Table of Contents

- [Introduction](#introduction)

- [What Does a Medical Billing and Coding Specialist Do?](#what-they-do)

- [Average Medical Billing and Coding Salaries: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in a Medical Billing and Coding Career](#how-to-start)

- [Conclusion: Is This Career Right for You?](#conclusion)

---

Introduction

Are you a meticulous, detail-oriented individual with a knack for organization and problem-solving? Are you searching for a stable, in-demand career in the booming healthcare industry that doesn't require direct patient care? If so, you may have found your perfect match in medical billing and coding. This critical profession forms the financial backbone of the entire healthcare system, ensuring that providers are paid correctly for their services, and it offers a surprisingly lucrative and flexible career path for those who master its intricacies.

The financial potential in this field is significant and stable. While salaries vary based on numerous factors we will explore in-depth, the U.S. Bureau of Labor Statistics (BLS) reports the median annual wage for medical records and health information specialists was $48,780 as of May 2023, with the top 10% earning more than $81,090. With the right certifications, specializations, and experience, six-figure incomes are well within reach for dedicated professionals. This guide will serve as your comprehensive roadmap to understanding not just the average medical billing and coding salaries, but how to strategically maximize your own earning potential.

I was once on the receiving end of a bafflingly complex medical bill after a minor procedure. It was a jumble of codes and charges I couldn't decipher, and it was only through the patient, diligent work of a hospital's billing specialist that the errors were corrected. That experience gave me a profound appreciation for these unsung heroes of healthcare—the professionals who ensure accuracy, fairness, and financial viability in a system that touches all of our lives. They are the crucial translators between medical services and financial reimbursement, and their expertise is invaluable.

This article will leave no stone unturned. We will dissect the role itself, dive deep into national salary data, meticulously break down the factors that can dramatically increase your pay, analyze the robust job outlook, and provide a clear, step-by-step guide to launching your own successful career in this field.

---

What Does a Medical Billing and Coding Specialist Do?

At its core, a medical billing and coding specialist is a translator. They translate the complex language of healthcare—diagnoses, procedures, services, and equipment—into a universal alphanumeric code that insurance companies and government payers can understand. This process is the foundation of the entire healthcare revenue cycle. Without accurate coding and billing, healthcare providers would not receive payment for their services, and the system would grind to a halt.

While the terms "billing" and "coding" are often used interchangeably, they represent two distinct, albeit deeply intertwined, functions.

- Medical Coding: The coder is the initial translator. They meticulously review patient charts, physician's notes, lab results, and other medical records. Their job is to abstract all pertinent information and assign the appropriate standardized codes. The primary code sets they use are:

- ICD-10-CM (International Classification of Diseases, 10th Revision, Clinical Modification): These codes represent a patient's diagnoses, symptoms, and conditions. For example, `J45.909` is the code for an unspecified asthma attack.

- CPT (Current Procedural Terminology): These codes represent the medical, surgical, and diagnostic services and procedures performed by the healthcare provider. For example, `99213` is a common code for an established patient office visit.

- HCPCS Level II (Healthcare Common Procedure Coding System): These codes are used for products, supplies, and services not included in CPT, such as ambulance services, durable medical equipment, and certain drugs.

- Medical Billing: The biller takes the coded information and uses it to create a "superbill" or claim. This claim is a formal request for payment sent to the patient's insurance company (e.g., Blue Cross Blue Shield, Aetna, Cigna) or a government payer (e.g., Medicare, Medicaid). The biller's job doesn't end there. They are also responsible for:

- Verifying patient insurance eligibility and benefits.

- Ensuring claims are "clean" and free of errors before submission.

- Submitting claims electronically.

- Following up on unpaid or rejected claims (a process called accounts receivable management).

- Investigating and appealing claim denials.

- Posting payments received from payers.

- Billing patients for any remaining balances, such as deductibles, co-pays, and co-insurance.

### A Day in the Life of a Remote Certified Coder

To make this more tangible, let's imagine a day for "Alex," a Certified Professional Coder (CPC) working remotely for a large orthopedic practice.

- 8:00 AM: Alex logs into the practice's Electronic Health Record (EHR) system, Epic, from their home office. They check their queue of patient charts from the previous day's appointments and surgeries.

