In the high-stakes world of global markets, where fortunes are made and lost in the blink of an eye, the guiding hand of a skilled finance professional is indispensable. For those with a quantitative mindset, a passion for strategy, and an ambition to drive economic growth, a career in finance is not just a job—it's a calling. The question that often follows this ambition is a practical yet crucial one: What is the return on investment for an advanced education in this field? Specifically, what does a master's degree in finance salary and career trajectory truly look like?

The answer is compelling. Professionals equipped with a Master's in Finance (MSF) or a related graduate degree often command starting salaries that eclipse those of many other fields, with the potential to reach well into the six-figure, and even seven-figure, range over the course of their careers. This path is not merely about crunching numbers; it's about becoming a strategic architect of financial futures—for corporations, for investors, and for your own professional life. Early in my career as a professional development analyst, I mentored a young graduate who was hesitant about the cost and effort of pursuing an MSF. A few years later, after he had taken the leap, he called me to discuss a complex M&A deal he was helping to structure, his voice buzzing with an excitement and confidence that had been absent before. That transformation, from a capable analyst into a strategic leader, is the true promise of a master's-level finance education.

This comprehensive guide is designed to be your definitive resource, a roadmap that navigates the intricate landscape of finance careers. We will dissect salary expectations, explore the myriad factors that influence your earning potential, and provide a step-by-step plan to launch your own successful journey.

### Table of Contents

- [What Does a Finance Professional with a Master's Degree Do?](#what-does-a-finance-professional-do)

- [Average Master's Degree in Finance Salary: A Deep Dive](#average-salary-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth in Finance](#job-outlook-and-career-growth)

- [How to Get Started on Your Finance Career Path](#how-to-get-started)

- [Conclusion: Is a Master's in Finance Your Path to Success?](#conclusion)

What Does a Finance Professional with a Master's Degree Do?

Holding a master's degree in finance positions you as a specialist, an expert trained to navigate the complex currents of capital, risk, and investment. While the title might be "Financial Analyst," "Investment Banker," or "Portfolio Manager," the core function remains the same: to use quantitative and qualitative analysis to allocate financial resources effectively and maximize value. This is a far cry from simple bookkeeping; it's about forward-looking strategy and decision-making under uncertainty.

The responsibilities are diverse and intellectually stimulating. A graduate-level finance professional is expected to perform sophisticated tasks that drive an organization's financial health and strategic direction.

Core Responsibilities and Daily Tasks:

- Financial Modeling: This is the bedrock of modern finance. Professionals build complex spreadsheets and use software to forecast future revenues, expenses, and profits. These models are used to evaluate potential investments, plan corporate budgets, and assess the financial impact of strategic decisions, such as a new product launch or a merger.

- Valuation Analysis: Determining the "worth" of an asset is a central task. This could involve valuing an entire company for a merger or acquisition (M&A), pricing a new stock for an Initial Public Offering (IPO), or assessing a real estate investment. Techniques like Discounted Cash Flow (DCF), comparable company analysis, and precedent transaction analysis are standard tools.

- Investment Analysis & Portfolio Management: For those in asset management or investment banking, the goal is to grow capital. This involves researching stocks, bonds, and other securities; analyzing market trends; and constructing and managing portfolios to meet specific risk and return objectives for clients.

- Risk Management: Identifying, measuring, and mitigating financial risks is critical. This could involve using derivatives (like options and futures) to hedge against currency fluctuations, analyzing credit risk for a loan portfolio, or ensuring the company is compliant with financial regulations.

- Capital Budgeting & Corporate Finance: Within a corporation, finance professionals advise on how to raise and spend capital. They analyze which projects should receive funding, determine the best mix of debt and equity financing, and manage the company's cash flow to ensure operational stability.

### A Day in the Life: "Maya, a Corporate Finance Manager"

To make this tangible, let's follow a day in the life of Maya, a Corporate Finance Manager at a large technology firm who holds an MSF.

- 8:00 AM: Maya starts her day not with coffee, but with data. She scans the morning's financial news on her Bloomberg Terminal, checking for market movements, competitor earnings announcements, and any macroeconomic news that could impact her company's stock price or supply chain.

