Are you drawn to a career that combines meticulous analytical skill with a direct, tangible impact on every person in an organization? Do you see yourself as the quiet engine of a company, ensuring its most valuable asset—its people—are compensated accurately and on time? If so, a career as a payroll accountant might be your calling. This isn't just about crunching numbers; it's about upholding trust, ensuring legal compliance, and safeguarding the financial well-being of an entire workforce. The demand for this expertise is reflected in the payroll accountant salary, which offers a stable and rewarding financial path, with the U.S. national average hovering around $65,000 to $75,000 annually, and top earners with specialized skills exceeding $100,000.

I learned the true importance of this role early in my career. I once received a paycheck where a significant amount of overtime was miscalculated due to a system glitch during a software migration. The wave of panic was immediate—bills were due, and my budget was tight. The person who calmly listened, investigated the issue, and manually processed the correction wasn't just a faceless administrator; she was a problem-solver who restored my financial peace of mind. That experience cemented my belief that great payroll accountants are the unsung heroes of the corporate world, blending technical accounting prowess with a distinctly human touch.

This guide is designed to be your definitive resource for understanding the complete landscape of a payroll accountant career. We will dissect salary expectations, explore the factors that can maximize your earning potential, and lay out a clear, step-by-step roadmap to get you started.

### Table of Contents

- [What Does a Payroll Accountant Do?](#what-they-do)

- [Average Payroll Accountant Salary: A Deep Dive](#deep-dive)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#get-started)

- [Conclusion: Is This the Right Career for You?](#conclusion)

What Does a Payroll Accountant Do?

A payroll accountant is a specialized financial professional who bridges the gap between the human resources (HR) and accounting departments. While a payroll specialist or processor might focus primarily on the administrative task of running payroll, a payroll *accountant* takes a broader, more analytical view. They are responsible for not only processing payroll but also for reconciling it with the company's general ledger, ensuring tax compliance, managing financial reporting related to compensation, and analyzing payroll data to support business decisions.

Their role is a critical control function within any organization. They ensure that every dollar spent on employee compensation—from salaries and wages to bonuses, commissions, and benefits—is accurately recorded, accounted for, and compliant with a complex web of federal, state, and local regulations.

Core Responsibilities and Daily Tasks:

A payroll accountant's work is a mix of cyclical, recurring tasks and more strategic, project-based work.

- Payroll Processing & Verification: While they may oversee or execute it, their key role is verifying the accuracy of payroll runs. This includes checking hours, pay rates, overtime calculations, commissions, and bonus payments before disbursement.

- General Ledger (GL) Reconciliation: This is a cornerstone of the role. After payroll is run, the payroll accountant creates and posts journal entries to the general ledger, ensuring that all payroll-related expenses (wages, taxes, benefits contributions) are correctly recorded in the company's main accounting system. They perform monthly reconciliations of all payroll-related accounts to identify and correct discrepancies.

- Tax Compliance & Filing: They are responsible for calculating, withholding, and remitting all payroll taxes, including federal income tax, Social Security, Medicare (FICA), and federal and state unemployment taxes (FUTA/SUTA). This also involves preparing and filing quarterly (Form 941) and annual tax reports.

- Benefits Administration Accounting: They work with HR to account for employee benefits deductions, such as health insurance premiums, 401(k) contributions, and other voluntary deductions. They also reconcile carrier invoices against payroll deductions.

- Reporting and Analysis: They generate a variety of reports for management, including labor cost analysis, overtime reports, and budget vs. actual compensation reports. This data helps leaders make informed decisions about staffing, budgeting, and operational efficiency.

- Audits and Controls: They are the primary point of contact for internal and external audits related to payroll, such as the annual 401(k) audit or workers' compensation audits. They must maintain meticulous records and ensure internal controls are robust to prevent fraud and errors.

- System Maintenance: They often play a role in maintaining and optimizing the payroll and timekeeping systems (like ADP, Workday, or Paychex), ensuring pay codes, tax rates, and deduction rules are up-to-date.

### A "Day in the Life" of a Payroll Accountant (During a Payroll Week)

8:30 AM: Arrive and log in. The first task is reviewing the preliminary payroll register for the upcoming pay date. Scan for any glaring errors or anomalies—an employee with an unusually high or low net pay, missing hours, or an incorrect pay rate flagged by the system.

