Understanding your employment classification is fundamental to your career and financial planning. One of the most critical distinctions is whether you are an "exempt" or "non-exempt" employee, a classification that directly impacts your pay structure and eligibility for overtime. A major federal rule change in 2024 has significantly increased the minimum salary required for an employee to be classified as exempt, affecting millions of U.S. workers.

This guide will break down the new 2024 salary thresholds, explain the factors that determine your status, and clarify what these changes mean for your career and earning potential.

What Does It Mean to Be an "Exempt" Employee?

The term "exempt" comes from the Fair Labor Standards Act (FLSA), the federal law that establishes minimum wage, overtime pay, and recordkeeping standards. "Exempt" employees are exempt from (meaning, they do not receive) overtime pay.

In exchange for not receiving overtime, exempt employees are paid a fixed salary that does not change based on the quantity or quality of work performed in a week. To be legally classified as exempt, an employee must meet two primary criteria:

1. The Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of the work performed.

2. The Duties Test: The employee’s primary job duties must involve executive, administrative, or professional (EAP) tasks. There are also specific exemptions for outside sales employees, computer professionals, and highly compensated employees.

If an employee does not meet *both* the salary basis and the duties tests, they are considered "non-exempt" and are entitled to overtime pay (typically 1.5 times their regular rate) for any hours worked over 40 in a workweek.

The 2024 Minimum Salary Threshold for Exempt Employees

The most significant development for 2024 is the U.S. Department of Labor's (DOL) new Final Rule, which substantially increases the minimum salary required to be an exempt employee. This update is being implemented in two phases.

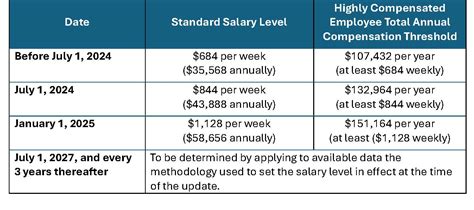

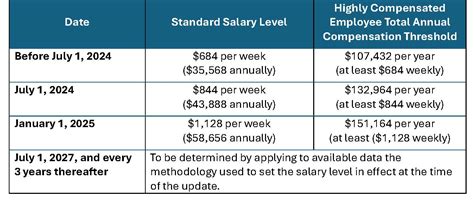

According to the U.S. Department of Labor, the standard salary level thresholds are as follows:

- Prior to July 1, 2024: $684 per week (equivalent to $35,568 per year).

- Effective July 1, 2024: $844 per week (equivalent to $43,888 per year).

- Effective January 1, 2025: $1,128 per week (equivalent to $58,656 per year).

This means that, as of January 1, 2025, if you are a salaried employee meeting the duties test but earn less than $58,656 per year, your employer must either increase your salary to meet the new threshold or reclassify you as non-exempt and pay you overtime for any hours worked beyond 40 per week.

The rule also increased the threshold for Highly Compensated Employees (HCEs), who are subject to a more lenient duties test:

- Effective July 1, 2024: Total annual compensation must be at least $132,964.

- Effective January 1, 2025: Total annual compensation must be at least $151,164.

Key Factors That Influence the Salary Threshold

While the federal numbers set the national floor, several other factors can influence the minimum salary requirements or an exempt employee's actual earnings, which are typically far above the legal minimum.

### Geographic Location

This is the most critical factor that can alter the legal minimum salary threshold. The federal FLSA rules are a baseline; many states have their own laws that set a higher bar. If state and federal laws conflict, the law that is more favorable to the employee applies.

- California: As of 2024, the minimum salary for exempt employees is two times the state's minimum wage for a full-time employee. With a state minimum wage of $16.00/hour, the exempt salary threshold is $66,560 per year.

- New York: The state has different thresholds based on location. In 2024, the minimum for New York City, Long Island, and Westchester County is $1,200/week ($62,400 per year), while the rest of the state is $1,124.20/week ($58,458.40 per year).

