For those with a keen eye for detail and a knack for financial analysis, a career as a mortgage underwriter can be both intellectually stimulating and financially rewarding. These professionals are the critical gatekeepers of the lending world, making the final decision on one of the most significant financial transactions in a person's life. But what does this responsibility translate to in terms of compensation?

In this comprehensive guide, we'll break down the salary you can expect as a mortgage underwriter, from your first day on the job to becoming a seasoned expert. While average salaries often range from $65,000 to over $100,000 annually, your actual earnings depend on a variety of key factors. Let's explore the data to see what your future could hold.

What Does a Mortgage Underwriter Do?

Before we dive into the numbers, it's essential to understand the role. A mortgage underwriter is a financial detective. Their primary job is to evaluate the risk associated with lending a large sum of money to a homebuyer. They meticulously analyze a loan application package to ensure it meets the lender's and industry's standards.

Key responsibilities include:

- Verifying Financial Information: Scrutinizing income documents (pay stubs, tax returns), asset statements, and employment history.

- Assessing Creditworthiness: Analyzing credit reports to understand an applicant's history of managing debt.

- Evaluating Property Value: Ensuring the appraisal report confirms the property is worth the loan amount.

- Ensuring Compliance: Confirming the loan file adheres to all federal regulations and guidelines set by entities like Fannie Mae, Freddie Mac, the FHA, or the VA.

- Making the Final Decision: Approving, suspending, or denying the loan application based on their comprehensive risk assessment.

In short, they protect the lender from risky loans while helping qualified borrowers achieve their dream of homeownership.

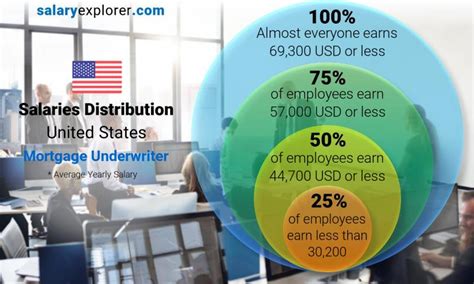

Average Mortgage Underwriter Salary

So, what can you expect to earn for this critical work? While figures vary between data sources, a clear picture emerges when we look at them together.

According to Salary.com, the median annual salary for a Mortgage Underwriter in the United States is approximately $82,271 as of late 2023, with a typical range falling between $70,000 and $96,000.

Other reputable sources provide similar data:

- Glassdoor reports a total pay estimate of around $75,500 per year, which includes base salary and potential additional compensation like bonuses.

- Payscale estimates the average base salary to be closer to $65,000, highlighting that bonuses and profit-sharing can significantly increase total compensation.

It's also useful to look at data from the U.S. Bureau of Labor Statistics (BLS). While the BLS doesn't have a specific category for "mortgage underwriter," it groups them under the broader category of "Loan Officers." For this group, the BLS reported a median annual wage of $76,960 in May 2023. The top 10% of earners in this category made more than $150,000.

This data shows that while a comfortable salary is standard, a six-figure income is well within reach as you gain expertise and experience.

Key Factors That Influence Salary

Your salary isn't a static number. It's influenced by a combination of your professional background, where you work, and what you know. Here are the most significant factors that will shape your earning potential.

### Level of Education

While a specific degree is not always a strict requirement, most employers prefer candidates with a bachelor's degree in a related field like finance, business, or accounting. A degree demonstrates analytical and quantitative skills and can lead to a higher starting salary.

More impactful than an advanced degree (like a Master's) are professional certifications. Earning designations such as an FHA Direct Endorsement (DE) or a VA Lender Appraisal Processing Program (LAPP/SAR) certification can immediately increase your value and earning potential, as it allows you to underwrite government-backed loans, which are always in demand.

### Years of Experience

Experience is arguably the single most important factor in determining an underwriter's salary. The career path typically follows a clear progression:

- Entry-Level / Underwriter I (0-2 years): In this role, you’ll likely start as a loan processor or underwriting assistant before moving into a junior underwriting position. You'll handle less complex files, such as conventional loans for salaried borrowers. Salaries typically range from $55,000 to $70,000.

