The title 'Managing Director at J.P. Morgan' represents the zenith of a career in finance. It’s a role synonymous with immense responsibility, strategic influence, and, of course, extraordinary financial rewards. For aspiring financiers, ambitious MBAs, and even seasoned banking professionals, reaching this level is the ultimate goal—a testament to years of dedication, unparalleled expertise, and a relentless drive to succeed. But what does that success truly look like in monetary terms? The answer is complex, multi-layered, and far more nuanced than a single number can convey.

The journey to becoming a Managing Director (MD) is a marathon, not a sprint, and the compensation reflects this cumulative effort. While total annual compensation can soar into the multi-million dollar range, it is a sophisticated package of base salary, performance-based bonuses, and long-term incentives. As a career analyst who has spent over two decades dissecting compensation structures on Wall Street, I've seen countless professionals fixate on the headline-grabbing bonus numbers. I once coached an Executive Director on the cusp of an MD promotion who was so focused on hitting a specific bonus target that he was neglecting the strategic, long-term relationship building that truly defines a successful Managing Director's value and secures their future earnings power. This article aims to pull back the curtain on the entire financial picture of a J.P. Morgan Managing Director, providing an authoritative, data-driven guide to the salary, the factors that shape it, and the rigorous path required to earn it.

This guide will provide a comprehensive roadmap, demystifying every aspect of this prestigious and demanding career.

### Table of Contents

- [What Does a Managing Director at J.P. Morgan Do?](#what-does-a-md-do)

- [Average J.P. Morgan Managing Director Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence a J.P. Morgan MD's Salary](#key-factors)

- [Job Outlook and Career Growth for Senior Finance Roles](#job-outlook)

- [How to Become a Managing Director at J.P. Morgan](#how-to-get-started)

- [Conclusion: Is the Climb to Managing Director Worth It?](#conclusion)

What Does a Managing Director at J.P. Morgan Do?

Before dissecting the compensation, it's critical to understand the immense scope of the Managing Director role. An MD is not simply a senior employee; they are a leader, a business generator, and a key steward of the firm's reputation and client relationships. While the specific focus can vary dramatically between divisions—such as Investment Banking, Sales & Trading, or Asset Management—the core responsibilities revolve around three primary functions:

1. Business Development & Client Relationship Management (Rainmaking): This is arguably the most important function of an MD. They are the primary interface with the firm's most important clients, including Fortune 500 CEOs, institutional investors, and government entities. Their job is to originate new business—sourcing M&A deals, leading underwriting mandates for IPOs, or securing massive investment portfolios. This requires a deep network, impeccable social skills, and the ability to build trust at the highest levels.

2. Strategic Execution & Transaction Oversight: While a team of Vice Presidents (VPs) and Associates will handle the granular details of financial modeling and due diligence, the MD provides high-level strategic direction. They structure the deals, lead key negotiations, solve complex problems that arise during a transaction, and are ultimately accountable for the successful outcome. Their experience and judgment are what guide the entire deal team.

3. Team Leadership & Firm Contribution: An MD is a senior leader within the firm. They are responsible for managing, mentoring, and developing the talent pipeline beneath them, from Analysts to Executive Directors (EDs). They play a crucial role in recruiting, performance reviews, and shaping the culture of their group. They also contribute to the firm's overall strategy, sitting on committees and acting as a culture carrier for J.P. Morgan's principles.

### A "Day in the Life" of a J.P. Morgan Investment Banking MD

To make this tangible, consider a hypothetical day for an MD in the Technology, Media, and Telecom (TMT) M&A group:

- 5:30 AM: Wake up, check overnight emails from Asian and European teams regarding an active cross-border deal. Read the *Wall Street Journal* and *Financial Times*, focusing on industry news relevant to key clients.

- 7:00 AM: Arrive at the office (or home office). First call of the day is with the deal team (VPs, Associates) to review a new pitch book for a potential client. The MD provides critical feedback on the strategic positioning and valuation approach.

- 9:00 AM: Lead a conference call with the CEO and CFO of a major software company to discuss their acquisition strategy for the next 12 months. The MD's role is to act as a trusted advisor, not a salesperson.

