Unlocking Your Earning Potential: A Deep Dive into Mortgage Banker Salaries

Considering a career as a mortgage banker? You're likely drawn to a dynamic field that directly helps people achieve their dream of homeownership. But beyond the satisfaction of closing a deal, you're also wondering about the financial rewards. The great news is that a mortgage banker's salary can be both substantial and highly scalable, with top performers earning well into the six figures.

While entry-level positions may start in the $45,000 to $55,000 range, the true earning potential is unlocked through performance. The national average total compensation often sits between $80,000 and $120,000, with seasoned experts in prime markets surpassing $200,000 or more annually. This comprehensive guide will break down what a mortgage banker does, what you can expect to earn, and the key factors that will dictate your financial success in this rewarding career.

What Does a Mortgage Banker Do?

Before we dive into the numbers, it's essential to understand the role. A mortgage banker is a finance professional who works directly for a financial institution, such as a bank, credit union, or independent mortgage lender. Their primary responsibility is to originate, or create, new home loans for their employer's portfolio.

Key responsibilities include:

- Building a Client Pipeline: Actively networking with real estate agents, developers, and potential homebuyers to generate leads.

- Financial Assessment: Analyzing a borrower's financial profile, including their income, assets, debts, and credit history, to determine their eligibility for a loan.

- Guiding Borrowers: Explaining different loan products (e.g., Conventional, FHA, VA) and helping clients choose the best option for their situation.

- Managing the Loan Process: Shepherding the loan application from submission through underwriting, approval, and ultimately, to closing.

Crucially, a mortgage banker's income is heavily tied to the number and value of the loans they successfully close. This performance-based structure is why salary ranges can vary so dramatically.

Average Mortgage Banker Salary

A mortgage banker's compensation is typically a combination of a base salary and commission. The base salary provides a stable income floor, while commissions, bonuses, and performance incentives are where high earnings are truly made.

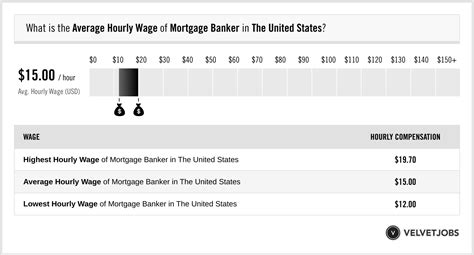

Here’s a look at what the data says from several authoritative sources:

- The U.S. Bureau of Labor Statistics (BLS) groups mortgage bankers under the broader category of "Loan Officers." As of May 2023, the BLS reports the median annual wage for loan officers was $72,690. The top 10% of earners in this category made more than $155,930. This figure provides a solid baseline for the profession as a whole.

- Salary.com reports a higher average, suggesting the median mortgage loan officer salary in the United States is around $98,401 as of May 2024. However, their data shows a very wide typical range, often falling between $78,639 and $122,860, which highlights the significant impact of commission.

- Glassdoor estimates the total pay for a Mortgage Banker in the U.S. to be an average of $118,255 per year, with a likely range between $77,000 and $181,000. This "total pay" figure includes base salary, commission, and other bonuses, giving a more realistic view of earning potential.

The takeaway is clear: While a base salary might be modest, your total compensation is directly influenced by your performance, skills, and the specific factors we'll explore next.

Key Factors That Influence Salary

Your salary as a mortgage banker isn't a fixed number. It's a dynamic figure shaped by several critical factors. Understanding these levers is the first step toward maximizing your income.

### Level of Education

While a bachelor's degree in finance, business, or economics is highly preferred and can give you a competitive edge, it is not always a strict requirement. Many successful mortgage bankers enter the field with a degree in an unrelated field or even an associate's degree, succeeding through sheer sales acumen and a deep understanding of the market.

What is non-negotiable, however, is licensing. All mortgage bankers must be licensed through the Nationwide Multistate Licensing System & Registry (NMLS). This involves pre-licensing education, passing a national exam, and undergoing a background check. Continuing education is also required to maintain your license. While this doesn't directly increase your salary, it is the fundamental ticket to entry and professional practice.