- 9:00 AM: She joins a video call with the product development team. They are proposing a new multi-million dollar R&D project. Maya’s role is to act as the financial gatekeeper. She listens intently, asking pointed questions about expected costs, potential market size, and the timeline for revenue generation.

- 10:30 AM: Back at her desk, Maya opens the financial model she's been building for the R&D project. She plugs in the new assumptions from the meeting, running various scenarios. What if sales are 15% lower than projected? What if interest rates rise? Her analysis will produce key metrics like Net Present Value (NPV) and Internal Rate of Return (IRR), which she will present to the CFO.

- 1:00 PM: After a quick lunch, Maya pivots to the quarterly earnings report. She works with the accounting team to analyze the financial statements, drafting the narrative for the investor relations press release. Her job is to translate the raw numbers into a compelling story about the company's performance and future outlook.

- 3:00 PM: Maya meets with a junior financial analyst she is mentoring. They review his valuation model for a potential small acquisition target. She provides feedback, correcting a flawed assumption in his growth rate projection and teaching him a more sophisticated way to calculate the weighted average cost of capital (WACC).

- 4:30 PM: She spends the last part of her day preparing her presentation for the executive committee meeting tomorrow. She distills her complex R&D project analysis into a clear, concise recommendation, supported by data visualizations and a summary of key risks and opportunities. Her goal is to enable the C-suite to make a confident, data-driven decision.

This snapshot reveals that a finance role is not just about solitary number-crunching. It's a dynamic, collaborative, and highly strategic function that sits at the very heart of business operations.

Average Master's Degree in Finance Salary: A Deep Dive

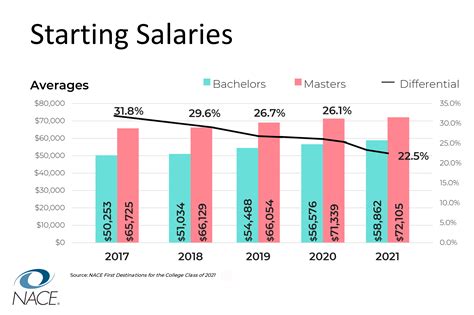

The primary driver for many pursuing an advanced finance degree is the significant earning potential. A master's degree in finance salary is not a single number but a spectrum, heavily influenced by role, experience, and location. However, the data consistently shows a substantial premium for those holding a graduate-level qualification.

Let's break down the compensation landscape, drawing from leading salary aggregators and industry data.

National Averages and Typical Ranges

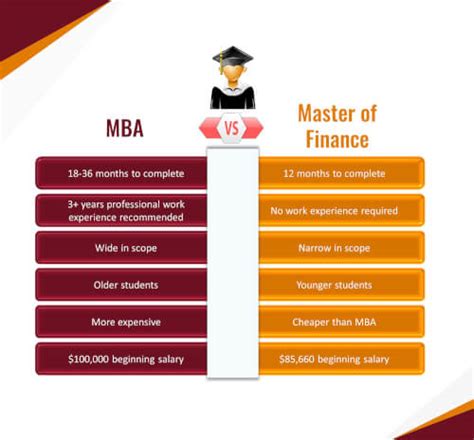

While an MBA has historically been the go-to graduate business degree, the specialized Master's in Finance (MSF) has gained immense traction for those certain of a career in finance. It's often a one-year program, making the opportunity cost lower and the ROI faster.

- According to Payscale, the average base salary for a professional with a Master of Science (MS) in Finance is approximately $92,000 per year as of late 2023.

- Salary.com provides a more granular look, showing that a Financial Analyst with a master's degree or MBA can expect a salary range that typically falls between $78,000 and $145,000, depending on a host of factors we'll explore later.

- Glassdoor reports an average base pay for "Master in Finance" graduates in the United States to be around $101,000 per year, with a likely range between $75,000 and $136,000.

It is critical to understand that these figures represent *base salary*. In the world of finance, total compensation is a much more important metric.

