Introduction

You're an ambitious professional. You’ve built a solid career in a field like human resources, healthcare, finance, or technology, but you feel a ceiling approaching. You see complex challenges on the horizon—new regulations, intricate contracts, and ever-present compliance risks—and you want to be the one who can navigate them, not just react to them. You've heard about the Master of Legal Studies (MLS) degree and wonder: Is this the key to unlocking the next level of my career? What is the real return on investment? What can I expect for a Master of Legal studies salary?

This guide is designed to answer those questions definitively. An MLS degree is a powerful, strategic tool for non-lawyers who want to gain a sophisticated understanding of the law as it applies to their industry. It positions you as a unique and invaluable asset, a bridge between your organization's operational goals and its legal obligations. While salary potential is a major driver, the true value lies in becoming an indispensable strategic leader. For professionals in this niche, salaries often range from $80,000 to well over $160,000, contingent on the specific role, industry, and experience you bring to the table.

As a career analyst, I once coached a mid-career HR manager who felt stuck. She was excellent at her job but was consistently passed over for senior compliance roles in favor of candidates with legal backgrounds. After extensive discussion, she pursued an MLS with a specialization in employment law. Two years later, she not only secured a Director of Compliance position at a major tech firm, but her starting salary was nearly 50% higher than her previous role. Her story isn't just about money; it’s about transforming her professional identity from a functional manager to a strategic risk mitigator, a journey this guide will help you navigate.

This article will serve as your comprehensive roadmap. We will dissect salary expectations, explore the factors that dramatically influence your earning potential, and provide a step-by-step plan for launching or advancing your career with a Master of Legal Studies.

### Table of Contents

- [What Do Professionals with a Master of Legal Studies Actually Do?](#what-do-professionals-with-a-master-of-legal-studies-actually-do)

- [Average Master of Legal Studies Salary: A Deep Dive](#average-master-of-legal-studies-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth for MLS Graduates](#job-outlook-and-career-growth-for-mls-graduates)

- [How to Get Started on Your MLS Career Path](#how-to-get-started-on-your-mls-career-path)

- [Conclusion: Is a Master of Legal Studies Worth It?](#conclusion-is-a-master-of-legal-studies-worth-it)

What Do Professionals with a Master of Legal Studies Actually Do?

Before we talk numbers, it's crucial to understand what a career with an MLS degree looks like. A common misconception is that this is a "lawyer-lite" degree. This couldn't be further from the truth. An MLS (also known as a Master of Studies in Law or Juris Master) is specifically designed for professionals who do not intend to practice law or sit for the bar exam.

Instead, MLS graduates become industry experts with a profound fluency in the language and frameworks of the law. They are the essential translators and strategic advisors who work at the intersection of business operations and legal or regulatory constraints. They don't represent clients in court; they ensure their organization never has to go to court in the first place.

Their core responsibility is to proactively identify, assess, and mitigate legal and regulatory risks within their specific domain. They are the go-to experts for questions like:

- "Does this new marketing campaign comply with consumer protection laws?"

- "How do we implement the new HIPAA data privacy rule across our patient care network?"

- "Is our hiring process vulnerable to discrimination claims under Title VII?"

- "What are the intellectual property risks of this new software development partnership?"

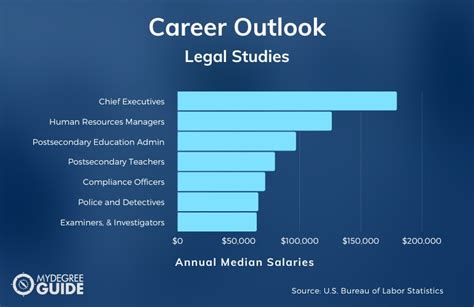

Common Job Titles for MLS Graduates Include:

- Compliance Manager/Officer: Ensures the company adheres to all industry-specific laws and government regulations. This is one of the most common and lucrative paths.

- Contract Administrator/Manager: Drafts, negotiates, and manages the lifecycle of business contracts, from vendor agreements to client partnerships.

- Risk Manager/Analyst: Identifies potential operational, financial, or legal risks and develops strategies to minimize their impact.

- Human Resources Manager (with a focus on Labor & Employment Law): Manages complex employee relations issues, ensures fair labor practices, and develops legally sound HR policies.

- Healthcare Administrator (with a focus on Regulatory Affairs): Navigates the incredibly complex web of healthcare laws (e.g., HIPAA, Stark Law, Anti-Kickback Statute).

