Vietnam, a nation pulsating with economic energy and cultural richness, has rapidly emerged as a global hub for business, manufacturing, and tourism. As one of Southeast Asia's fastest-growing economies, it presents a landscape of immense opportunity for international corporations, ambitious expatriates, and its own burgeoning workforce. Yet, beneath the headlines of stellar GDP growth and foreign investment lies a fundamental question for anyone looking to work, hire, or do business in the country: what exactly is the minimum salary in Vietnam? The answer is far more nuanced and dynamic than a single number, revealing a complex tapestry of regional economics, industrial demands, and legal frameworks.

Understanding this foundational aspect of the Vietnamese labor market is not just a matter of legal compliance; it is the key to strategic business planning, successful talent acquisition, and realistic career expectations. The official minimum wage serves as the legal floor, but the *actual* earning potential for skilled professionals and in-demand roles can soar far above it. This guide is designed to be your definitive resource, cutting through the complexity to provide a clear, data-driven, and comprehensive analysis. We will dissect the official four-tiered regional system, explore the vast differences in salaries across industries and job functions, and map out the economic forces shaping the future of wages in this dynamic country.

I once consulted for a mid-sized tech company planning its expansion into Ho Chi Minh City. Their initial financial models, based on a single, misunderstood "national" minimum wage figure, were wildly inaccurate, underestimating the competitive salaries needed for skilled developers by nearly 400%. This experience was a stark reminder that true success in a new market requires looking beyond the surface-level data to understand the real-world economic context.

This article will provide that deeper context. Whether you are an HR manager setting up a new office, an expatriate negotiating your contract, or a local professional planning your career trajectory, this guide will equip you with the knowledge to navigate Vietnam's employment landscape with confidence.

### Table of Contents

- [What Is the Minimum Salary in Vietnam? The Official Framework](#what-is-the-minimum-salary-in-vietnam-the-official-framework)

- [Vietnam's Minimum Salary Structure: A 2024 Deep Dive](#vietnams-minimum-salary-structure-a-2024-deep-dive)

- [Key Factors That Influence Your *Actual* Salary in Vietnam](#key-factors-that-influence-your-actual-salary-in-vietnam)

- [Economic Outlook and the Future of Wages in Vietnam](#economic-outlook-and-the-future-of-wages-in-vietnam)

- [Navigating the Job Market in Vietnam: A Practical Guide](#navigating-the-job-market-in-vietnam-a-practical-guide)

- [Conclusion: Opportunity Beyond the Minimum](#conclusion-opportunity-beyond-the-minimum)

What Is the Minimum Salary in Vietnam? The Official Framework

Unlike many countries that have a single national minimum wage, Vietnam employs a sophisticated, region-based system. This structure is designed to reflect the significant economic and cost-of-living disparities between bustling urban centers and more rural, agricultural provinces. The official term for this is "mức lương tối thiểu vùng" (regional minimum wage).

The Government of Vietnam, through the Ministry of Labour, Invalids and Social Affairs (MOLISA), and the National Wage Council, establishes and periodically updates these wage floors. The National Wage Council is a crucial tripartite body, comprising representatives from the government, employer federations (like the Vietnam Chamber of Commerce and Industry - VCCI), and employee confederations (like the Vietnam General Confederation of Labour - VGCL). This council negotiates and recommends adjustments based on factors like GDP growth, inflation (CPI), and labor productivity.

The primary purpose of the regional minimum wage is twofold:

1. To provide a social safety net: It establishes a legal baseline to protect unskilled workers from exploitation and ensure a basic standard of living.

2. To serve as a basis for other calculations: This is a critical point for employers. The minimum wage is the foundation upon which social insurance (SI), health insurance (HI), and unemployment insurance (UI) contributions are often calculated, as well as severance pay and other allowances.

### Daily Tasks and Application: A Day in the Life of an HR Manager

To make this tangible, let's consider a "Day in the Life" scenario for an HR Manager named An, working for a fictional international garment company with a factory in Bình Dương province (Region I) and a smaller workshop in Vĩnh Long province (Region III).