9:15 AM: A manager emails, noting that a new hire's signing bonus was not included in the preliminary run. Investigate the issue. It turns out the bonus approval was processed after the cutoff. Coordinate with HR and the manager to ensure the payment is processed as a special off-cycle check and that the proper approvals are documented for audit purposes.

10:30 AM: Time for detailed reconciliation. Export data from the payroll system (e.g., ADP) and begin matching it against timekeeping system reports (e.g., Kronos). This involves using Excel VLOOKUPs or pivot tables to ensure all approved hours, especially overtime and shift differentials, have been correctly transmitted.

12:00 PM: Lunch break.

1:00 PM: Focus on compliance. Review a memo from the legal department about a new local paid sick leave ordinance in a city where the company has a remote employee. Research the new regulation, determine how it impacts accruals, and schedule a task to update the payroll system's rules before the next pay cycle.

2:30 PM: The payroll is finalized and ready for processing. Perform a final review and then submit the file for funding. Once confirmed, begin drafting the general ledger journal entry. This entry will debit wage expenses, tax expenses, and employer benefit costs, and credit various liability accounts (like taxes payable and cash).

4:00 PM: Work on a month-end task: reconciling the health insurance liability account. Compare the total deductions taken from employees' paychecks for the month with the invoice received from the insurance carrier. Identify and investigate a small discrepancy, tracing it back to an employee who changed their coverage mid-month.

5:00 PM: Field a final question from an employee about their 401(k) contribution percentage. Look up their record, confirm the details, and provide a clear, helpful response. Tidy up the digital workspace, plan tomorrow's tasks (which will focus on post-payroll reporting), and head home.

Average Payroll Accountant Salary: A Deep Dive

Understanding the financial potential of a career is essential. For payroll accountants, the salary is competitive and reflects the critical nature of their work. Compensation is not just a single number; it's a package that includes a base salary, potential bonuses, and benefits, all of which grow significantly with experience.

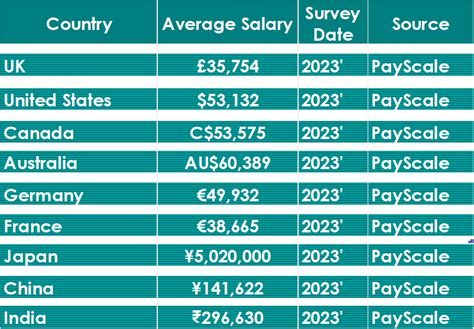

For our analysis, we will draw upon data from the most trusted sources in the industry. It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups payroll accountants under the broader category of "Accountants and Auditors." While this provides an excellent high-level view of the accounting profession, we will supplement it with more specific data from leading salary aggregators.

### National Averages and Typical Salary Ranges

According to recent data from several authoritative sources:

- Salary.com (as of late 2023) reports that the median salary for a Payroll Accountant I in the United States is $65,101. The typical range falls between $58,375 and $72,593. For a more senior Payroll Accountant III, the median jumps to $86,076, with a range typically between $77,055 and $96,009.

- Payscale.com indicates a similar trend, showing an average salary for a Payroll Accountant at approximately $62,500 per year. Their data emphasizes the significant impact of experience on earnings.

- Glassdoor, which aggregates self-reported data, lists the average base pay for a Payroll Accountant at around $73,250 per year, with total pay (including bonuses and other compensation) often reaching higher.

The U.S. Bureau of Labor Statistics (BLS), in its Occupational Outlook Handbook for Accountants and Auditors, reported a median annual wage of $78,000 in May 2022. While this category is broader, it confirms that roles requiring specialized accounting knowledge, like that of a payroll accountant, are well-compensated.

Key Takeaway: A reasonable expectation for a qualified payroll accountant is a starting salary in the $55,000 to $65,000 range, moving into the $70,000 to $85,000 range with mid-career experience, and potentially exceeding $95,000+ in senior, lead, or management roles, especially in high-cost-of-living areas or complex organizations.

