A career as a financial advisor offers the potential for significant income, professional autonomy, and the satisfaction of helping clients achieve their financial dreams. For those considering this path, a respected firm like Northwestern Mutual is often a top choice. But what does a Northwestern Mutual Financial Advisor *really* earn?

The answer is more complex than a single number. Unlike a traditional salaried role, compensation is heavily tied to performance, creating a wide range of possible incomes. While entry-level advisors may start modestly, established professionals can achieve six-figure earnings and beyond. This article will break down the compensation structure, salary data from authoritative sources, and the key factors that will determine your earning potential.

What Does a Northwestern Mutual Financial Advisor Do?

A Northwestern Mutual Financial Advisor, often starting as a Financial Representative, is a licensed professional who provides clients with financial guidance and solutions. The role is multifaceted and entrepreneurial. Key responsibilities include:

- Building a Client Base: Proactively prospecting and networking to find new clients.

- Financial Planning: Meeting with clients to understand their financial situation, goals (like retirement, education funding, or wealth transfer), and risk tolerance.

- Providing Solutions: Recommending and selling a range of suitable financial products, primarily Northwestern Mutual's proprietary life and disability insurance, annuities, and investment products.

- Ongoing Service: Maintaining long-term relationships with clients, reviewing their plans periodically, and adjusting strategies as their life circumstances change.

At its core, the job is about building a personal business under the reputable Northwestern Mutual brand.

Average Northwestern Mutual Financial Advisor Salary

Pinpointing an "average" salary for a Northwestern Mutual advisor is challenging because the compensation model is not a straight salary. It is primarily a commission-based structure, especially in the initial years. New advisors often receive a training stipend or allowance to provide some income stability while they build their client book, but long-term earnings are directly linked to sales performance and assets under management.

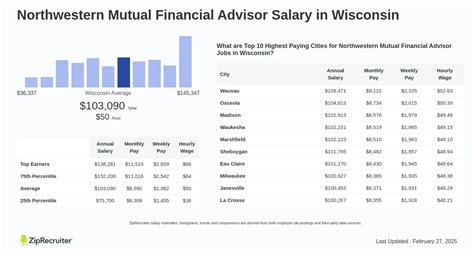

Here's what data from leading salary aggregators suggests:

- Glassdoor reports that the estimated total pay for a Financial Advisor at Northwestern Mutual is approximately $118,500 per year, with a typical range between $77,000 and $183,000. This figure includes a lower estimated base pay (around $62,000) supplemented significantly by additional pay like commissions, bonuses, and profit sharing (around $56,500).

- Payscale shows a wider range, with an average reported salary of around $73,000 per year. However, their data shows a total pay spectrum from $43,000 for the 10th percentile to over $160,000 for the 90th percentile, highlighting the performance-driven variability.

- Salary.com lists the median salary for a "Financial Representative" at Northwestern Mutual at approximately $65,400, but explicitly notes that this does not include bonuses or commissions, which form the bulk of an advisor's income.

Key Takeaway: While starting income might be in the $50,000 to $70,000 range (including initial support), a successful, established advisor with several years of experience can realistically earn $150,000 to $250,000+ annually from new business commissions, renewal commissions on insurance products, and fees from assets under management.

Key Factors That Influence Salary

Your earnings are not predetermined. They are a direct result of your effort, skills, and strategic career choices. Several key factors will influence your income trajectory.

### Years of Experience

This is arguably the most critical factor in a commission-based role. The earnings journey for a financial advisor often follows a "J-curve":

- Years 1-2: This is the building phase. Earnings are typically lowest as you focus on licensing, training, and prospecting for your initial clients. Income is heavily dependent on the company's initial stipend and your ability to generate new business.

- Years 3-5: Momentum builds. Your client base is growing, leading to more referrals. Crucially, you begin earning renewal commissions from insurance policies sold in previous years, creating a more stable income stream on top of new sales.

- Years 5+: This is where top earners emerge. Established advisors have a large book of business that generates significant renewal and fee-based income. Their reputation is solid, referrals are consistent, and they can focus on serving high-value clients.

### Level of Education & Certifications

While a bachelor's degree in a field like finance, business, or economics is a standard entry point, advanced credentials are what truly unlock higher earning potential. Certifications demonstrate expertise and build trust with clients. The most respected designations include:

- CFP® (Certified Financial Planner™): The gold standard in financial planning, covering insurance, investments, retirement, estate, and tax planning.

- ChFC® (Chartered Financial Consultant®): A comprehensive designation similar to the CFP®.

- RICP® (Retirement Income Certified Professional®): Specializes in creating sustainable retirement income plans.

Advisors with these credentials can attract more affluent clients and manage more complex financial situations, directly leading to higher compensation.

### Geographic Location

Where you build your practice matters. Advisors in major metropolitan areas with a higher cost of living and a greater concentration of wealth generally have a higher earning potential. According to Salary.com's analysis, financial advisors in cities like San Francisco, New York, and Boston can earn 15-25% more than the national average. This is because they have access to a larger pool of potential clients with significant assets to invest and protect.

### Business Model Impact

It is essential to understand that working as a Northwestern Mutual advisor means you are operating as an independent contractor, not a traditional employee. You are building your own business with the support, products, and brand of a major corporation. This differs from a bank-based advisor who might receive a higher base salary but a much smaller percentage of the commission, or a fee-only Registered Investment Advisor (RIA) who charges clients directly for advice rather than earning commissions on products. The Northwestern Mutual model offers high-end upside potential but requires a strong entrepreneurial spirit.

### Area of Specialization

Generalist advisors can do well, but specialists often do better. By developing a niche, you become the go-to expert for a specific demographic, which can dramatically increase your income. Examples of profitable specializations include:

- Retirement Planning for Medical Professionals: Doctors and dentists have high incomes but complex financial needs.

- Business Succession Planning: Helping small business owners plan their exit strategies.

- High-Net-Worth Individuals: Providing comprehensive wealth management and estate planning services.

Specialization builds a powerful referral network and allows you to provide higher-value, more lucrative services.

Job Outlook

The future for financial advisors is bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for personal financial advisors is projected to grow 13 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS cites two primary drivers for this growth:

1. The aging population: As the massive Baby Boomer generation enters retirement, the demand for expert retirement planning advice will soar.

2. Increased life expectancy: Longer lifespans require more complex and robust long-term financial strategies.

This projected industry growth provides a stable and expanding market for new and established advisors alike.

Conclusion

A career as a Northwestern Mutual Financial Advisor is not a simple salaried job; it is an entrepreneurial venture with a direct correlation between effort and reward. While the initial years require dedication and perseverance to build a client base, the long-term potential is substantial.

For a driven, self-motivated individual with strong communication and networking skills, this career path offers an opportunity for high six-figure earnings, professional independence, and the profound satisfaction of helping clients secure their financial futures. By focusing on continued education, professional certifications, and developing a niche, you can build a highly successful and rewarding practice.