- 11:00 AM: Internal meeting with the head of the Equity Capital Markets (ECM) division to discuss the feasibility of an IPO for a different client. They strategize on timing, valuation, and market appetite.

- 12:30 PM: Business lunch with a private equity fund partner. The conversation is less about a specific deal and more about strengthening the relationship, sharing market insights, and uncovering potential future opportunities.

- 2:30 PM: Join a high-stakes negotiation session via video conference for a live M&A deal. The MD intervenes at critical junctures to resolve deadlocks on key terms, relying on experience from hundreds of past transactions.

- 4:00 PM: Conduct a one-on-one mentoring session with a newly promoted VP. They discuss career goals, provide feedback on a recent project, and offer guidance on navigating firm politics.

- 5:30 PM: Final review and approval of a commitment letter for a multi-billion dollar financing package. The MD's signature carries immense weight and liability.

- 7:00 PM: Attend a charity dinner or industry event. This is not downtime; it's a critical networking opportunity to maintain visibility and connect with current and potential clients.

- 10:00 PM: Final check of emails, responding to urgent requests before preparing for the next day.

This schedule highlights that the MD role is a blend of high-level strategy, client-facing salesmanship, and internal leadership—a demanding reality that commands a top-tier compensation package.

Average J.P. Morgan Managing Director Salary: A Deep Dive

The compensation for a Managing Director at a bulge-bracket investment bank like J.P. Morgan is one of the most widely discussed yet opaque topics in the corporate world. It is not a simple annual salary; it's a complex structure designed to reward performance, align interests with the firm, and retain top talent.

The total compensation, often referred to as "Total Comp" or "The Number," is broken down into three main components:

1. Base Salary: This is the fixed, guaranteed portion of the compensation, paid bi-weekly or monthly. It provides a stable foundation of income.

2. Cash Bonus (or "All-In Cash"): This is the highly variable, performance-based component. It is determined at the end of the fiscal year based on a combination of the individual's performance (deals won, revenue generated), the performance of their specific group or division, and the overall profitability of J.P. Morgan. This is the component that can fluctuate dramatically from year to year.

3. Deferred Compensation / Stock Awards: A significant portion of the bonus, especially at the MD level, is often paid in restricted stock units (RSUs) or other forms of deferred compensation. These assets typically vest over a period of three to five years. This practice serves two purposes: it encourages long-term thinking and loyalty to the firm, and it allows the bank to "claw back" compensation in cases of misconduct or catastrophic losses on deals.

### The Numbers: What to Expect

Citing precise, official figures is impossible as these are private compensation details. However, by aggregating data from reputable sources like Glassdoor, Salary.com, Levels.fyi, and industry reports from firms like Johnson Associates, we can build a highly accurate picture.

- Base Salary: For a Managing Director at J.P. Morgan in a major financial hub like New York City, the base salary typically falls in the range of $400,000 to $600,000 per year. According to recent data from Glassdoor, the "most likely range" for a JPM MD base salary is centered around $480,000. This figure has been creeping upwards in recent years as banks compete for talent.

- Performance Bonus: This is where the numbers become truly significant and highly variable. The bonus is often expressed as a multiple of the base salary. For a typical year and a solid performer, the cash and deferred bonus can range from 1.0x to 3.0x the base salary.

- Low End (Challenging Year / Lower Performing Group): $300,000 - $500,000

- Mid-Range (Average Year / Solid Performer): $600,000 - $1,200,000

- High End (Strong Year / Top Performer in a Hot Sector): $1,500,000 - $3,000,000+

- Total Compensation: Combining these components, the typical annual compensation for a J.P. Morgan Managing Director lands in the $800,000 to $3,500,000 range. Outliers exist on both ends. A first-year MD in a slower division might be closer to the bottom of this range, while a veteran MD in a top-tier M&A group who has had an exceptionally successful year could easily surpass $5 million or more. Data from Levels.fyi corroborates this, with user-submitted profiles for JPM MDs frequently showing total compensation packages well over $1 million.