- 8:15 AM - 12:00 PM: The morning is dedicated to focused coding. Alex opens the first chart for a patient who had a knee arthroscopy. They carefully read the surgeon's operative report, the anesthesiologist's notes, and the post-op diagnosis. They assign the correct CPT code for the surgical procedure, an ICD-10-CM code for the diagnosis (e.g., a meniscal tear), and any necessary HCPCS Level II codes for supplies. They double-check for any modifiers needed to add specificity to the claim. They repeat this meticulous process for a dozen more charts, ranging from simple office visits for back pain to complex spinal fusion surgeries.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 3:00 PM: Alex switches tasks to work on claim denials. They log into the billing software and review a list of claims rejected by insurance companies. One denial is for a "lack of medical necessity." Alex must now play detective, re-reading the physician's notes to find the specific documentation that justifies the procedure, writing a concise appeal letter, and resubmitting the claim with the supporting evidence.

- 3:00 PM - 4:30 PM: Alex joins a video call with the practice manager and a new physician. Alex is the compliance expert and is training the new doctor on documentation best practices to ensure future claims are clean and defensible. They explain the importance of linking a specific diagnosis to every procedure performed.

- 4:30 PM - 5:00 PM: Alex finishes the last few charts in their queue, answers a few emails from the billing team regarding a complex claim, and logs off for the day, having played a vital role in securing tens of thousands of dollars in revenue for the practice.

This example showcases the blend of analytical focus, investigative work, and communication that defines the profession.

---

Average Medical Billing and Coding Salaries: A Deep Dive

Understanding the earning potential is a primary motivation for anyone considering a new career. For medical billing and coding, the salary landscape is promising and offers substantial room for growth. While a single "average" salary provides a useful benchmark, the real story lies in the ranges and the components that make up total compensation.

### National Salary Averages and Ranges

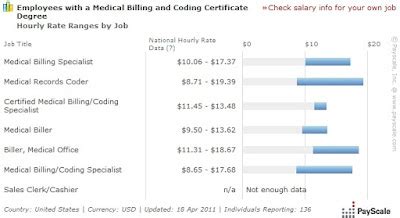

Let's start with the most authoritative data from government and industry sources. It's important to note that different sources may have slightly different numbers due to their unique methodologies (employer-reported data vs. user-reported data, inclusion of different job titles, etc.).

- U.S. Bureau of Labor Statistics (BLS): The BLS groups medical coders and billers under the category "Medical Records and Health Information Specialists." As of its May 2023 report, the BLS provides the following data:

- Median Annual Wage: $48,780 (This means half of all workers in the occupation earned more than this amount, and half earned less).

- Median Hourly Wage: $23.45

- Lowest 10% Earned: Less than $34,640

- Highest 10% Earned: More than $81,090

This BLS range ($34k to $81k+) is a powerful indicator of the career's trajectory. You start at a solid living wage and can grow your income substantially over time.

- AAPC (American Academy of Professional Coders): As the largest training and certification organization for the industry, the AAPC's annual salary survey is arguably the most specific and trusted resource. The 2023 survey revealed:

- Overall Average Salary (with at least one AAPC certification): $64,712

- Average Salary (without certification): $51,699

This immediately highlights the immense value of certification—an average salary boost of over $13,000 per year.

- Salary Aggregators: Websites like Salary.com, Payscale, and Glassdoor provide real-time, user-reported data that often reflects a wider range of job titles and compensation packages.

- Salary.com (as of late 2023): Reports the median salary for a "Medical Coder" in the U.S. is $61,168, with a typical range falling between $53,822 and $70,227.

- Payscale (as of late 2023): Shows the average base salary for a "Certified Professional Coder (CPC)" is around $59,000 per year.

Key Takeaway: A realistic starting point for an entry-level, non-certified individual might be in the $38,000 - $45,000 range. However, upon earning a core certification like the CPC, that baseline quickly jumps to the $50,000 - $60,000 range, with significant upward mobility from there.

### Salary Progression by Experience Level

Your value—and therefore your salary—grows directly with your experience. As you encounter more complex cases, master different specialties, and prove your accuracy, you become a more valuable asset.

Here is a typical salary progression, compiled from AAPC and Payscale data:

| Experience Level | Typical Role & Responsibilities | Estimated Annual Salary Range |

| :--- | :--- | :--- |

| Entry-Level (0-2 years) | Coder I, Billing Assistant. Handles basic coding (e.g., family practice visits), data entry, payment posting. Often has an apprentice-level certification (CPC-A). | $40,000 - $52,000 |

| Mid-Career (3-9 years) | Coder II, Senior Biller, Claims Analyst. Handles more complex cases (e.g., specialty clinics, minor procedures), begins to handle claim denials and appeals. Holds full certification (CPC, CCS). | $53,000 - $68,000 |

| Senior (10-19 years) | Coder III, Lead Coder, Auditor, CDI Specialist. Codes the most complex cases (e.g., major surgeries, inpatient hospital stays), audits other coders' work for accuracy and compliance, educates providers. May hold multiple specialty certifications. | $69,000 - $85,000+ |

| Expert/Management (20+ years) | Coding Manager, Revenue Cycle Director, Compliance Officer. Manages a team of coders, oversees the entire billing department, develops compliance policies, responsible for departmental budget and performance. | $85,000 - $120,000+ |