### Salary by Experience Level

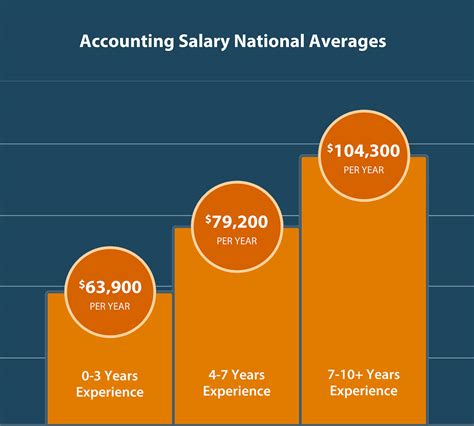

Your value—and therefore your salary—grows directly with your experience. As you move from executing tasks to managing processes and then to strategizing, your compensation reflects that increased responsibility.

| Experience Level | Typical Years of Experience | Average Salary Range (Annual) | Key Responsibilities |

| ----------------------- | --------------------------- | ----------------------------- | -------------------------------------------------------------------------------------------------------------------- |

| Entry-Level Payroll Accountant | 0-2 Years | $55,000 - $68,000 | Data entry, assisting with payroll processing, basic reconciliations, responding to employee queries, learning systems. |

| Mid-Career Payroll Accountant | 3-6 Years | $68,000 - $82,000 | Full-cycle payroll processing, complex GL reconciliations, tax filings, handling payroll for multiple states, audits. |

| Senior Payroll Accountant | 7-10+ Years | $80,000 - $98,000+ | Managing payroll team, system implementation, process improvement, strategic analysis of labor costs, complex compliance. |

| Payroll Manager/Director | 10+ Years | $95,000 - $130,000+ | Overseeing entire payroll function, department strategy, vendor management, executive reporting, global payroll. |

*Source: Synthesized data from Salary.com, Payscale, and Glassdoor (2023/2024).*

### Beyond the Base Salary: Understanding Total Compensation

Your salary is just one piece of the puzzle. Total compensation provides a more accurate picture of your earnings. For a payroll accountant, this package often includes:

- Bonuses: Annual performance bonuses are common, especially in corporate environments. These can range from 3% to 15% of the base salary, depending on individual and company performance. A senior payroll accountant with a salary of $90,000 might receive a bonus between $4,500 and $13,500.

- Profit Sharing: Some companies, particularly private or smaller firms, offer profit-sharing plans where a portion of the company's profits is distributed to employees. This can add a significant, though variable, amount to your annual income.

- Retirement Contributions: A strong 401(k) or 403(b) plan with a generous employer match is a critical component of compensation. A company that matches 100% of your contributions up to 6% of your salary is effectively giving you a 6% raise dedicated to your retirement.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance are standard. The value of this benefit can be substantial, as employer contributions to premiums can save you thousands of dollars a year.

- Paid Time Off (PTO): A generous PTO policy (including vacation, sick leave, and holidays) is another valuable, non-monetary benefit.

- Professional Development: Many employers will pay for relevant certifications (like the CPP), continuing education courses, and memberships in professional organizations like the American Payroll Association (APA). This is a direct investment in your future earning power.

When evaluating a job offer, it's crucial to look beyond the base salary and calculate the total value of the compensation package being offered.

Key Factors That Influence Your Salary

While national averages provide a useful benchmark, your specific salary as a payroll accountant will be determined by a combination of powerful factors. Understanding these levers is the key to maximizing your earning potential throughout your career. Think of your career as an equation; each of these factors is a variable you can influence.

###

Level of Education

Your educational foundation sets the stage for your career trajectory.

- Associate's Degree: An Associate's degree in Accounting or a related field can be a sufficient entry point for junior or assistant payroll accountant roles, particularly in smaller companies. It provides the fundamental knowledge needed for processing and basic reconciliations. However, it may limit upward mobility into senior and management positions.

- Bachelor's Degree: This is the standard and most common requirement for payroll accountant roles. A Bachelor's degree in Accounting is the gold standard, as it provides a deep understanding of Generally Accepted Accounting Principles (GAAP), financial reporting, and auditing—all of which are central to the role. Degrees in Finance or Business Administration are also highly relevant. A bachelor's degree typically unlocks opportunities for higher starting salaries and is often a prerequisite for senior positions.

- Master's Degree: A Master of Accountancy (MAcc) or an MBA with an accounting concentration can provide a significant salary boost and accelerate your path to leadership. It is particularly valuable for those aspiring to become a Payroll Manager, Controller, or Director of Finance. It signals a high level of expertise in financial strategy, internal controls, and management.

- Professional Certifications: This is arguably one of the most impactful ways to increase your salary.

- Certified Payroll Professional (CPP): Offered by the American Payroll Association (APA), the CPP is the most prestigious certification in the payroll industry. It demonstrates mastery of complex payroll topics, including taxation, benefits, wage and hour laws, and payroll systems. According to the APA, certified professionals can earn up to $15,000 more per year than their non-certified counterparts. It signals to employers that you are a dedicated expert.