### The Career Compensation Trajectory

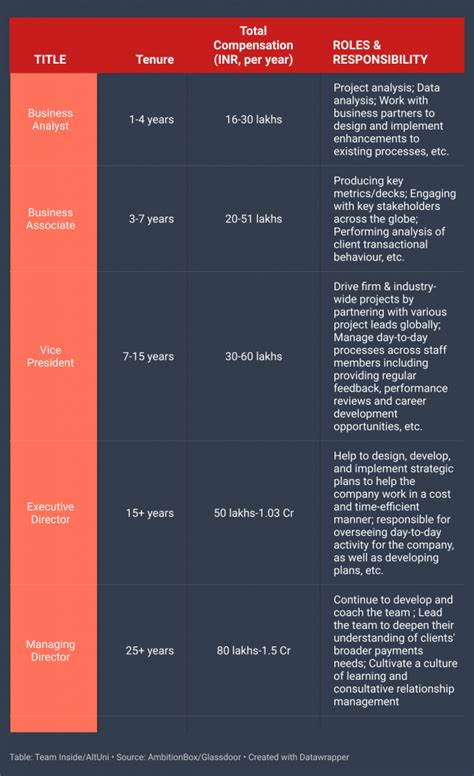

The MD salary is the culmination of a long and financially rewarding career path. To put it in context, here is a typical compensation progression at a bulge-bracket bank like J.P. Morgan.

| Title | Years of Experience | Typical Base Salary Range | Typical Total Compensation Range |

| :--- | :--- | :--- | :--- |

| Investment Banking Analyst | 0-3 years | $100,000 - $125,000 | $175,000 - $250,000 |

| Investment Banking Associate | 3-6 years (Post-MBA) | $175,000 - $225,000 | $300,000 - $500,000 |

| Vice President (VP) | 6-10 years | $250,000 - $300,000 | $450,000 - $800,000 |

| Executive Director (ED) / Director | 10-14 years | $300,000 - $400,000 | $600,000 - $1,200,000 |

| Managing Director (MD) | 14+ years | $400,000 - $600,000 | $800,000 - $3,500,000+ |

*Source: Analysis based on aggregated data from Glassdoor, Levels.fyi, Wall Street Oasis, and industry reports (2022-2024).*

This table clearly illustrates the exponential growth in compensation, with the most significant leaps occurring at the VP and MD levels, where the role shifts from execution to business generation and the bonus component becomes the dominant part of the pay package.

Key Factors That Influence a J.P. Morgan MD's Salary

While the ranges above provide a solid benchmark, the exact compensation an individual MD receives is determined by a confluence of factors. Understanding these variables is key to understanding the Wall Street compensation game. This is the most critical section for anyone aspiring to maximize their earnings potential in this field.

### ### Level of Education

At the Managing Director level, your undergraduate institution has long faded in importance. The key educational credential that significantly impacts both the path and the initial compensation at the mid-levels is a Master of Business Administration (MBA).

- Top-Tier MBA (M7/T15 Schools): Graduating from an elite MBA program like Harvard Business School, Stanford GSB, Wharton, Booth, or Columbia is the most traditional and reliable accelerator to the senior ranks of investment banking. Banks like J.P. Morgan heavily recruit from these schools for their Associate classes. An MBA from a top program not only provides the necessary finance and strategy toolkit but also grants access to a powerful alumni network, which is invaluable for client sourcing later in one's career. While it doesn't directly set the MD's salary 15 years later, it is often a prerequisite for the path that leads to the highest-paying MD roles.

- Other Advanced Degrees (JD, PhD): A Juris Doctor (JD) can be particularly valuable for MDs specializing in restructuring or activism defense. A PhD in a technical field might be an advantage for an MD covering the life sciences or deep tech sectors. These are less common paths but can provide a unique edge.

- Certifications (CFA): The Chartered Financial Analyst (CFA) designation is highly respected but is more of a differentiator at the junior and mid-levels (Analyst to VP). By the time someone makes MD, their deal sheet and client list are far more important than any certification. However, the rigor and deep knowledge required to earn a CFA charter are often seen as indicators of a strong work ethic and technical proficiency early in one's career.

### ### Years of Experience & Seniority

This is arguably the most significant factor. "Experience" in this context is not just about time served; it's about the quality and depth of that experience.