8:30 AM: An starts her day by reviewing payroll data for the new month. Her first task is to onboard a group of new assembly line workers for the Bình Dương factory. She ensures their base contract salary is no lower than the Region I minimum wage. This is the absolute legal floor.

10:00 AM: She then calculates the mandatory insurance contributions. The company and the employee both contribute a percentage of the employee's gross salary towards SI, HI, and UI. For a worker earning just above the minimum, these calculations are directly tied to that regional floor. For higher-paid staff, contributions are capped, but the regional minimum wage remains a reference point.

11:30 AM: A query comes in from the Vĩnh Long workshop supervisor. They want to hire a local apprentice who has completed a vocational training course. An advises the supervisor that, according to Vietnam's Labour Code, an employee who has completed vocational training must be paid at least 7% higher than the applicable regional minimum wage. She provides the supervisor with the correct figure for Region III plus the 7% premium.

2:00 PM: An participates in a management meeting about the company's annual salary review. The leadership team is analyzing wage inflation and competitor pay scales. An presents data showing that while they are compliant with the Region I minimum wage, the *market rate* for experienced sewing machine operators in Bình Dương is actually 25-30% higher due to high demand from competing factories. They decide to adjust their pay scales upwards to reduce employee turnover, demonstrating the difference between the legal minimum and the competitive reality.

4:00 PM: She prepares a report for the upcoming National Wage Council negotiations, which her company's industry association will use. The report details the impact of the last wage increase on operational costs versus the positive effect on employee morale and productivity.

This example illustrates that the minimum salary is not a static figure but an active, integral part of daily HR operations, legal compliance, and strategic business planning in Vietnam.

Vietnam's Minimum Salary Structure: A 2024 Deep Dive

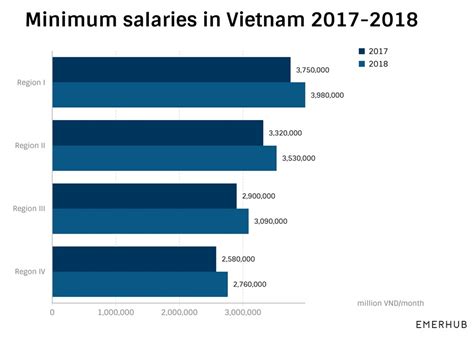

The core of Vietnam's wage system is its division of the country into four distinct economic regions. These regions are defined by their level of development, industrialization, and cost of living. The most current figures are stipulated in Decree No. 38/2022/ND-CP, which came into effect on July 1, 2022. It's important to note that while these figures have been in place since mid-2022, discussions for a potential increase in 2024 are ongoing within the National Wage Council.

The decree establishes both a monthly and an hourly minimum wage, providing flexibility for different types of employment contracts.

### Official Regional Minimum Wages (as of 2024, per Decree 38/2022/ND-CP)

Here is a breakdown of the current rates. The USD equivalents are approximate and based on a typical exchange rate of ~25,000 VND to 1 USD, which fluctuates daily.

| Region | Monthly Minimum Wage (VND) | Monthly Minimum Wage (Approx. USD) | Hourly Minimum Wage (VND) | Hourly Minimum Wage (Approx. USD) | Major Cities/Provinces in this Region |

| :-------- | :------------------------- | :--------------------------------- | :------------------------ | :-------------------------------- | :-------------------------------------------------------------------------- |

| Region I | 4,680,000 | ~$187 | 22,500 | ~$0.90 | Urban districts of Hanoi and Ho Chi Minh City; Hai Phong, Dong Nai, Binh Duong |

| Region II | 4,160,000 | ~$166 | 20,000 | ~$0.80 | Rural districts of Hanoi and HCMC; Da Nang, Can Tho, Bac Ninh, Hai Duong |

| Region III| 3,640,000 | ~$146 | 17,500 | ~$0.70 | Provincial cities and districts like Bac Giang, Phu Tho, Thua Thien Hue, Vinh Long |

| Region IV | 3,250,000 | ~$130 | 15,600 | ~$0.62 | Remaining rural and remote areas of the country |

Source: *Vietnam Government Decree No. 38/2022/ND-CP.*

It is crucial for any business operating in Vietnam to correctly identify the region in which their operations are located. A company with offices in both downtown Ho Chi Minh City (Region I) and a satellite factory in a neighboring, less-developed province (e.g., Region III) must apply two different minimum wage standards.