- Policy Analyst: Works for government agencies, think tanks, or corporations to research, analyze, and advise on the impact of public policy and legislation.

- Intellectual Property (IP) Manager: Helps technology or creative companies manage their portfolio of patents, trademarks, and copyrights.

### A Day in the Life: A Healthcare Compliance Manager with an MLS

To make this tangible, let's imagine a day for "Alex," a Compliance Manager at a large regional hospital who holds an MLS degree.

- 9:00 AM - 9:45 AM: Alex starts the day by reviewing a daily digest of regulatory updates from federal (HHS, CMS) and state agencies. A new advisory opinion on patient data sharing has been released. Alex flags it for deeper analysis and schedules a meeting with the IT security lead.

- 10:00 AM - 11:30 AM: Alex leads a training session for a newly hired group of nurses and administrative staff on HIPAA best practices and patient privacy protocols. The MLS degree provided the expertise to not only explain the law but also translate it into practical, on-the-ground procedures.

- 11:30 AM - 1:00 PM: Alex investigates a potential compliance issue reported through the hospital's anonymous hotline. It involves a potential conflict of interest with a third-party vendor. This requires discreet fact-finding, reviewing contracts, and documenting every step of the investigation.

- 1:00 PM - 2:00 PM: Lunch meeting with the hospital's in-house legal counsel (who holds a JD). They discuss the findings of Alex's investigation. Alex provides the operational context and compliance analysis; the lawyer provides the formal legal opinion. They are peers with distinct but complementary expertise.

- 2:00 PM - 4:00 PM: Alex works on drafting a new policy for the use of personal devices to access patient records, prompted by the morning's regulatory update. This involves collaborating with the IT, clinical, and administrative departments to create a policy that is both compliant and operationally feasible.

- 4:00 PM - 5:00 PM: Alex prepares a quarterly compliance report for the hospital's executive board, using data and analytics to demonstrate trends, highlight areas of risk, and showcase the success of recent training initiatives.

This "day in the life" illustrates the MLS professional's role perfectly: proactive, analytical, collaborative, and deeply embedded in the organization's operational fabric.

Average Master of Legal Studies Salary: A Deep Dive

Now, let's get to the core of the query: the salary. It's essential to reiterate that there isn't one single "Master of Legal Studies salary." Your salary is determined by the *job you perform* with the degree. The MLS is a powerful enhancer that unlocks access to higher-paying roles and provides a significant salary premium over candidates without this specialized legal knowledge.

National Averages and Salary Ranges

According to data from leading salary aggregators, professionals holding an MLS degree see a significant boost in earning potential.

- Payscale.com reports the average salary for a professional with a Master of Legal Studies (MLS) degree is approximately $82,000 per year as of late 2023. However, this is just an average and the range is wide, from around $55,000 for entry-level roles to over $146,000 for experienced directors.

- Salary.com provides salary data for specific roles often held by MLS graduates. For example, a mid-career Compliance Manager in the United States typically earns between $103,978 and $141,475, with a median salary of $121,791 as of November 2023. A Contract Manager earns a median salary of $129,566.

- Glassdoor corroborates these figures, showing an average base pay for a Compliance Officer at $84,213 per year, with total pay (including bonuses) often exceeding $100,000. Senior roles like "Director of Compliance" frequently command salaries in the $150,000 to $200,000 range.

The overarching takeaway is that a mid-career professional can realistically expect a salary in the $90,000 to $130,000 range, with a clear path to $150,000+ with experience and specialization.

### Salary by Experience Level

Your salary as an MLS graduate will grow substantially as you accumulate relevant professional experience. The degree is most powerful when combined with a proven track record in your industry.

| Experience Level | Typical Salary Range (Annual) | Common Roles Held |

| :--- | :--- | :--- |

| Early Career (0-3 years post-MLS) | $65,000 - $90,000 | Compliance Analyst, Contract Administrator, HR Generalist (with compliance focus), Policy Analyst |

| Mid-Career (4-9 years post-MLS) | $90,000 - $135,000 | Compliance Manager, Contract Manager, Senior Risk Analyst, HR Business Partner, Healthcare Administrator |

| Senior/Executive Level (10+ years)| $135,000 - $185,000+ | Director of Compliance, Director of Risk Management, Chief Compliance Officer (CCO), VP of HR |

*Source: Synthesized data from Payscale, Salary.com, and BLS reports for related professions, updated for late 2023. Ranges are indicative and vary based on the factors discussed in the next section.*

### Beyond the Base Salary: Understanding Total Compensation

Your base salary is only one piece of the puzzle. For many roles accessible to MLS graduates, especially in the corporate sector, total compensation is a much more important metric.