- First-Year MD vs. Veteran MD: There is a substantial pay gap between a newly promoted MD and a 10-year veteran MD who is a recognized leader in their industry group. A new MD (often called a "baby MD") might earn at the lower end of the total compensation spectrum ($800k - $1.2M). Their initial years are a trial period where they must prove they can originate business independently.

- Veteran / Group Head MD: A seasoned MD who has a proven, multi-year track record of generating significant revenue, who holds key client relationships that are "sticky" to them personally, and who may lead a specific industry or product group, will command the highest compensation packages. These are the individuals who consistently pull in multi-million dollar paydays. Their value to the firm is undeniable, and J.P. Morgan will pay a premium to retain them and prevent them from being poached by competitors. The compensation growth trajectory doesn't stop at promotion; it continues as the MD builds their franchise.

### ### Geographic Location

Investment banking is a global business, but compensation is not uniform across the globe. The major financial centers command the highest salaries, driven by competition for talent and a higher concentration of deal flow.

- New York City: As the undisputed capital of global finance, New York sets the benchmark for compensation. The figures discussed in this article are primarily based on the NYC market. The density of clients, competitors, and capital makes it the most lucrative place to be a senior banker.

- London: London is the primary financial hub for Europe. MD salaries there are very competitive with New York, but there can be differences due to currency fluctuations, tax structures, and regulatory bonus caps imposed by the European Union (which the UK has moved away from post-Brexit, but whose influence remains). Historically, London compensation might trail New York by 5-15%, particularly in the bonus component.

- Hong Kong & Singapore: These are the key hubs for Asia. Compensation here is also very high, driven by the massive growth and deal flow in the region. Salaries can be on par with or even exceed London's, especially in years where the Asian markets are particularly active. Tax advantages in these locations can also significantly increase take-home pay compared to NYC or London.

- Other U.S. Cities (Chicago, San Francisco, Houston): J.P. Morgan has significant offices in other domestic hubs. San Francisco is a top-paying location, especially for MDs in the TMT group, with compensation rivaling New York's. Houston is a critical hub for Energy banking and pays its top producers exceptionally well. Chicago, as a more diversified financial center, has strong compensation but may slightly trail the coastal hubs.

### ### Division & Area of Specialization

This is a critically important, yet often misunderstood, factor. Not all MDs at J.P. Morgan are created equal in terms of compensation. The division you work in, and your specialization within it, has a massive impact on your earnings potential.

- Investment Banking Division (IBD): This is the classic, high-profile division focused on M&A advisory and capital raising (IPOs, debt offerings). IBD typically offers the highest potential compensation. An MD's bonus is directly tied to the "fee credits" they generate from deals they originate and close.

- M&A: Generally seen as the most prestigious and lucrative group. Leading multi-billion dollar takeovers generates enormous fees for the bank.

- Leveraged Finance (LevFin): Another highly profitable area, specializing in financing for private equity buyouts.

- Industry Groups (TMT, Healthcare, FIG): Within IBD, certain industry groups can be "hotter" than others. In a tech boom, TMT MDs will do exceptionally well. During the COVID-19 pandemic, Healthcare MDs were incredibly busy. Your pay is tied to the deal flow in your specific sector.

- Sales & Trading (S&T): Compensation in S&T is more directly tied to the Profit and Loss (P&L) of the MD's trading desk. This can lead to incredible upside in a good year but also significantly more volatility. A trader who has a blowout year could potentially earn more than an IBD MD, but a trader who has a flat or losing year will see their bonus shrink dramatically or disappear entirely. An MD on a high-volume Equity Derivatives desk will have a different pay structure than one on a sovereign debt trading desk.

- Asset & Wealth Management (AWM): MDs in this division manage money for institutions and high-net-worth individuals. Compensation is generally more stable than in IBD or S&T. It is often tied to the growth of Assets Under Management (AUM) and performance fees. While the absolute ceiling might be lower than for a top M&A banker, the year-to-year volatility is also lower, providing a more predictable income stream.

- Commercial & Corporate Banking: These MDs manage lending and treasury relationships with large and mid-sized corporations. This is a crucial and profitable part of J.P. Morgan's business, but the compensation structure has a lower ceiling than the investment bank. Bonuses are more modest and less volatile, reflecting the relationship-based, annuity-like nature of the revenue.