### Beyond the Base Salary: Understanding Total Compensation

Your paycheck is more than just your hourly wage or annual salary. Total compensation includes other forms of payment and benefits that significantly add to the overall value of a job offer. When evaluating medical billing and coding salaries, consider the complete package:

- Bonuses: These are common in larger practices, hospitals, and third-party billing companies. Bonuses are often tied to performance metrics such as:

- Productivity: Number of charts coded per hour/day.

- Accuracy: Maintaining a high accuracy rate (e.g., 95% or higher) on internal and external audits.

- Team/Company Performance: A share of the profits if the organization meets its revenue goals.

- Annual bonuses can range from a few hundred dollars to several thousand dollars.

- Profit Sharing: While less common than performance bonuses, some private practices and smaller companies offer profit-sharing plans, where a portion of the company's profits is distributed among employees.

- Overtime Pay: Many coding and billing positions are hourly (non-exempt), meaning you are eligible for overtime pay (typically 1.5 times your hourly rate) for any hours worked over 40 in a week. This can significantly boost income during busy periods.

- Benefits (The Hidden Salary): The value of a strong benefits package cannot be overstated. This is a major differentiator between employers. A typical full-time benefits package includes:

- Health Insurance: Medical, dental, and vision coverage. A good plan with low deductibles can be worth $5,000 - $15,000 per year in value.

- Retirement Savings Plan: Access to a 401(k) or 403(b) plan, especially with an employer match, is essentially free money for your retirement.

- Paid Time Off (PTO): Includes vacation days, sick leave, and paid holidays.

- Continuing Education Stipend: Many employers, particularly hospitals, will pay for your annual certification maintenance fees (CEUs) and may even pay for you to earn additional specialty certifications. This is a massive perk that directly supports your career growth.

- Life and Disability Insurance: Provides a crucial financial safety net.

When comparing job offers, don't just look at the base salary. Calculate the total value of the compensation package to make the most informed decision.

---

Key Factors That Influence Your Salary

Now we arrive at the most critical section of this guide. Why does one coder make $55,000 while another in the same city makes $85,000? The answer lies in a combination of powerful factors that you can strategically leverage to maximize your earnings. Mastering these variables is the key to unlocking the upper echelons of medical billing and coding salaries.

### 1. Education and, Crucially, Certification

Your foundational knowledge is important, but in the world of medical coding, certification is king. It is the single most powerful tool for increasing your initial and long-term salary. An employer sees a certified coder as a professional who has passed a rigorous, standardized exam, demonstrating their competence and reducing the employer's compliance risk.

- Formal Education:

- Certificate/Diploma Program: This is the most common and fastest path. These programs, offered by community colleges and vocational schools, typically last 9-12 months and are laser-focused on preparing you for certification exams.

- Associate's Degree (A.S. or A.A.S.): A two-year degree, often in Health Information Technology (HIT), provides a broader education, including anatomy, physiology, pharmacology, and healthcare law. This path often leads to the Registered Health Information Technician (RHIT) credential from AHIMA. According to Payscale, RHITs have an average salary of around $54,000, but this degree provides a stronger foundation for moving into management or data analysis roles later.

- Bachelor's Degree (B.S.): A four-year degree in Health Information Management (HIM) is the pathway to leadership. It prepares you for the Registered Health Information Administrator (RHIA) credential. RHIAs are not typically frontline coders; they are managers, directors, and compliance officers. The AAPC reports that coding managers earn an average of $85,081.

- The Power of Professional Certifications:

This is where the real salary differentiation happens. Holding one or more of these credentials is non-negotiable for career growth.

AAPC Certifications (Primarily for physician-based/outpatient settings):

- CPC (Certified Professional Coder): The gold standard for outpatient coding. It is the most recognized and sought-after credential. As noted, the AAPC finds that CPCs earn an average of $64,712. New coders start as a CPC-A (Apprentice) until they have two years of experience, which removes the "A" and typically comes with a pay raise.

- COC (Certified Outpatient Coder): Formerly CPC-H, this is for coders working in hospital outpatient facilities like emergency departments or ambulatory surgery centers. Average salary is often slightly higher than a CPC, around $70,186 according to the AAPC survey.