Deconstructing Total Compensation: Base vs. Bonus

In few other professions is the bonus culture as prominent as it is in finance, particularly in high-finance roles like investment banking, private equity, and hedge funds.

- Base Salary: This is your guaranteed, fixed annual income. It provides stability and is the foundation of your compensation package. For early-career corporate finance roles, this will make up the bulk of your pay.

- Performance Bonus: This is a variable, annual payment tied to both your individual performance and the firm's profitability. In a good year, a bonus can be substantial. For a first-year analyst at an investment bank, the bonus can often be 50% to 100% of their base salary. For senior-level professionals in revenue-generating roles, bonuses can be multiples of their base salary, sometimes reaching into the millions.

- Profit Sharing & Stock Options: Some companies, especially publicly traded ones or mature startups, offer profit sharing or equity (stock options or Restricted Stock Units - RSUs). This aligns your financial interests with the long-term success of the company and can be an extremely lucrative component of compensation over time.

- Signing Bonus: Highly sought-after graduates, especially those entering prestigious investment banking or consulting programs, are often offered a one-time signing bonus, which can range from $10,000 to $50,000 or more.

Salary Progression by Experience Level

Your earning potential grows significantly as you gain experience and move up the career ladder. A master's degree accelerates this trajectory. Here is a typical progression, combining data from various sources:

| Experience Level | Typical Role(s) | Typical Base Salary Range (with MSF) | Total Compensation Insights |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | Financial Analyst, Investment Banking Analyst, Junior Portfolio Analyst | $85,000 - $115,000 | Total compensation can reach $150,000 - $200,000+ in investment banking due to high bonuses. |

| Mid-Career (3-8 Years) | Senior Financial Analyst, Associate (IB/PE), Finance Manager | $110,000 - $160,000 | Bonuses become more significant. Total comp can range from $175,000 - $350,000+, with Associates in private equity at the higher end. |

| Senior-Level (8-15 Years) | Finance Director, Vice President (VP) in Investment Banking, Senior Portfolio Manager | $160,000 - $250,000+ | At this level, variable compensation (bonus and equity) often exceeds base salary. Total compensation can be $300,000 - $750,000+. |

| Executive-Level (15+ Years) | Chief Financial Officer (CFO), Managing Director (MD), Partner | $250,000 - $500,000+ | Base salary is only a fraction of the total package. Total compensation is heavily performance-based and can easily exceed $1,000,000. |

*Sources: Data synthesized from reports and aggregators including Payscale, Salary.com, Glassdoor, and industry reports from sources like Wall Street Oasis and the CFA Institute.*

This progression illustrates that a master's degree in finance is not just about securing a higher starting salary; it's about qualifying for roles with a steeper, more explosive long-term compensation curve.

Key Factors That Influence Your Salary

While the averages provide a benchmark, your individual salary is a unique equation with multiple variables. Understanding these factors is key to maximizing your earning potential. A master's degree in finance salary is highly sensitive to the choices you make regarding your education, location, industry, and skillset.

### Level of Education and Certifications

Your educational foundation is the first major determinant of your value in the marketplace.

- Master's in Finance (MSF) vs. MBA with Finance Concentration: An MSF is a specialized, deep dive into financial theory, quantitative methods, and financial markets. It's ideal for those who know they want a pure finance role. An MBA is broader, covering management, marketing, and strategy alongside finance. For pure finance roles like quantitative analysis or investment management, an MSF from a top-tier program (like MIT Sloan, Princeton Bendheim Center, or LSE) can be more potent. For corporate leadership (like a future CFO) or private equity roles that require operational expertise, an MBA from an M7 or T15 school (like Wharton, HBS, or Booth) may hold more weight and command a higher initial salary, often due to the power of its alumni network. The salary difference is often negligible at the start but can diverge based on the career path taken.

- Professional Certifications: These are powerful salary boosters.

- Chartered Financial Analyst (CFA): The gold standard in investment management. Passing all three levels of the notoriously difficult CFA exam demonstrates a profound mastery of investment analysis, portfolio management, and ethics. According to the CFA Institute, charterholders often report earning significantly more than their non-chartered peers. Payscale data suggests a CFA charter can add a 15-20% premium to a base salary.

