A major change is coming to the American workplace, and it could directly impact your salary and work hours. In 2024, the U.S. Department of Labor announced a new rule that significantly increases the minimum salary required for an employee to be considered "exempt" from overtime pay. This change, which takes full effect on January 1, 2025, is poised to extend overtime eligibility to millions of salaried workers across the country.

This article breaks down the new salary law, who it affects, and how it could shape your career and earning potential in the years to come.

What Is the New 2025 Salary Overtime Rule?

At its core, the new rule updates the Fair Labor Standards Act (FLSA). The FLSA requires that most employees in the United States receive overtime pay (at least 1.5 times their regular rate) for all hours worked over 40 in a workweek.

However, some employees can be classified as "exempt" from this requirement if they meet three specific tests:

1. Salary Basis Test: They are paid a fixed salary, not an hourly wage.

2. Salary Level Test: Their salary is above a certain minimum threshold.

3. Duties Test: Their primary job duties involve executive, administrative, or professional (EAP) tasks.

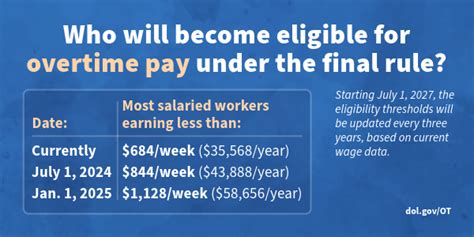

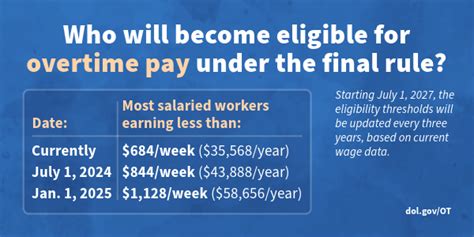

The new rule directly changes the Salary Level Test. For years, the threshold was $35,568 per year. The new rule significantly raises this number in two phases, meaning millions of employees who were previously exempt may now become eligible for overtime pay.

Impact on Salaries: The New Overtime Thresholds

The most critical part of this new rule is the updated salary thresholds. If your salary falls below these new levels, your employer must pay you overtime for any hours worked beyond 40 per week, regardless of your job title or duties.

The new federal salary thresholds are:

- Effective July 1, 2024: The threshold increases to $43,888 per year (equivalent to $844 per week).

- Effective January 1, 2025: The threshold increases again to $58,656 per year (equivalent to $1,128 per week).

Furthermore, the rule increases the threshold for Highly Compensated Employees (HCEs), who are subject to a more lenient duties test. That threshold will rise to $151,164 per year on January 1, 2025.

*(Source: U.S. Department of Labor, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees; Final Rule," 2024.)*

Key Factors: How Will the New Rule Affect You?

The impact of this rule won't be uniform. Several key factors will determine how it affects your job and compensation.

### Level of Education

While the law itself isn't based on education, your field of study often correlates with roles and salaries that are impacted. The "learned professional" exemption under the duties test applies to roles requiring advanced knowledge (e.g., doctors, lawyers, teachers). However, many positions that require a bachelor's degree—such as junior analysts, marketing coordinators, or non-profit program managers—often have starting salaries that may fall below the new $58,656 threshold. Individuals in these roles may find themselves reclassified as non-exempt and eligible for overtime.

### Years of Experience

Experience is perhaps the most significant factor.

- Entry-Level & Early-Career Professionals (0-4 years): This group is most likely to be affected. Roles like Assistant Manager, Staff Accountant, or Human Resources Generalist often have starting salaries in the $45,000 to $60,000 range. According to a 2023 report from the National Association of Colleges and Employers (NACE), the average starting salary for the class of 2022 was around $58,862, placing many new graduates right at the new threshold. Those earning below this will either see a pay raise to remain exempt or be reclassified as non-exempt.

- Mid-Level & Senior Professionals (5+ years): Professionals with significant experience often earn salaries well above the new $58,656 threshold and are less likely to be directly impacted. For instance, a Senior Financial Analyst or an experienced Project Manager typically earns a salary that keeps them in the exempt category.

### Geographic Location

Where you live and work plays a massive role. The federal threshold doesn't account for regional differences in the cost of living.

- High Cost-of-Living (HCOL) Areas: In cities like New York, San Francisco, or Boston, many professional salaries already exceed the new threshold. For example, data from Salary.com shows the median salary for a Marketing Coordinator in New York City is approximately $69,000, well above the new limit. The impact here will be less pronounced.

- Low Cost-of-Living (LCOL) Areas: The rule will have a much larger impact in states and cities with lower living costs. The median salary for that same Marketing Coordinator role in Omaha, Nebraska, is closer to $57,000 (Salary.com). An employee in this role would likely be reclassified as non-exempt, fundamentally changing how they are paid.

### Company Type and Industry

The industry you work in and the size of your company will also influence the outcome.

- Retail, Hospitality, and Non-Profits: These sectors traditionally have many salaried managers and supervisors with pay scales that fall below the new threshold. First-line supervisors in retail, for example, have a national median pay of around $47,750 per year (BLS, 2023). These industries will see a significant number of employees become newly eligible for overtime.

- Tech, Finance, and Consulting: These industries typically offer higher starting salaries. A first-year software developer or financial analyst will often start well above the $58,656 mark, making them largely unaffected by this specific rule change.

- Small Businesses vs. Large Corporations: Large corporations may have dedicated HR and legal teams to manage the transition smoothly, often by raising salaries to maintain exemptions. Small businesses may face a tougher choice between increasing payroll costs or strictly managing employee hours to avoid paying overtime.

### Area of Specialization

Your specific job function is critical. The rule is aimed at roles that may carry a "manager" or "professional" title but involve significant amounts of non-exempt work and have salaries in the lower-to-middle range. Specializations most likely to be reviewed include:

- Retail Store Managers

- Restaurant Assistant Managers

- Administrative Department Supervisors

- Non-Profit Program Coordinators

- Junior Graphic Designers or Content Writers

Job Outlook

This new rule is expected to have a significant effect on the job market itself. While it doesn't directly create jobs, it changes the nature of them. We may see:

1. Increased Demand for HR Professionals: Companies will need experts in compensation, payroll, and compliance to navigate this change. The U.S. Bureau of Labor Statistics (BLS) already projects that employment for Human Resources Specialists will grow by 6% from 2022 to 2032, faster than the average for all occupations. This new rule could accelerate that demand.

2. Shift in Job Structures: Some employers may restructure roles to better separate exempt and non-exempt duties. Other companies may choose to hire more part-time or hourly workers to avoid overtime costs.

3. Salary Compression Adjustments: When companies raise the salaries of their lowest-paid managers to meet the new threshold, they may also need to adjust the pay of more senior employees to maintain a logical pay hierarchy.

Conclusion: Preparing for the Changes

The new 2025 salary overtime rule represents one of the most significant wage-and-hour updates in two decades. For millions of professionals, it brings the potential for better work-life balance and fairer compensation for extra hours worked.

Here are the key takeaways:

- Know the Numbers: The key thresholds are $43,888/year by July 1, 2024, and $58,656/year by January 1, 2025.

- Assess Your Situation: Consider your experience, industry, and location to understand if you are likely to be affected.

- Prepare for a Conversation: If your salary falls below the new threshold, anticipate a discussion with your employer about whether you will receive a pay raise to remain exempt or be reclassified as non-exempt and become eligible for overtime.

This legislation is a powerful reminder that understanding labor laws is a key part of smart career management. By staying informed, you can better advocate for yourself and navigate a changing professional landscape with confidence.