Reaching the level of Managing Director (MD) at a powerhouse investment bank like Goldman Sachs represents the pinnacle of a career in finance. It’s a role associated with immense responsibility, strategic influence, and, consequently, significant financial reward. For those aspiring to climb the corporate ladder, the compensation for an MD is often a key motivator. While the path is demanding, total compensation can easily reach into the seven figures, making it one of the most lucrative positions in the corporate world.

This guide will break down the salary, bonuses, and key factors that determine the earnings of a Managing Director at Goldman Sachs.

What Does a Managing Director at Goldman Sachs Do?

A Managing Director at Goldman Sachs is a senior leader responsible for driving business, managing large teams, and cultivating key client relationships. This is not a middle-management role; it's a top-tier executive position. Their primary responsibilities often transcend day-to-day operations and focus on strategic goals:

- Business Origination: Often called "rainmaking," this is the core function. MDs are expected to leverage their extensive network to source and win major deals, whether in Mergers & Acquisitions (M&A), capital markets, or asset management.

- Client Relationship Management: They are the primary point of contact for the firm's most important clients, including Fortune 500 corporations, governments, and institutional investors.

- Strategic Leadership: MDs set the strategy for their specific division or group, ensuring its goals align with the firm's broader objectives.

- P&L Responsibility: They are ultimately accountable for the profitability of their business unit.

- Team Leadership and Mentorship: They lead large teams of Vice Presidents, Associates, and Analysts, playing a crucial role in mentoring the next generation of leaders at the firm.

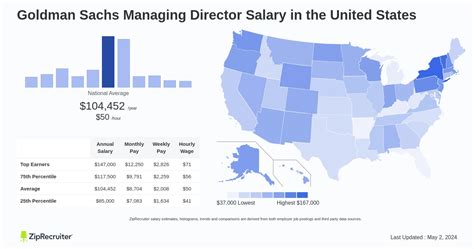

Average Managing Director Salary at Goldman Sachs

Compensation for a Managing Director at Goldman Sachs is multifaceted, consisting of a base salary and a significant variable component (the annual bonus). It is crucial to look at total compensation to understand the full earning potential.

- Average Base Salary: The base salary for a Managing Director at Goldman Sachs typically falls in the range of $450,000 to $600,000 per year. According to salary data aggregator Levels.fyi, a common base salary for this role is around $500,000.

- Variable Compensation (Bonus): The bonus is where MDs see the majority of their earnings. This component is highly variable and depends on both individual and firm-wide performance. Bonuses can range from several hundred thousand to well over a million dollars.

- Total Compensation: When combining base salary and the annual bonus, the total compensation for a Goldman Sachs MD typically ranges from $900,000 to $2,500,000 annually. Top performers in highly profitable divisions during a strong market year can potentially exceed this range. Data from Glassdoor reflects an average total pay of around $1 million, with significant additional compensation reported in the form of bonuses and stock awards.

Key Factors That Influence Salary

Not all Managing Directors earn the same. Compensation is carefully calibrated based on several critical factors.

Years of Experience

While "Managing Director" is a senior title, there is still a hierarchy of experience within the role. A newly promoted MD (often with 12-15 years of industry experience) will be at the lower end of the compensation band. A seasoned MD with a 20+ year track record and a powerful client book will command a significantly higher salary and bonus, reflecting their proven ability to generate revenue for the firm. The career path is a marathon: Analyst (2-3 years) -> Associate (3-4 years) -> Vice President (VP) (5-8 years) -> Managing Director.

Area of Specialization

The division in which an MD works is arguably the biggest determinant of their bonus potential.

- Front-Office (Revenue Generating): MDs in divisions like the Investment Banking Division (IBD), particularly in M&A, or in Sales & Trading, have the highest earning potential. Their compensation is directly tied to the fees and revenue they generate.

- Asset & Wealth Management: MDs in these roles also have high earning potential, with compensation often tied to assets under management (AUM) and performance fees.

- Support & Federation Roles: MDs in functions like Risk, Compliance, Technology, or Human Resources are vital to the firm but are not direct revenue generators. While they are still compensated exceptionally well, their total compensation is generally lower than their front-office counterparts.

Geographic Location

Where an MD is based has a significant impact on their earnings due to market size, deal flow, and cost of living.

- Top Tier (New York, London): These are the firm's largest offices and the world's primary financial centers. MDs here handle the biggest deals and manage the largest teams, leading to the highest compensation packages globally.

- Second Tier (Hong Kong, San Francisco, Singapore): These are also major financial hubs with significant deal flow, especially in technology (San Francisco) and Asian markets (Hong Kong, Singapore). Compensation is extremely competitive but may be slightly below New York levels.

- Other Major Offices (e.g., Chicago, Frankfurt, Dallas): While still offering very high compensation, salaries and bonuses in these regional hubs may be adjusted to reflect the local market and cost of living.

Level of Education

By the time a professional reaches the MD level, their performance and experience far outweigh their initial educational background. However, education plays a critical role in gaining entry and accelerating a career in investment banking. A majority of VPs and MDs at top firms hold a Master of Business Administration (MBA) from an elite, M7 business school (e.g., Harvard, Stanford, Wharton, Columbia). An MBA from a top-tier program can accelerate the path to VP and provide the network necessary to build a successful career.

Company Type

While this article focuses on Goldman Sachs (a "bulge bracket" bank), it's useful to understand how its compensation compares to other firms. An MD who leaves Goldman might go to:

- Boutique Investment Banks: These smaller, specialized firms may offer a higher percentage of deal fees, leading to immense upside in good years, but potentially lower base salaries.

- Private Equity Firms or Hedge Funds: These are the primary competitors for top talent. Compensation at successful PE firms or hedge funds can often exceed that of an investment bank, with the potential for "carry" (a share of the fund's profits) offering transformative wealth-creation opportunities.

Job Outlook

The specific role of Managing Director at Goldman Sachs is not tracked by the U.S. Bureau of Labor Statistics (BLS). However, we can look at the broader category of "Top Executives" and "Financial Managers" for an industry-level perspective.

The BLS projects that employment for Financial Managers will grow by 16% from 2022 to 2032, a rate much faster than the average for all occupations. This growth is driven by the increasing complexity of the global financial landscape and the need for expert financial leadership.

However, it is crucial to add a major caveat: this data reflects the overall industry. The number of Managing Director positions at an elite firm like Goldman Sachs is extremely limited and intensely competitive. Promotion to MD is a highly selective process, with only a small fraction of VPs making the cut each year.

Conclusion

A career path culminating in a Managing Director role at Goldman Sachs is one of the most challenging and rewarding in modern finance. It demands over a decade of intense dedication, exceptional performance, and a unique ability to build relationships and drive revenue.

For those who succeed, the rewards are commensurate with the demands:

- Exceptional Earning Potential: Total compensation consistently reaches seven figures, with top performers earning substantially more.

- Strategic Influence: MDs are at the helm of major financial decisions that shape industries and economies.

- Prestige and Recognition: The title carries immense weight and respect within the global business community.

If you are a driven, ambitious professional with a passion for finance, the journey to becoming a Managing Director is a formidable mountain to climb. But for those who reach the summit, the view—and the compensation—are unparalleled.