- Mid-Career / Underwriter II & III (3-7 years): With a few years of experience, you'll be trusted with more complex applications, including loans for self-employed individuals or those with complicated income streams. Your autonomy increases, and so does your pay, often falling in the $70,000 to $95,000 range.

- Senior / Lead Underwriter (8+ years): Senior underwriters are experts who handle the most challenging files, such as jumbo loans or non-qualified mortgages (Non-QM). They often have significant signing authority and may mentor junior staff. At this level, salaries regularly exceed $100,000, and lead or management roles can push compensation to $120,000 or higher.

### Geographic Location

Where you work matters. Salaries for mortgage underwriters are often higher in major metropolitan areas with a high cost of living and robust housing markets. Cities like New York, San Francisco, Los Angeles, and Boston will typically offer higher base salaries to compensate for living expenses. Conversely, salaries may be lower in rural areas or states with a lower cost of living.

The rise of remote work has added a new dimension to this. Some companies pay based on their headquarters' location, while others may adjust your salary based on your geographic location. A remote role can provide an excellent opportunity if you can secure a position with a company based in a high-paying area while living somewhere more affordable.

### Company Type

The type of company you work for can have a significant impact on your compensation structure.

- Large National Banks: Institutions like JPMorgan Chase or Bank of America typically have very structured salary bands, excellent benefits, and a high volume of loans to underwrite.

- Credit Unions: These member-owned institutions often offer competitive salaries, strong benefits, and are known for a positive work-life balance, though their top-end pay may not be as high as at large mortgage lenders.

- Independent Mortgage Lenders: These companies, whose sole business is mortgages, can offer some of the most lucrative opportunities. Compensation is often heavily tied to performance, with significant bonus potential based on the number of loans you underwrite, making it a great fit for efficient, high-performing individuals.

### Area of Specialization

Specializing in high-demand or complex loan types can make you a more valuable asset and boost your salary.

- Government Underwriting (FHA/VA): As mentioned, having certifications to underwrite FHA and VA loans is a major advantage. These loans have unique guidelines, and skilled underwriters are always needed.

- Jumbo & Non-QM Underwriting: These loans fall outside of standard guidelines and are often for high-net-worth clients. They involve greater complexity and risk, and underwriters who can expertly navigate them command premium pay.

- Manual Underwriting: In an age of automated underwriting systems (AUS), the ability to manually underwrite a file—making a decision based purely on a deep analysis of the documents—is a highly respected and well-compensated skill.

Job Outlook

The career outlook for mortgage underwriters is closely tied to the health of the real estate market and interest rate trends. According to the U.S. Bureau of Labor Statistics, the broader field of Loan Officers is projected to grow by 3 percent from 2022 to 2032, which is about as fast as the average for all occupations.

While technology and automated systems continue to streamline the process, they cannot replace the critical thinking and nuanced judgment of a skilled underwriter, especially for complex files. When interest rates are low and refinancing booms, demand for underwriters soars. Even in cooler markets, the need for meticulous risk assessment remains constant. This creates a stable long-term career path for those who build strong skills.

Conclusion

A career as a mortgage underwriter offers a clear path to a strong, competitive salary. While you can expect a solid starting wage, your long-term earning potential is directly in your hands. To maximize your income, focus on the following:

- Gain Experience: Methodically move from simpler to more complex loan files.

- Pursue Certifications: Earn government-related designations like DE and LAPP/SAR to become indispensable.

- Consider Specializing: Develop expertise in high-value areas like jumbo or non-QM loans.

- Be a Top Performer: In an industry where efficiency is valued, speed and accuracy directly translate to higher bonuses and career advancement.

If you are a detail-oriented problem-solver who thrives on making sound financial judgments, mortgage underwriting is a career path that offers both professional satisfaction and the potential for a six-figure income.