- Certified Public Accountant (CPA): While an accounting designation, a CPA is highly valued in corporate finance, forensic accounting, and roles requiring deep knowledge of financial reporting. A professional holding both an MSF and a CPA is a formidable candidate for a Controller or CFO track.

- Financial Risk Manager (FRM): The premier certification for risk management professionals, demonstrating expertise in managing market, credit, and operational risk. In a post-2008 world, this certification is highly prized and compensated accordingly.

### Years of Experience: The Climb Up the Ladder

Experience is arguably the most significant multiplier of your salary. The finance industry operates on a clear, hierarchical structure, and compensation rises dramatically with each promotion.

- Analyst Level (0-3 years): The learning phase. You're responsible for the heavy lifting: building models, doing research, and preparing presentations. Base salaries are strong ($85k-$115k), and in banking, the "all-in" (base + bonus) can be staggering for a recent graduate, but the hours are famously brutal.

- Associate Level (3-5 years): Post-MBA or a direct promotion from Analyst. Associates manage the analysts, check their work, and begin to take on more client-facing or project management responsibilities. Base salaries jump to the $150k-$200k range in high finance, with total compensation pushing well into the $250k-$400k range.

- Vice President (VP) Level (5-10 years): Now you are a leader. VPs are responsible for execution, managing client relationships, and driving deals or strategies forward. They manage teams of Associates and Analysts. Base salaries can range from $200k-$275k, but this is where bonus compensation truly takes off. Total compensation of $400k-$600k is common.

- Director / Managing Director (MD) / Partner Level (10+ years): The top of the pyramid. These professionals are rainmakers, responsible for sourcing new business, setting firm strategy, and managing major client relationships. Their compensation is almost entirely variable and tied to the revenue they generate. Total compensation is routinely in the high six figures and often exceeds seven figures.

### Geographic Location: Where You Work Matters

Your physical location plays a massive role in your paycheck, primarily driven by the concentration of financial institutions and the cost of living.

- Top-Tier Financial Hubs: These cities are the global nerve centers of finance and offer the highest salaries.

- New York, NY: The undisputed king. Home to Wall Street, major investment banks, and hedge funds. Salaries here are the highest in the country, but so is the cost of living. A first-year analyst in NYC can expect a higher base and bonus than anywhere else.

- San Francisco / Bay Area, CA: The center of venture capital, tech finance, and a growing FinTech scene. Salaries are competitive with NYC, driven by the high cost of living and competition for talent from tech giants.

- Chicago, IL: A major hub for derivatives trading, commodities, and private equity. Offers high salaries with a more manageable cost of living than the coastal hubs.

- Boston, MA: A powerhouse in asset management, with giants like Fidelity and Putnam headquartered here.

- Second-Tier Financial Centers: These cities have robust financial sectors and offer excellent opportunities with a better work-life balance and lower cost of living.

- Charlotte, NC: A major banking center, home to Bank of America's headquarters.

- Dallas/Houston, TX: Strong in corporate finance, energy finance, and a growing number of investment firms.

- Los Angeles, CA: A hub for entertainment finance and a growing private equity scene.

- Salary Variation Example: According to Salary.com, a Financial Analyst III (a senior role) in New York, NY, might earn a median base salary of $105,000, whereas the same role in Orlando, FL, might earn $92,000. While the NYC salary is higher, the difference in cost of living means the Orlando professional might have more disposable income. However, the bonus potential in NYC will almost certainly dwarf that in Orlando.

### Company Type & Industry: Where You Apply Your Skills

The industry you choose is a powerful determinant of your compensation structure.

- Investment Banking (Bulge Bracket & Elite Boutiques): The highest-paying entry point. These firms (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley, Evercore, Lazard) advise on large-scale M&A, IPOs, and debt offerings. The compensation is a combination of a high base salary and a very large bonus, but it comes at the cost of grueling 80-100 hour work weeks.

