Are you a salaried professional who regularly works more than 40 hours a week? It's a common belief that a fixed salary automatically disqualifies you from overtime pay. This is one of the most persistent and costly misconceptions in the American workplace. The reality is that millions of salaried employees are legally entitled to overtime compensation, and understanding your rights can significantly impact your financial well-being and work-life balance.

This guide will demystify the complex web of federal and state regulations, explain who is eligible, and empower you with the knowledge to ensure you are being paid fairly for every hour you work.

Understanding the "Salaried vs. Exempt" Distinction

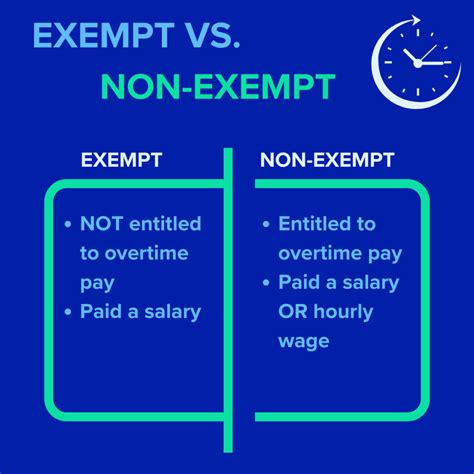

The first and most critical step is to understand that the terms "salaried" and "exempt from overtime" are not the same thing.

- Salaried simply refers to how you are paid: a fixed amount of money per pay period (e.g., weekly, bi-weekly) regardless of the exact hours you work.

- Exempt is a legal classification under the Fair Labor Standards Act (FLSA) that exempts an employer from the legal requirement to pay an employee overtime.

Many employees are salaried but are legally considered non-exempt, meaning they are still entitled to overtime pay (1.5 times their regular rate of pay) for any hours worked beyond 40 in a workweek. To be legally classified as exempt, an employee must meet specific criteria related to their salary and job duties, as defined by the U.S. Department of Labor (DOL).

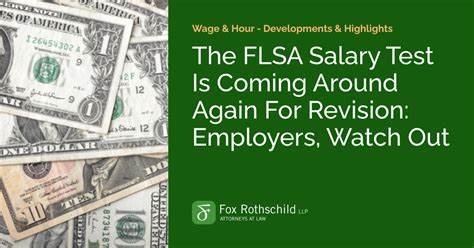

The FLSA Salary Threshold Test

For most employees, the first test for determining overtime exemption is the salary threshold. If you earn a salary below this specific amount, you are automatically eligible for overtime, regardless of your job title or duties.

The U.S. Department of Labor has issued a final rule, effective in 2024 and 2025, significantly increasing this threshold.

- Current Standard Salary Level (until June 30, 2024): $684 per week, which is equivalent to $35,568 per year.

- New Salary Level (effective July 1, 2024): $844 per week, which is equivalent to $43,888 per year.

- New Salary Level (effective January 1, 2025): $1,128 per week, which is equivalent to $58,656 per year.

*Source:* *U.S. Department of Labor, "Final Rule: Restoring and Extending Overtime Protections," April 2024.*

If your salary falls below these federal thresholds during the specified timeframes, you are legally non-exempt and must be paid overtime.

Key Factors That Determine Overtime Eligibility

If you earn *more* than the salary threshold, you are not automatically exempt. Your employer must also prove that your specific job responsibilities meet the "duties test." This is where the classification becomes more complex.

### The "Duties Test": What You Actually Do

Your job title does not determine your eligibility; your day-to-day responsibilities do. To be exempt, your primary duties must fall into one of the following "EAP" categories.

- Executive Exemption: Your primary duty must be managing the enterprise or a recognized department. You must customarily and regularly direct the work of at least two full-time employees, and you must have the authority to hire or fire other employees (or your recommendations on these matters must be given particular weight).

- Administrative Exemption: Your primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or its customers. Your role must also include the exercise of discretion and independent judgment with respect to matters of significance. This is often the most misapplied exemption. Roles like executive assistants who primarily handle scheduling or routine tasks typically do not qualify.

- Professional Exemption: This splits into two types:

- Learned Professional: Your primary duty must be work requiring advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (e.g., doctors, lawyers, engineers, accountants).

- Creative Professional: Your primary duty must be work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., artists, musicians, writers, actors).

