For those with a passion for financial planning and a drive to help others secure their future, a career as a life insurance broker offers a rewarding path. It’s a role that combines analytical skill with interpersonal connection, but what about the financial rewards? A common question for aspiring professionals is, "What is a typical life insurance broker salary?"

The answer is complex but encouraging. While entry-level positions may start with a modest base, the earning potential for an experienced and successful life insurance broker is substantial, often exceeding six figures. This article will break down the salary you can expect and the key factors that will determine your income trajectory.

What Does a Life Insurance Broker Do?

Before diving into the numbers, it's essential to understand the role. Unlike a "captive" insurance agent who works for a single company, a life insurance broker acts as an independent intermediary. They represent the client, not the insurance carrier.

Their primary responsibilities include:

- Needs Analysis: Meeting with clients to understand their financial situation, dependents, and long-term goals.

- Market Comparison: Researching and comparing policies from various insurance carriers to find the best fit in terms of coverage and cost.

- Advising and Educating: Explaining complex policy details, terms, and benefits in a clear and understandable way.

- Application and Underwriting: Guiding clients through the application process and acting as a liaison with the insurance company during underwriting.

- Ongoing Service: Maintaining client relationships and reviewing policies periodically to ensure they still meet the client's needs.

This client-centric approach is fundamental to a broker's role and is a key driver of their long-term success.

Average Life Insurance Broker Salary

A life insurance broker's income is typically a combination of a base salary and, more significantly, commissions. This performance-based structure means there is a wide salary range, but it also creates a high ceiling for top performers.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all "Insurance Sales Agents" was $60,340 in May 2023. However, this figure tells only part of the story. The BLS data also shows a vast range:

- Lowest 10%: Earned less than $31,500

- Highest 10%: Earned more than $141,830

This significant spread highlights the impact of commission earnings. Salary aggregators provide further insight, often accounting for bonuses and commissions more directly:

- Salary.com reports that the median salary for a Life Insurance Agent in the United States is around $64,748, with a typical range falling between $59,103 and $72,605. This often reflects a more stable, base-heavy compensation structure.

- Glassdoor estimates a higher total pay of approximately $80,265 per year for life insurance brokers, which includes a base salary and additional pay like commissions and bonuses.

- Payscale shows a clear correlation between experience and income, reporting an average salary of $61,569, but notes that experienced brokers can earn significantly more from profit-sharing and commission structures.

In short, while a starting broker might earn between $45,000 and $60,000, a seasoned, successful broker can realistically earn $100,000 to $200,000+ annually by building a strong client portfolio.

Key Factors That Influence Salary

Your individual earnings as a life insurance broker will depend on several critical factors. Understanding these variables can help you strategize your career path for maximum earning potential.

###

Level of Education

While a bachelor's degree is not always a strict requirement to become a licensed broker, it is highly advantageous. Employers often prefer candidates with a degree in finance, business, economics, or marketing. A degree can build a foundation of credibility with clients and may open doors to positions at more prestigious firms. Furthermore, advanced certifications like the Chartered Life Underwriter (CLU) or Chartered Financial Consultant (ChFC) can significantly boost your expertise and, consequently, your income by allowing you to handle more complex financial planning cases.

###

Years of Experience

Experience is arguably the single most important factor in a broker's income. A career in life insurance is built on relationships and referrals.

- Entry-Level (0-2 years): In the beginning, your focus is on learning the products, passing licensing exams, and building your initial client base. Income is often lower and may be supplemented by a higher base salary or a training stipend.

- Mid-Career (3-10 years): By this stage, you have an established network. A significant portion of your income comes from new business generated through referrals and renewal commissions from policies sold in previous years.

- Senior-Level (10+ years): Experienced brokers have a large book of business that generates consistent renewal income. They are often sought after for complex cases, such as estate planning or business succession, which command much larger policies and higher commissions.

###

Geographic Location

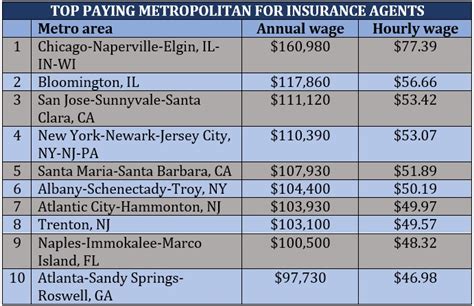

Where you work matters. Brokers in major metropolitan areas with a high cost of living and a high concentration of wealth tend to earn more. Larger policies are more common in these regions, leading to higher commissions. According to the BLS, the top-paying states for insurance sales agents include:

- Massachusetts

- New York

- District of Columbia

- New Jersey

- California

Operating in a region with thriving industries and high-net-worth individuals can provide more lucrative opportunities.

###

Company Type

The structure of your employer plays a major role in your compensation.

- Independent Brokerage: As an independent broker, you have access to products from many different carriers. This flexibility allows you to find the absolute best solution for your client, which builds trust and can lead to higher long-term earnings. However, you are often responsible for your own lead generation and business expenses.

- Large National Firm: Working for a large, well-known firm like Marsh McLennan or Aon can provide access to extensive resources, training programs, and a steady stream of leads. While your commission split might be lower than that of a fully independent broker, the stability and support can be invaluable, especially early in your career.

- Boutique Agency: Smaller, specialized firms may focus on a specific niche, such as high-net-worth clients or business insurance. Excelling in this environment can be highly profitable.

###

Area of Specialization

Generalizing can be a good starting point, but specializing is where top earners set themselves apart. Specializing allows you to become a go-to expert in a specific domain, attracting more complex and profitable cases. High-earning specializations include:

- High-Net-Worth Individuals: Focusing on estate planning, wealth transfer, and tax-advantaged strategies for affluent clients.

- Business Insurance: Working with companies on key person insurance, buy-sell agreements, and other corporate-owned life insurance policies.

- Advanced Policy Design: Mastering complex products like Indexed Universal Life (IUL) or Variable Universal Life (VUL) for sophisticated investment and protection goals.

Job Outlook

The future for life insurance professionals is bright. The BLS projects that employment for Insurance Sales Agents will grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

This growth is driven by several factors:

- An aging population requires solutions for retirement income and estate planning.

- The increasing complexity of financial products necessitates the guidance of a knowledgeable professional.

- Life events like marriage, homeownership, and the birth of a child continue to drive demand for life insurance.

While online tools and "insurtech" are changing the industry, they are not replacing the need for expert human advice, especially for complex and significant financial decisions.

Conclusion

A career as a life insurance broker offers a direct correlation between effort and reward. While the reported median salaries of $60,000 to $80,000 provide a solid benchmark, they only hint at the true potential. Your income is not just a number—it is a reflection of the trust you build, the expertise you develop, and the number of people you help secure their financial legacy.

For the driven, empathetic, and business-savvy individual, the path of a life insurance broker is not just a job, but a lucrative and deeply fulfilling career with virtually unlimited earning potential. Your success will ultimately be defined by your dedication to your clients and your craft.