Navigating the world of compensation can be complex, but understanding the foundational concept of "minimum salary pay," or minimum wage, is the first step for any aspiring professional or savvy employer. This legal standard is the baseline for compensation in the United States, but it's far from a single number. While the federal minimum wage provides a national floor, your actual minimum earning potential is heavily influenced by where you live, the work you do, and several other key factors. This guide will break down everything you need to know about minimum wage laws and what they mean for your career journey.

What is the Minimum Wage?

The "minimum salary pay" or minimum wage is the lowest hourly, daily, or monthly remuneration that employers are legally required to pay their workers. In the United States, this standard is established by the Fair Labor Standards Act (FLSA), a federal law that sets the baseline for wages, overtime pay, recordkeeping, and youth employment standards.

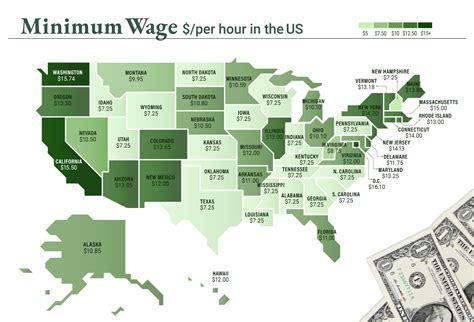

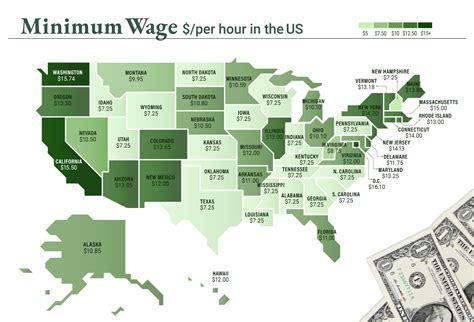

The core purpose of the minimum wage is to protect workers from unduly low pay and create a minimum standard of living. It's important to understand that the federal rate is a floor, not a ceiling. States, cities, and counties can—and often do—set their own, higher minimum wage rates. When state and federal laws conflict, the employee is entitled to the higher of the two wages.

Average Minimum Salary Pay

When discussing minimum wage, there isn't a single "average" but rather a hierarchy of rates.

- Federal Minimum Wage: As of 2024, the federal minimum wage is $7.25 per hour. This rate has not changed since 2009 (Source: U.S. Department of Labor).

- State & Local Minimum Wage Range: This is where the numbers vary dramatically. Many states and municipalities have enacted laws to set higher minimums. For example:

- The District of Columbia has a minimum wage of $17.00 per hour.

- Washington state's minimum wage is $16.28 per hour.

- California's minimum wage is $16.00 per hour.

(Source: Economic Policy Institute, Minimum Wage Tracker, 2024).

- Tipped Minimum Wage: For employees who regularly receive tips, such as restaurant servers, the federal minimum cash wage is $2.13 per hour. However, the employer must ensure that the employee's combined cash wage and tips equal at least the standard federal minimum wage of $7.25 per hour. Many states have different, higher requirements for tipped workers.

Key Factors That Influence Salary

While the minimum wage sets a legal floor, your actual earnings are determined by the same factors that influence all salaries. Understanding these is key to moving beyond minimum pay.

###

Geographic Location

This is the single most significant factor impacting the minimum wage you are entitled to receive. The cost of living varies drastically across the country, and local wage laws reflect this.

- Federal vs. State: A worker in Georgia or Wyoming, which adhere to the federal $7.25 rate, will have a much lower minimum wage than a worker in a state like New York ($15.00) or Massachusetts ($15.00).

- State vs. City: Many large metropolitan areas have set even higher local ordinances. For example, the minimum wage in Seattle, Washington, is $19.97 per hour, significantly higher than Washington's statewide rate (Source: City of Seattle Office of Labor Standards). Similarly, Denver, Colorado ($18.29/hr) surpasses the state's minimum wage.

###

Level of Education

Education does not change the legal minimum wage, but it is the primary driver for earning substantially more than it. While many minimum wage jobs do not require a college degree, obtaining certifications, an associate's, or a bachelor's degree opens doors to professions with much higher starting salaries. For example, the U.S. Bureau of Labor Statistics (BLS) reports that in 2022, the median weekly earnings for a high school graduate were $853, while for a bachelor's degree holder, they were $1,432. Education is a direct investment in moving beyond entry-level pay scales.

###

Years of Experience

Like education, experience is your ticket to higher earnings. The minimum wage is typically associated with entry-level positions requiring little to no prior experience. As you accumulate years in an industry, you develop valuable skills, increase your efficiency, and gain the ability to take on more responsibility. This experience makes you a more valuable asset to an employer, justifying a salary well above the legal minimum. A retail associate might start at minimum wage, but a shift supervisor or store manager with 5-10 years of experience will earn a significantly higher hourly rate or a full-time salary.

###

Company Type

The type of company you work for can influence your starting pay, even for entry-level roles.

- Small Businesses vs. Large Corporations: While both must adhere to minimum wage laws, large corporations often have internal pay scales that set their minimum starting wage higher than the legal requirement to attract and retain talent. Companies like Costco and Bank of America have been known to set their corporate minimum wages well above the federal and even state levels.

- Government Contractors: Companies that have contracts with the federal government are often required to pay a higher minimum wage. As of early 2024, an Executive Order mandates a minimum wage of $17.20 per hour for federal contract workers.

###

Area of Specialization

The industry and specific job function play a massive role. Some industries have inherently higher starting wages due to the skills required, even for entry-level positions. For example, an entry-level position in a skilled trade, like a plumber's apprentice, will typically pay much more than the standard minimum wage. A starting role in IT support or healthcare administration, even without a four-year degree, will almost always begin at a rate far exceeding the legal minimum due to the specialized knowledge required.

Job Outlook

The concept of a "minimum wage job" isn't a profession in itself, but a pay classification. However, the political and economic discussion around the minimum wage is very active. There is an ongoing national movement, often called the "Fight for $15," advocating for a higher federal minimum wage.

The U.S. Bureau of Labor Statistics (BLS) does not project growth for a "job" of minimum wage, but it does project growth for occupations where many workers tend to earn at or near the minimum wage. For example, employment of food and beverage serving and related workers is projected to grow 11 percent from 2022 to 2032, much faster than the average for all occupations. As the economy evolves and the cost of living rises, it is highly likely that more states and cities will continue to increase their minimum wage rates, independent of federal action.

Conclusion

Understanding "minimum salary pay" is essential for anyone entering the workforce. It is a safety net, not a career destination. The key takeaways are:

- It's a Floor, Not a Ceiling: The minimum wage is the legal starting point for compensation.

- Location is Everything: Where you live is the single biggest determinant of your local minimum wage.

- Growth is in Your Hands: While the law sets the minimum, your path to higher earnings is paved with education, experience, and specialization.

For prospective students and professionals, view the minimum wage as a temporary step on your career ladder. By focusing on developing valuable skills and gaining experience in a chosen field, you can quickly and effectively move beyond this baseline and achieve your long-term financial and professional goals.