### Years of Experience

Experience is arguably the most significant driver of a mortgage banker's income. As you build your reputation and referral network, your loan volume naturally increases.

- Entry-Level (0-2 years): In this phase, you might be a Loan Officer Assistant or a Junior Banker. Your focus is on learning the products, understanding the underwriting process, and building initial relationships. Total compensation typically ranges from $45,000 to $65,000, with a higher percentage of that coming from a base salary.

- Mid-Career (3-8 years): An established mortgage banker has a reliable network of real estate agents and a steady flow of referrals. You are proficient in handling complex files and can manage a significant loan pipeline. Total compensation often falls between $80,000 and $150,000, with commissions making up a substantial portion of your earnings.

- Senior/Top Producer (8+ years): At this level, you are a recognized expert. You may manage a team, handle high-net-worth clients, or be the go-to professional in your market. Your referral network is extensive and self-sustaining. Top producers regularly earn $175,000 to $250,000+ annually.

### Geographic Location

Where you work matters immensely. Salaries are higher in metropolitan areas with high costs of living and expensive real estate markets. This is because commissions are a percentage of the loan amount—a larger loan directly translates to a larger commission check.

For example, a mortgage banker in San Jose, CA, or New York, NY, where the median home price is well over $1 million, has a much higher per-deal earning potential than a banker in a market where the median home price is $300,000. States like California, New York, Massachusetts, and Washington consistently rank among the highest-paying locations for loan officers.

### Company Type

The type of institution you work for also shapes your compensation structure.

- Large National Banks (e.g., Chase, Bank of America): These institutions often offer brand recognition, a steady stream of internal leads, and strong benefits packages. However, their commission structures may be more modest compared to other lenders.

- Independent Mortgage Lenders (e.g., Rocket Mortgage, loanDepot): These companies specialize exclusively in mortgages. They often offer more competitive commission splits and a more sales-driven culture. This environment can be highly lucrative for self-motivated individuals who can build their own business.

- Credit Unions: Working for a credit union often means a more stable, member-focused environment. Compensation might include a more generous base salary but potentially smaller commissions compared to independent lenders.

### Area of Specialization

Developing a niche can make you a sought-after expert and significantly boost your income. Specializing allows you to master the unique guidelines and client needs of a particular loan type, leading to more efficient processing and more referrals. High-value specializations include:

- Jumbo Loans: Mortgages that exceed the conforming loan limits set by the FHFA. These are high-value loans for expensive properties, resulting in larger commissions.

- VA Loans: Specializing in loans for veterans and active-duty service members can make you the preferred lender for military communities.

- Construction and Renovation Loans: These are complex loans that require specialized knowledge, a skill that is in high demand among clients building or significantly renovating a home.

Job Outlook

According to the U.S. Bureau of Labor Statistics, the overall employment of loan officers is projected to show little or no change from 2022 to 2032. The BLS notes that increasing automation and online lending platforms may temper growth in the field.

However, this data doesn't tell the whole story. While technology can handle simple applications, the need for skilled, knowledgeable, and trustworthy mortgage bankers remains strong, especially for complex financial situations, first-time homebuyers needing guidance, or clients seeking specialized loan products. The professionals who can build strong relationships and provide expert advice will continue to be in high demand, regardless of technological shifts.

Conclusion

A career as a mortgage banker offers a direct path to a high income, but it is not a traditional salaried role. Your success is intrinsically linked to your effort, expertise, and ability to build a network.

Here are the key takeaways:

- Potential is High: Total compensation can easily exceed six figures for experienced professionals.

- Performance is Everything: Your income is driven by commissions from the loans you close.

- Experience Pays: Your earning power grows significantly as you build your career and referral base.

- Location and Specialization Matter: Working in a high-cost market and developing a niche are powerful strategies for maximizing your salary.

If you are a driven, personable individual with a strong work ethic and a passion for finance, a career as a mortgage banker can be an incredibly rewarding and lucrative path, putting you in the driver's seat of your own financial future.