### Geographic Location

While the FLSA sets the federal floor, many states have their own, more protective labor laws. It is crucial to check your state's regulations, as they may provide a higher salary threshold or have stricter definitions for the duties test.

For example:

- California: As of 2024, the minimum salary for exempt employees is $66,560 per year, significantly higher than the federal level. California also has very strict duties test requirements.

- New York: The salary threshold varies by region, with the highest requirement in New York City, Long Island, and Westchester County (currently $1,200/week or $62,400/year).

Always refer to your specific state’s Department of Labor website for the most accurate and up-to-date information.

### The Highly Compensated Employee (HCE) Test

The FLSA has a separate, more streamlined test for highly compensated employees. To qualify:

- An employee must earn a total annual compensation of $107,432 or more (this will increase to $132,964 on July 1, 2024, and $151,164 on January 1, 2025).

- The employee must customarily and regularly perform at least one of the duties of an exempt executive, administrative, or professional employee.

This test is simpler because it does not require the employee's "primary duty" to be exempt work.

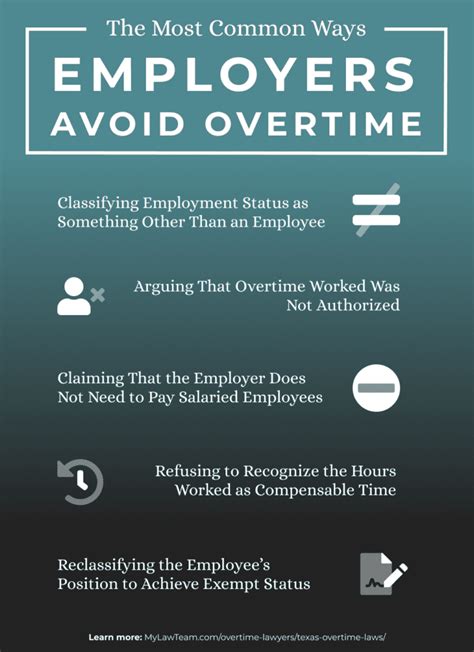

### Special Exemptions and Common Misconceptions

Certain job categories have unique rules. For example, outside sales employees, computer professionals (who may be paid hourly at a high rate or a salary above a certain threshold), and certain transportation workers are subject to special exemptions.

A common area of misclassification is the "assistant manager" role in retail or food service. These individuals are often salaried but spend the vast majority of their time on non-exempt tasks like running a cash register, stocking shelves, or cleaning. If their primary duties are not managerial, they are likely owed overtime despite their title.

What to Do If You Believe You're Owed Overtime

Navigating this situation requires professionalism and a clear strategy.

1. Review Your Job Duties: Objectively analyze your day-to-day tasks. How much of your time is spent on managerial, administrative, or professional duties versus routine, non-exempt work?

2. Document Everything: Keep a private, detailed log of the hours you work each day. Note the specific tasks you perform.

3. Consult Your Company's HR Department: Approach them with a calm, professional inquiry. You could frame it as, "I've been reading about FLSA classifications and I'd like to better understand how my role is classified as exempt."

4. Seek Legal Counsel: If you are not satisfied with the response or are hesitant to speak with HR, consult an employment law attorney. Most offer free initial consultations to evaluate your case.

5. File a Complaint: You can file a wage complaint directly with the U.S. Department of Labor’s Wage and Hour Division or your state’s labor agency.

Conclusion: Know Your Worth and Your Rights

Understanding overtime laws is not just about legal compliance; it's about valuing your time and expertise. As a professional, your greatest assets are your skills and the hours you dedicate to your work. Misclassification can cost you thousands of dollars in lost wages annually and contribute to burnout.

Key Takeaways:

- "Salaried" does not automatically mean "exempt from overtime."

- Your eligibility depends on three tests: the Salary Basis Test (you're paid a salary), the Salary Level Test (your salary is above the legal threshold), and the Duties Test (your job functions meet specific criteria).

- The federal salary threshold is increasing significantly in 2024 and 2025, making millions more workers eligible for overtime.

- State laws can offer even greater protection than federal law.

- Empower yourself by documenting your hours, understanding your duties, and seeking expert advice when necessary.

By staying informed, you can ensure you are compensated fairly, protect your work-life balance, and continue to build a rewarding and sustainable career.