When navigating the professional world, job titles and compensation structures can often seem complex. One term that frequently causes confusion is "non-exempt salaried employee." While it's not a specific job title like "Accountant" or "Project Manager," understanding this classification is absolutely critical to knowing your rights and maximizing your earning potential.

In short, this classification can offer the best of both worlds: the stability of a predictable salary combined with the legal right to overtime pay. The compensation for roles under this classification varies widely, from around $38,000 for entry-level positions to over $75,000 for experienced specialists in high-demand fields. This guide will demystify the non-exempt salaried employee, exploring what it means for your wallet and your career trajectory.

What is a Non-Exempt Salaried Employee?

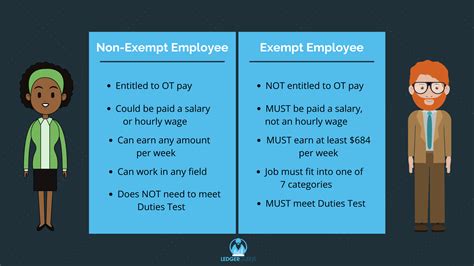

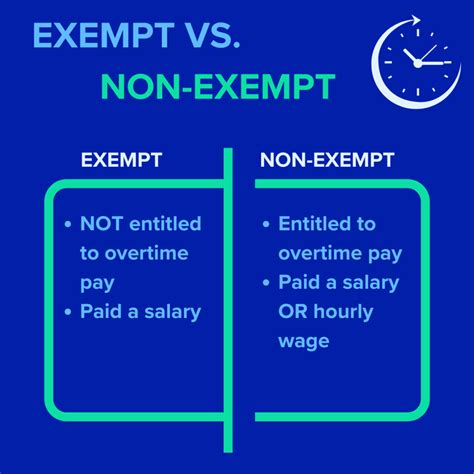

A non-exempt salaried employee is a professional who is paid a fixed annual salary but is still entitled to overtime pay under the Fair Labor Standards Act (FLSA). Let's break that down:

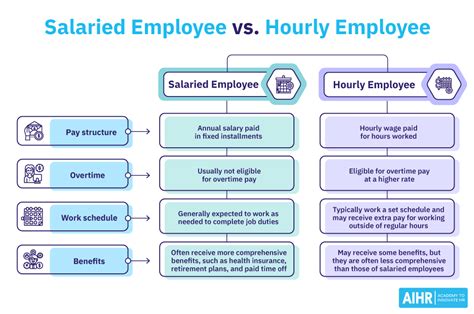

- Salaried: You receive a predetermined, fixed amount of money each pay period. This provides predictable income, unlike hourly work where pay can fluctuate based on the exact hours worked.

- Non-Exempt: This is the key part. You are *not exempt* from the FLSA's overtime provisions. This means your employer must pay you at a rate of at least 1.5 times your regular rate of pay for all hours worked over 40 in a single workweek.

To be classified as "exempt" (and therefore not eligible for overtime), an employee must generally meet three tests: be paid on a salary basis, be paid at least the federal minimum salary threshold ($35,568 per year, or $684 per week, as of early 2024), and perform specific "exempt" job duties (typically executive, administrative, or professional roles). Employees who are paid a salary but do *not* meet the duties test are classified as non-exempt salaried.

Common roles that often fall into this category include:

- Administrative and Executive Assistants

- Paralegals and Legal Assistants

- Customer Service Managers

- Bookkeepers and Accounting Clerks

- Inside Sales Representatives

- Certain entry-level or junior professional roles

Average Salary for Non-Exempt Salaried Roles

Because "non-exempt salaried" is a classification, not a job, there is no single average salary. Compensation depends entirely on the specific role, industry, and location. However, we can look at the salary data for common jobs that are often classified this way.

| Job Title | Median Annual Salary (BLS, 2023) | Typical Salary Range (Aggregator Data, 2024) |

| :--- | :--- | :--- |

| Administrative Assistants | $44,540 | $39,000 - $55,000 |

| Paralegals & Legal Assistants | $60,970 | $48,000 - $78,000 |

| Customer Service Representatives | $38,510 | $34,000 - $47,000 |

| Bookkeeping & Accounting Clerks| $47,440 | $40,000 - $56,000 |

*Sources: [U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook](https://www.bls.gov/ooh/), [Salary.com](https://www.salary.com/), and [Glassdoor.com](https://www.glassdoor.com/) (accessed June 2024). Ranges reflect approximate 25th to 75th percentile earnings.*

Remember, these base salaries do not include potential overtime, which can significantly increase total annual earnings for employees who regularly work more than 40 hours per week.