### From Gross to Net: Understanding Salary Deductions

The minimum wage—and indeed any salary in Vietnam—is quoted as a gross figure. An employee's take-home pay (net salary) is lower after mandatory contributions are deducted. These deductions are a shared responsibility between the employer and the employee.

Understanding these is vital for both parties. For employers, they represent a significant additional labor cost on top of the gross salary. For employees, they explain the difference between their contracted pay and what appears in their bank account.

Here’s a simplified breakdown of the key deductions based on an employee's gross salary:

Employee Contributions:

- Social Insurance (SI): 8%

- Health Insurance (HI): 1.5%

- Unemployment Insurance (UI): 1%

- Total Employee Deduction (Pre-Tax): ~10.5%

Employer Contributions:

- Social Insurance (SI): 17.5% (includes 3% for sickness/maternity fund and 0.5% for occupational accident fund)

- Health Insurance (HI): 3%

- Unemployment Insurance (UI): 1%

- Total Employer Contribution: ~21.5%

Personal Income Tax (PIT):

After the 10.5% insurance deduction, the remaining salary is subject to Personal Income Tax (PIT). Vietnam has a progressive tax system, but there is a significant tax-free threshold. As of 2024, the personal deduction is 11,000,000 VND per month, with an additional 4,400,000 VND deduction per registered dependent.

What this means in practice: An unskilled worker earning the Region I minimum wage of 4,680,000 VND per month would pay their ~10.5% insurance contribution but would pay zero Personal Income Tax because their income is well below the 11,000,000 VND threshold. A mid-level professional earning 30,000,000 VND, however, would have their income above the threshold subject to a progressive tax rate starting at 5%.

### Beyond the Basics: Important Stipulations

- Trained Worker Premium: As mentioned in the HR manager example, Vietnam's Labour Code (Article 90) mandates that employees who have undergone vocational training or apprenticeship must be paid a salary that is at least 7% higher than the applicable regional minimum wage. This is a critical and often overlooked compliance point.

- Overtime and Night Shift Pay: The base salary is used to calculate overtime pay. Working overtime on a normal day is compensated at 150% of the normal hourly rate, 200% on a weekend, and 300% on a public holiday. A night shift (10 PM to 6 AM) commands at least a 30% premium.

This detailed structure shows that while the headline minimum wage figures may seem low by international standards, they form the bedrock of a complex and legally defined compensation system.

Key Factors That Influence Your *Actual* Salary in Vietnam

While the regional minimum wage provides a legal floor, it is arguably the *least* important number when discussing the earning potential for skilled professionals, expatriates, or even experienced local workers in competitive industries. The reality of the Vietnamese job market is one of huge salary variance driven by a powerful combination of factors. A software developer in Ho Chi Minh City might earn 15 times the minimum wage, while an agricultural worker in a remote province may earn just that—the minimum.

This section provides an in-depth analysis of the real drivers of salary in Vietnam.

###

1. Geographic Location (Beyond the Four Regions)

The four-tiered system is the starting point, but the economic reality within those regions varies immensely.

- Tier 1 Powerhouses (Region I): Ho Chi Minh City (HCMC) and Hanoi. These two cities are the undisputed economic and political centers of Vietnam. They host the vast majority of corporate headquarters, international firms, tech startups, and financial institutions. Consequently, competition for talent is fierce, driving salaries for professional roles significantly higher than anywhere else in the country. According to a 2023 salary guide by the recruitment firm Adecco Vietnam, a senior marketing manager in HCMC could expect to earn between 80-150 million VND per month, while the same role in a smaller city might command half of that. The cost of living, particularly housing, is also dramatically higher in these metropolises.