- Annual Bonuses: These are extremely common in compliance, finance, and risk management roles. Bonuses are typically tied to individual and company performance and can range from 10% to 30% or more of your base salary. A Compliance Manager with a $120,000 base salary might easily earn an additional $15,000 - $25,000 bonus in a good year.

- Profit Sharing: Some companies, particularly in the financial services or consulting sectors, offer profit-sharing plans where a portion of the company's profits is distributed to employees.

- Stock Options/Restricted Stock Units (RSUs): In publicly traded companies, especially in the tech sector, equity is a significant part of compensation. This gives you a stake in the company's long-term success and can be incredibly lucrative.

- Comprehensive Benefits: Don't underestimate the value of a top-tier benefits package. This includes high-quality health, dental, and vision insurance; a generous 401(k) or 403(b) matching program; paid time off; and parental leave. Government roles are particularly well-known for their excellent and stable benefits.

- Tuition Reimbursement & Professional Development: Many large organizations that value the skills an MLS provides will offer tuition reimbursement to help you earn the degree. They also typically budget for ongoing professional development, including funding for certifications and conference attendance.

When evaluating a job offer, always calculate the total compensation package. A role with a slightly lower base salary but a massive bonus potential and excellent benefits might be far more valuable than one with a higher base salary alone.

Key Factors That Influence Your Salary

A national average provides a useful benchmark, but your personal salary will be determined by a specific set of variables. Understanding these factors is the key to maximizing your earning potential with a Master of Legal Studies degree. This is the most critical section for anyone looking to strategically plan their career and salary growth.

### ### 1. Area of Specialization and Industry

This is arguably the most significant factor. The industry you work in and your area of legal specialization directly correlate with your salary. An MLS is not a one-size-fits-all degree; its value is magnified in highly regulated, high-stakes industries.

- Financial Services and Fintech (Highest Earning Potential): This is the top tier for compensation. Professionals who understand the intricate rules set by the SEC, FINRA, the CFPB, and anti-money laundering (AML) regulations are in constant demand. A Senior Compliance Manager in a New York-based investment bank or a fintech startup can easily command a salary of $150,000 - $220,000+ plus substantial bonuses.

- Healthcare and Pharmaceuticals: With a labyrinth of laws like HIPAA, the HITECH Act, the Anti-Kickback Statute, and FDA regulations, healthcare is another high-paying sector. Healthcare Administrators and Compliance Directors with a legal studies background are critical. Salaries for experienced managers often fall in the $120,000 - $170,000 range.

- Technology (Cybersecurity & Data Privacy): This is the fastest-growing specialization. As companies grapple with regulations like GDPR in Europe and the CCPA/CPRA in California, professionals who can bridge the gap between technology and privacy law are gold. An MLS combined with a tech background can lead to roles like Privacy Program Manager or Cybersecurity Policy Advisor, with salaries often reaching $130,000 - $180,000.

- Energy and Environmental Law: Companies in the energy sector face intense scrutiny regarding environmental regulations (EPA rules, ESG reporting). An MLS in environmental law can lead to a lucrative career in EHS (Environment, Health, and Safety) compliance, with senior roles paying $110,000 - $160,000.

- Human Resources and Employment Law: While perhaps not as high-paying as finance, this is a very stable and essential field. HR Managers with deep knowledge of Title VII, ADA, FMLA, and state-specific labor laws are highly valued. Senior HR Business Partners or Directors in large companies can earn $115,000 - $155,000.

- Government, Non-Profit, and Academia (Lower Earning Potential): These sectors offer immense personal satisfaction and excellent benefits, but typically come with lower base salaries. A Policy Analyst for a federal agency might start on the GS-9 or GS-11 scale (around $60,000 - $90,000 depending on location), while a university compliance officer might earn $80,000 - $110,000.

### ### 2. Geographic Location

Where you work matters immensely. Salaries are adjusted for the cost of labor and cost of living, which vary dramatically across the United States. Major metropolitan areas with a high concentration of corporate headquarters, particularly in finance, tech, and healthcare, will always offer the highest salaries.