- Washington: In 2024, the exempt salary threshold is 2 times the state minimum wage, making it approximately $67,724.80 per year.

### Area of Specialization & Education

Certain professions have unique rules under the FLSA and are not subject to the standard salary basis test. These are often referred to as "learned professionals" or other specific exemptions.

- Learned Professionals: This includes doctors, lawyers, and teachers. These roles are considered exempt based on their duties and advanced educational requirements, regardless of whether they meet the standard salary threshold.

- Computer Professionals: Computer systems analysts, programmers, and software engineers may be paid on an hourly basis of at least $27.63 per hour and still be considered exempt, or they can be paid a salary meeting the standard threshold.

- Creative Professionals: This exemption applies to roles requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., actors, musicians, writers).

### Years of Experience

While experience level does not change the *legal minimum salary*, it is the single greatest driver of an exempt employee's *actual* salary. The legal threshold is simply a floor; market rates are typically much higher and scale dramatically with experience.

For example, consider a common exempt role like a Project Manager:

- Entry-Level (0-2 years): The salary may start around $65,000 to $75,000, well above the federal minimum.

- Mid-Career (5-9 years): The average salary often climbs to between $90,000 and $110,000.

- Senior-Level (10+ years): A senior or principal project manager can easily earn $120,000 to $150,000+, according to data from aggregators like Salary.com and Glassdoor.

### Company Type

The size, industry, and financial health of a company heavily influence compensation for exempt roles.

- Startups: May offer lower base salaries but supplement them with significant equity options.

- Large Corporations (Fortune 500): Typically offer higher base salaries, robust benefits packages, and structured bonus programs. An exempt Marketing Manager at a large CPG company will likely earn more than one at a small non-profit.

- Industry: Exempt professionals in high-paying industries like technology, finance, and pharmaceuticals generally command higher salaries than those in retail or education.

Job Outlook and Future of Salary Thresholds

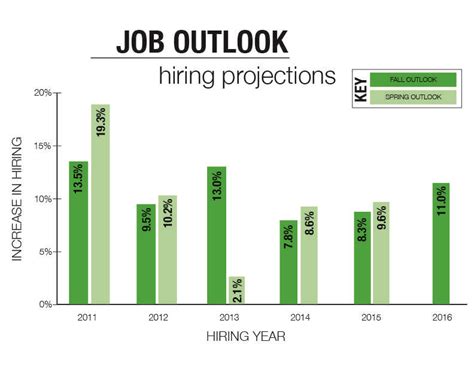

The concept of an "exempt employee" isn't a job in itself, but the career outlook for the types of roles that fall under this classification—managers, professionals, and administrators—is strong. The U.S. Bureau of Labor Statistics (BLS) projects that management occupations are expected to grow 6 percent from 2022 to 2032, faster than the average for all occupations.

More importantly, the 2024 DOL rule includes a provision to automatically update the salary thresholds every three years based on current wage data. This means that unlike the long gaps between previous updates, employees and employers can expect regular, predictable adjustments to the exempt salary floor, ensuring it keeps pace with economic changes.

Conclusion

The 2024 changes to the minimum salary for exempt employees represent a pivotal moment for the American workforce. For professionals considering or currently in salaried roles, here are the key takeaways:

- Know the New Numbers: The federal minimum salary to be classified as exempt rises to $43,888 on July 1, 2024, and to $58,656 on January 1, 2025.

- State Law Matters: Your geographic location may mean your minimum salary threshold is already higher than the new federal standard. Always check your state and local labor laws.

- Duties Are Crucial: Salary is only one part of the equation. Your primary job responsibilities must align with the executive, administrative, or professional duties tests to be legally exempt.

- The Floor is Not the Ceiling: The legal minimum is simply the starting line. Your skills, experience, industry, and location will determine your actual market value, which for most professional exempt roles is significantly higher.

By understanding these rules, you can better advocate for fair compensation, ensure you are classified correctly, and make informed decisions as you navigate your professional journey.