- Industrial Hubs (Primarily Region I & II): Provinces like Bình Dương, Đồng Nai (near HCMC), and Bắc Ninh (near Hanoi) are manufacturing behemoths, packed with foreign-invested factories producing everything from electronics for Samsung to sneakers for Nike. While the cost of living is lower than in the city centers, the high concentration of industrial activity creates intense demand for factory managers, engineers, supply chain experts, and quality control supervisors, leading to highly competitive salaries in these specific roles.

- Coastal & Tourism Centers (Primarily Region II): Da Nang and Nha Trang. Da Nang has branded itself as a "livable city" and a burgeoning IT and tech hub, attracting a "work-life balance"-oriented professional class. Salaries for IT and hospitality roles here are strong, though generally 10-20% below HCMC levels.

- Developing & Rural Areas (Region III & IV): These regions, including the Mekong Delta and the Central Highlands, are the agricultural heartland of Vietnam. In these areas, the official minimum wage is much more representative of actual earnings for a large portion of the local, non-specialized workforce.

###

2. Industry and Sector

The industry you work in is perhaps the single greatest determinant of your salary, creating a clear divide in earning potential across the nation.

| Industry Sector | Typical Monthly Salary Range (VND) - Mid-Level Professional | Notes |

| :------------------------------ | :--------------------------------------------------------- | :---------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Information Technology (IT) | 30,000,000 - 60,000,000+ | Highest-paying sector. Extreme demand for Software Developers, DevOps, Data Scientists, and AI/ML engineers. Senior roles can easily exceed 100 million VND. |

| Manufacturing (Management) | 40,000,000 - 90,000,000 | Factory Directors, Production Managers, and Supply Chain experts, especially those with international experience, command very high salaries in industrial zones. |

| Banking & Finance | 25,000,000 - 55,000,000 | Roles in investment banking, risk management, and financial analysis in both local and international banks are well-compensated. |

| Education (Expatriate) | 35,000,000 - 60,000,000 | English teachers at international schools or reputable language centers. Licensed K-12 teachers can earn significantly more, often with housing benefits. |

| Marketing & Sales | 20,000,000 - 45,000,000 | Strong demand for Digital Marketing, E-commerce, and Brand Management, particularly in consumer goods (FMCG) and tech. |

| Garment/Textile (Worker) | 6,000,000 - 9,000,000 | Represents the reality for millions. Salary is often composed of a base salary close to the minimum wage, plus performance/overtime bonuses. |

| Agriculture (Worker) | 4,000,000 - 7,000,000 | Often tracks closely with the Region III and IV minimum wage levels. |

Sources: *Data synthesized from 2023-2024 salary reports by Robert Walters Vietnam, Adecco Vietnam, and salary aggregators like Glassdoor and TopCV for the Vietnamese market.*

###

3. Company Type & Size

The nature of the employer has a profound impact on compensation packages.

- Foreign-Invested Enterprises (FIEs) / Multinational Corporations (MNCs): These are generally the top payers in the market. Companies like Intel, Samsung, Unilever, or international banks often pay a significant premium (20-50% or more) over local competitors for the same roles. They do this to attract the best talent, and they often offer better benefits packages, including premium health insurance, professional development opportunities, and clearer career progression paths.

- Local Vietnamese Corporations: Large local companies like Vingroup, Masan, or FPT offer competitive salaries, especially for senior management, but may be slightly below top-tier MNCs. They offer a deep understanding of the local market and significant opportunities for growth within a Vietnamese context.

- Startups: The tech startup scene in HCMC and Hanoi is vibrant. Salaries can be highly variable. Early-stage startups may offer lower base salaries but compensate with potentially valuable stock options (ESOPs). Well-funded, later-stage startups often compete directly with MNCs for top tech talent.

- State-Owned Enterprises (SOEs): Traditionally, SOEs offered lower base salaries but provided immense job security and excellent benefits. This is changing, with many SOEs undergoing "equitization" (partial privatization) and adopting more market-oriented salary structures to compete for talent.