Comparison of Median Salary for a "Compliance Manager" Role by City:

| City | Median Base Salary | Typical Salary Range | Reason for Variation |

| :--- | :--- | :--- | :--- |

| New York, NY | $145,500 | $124,200 - $169,300 | Epicenter of global finance and corporate headquarters. |

| San Francisco, CA | $151,800 | $129,500 - $175,900 | Hub of the technology industry and venture capital. |

| Boston, MA | $138,200 | $117,900 - $160,200 | Strong biotech, pharmaceutical, and financial services sectors. |

| Washington, D.C. | $134,700 | $114,900 - $156,100 | Center for government, lobbying, and federal contractors. |

| Chicago, IL | $127,600 | $108,800 - $147,900 | Major hub for diverse industries including finance and healthcare. |

| Houston, TX | $124,300 | $106,000 - $144,100 | Core of the energy industry. |

| A Smaller Midwestern City (e.g., Indianapolis, IN) | $115,900 | $98,800 - $134,300 | Lower cost of living results in lower, but still competitive, salaries. |

*Source: Salary.com, data accessed November 2023. These figures are for a mid-career manager and would scale up or down based on experience.*

The lesson is clear: if maximizing salary is your primary goal, targeting major coastal or industry-specific hubs is the most effective strategy.

### ### 3. Years of Experience and Career Progression

As detailed in the previous section, experience is a primary driver of salary growth. However, it's not just about the number of years, but the *quality* and *progression* of that experience.

- Individual Contributor (0-4 years): As an Analyst or Administrator, your focus is on execution. You research regulations, review documents, and run reports. Your salary grows as you become more efficient and knowledgeable.

- Manager (5-10 years): As a Manager, your focus shifts to oversight and program management. You manage a small team, develop policies, and are responsible for a specific compliance program (e.g., Anti-Bribery). This is where you see a significant salary jump. An MLS degree is often the credential that facilitates this leap from individual contributor to manager.

- Director/Senior Leadership (10+ years): At this level, you are a strategic leader. You are not just managing compliance; you are advising the C-suite on risk strategy. You interface with the board, manage large teams, and set the entire compliance and ethics tone for the organization. This is where salaries can climb well into the high $100s and even exceed $200,000, especially in high-paying industries.

### ### 4. Company Type and Size

The type and size of your employer create different compensation structures and opportunities.

- Large Public Corporations (Fortune 500): These companies typically offer the most structured and predictable career paths. They provide high base salaries, solid annual bonuses, and excellent benefits. A Director of Compliance at a Fortune 100 company is a highly compensated and respected position.

- Tech Startups and High-Growth Companies: The compensation model here is different. The base salary might be slightly lower than at a massive corporation, but the potential for wealth creation through stock options or equity can be enormous if the company is successful. These roles are often higher-risk, higher-reward.

- Government Agencies (Federal, State, Local): Government roles offer unparalleled job security, predictable hours, and fantastic benefits, including pensions in some cases. Salaries are determined by transparent pay scales (like the federal GS scale). While the top-end salary may not match the private sector, the total lifelong value of the benefits can be immense.

- Non-Profits and Universities: These organizations are mission-driven. Salaries are almost always lower than in the for-profit sector. However, they often offer a better work-life balance, a collaborative atmosphere, and strong benefits, making them an attractive option for many professionals.

### ### 5. In-Demand Skills and Certifications

Beyond your degree, specific skills and professional certifications can add a quantifiable premium to your salary. Possessing these signals to employers that you have specialized, validated expertise.

High-Value Skills:

- Regulatory Interpretation and Analysis: The core ability to read dense legal and regulatory text and translate it into actionable business guidance.

- Risk Management Frameworks: Knowledge of frameworks like COSO for identifying, assessing, and mitigating enterprise risk.

- Contract Drafting and Negotiation: A highly sought-after skill that directly impacts the company's bottom line and risk exposure.

- Data Analysis and Reporting: The ability to use data to monitor compliance, identify trends, and create compelling reports for leadership is becoming increasingly critical.

- Project Management: Leading compliance initiatives, policy rollouts, or internal investigations requires strong project management discipline.

Salary-Boosting Certifications:

- Certified Compliance & Ethics Professional (CCEP): Offered by the Society of Corporate Compliance and Ethics (SCCE), this is the gold standard certification for general compliance professionals.

- Certified in Healthcare Compliance (CHC): Offered by the Health Care Compliance Association (HCCA), this is essential for anyone serious about a career in healthcare compliance.

- Certified Information Privacy Professional (CIPP): Offered by the IAPP, this is the leading certification for data privacy professionals and is in