### ### In-Demand Skills & Performance Metrics

Ultimately, an MD's salary is a reflection of the value they bring to the firm. This value is measured by a combination of quantitative metrics and qualitative skills.

- Rainmaking & Business Origination: This is the #1 skill. Can you bring in new, profitable business? An MD who can originate a $50 million fee deal is exponentially more valuable than one who is merely a good manager of existing accounts.

- Client Relationship "Stickiness": Do clients call you first? Is their loyalty to you personally, or just to the J.P. Morgan brand? MDs who "own" deep, trusted relationships are indispensable.

- Negotiation & Deal-Closing Ability: The ability to navigate complex, high-pressure negotiations and bring a deal across the finish line is a core skill that directly translates to revenue.

- Leadership and Mentorship: While harder to quantify, the ability to build and lead a high-performing team is a key consideration in an MD's evaluation. A great leader who develops future VPs and MDs is a massive asset to the firm's long-term health.

- P&L and Revenue Credits: For every deal, the bank tracks which bankers were responsible for originating and executing it. An MD's annual "revenue credit" or "P&L" is the most important quantitative metric in their bonus determination.

Job Outlook and Career Growth for Senior Finance Roles

While the title "Managing Director" is specific to finance, it falls under the broader category of "Top Executives" and "Financial Managers" as classified by the U.S. Bureau of Labor Statistics (BLS). This data provides a valuable macro-level perspective on the career landscape.

According to the BLS's Occupational Outlook Handbook, employment for Financial Managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this strong growth to the increasing complexity of the global financial environment, the need for expert financial analysis, and a growing demand for services like cash management and risk management. Approximately 52,500 openings for financial managers are projected each year, on average, over the decade.

For the broader category of Top Executives, the BLS projects a growth rate of 3 percent over the same period, which is about average. While the competition for these top-tier roles is incredibly fierce, the underlying demand for skilled senior leadership remains stable.

### What This Means for Aspiring J.P. Morgan MDs

The BLS data paints an optimistic picture for finance professionals in general. However, the path to an MD role at a bulge-bracket firm like J.P. Morgan is a highly competitive tournament, not a steady-growth profession. There are far more Analysts than there are MD positions available. This creates a powerful "up or out" culture, where professionals are either promoted to the next level within a certain timeframe or are encouraged to seek opportunities elsewhere.

### Emerging Trends and Future Challenges

The role of a Managing Director is not static. A successful MD in 2030 will need to master skills and navigate trends that were nascent a decade earlier. Aspiring professionals should pay close attention to:

- Technological Disruption (AI & Data Science): Artificial intelligence is beginning to automate aspects of financial modeling and due diligence. The MD of the future will need to be data-literate, understanding how to leverage technology to gain insights and serve clients more effectively. Their value will shift even further toward strategic advice, creative deal-making, and relationship management—areas machines cannot easily replicate.

- ESG (Environmental, Social, and Governance) Integration: ESG is no longer a niche concern; it is a core part of corporate strategy and investor demands. MDs must be fluent in the language of sustainable finance, able to advise clients on ESG-related risks and opportunities, and structure green bonds or sustainability-linked loans. This is a major growth area.

- The Regulatory Environment: The financial industry remains under intense regulatory scrutiny. MDs must have a sophisticated understanding of compliance and navigate a complex web of rules that vary by jurisdiction. This is particularly true in areas like cross-border M&A and financial products.

- Globalization and Geopolitical Risk: As business becomes more global, so do the risks. An MD advising on a deal involving China, for instance, must be an expert not just on finance but also on geopolitics, trade policy, and international relations.

- The Future of Work: The shift towards hybrid work models presents new challenges for leadership. An MD must be able to lead, mentor, and foster a strong team culture in an environment that is no longer 100% face-to-face.

To stay relevant and continue to advance, senior finance professionals must be committed to lifelong learning. This means actively seeking to understand new technologies, staying abreast of regulatory changes, building expertise in growth areas like ESG, and continuously honing the timeless skills of leadership and client service.

How to Become a Managing Director at J.P. Morgan

The path to becoming a Managing Director at a firm like J.P. Morgan is exceptionally demanding and structured. While there are occasional outliers, the vast majority of MDs follow a well-trodden path that requires