Leasing Managers under the broader category of "Property, Real Estate, and Community Association Managers." As of May 2023, the median annual wage for this group was $60,950. The lowest 10 percent earned less than $31,570, and the highest 10 percent earned more than $130,590.

- Salary.com reports a higher median salary specifically for a "Leasing Manager" at $104,188 as of May 2024. Their data suggests a typical range falls between $85,557 and $127,624, reflecting roles that may carry more strategic responsibility or are in higher-paying commercial sectors.

- Glassdoor estimates the total pay for a Leasing Manager to be around $83,614 per year in the United States, which includes a base salary of approximately $64,420 and additional pay (bonuses, commission) of nearly $19,194.

- Payscale provides an average base salary of around $62,500 per year, emphasizing that experience level heavily impacts earnings.

The differences in these figures highlight the importance of bonuses and commissions in this role. While the base salary may be in the $60k range, strong performance can elevate total earnings into the six-figure territory.

Key Factors That Influence Salary

Your specific salary as a leasing manager will be determined by a combination of factors. Understanding these variables can help you maximize your earning potential.

###

Level of Education

While a bachelor's degree is not always a strict requirement, employers increasingly prefer candidates who have one, especially for management positions at larger firms. Degrees in Business Administration, Real Estate, Finance, or Marketing are particularly relevant. More importantly, professional certifications can provide a significant salary boost. Prestigious credentials include:

- Certified Property Manager (CPM): Offered by the Institute of Real Estate Management (IREM).

- Certified Apartment Manager (CAM): Offered by the National Apartment Association (NAA).

Holding these certifications demonstrates a high level of expertise and commitment to the industry, often leading to more senior roles and higher pay.

###

Years of Experience

Experience is arguably the most critical factor in determining your salary. The career ladder in property management offers clear progression:

- Entry-Level (0-2 years): Professionals often start as a Leasing Consultant or Agent. In this role, salaries are typically in the $40,000 to $55,000 range, with a heavy emphasis on commission.

- Mid-Career (3-8 years): As a Leasing Manager with proven success in filling vacancies and managing a team, you can expect your base salary to rise into the $60,000 to $85,000 range, with total compensation often exceeding this.

- Senior-Level (8+ years): Senior or Regional Leasing Managers who oversee multiple properties or large commercial portfolios can command base salaries of $90,000 to over $125,000. At this level, substantial bonuses can push total earnings even higher.

###

Geographic Location

Where you work matters immensely. Salaries are typically higher in major metropolitan areas with a high cost of living and dynamic real estate markets. According to data from Salary.com, cities like San Jose, CA, and New York, NY, offer salaries that are 20-30% above the national average. Conversely, salaries in smaller cities and rural areas are generally lower.

Top-Paying Metropolitan Areas for Property Managers (BLS Data):

1. Naples-Immokalee-Marco Island, FL

2. New York-Newark-Jersey City, NY-NJ-PA

3. Boston-Cambridge-Nashua, MA-NH

4. San Francisco-Oakland-Hayward, CA

###

Company Type

The type of company you work for plays a significant role in your compensation.

- Large Real Estate Investment Trusts (REITs) and Corporations: These firms manage vast portfolios and often offer higher base salaries, more structured bonus plans, and comprehensive benefits packages.

- Third-Party Property Management Firms: These companies manage properties for various owners and can offer competitive pay, often with strong commission incentives.

- Small, Family-Owned Companies: While they may offer lower base salaries, they can provide greater autonomy and sometimes a more direct share of the profits.

###

Area of Specialization

Not all leasing is the same. The type of property you manage has a direct impact on your earnings due to the complexity and value of the leases.

- Commercial Leasing (Office, Retail, Industrial): This is often the most lucrative specialization. Leases are longer, more complex, and involve high-value corporate tenants. Commercial leasing managers often earn the highest salaries in the field.

- Residential Leasing (Multifamily Apartments): This is the most common area and offers stable career paths. While individual lease values are lower, managers at large or luxury apartment communities can earn excellent salaries, especially with strong occupancy-based bonuses.

- Luxury and Niche Properties: Specializing in luxury condominiums, student housing, or senior living can also lead to higher-than-average compensation due to the specialized knowledge required.

Job Outlook

The future for leasing and property managers is stable. The U.S. Bureau of Labor Statistics (BLS) projects that employment for property, real estate, and community association managers will grow 2 percent from 2022 to 2032.

While this growth rate is slower than the average for all occupations, it still translates to a consistent need for qualified professionals. The BLS anticipates about 39,200 openings in this field each year, primarily due to professionals retiring or transitioning to other occupations. The continued growth of the rental market and the need for professional management of existing properties will ensure that skilled leasing managers remain in demand.

Conclusion

A career as a leasing manager offers a clear path for professional and financial growth. While a national average salary provides a useful benchmark, your ultimate earning potential is in your hands. By focusing on gaining experience, pursuing relevant education and certifications, and strategically choosing your location and specialization, you can build a highly rewarding career. For individuals with strong negotiation skills, a customer-centric mindset, and a deep understanding of the real estate market, this profession promises both stability and the opportunity to earn a six-figure income.