- Non-Governmental Organizations (NGOs): Salaries in the NGO sector are typically lower than in the for-profit world but are often attractive to those driven by mission and purpose. International NGOs tend to pay more than local ones.

###

4. Level of Education and Years of Experience (The Salary Growth Trajectory)

As in any market, experience is king. Vietnam's salary growth curve is steep, especially in the first 10 years of a professional's career.

- Entry-Level (0-2 Years): A fresh local university graduate in a non-technical field might expect to start at 8-12 million VND per month in a major city. A graduate with a technical degree (e.g., engineering, IT) from a top university could start at 15-20 million VND.

- Mid-Career (3-7 Years): This is where salaries see significant jumps. A professional with proven skills and a track record of success can expect to earn 25-50 million VND. This is the stage where job-hopping for a significant salary increase is common.

- Senior/Managerial (8-15 Years): Experienced professionals and first-time managers typically fall into the 50-100 million VND range. This level requires a blend of technical expertise, leadership skills, and strategic thinking.

- Director/Executive (15+ Years): Top-level executives (local or expat) at large corporations or MNCs can command salaries well over 150-200 million VND, often supplemented with substantial bonuses, stock options, and comprehensive benefits packages (car, housing, school fees for children).

An advanced degree (Master's, MBA, PhD) from a reputable international university can significantly boost starting salaries and accelerate this trajectory, particularly for management-track roles in MNCs.

###

5. In-Demand Skills: The Ultimate Salary Multiplier

Beyond formal titles, possessing specific, high-demand skills can dramatically increase earning potential. In Vietnam's current economic climate, the following skills are commanding a premium:

- Technology:

- Cloud Computing: Expertise in AWS, Azure, or Google Cloud.

- Data Science & AI/ML: Python, R, machine learning frameworks.

- Cybersecurity: Protecting against digital threats is a top priority for all businesses.

- Specific Programming Languages: Go (Golang), and Rust are in high demand in the startup scene.

- Business & Management:

- Digital Marketing: SEO/SEM, performance marketing, and e-commerce strategy.

- Supply Chain & Logistics: Expertise in optimizing Vietnam's complex supply chains is invaluable.

- Financial Planning & Analysis (FP&A): High-level financial modeling and strategic planning.

- Language Skills:

- Fluency in English: Remains a fundamental requirement for almost all high-paying professional roles.

- Japanese, Korean, Mandarin: Fluency in these languages is a massive asset in the manufacturing sector, as Japan, South Korea, and China are among Vietnam's largest foreign investors. A Vietnamese factory manager who can communicate directly with Korean executives is a highly prized and well-paid asset.

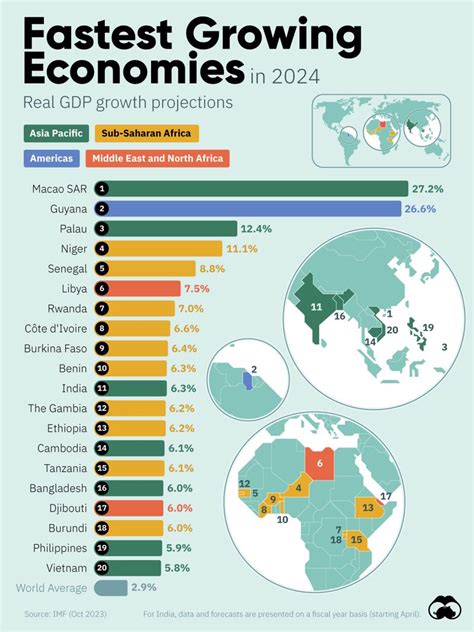

Economic Outlook and the Future of Wages in Vietnam

Vietnam's wage landscape is not static; it is a direct reflection of its dynamic, forward-moving economy. Understanding the macroeconomic trends and policy directions is essential for predicting the future of salaries and job opportunities.

### A Roaring Economy: The Foundation for Wage Growth

Vietnam has been one of the world's standout economic performers for over a decade. Despite global headwinds, its outlook remains robust.

- Projected GDP Growth: International institutions like the World Bank and the **Asian Development Bank (ADB