- Private Equity (PE) & Venture Capital (VC): Often considered the "exit opportunity" from investment banking. These roles involve buying, improving, and selling companies (PE) or investing in early-stage startups (VC). Compensation is extremely high, with base + bonus often supplemented by "carried interest," a share of the investment profits, which can lead to life-changing wealth over the long term. These jobs are incredibly competitive.

- Hedge Funds & Asset Management: These firms manage large pools of capital for institutional and wealthy clients. Compensation for portfolio managers and research analysts is heavily tied to the performance of their fund (the "alpha" they generate). A successful portfolio manager at a major hedge fund is among the highest-paid professionals in the world.

- Corporate Finance: Working within a non-financial company (e.g., Apple, Ford, Procter & Gamble) in the finance department. Roles include financial planning & analysis (FP&A), treasury, and corporate development. The pay is excellent, with a much better work-life balance than Wall Street. Base salaries are strong, and bonuses are more modest, often in the 10-30% range of base. This is a common and highly rewarding path for MSF graduates.

- FinTech: A rapidly growing sector that blends finance and technology. Roles include quantitative analysts, data scientists, and product managers for financial products. Compensation is competitive and often includes significant stock options, offering high upside potential if the company succeeds.

- Government & Non-Profit: Roles at institutions like the Federal Reserve, the Treasury Department, or large foundations. Salaries are lower than in the private sector, but they offer unparalleled job security, excellent benefits, and a mission-driven purpose. A financial economist at the Fed may start around $100k-$120k with a PhD, with MSF holders being competitive for related analyst roles.

### Area of Specialization

Within finance, your chosen niche matters.

- Quantitative Finance ("Quants"): These professionals use advanced mathematics, statistics, and computer programming (often Python or C++) to develop complex trading algorithms and risk models. Due to the highly specialized skillset, Quants are among the best-compensated professionals, especially at hedge funds and proprietary trading firms.

- Mergers & Acquisitions (M&A): A specialization within investment banking or corporate development that focuses on the buying and selling of companies. It is one of the most prestigious and lucrative areas.

- Risk Management: As regulations have tightened, the demand for skilled risk managers has soared. Professionals who can model credit risk, market risk, and operational risk command a salary premium.

- Wealth Management / Private Banking: Advising high-net-worth individuals on their investments. Compensation is often a percentage of assets under management (AUM), so successful advisors can build a very lucrative book of business over time.

### In-Demand Skills: Your Toolkit for a Higher Salary

Beyond your degree, specific, demonstrable skills can dramatically increase your market value.

- Advanced Excel & Financial Modeling: Non-negotiable. You must be an Excel wizard, capable of building robust, dynamic, three-statement financial models from scratch.

- Programming & Data Analysis: Skills in Python (with libraries like Pandas, NumPy, Scikit-learn) and SQL are no longer just for quants. They are increasingly required in corporate finance and asset management for handling large datasets and automating analysis.

- Data Visualization Tools: The ability to communicate complex data simply is a superpower. Proficiency in tools like Tableau or Power BI is highly valued.

- Bloomberg Terminal Proficiency: In many market-facing roles, being fluent with the Bloomberg Terminal for data, news, and analytics is a prerequisite.

- Valuation Expertise: A deep, nuanced understanding of various valuation methodologies (DCF, Comps, Precedents) and when to apply them.

- Soft Skills: Do not underestimate these. The ability to communicate complex financial information to non-finance stakeholders, strong negotiation skills, and impeccable attention to detail are what separate good analysts from great leaders and are often the deciding factor in promotions to senior roles.

Job Outlook and Career Growth in Finance

Investing time and money into a master's degree requires confidence in the long-term viability of the profession. Fortunately, the outlook for skilled finance professionals remains strong, though the field is continuously evolving.

U.S. Bureau of Labor Statistics (BLS) Projections

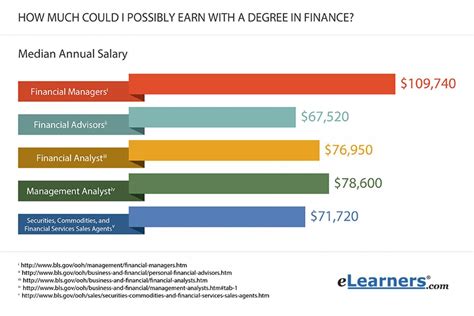

The most reliable source for job outlook data in the United States is the BLS. While they don't have a specific category for "Master's in Finance holder," we can look at key roles that these graduates fill.