Key Factors That Influence Salary

Your base salary in a non-exempt role is determined by the same market forces that affect all professions. Understanding these factors is key to negotiating higher pay and advancing your career.

### Level of Education

While many non-exempt roles are accessible with a high school diploma, higher education can unlock higher starting salaries and more specialized positions. For example, a paralegal with an associate's or bachelor's degree and a paralegal certificate will almost always command a higher salary than one without formal credentials. Similarly, certifications in specific software (like QuickBooks for a bookkeeper) or project management can directly translate to a higher paycheck.

### Years of Experience

Experience is one of the most significant drivers of salary. An entry-level Administrative Assistant may start around the national average, but a Senior Executive Assistant with 10+ years of experience supporting C-suite executives can earn upwards of $80,000 or more, according to Payscale data. As you gain experience, you become more efficient, require less supervision, and can handle more complex tasks, making you a more valuable asset to your employer.

### Geographic Location

Where you work matters immensely. A higher cost of living in major metropolitan areas directly correlates with higher salaries. According to BLS data, paralegals in major hubs like San Francisco, CA, and New York, NY, earn significantly more than the national median. In contrast, the same role in a smaller city or rural area will likely pay closer to or below the national median. When considering a role, always weigh the salary against the local cost of living to understand your true purchasing power.

### Company Type and Industry

The size, prestige, and financial health of your employer play a huge role. A non-exempt administrative role at a Fortune 500 tech company or a major corporate law firm will typically pay far more than a similar position at a small non-profit or local business. High-revenue industries like finance, technology, and specialized legal services generally offer more competitive compensation and benefits packages to attract and retain top talent.

### Area of Specialization

Developing a niche skillset is a powerful way to increase your earnings. A generalist customer service representative will earn a standard market rate. However, a technical support representative specializing in complex SaaS products or a bilingual customer service manager will command a premium. For paralegals, specializing in a lucrative and complex area like patent litigation or corporate mergers and acquisitions can lead to salaries that rival many "exempt" professions.

Job Outlook

The job outlook for non-exempt salaried positions is entirely dependent on the specific occupation. It's crucial to research the trajectory of the career path you are interested in.

- Paralegals and Legal Assistants: The outlook is excellent. The BLS projects employment to grow 4% from 2022 to 2032, which is faster than the average for all occupations. This growth is driven by law firms and corporations seeking to increase efficiency and reduce costs by hiring paralegals to perform tasks once handled by lawyers.

- Administrative Assistants: The BLS projects a 7% decline in employment from 2022 to 2032. However, this statistic can be misleading. Technology is automating some routine tasks, but the need for skilled assistants who can manage complex scheduling, coordinate projects, and provide high-level support remains. The BLS still projects about 329,800 openings each year, on average, primarily due to the need to replace workers who retire or change careers.

Conclusion

Being a non-exempt salaried employee is not a career in itself, but rather a beneficial legal classification that provides a stable income with the added protection and earning potential of overtime pay.

Here are your key takeaways:

1. Know Your Rights: Understand that "non-exempt" means you are legally entitled to overtime pay for hours worked beyond 40 per week. Track your hours carefully to ensure you are compensated fairly.

2. Focus on Your Role's Market Value: Your salary is determined by your specific job title, not the classification. Research your role's average pay based on the factors that matter.

3. Invest in Yourself: To maximize your earnings, focus on gaining experience, pursuing relevant education or certifications, and developing valuable specializations.

4. Location and Industry Matter: Be strategic about where you work. A role in a high-paying industry or city can dramatically increase your income, even in a non-exempt position.

By understanding what it means to be a non-exempt salaried employee, you can make more informed career decisions, negotiate from a position of strength, and build a financially rewarding professional life.