- Specialty Certifications: This is how you build on the CPC. Each specialty cert you add demonstrates deep expertise and can add 5-10% to your base salary. Examples include: Certified Cardiology Coder (CCC), Certified Orthopedic Surgery Coder (COSC), etc. Holding two credentials bumps the average salary to $74,896, and three or more pushes it to $83,866.

AHIMA Certifications (Primarily for hospital/inpatient settings):

- CCS (Certified Coding Specialist): The gold standard for inpatient hospital coding. This is generally considered more difficult to obtain than the CPC, as it requires mastery of the complex ICD-10-PCS procedural coding system. Because of this complexity, CCS-certified coders are in high demand and often command higher salaries, with Payscale showing an average around $68,000 and top earners exceeding $90,000.

- CCA (Certified Coding Associate): An entry-level credential from AHIMA.

Salary Impact Summary: Going from uncertified to certified (e.g., earning your CPC) can instantly boost your salary potential by $10,000 or more. Adding a second certification can add another $5,000-$10,000, and a third can propel you even higher.

### 2. Years of Experience

As detailed in the salary progression table, experience is a linear driver of income. But it's not just about time served; it's about the *quality* of that experience.

- 0-2 Years (The Foundation): Your focus is on accuracy and speed. You are building your core competency. The biggest financial jump happens when you remove the "-A" (Apprentice) designation from your CPC credential.

- 3-9 Years (The Specialization): You've proven your skills. This is the time to move into more complex areas. If you're in family practice, seek a role in a surgical clinic. If you're coding office visits, learn to code minor procedures. This is when you should pursue a specialty certification. Your salary growth here is tied to taking on more challenging work.

- 10+ Years (The Expertise): You are now a subject matter expert. Your value lies not just in coding but in leveraging your knowledge. This is when you can pivot into higher-paying adjacent roles:

- Medical Auditing: Reviewing other coders' work for compliance and accuracy. Auditors are highly valued and well-compensated. The AAPC reports the average salary for a Certified Professional Medical Auditor (CPMA) is $81,048.

- Clinical Documentation Improvement (CDI): Working with physicians in real-time to ensure their documentation is complete and specific enough to support the codes. CDI specialists have a significant impact on revenue and compliance, with salaries often ranging from $80,000 to $110,000+.

- Management: Leading a team of coders, which comes with a significant pay increase.

### 3. Geographic Location

Where you live and work has a profound impact on your salary, driven primarily by local market demand and cost of living. A salary that feels modest in a major metropolitan area could provide a very comfortable lifestyle in a smaller city or rural area.

The BLS provides excellent state- and metro-level data for "Medical Records and Health Information Specialists."

Top-Paying States (Annual Mean Wage):

1. District of Columbia: $76,960

2. New Jersey: $70,860

3. California: $64,360

4. Maryland: $62,940

5. Massachusetts: $61,500

Top-Paying Metropolitan Areas (Annual Mean Wage):

1. Trenton, NJ: $82,490

2. San Jose-Sunnyvale-Santa Clara, CA: $77,910

3. Washington-Arlington-Alexandria, DC-VA-MD-WV: $77,330

4. San Francisco-Oakland-Hayward, CA: $75,320

5. Sacramento-Roseville-Arden-Arcade, CA: $69,790

Conversely, states in the South and Midwest tend to have lower average salaries, but also a significantly lower cost of living. For example, the annual mean wage in Alabama is $42,390 and in Oklahoma is $42,660.

The Rise of Remote Work: The increasing prevalence of remote coding jobs has changed this dynamic. You can now potentially live in a low-cost-of-living area while working for a company based in a high-paying state. However, many companies are now implementing location-based pay adjustments, offering a salary that reflects your local market rather than the company's headquarters. Nonetheless, remote work provides unprecedented flexibility and can create opportunities to earn a higher-than-local-average salary.

### 4. Work Environment (Company Type & Size)

The type of facility you work for is a major salary determinant, as it dictates the complexity of the coding and the financial resources of the employer.

- Hospitals (General Medical and Surgical): This is often the highest-paying environment. According to the BLS, the average salary for specialists in this setting is $54,260. Inpatient coders (using ICD-10-PCS) who work for large hospital systems are among the highest earners in the field due to the complexity and high-dollar value of the claims they handle.

- Physician Offices: This is the most common work environment. The pay is solid and aligns with the national median. The BLS reports an average of $45,390 in this setting, but this can rise dramatically in specialty practices (e.g., neurosurgery, cardiology).

- Outpatient Care Centers: These include ambulatory surgery centers and urgent care clinics. The work is often fast