For Financial Analysts, the BLS projects job growth of 8 percent from 2022 to 2032, which is much faster than the average for all occupations. This translates to an estimated 39,700 new jobs over the decade. The BLS attributes this growth to the increasing complexity of financial products and the need for in-depth analysis of geographic markets. The median annual wage for financial analysts was $95,570 in May 2022, but the BLS notes that the highest 10 percent earned more than $169,790. This highest tier is where those with master's degrees, CFAs, and significant experience are typically found.

For Financial and Investment Managers, a role that many senior professionals grow into, the outlook is even more robust. The BLS projects a growth rate of 17 percent from 2022 to 2032, which is vastly faster than average. This represents about 75,700 new jobs. The median annual wage for this group was $139,790 in May 2022, with the top earners easily clearing $208,000 in base pay alone.

This data paints a clear picture: demand for high-level financial expertise is not just stable; it's growing at a rapid pace.

Emerging Trends and Future Challenges

The finance industry of tomorrow will not look exactly like the industry of today. Staying ahead of these trends is crucial for long-term career success.

1. The Rise of FinTech and AI: Technology is the single biggest disruptor. Artificial intelligence and machine learning are being used to automate routine analysis, power algorithmic trading, and improve risk modeling. This is a double-edged sword. It threatens to make some lower-level analytical tasks obsolete, but it creates immense opportunities for those who can build, manage, and interpret these new technologies. A finance professional who also understands data science and programming (a "Quant-lite" skillset) will be in exceptionally high demand.

2. ESG (Environmental, Social, and Governance) Investing: This is no longer a niche. There is a massive global shift towards sustainable and ethical investing. Billions of dollars are flowing into funds that screen companies based on their ESG performance. Finance professionals who have expertise in ESG metrics, sustainable finance, and impact investing will find themselves at the forefront of a major industry trend.

3. Data Proliferation: We live in a world of big data. The ability to source, clean, and analyze vast, unstructured datasets (e.g., satellite imagery to track retailer foot traffic, social media sentiment analysis) is becoming a key competitive advantage in investment analysis. Skills in SQL and Python are becoming prerequisites, not just differentiators.

4. Globalization and Geopolitical Risk: As capital flows more freely across borders, understanding international finance, currency risk, and the impact of geopolitical events on markets is more important than ever. A global mindset is essential.

How to Stay Relevant and Advance

Advancement in finance is a marathon, not a sprint. It requires a commitment to continuous learning.

- Embrace Lifelong Learning: Your MSF is the beginning, not the end. Pursue certifications like the CFA or FRM. Take online courses in Python, data science, or machine learning.

- Develop a Niche: While a generalist skillset is valuable early on, long-term success often comes from becoming a go-to expert in a specific area—be it SaaS company valuation, renewable energy project finance, or emerging market debt.

- Cultivate Your Network: The adage "it's not what you know, it's who you know" is partially true in finance. Your network provides market intelligence, career opportunities, and a support system. Actively maintain relationships with colleagues, mentors, and alumni.

- Focus on Communication: The most brilliant financial model is useless if you can't explain its conclusions to the CEO or a client. Work on your presentation, writing, and interpersonal skills. The ability to translate complexity into a clear, compelling narrative is the hallmark of a senior leader.

How to Get Started on Your Finance Career Path

The path to a high-paying finance career is structured and competitive, but it is achievable with a clear plan and dedicated effort. Here is a step-by-step guide for aspiring professionals.

Step 1: Build a Strong Academic Foundation (Undergraduate)

It starts with your bachelor's degree. While you don't strictly need to major in finance, it helps. Strong choices include Finance, Economics, Accounting, Mathematics, or Statistics. What's most important is a demonstrated track record of academic excellence and strong quantitative skills. Maintain a high GPA (ideally 3.5 or higher), as top graduate programs and employers use this as an initial screening tool.