- Fundamental Payroll Certification (FPC): Also from the APA, the FPC is an excellent entry-level certification for those new to the field. It validates your baseline knowledge and can help you secure your first role or an early-career promotion.

- Certified Public Accountant (CPA): While not strictly required for payroll, holding a CPA license makes you an exceptionally strong candidate. It signifies the highest level of competence in accounting and is highly sought after for senior and management roles where payroll is integrated into the broader financial strategy of the organization. A Payroll Accountant with a CPA can command a premium salary.

###

Years of Experience

Experience is the single most significant driver of salary growth in this field. Employers pay a premium for professionals who have navigated complex payroll scenarios, managed system implementations, and successfully handled audits.

- 0-2 Years (Entry-Level): At this stage, you're learning the ropes. Your focus is on accurate data processing, understanding the payroll cycle, and mastering the company's specific software. Your salary will be at the lower end of the spectrum, likely in the $55,000 - $68,000 range.

- 3-6 Years (Mid-Career): You are now a fully proficient and independent contributor. You can handle the entire payroll cycle for a multi-state workforce, perform complex reconciliations without supervision, and begin to train junior staff. You are the go-to person for resolving moderately complex issues. Your salary climbs into the $68,000 - $82,000 bracket.

- 7-10+ Years (Senior/Lead): You are no longer just processing payroll; you are improving it. You lead process improvement projects, play a key role in selecting and implementing new payroll systems, manage audits, and provide analytical insights to leadership. You may have direct reports. At this level, salaries regularly push into the $80,000 - $98,000+ range. Holding a CPP or CPA at this stage can easily push your earnings over the $100,000 mark.

###

Geographic Location

Where you work matters—a lot. Salaries are adjusted for the local cost of living and the demand for talent in a specific market. Major metropolitan areas with high concentrations of corporate headquarters and high living costs will always pay more than smaller towns or rural areas.

High-Paying Metropolitan Areas:

| City | Average Payroll Accountant Salary | Why it's High |

| ----------------------- | --------------------------------- | ----------------------------------------------------------------------------- |

| San Jose, CA | $85,000 - $105,000+ | Tech hub with complex equity compensation (stock options, RSUs), high cost of living. |

| New York, NY | $80,000 - $100,000+ | Global finance center, massive corporate presence, very high cost of living. |

| Boston, MA | $78,000 - $98,000+ | Biotech, finance, and tech industries, strong economy, high cost of living. |

| Washington, D.C. | $75,000 - $95,000+ | Government contractors, non-profits, and lobbying firms with complex regulations. |

| Seattle, WA | $75,000 - $95,000+ | Major tech companies (Amazon, Microsoft) drive up wages, high cost of living. |

*Source: Data ranges synthesized from Salary.com and Glassdoor for metropolitan statistical areas.*

Lower-Paying States/Regions:

Conversely, states in the South and Midwest with a lower cost of living tend to offer lower base salaries, though the purchasing power may be comparable. For example, a payroll accountant in cities like Memphis, TN, or Omaha, NE, might see salaries closer to the $55,000 - $70,000 range. The rise of remote work is starting to blur these lines, but location remains a dominant factor for in-office and hybrid roles.

###

Company Type & Size

The type and scale of your employer create different environments and compensation structures.

- Large Corporations (Fortune 500): These companies typically offer the highest base salaries and most structured bonus programs. Payroll is often highly complex, involving thousands of employees across multiple states or even countries (global payroll). They have dedicated payroll departments and clear career progression paths.

- Startups and Small/Medium-Sized Businesses (SMBs): Base salaries might be slightly lower than at large corporations. However, compensation can be supplemented with stock options or other forms of equity, which can have a huge upside if the company is successful. The role is often broader, requiring you to wear multiple hats (e.g., handling some HR or general accounting duties as well).

- Government (Federal, State, Local): Government jobs are known for stability and excellent benefits, including pensions, which are rare in the private sector. The base salary may be slightly less competitive than in the top-tier corporate world, but the total compensation package, when factoring in benefits and job security, is often very attractive.

- Non-Profit Organizations: These roles are often mission-driven. Salaries tend to be lower than in the for-profit sector due to budget constraints. However, they can offer great work-life balance and a strong sense of purpose.

- Public Accounting / Payroll Service Providers (e.g., ADP, Paychex): Working for a company that *provides* payroll services to other businesses offers a unique experience. You gain exposure to a wide variety of clients and industries, which can rapidly accelerate your learning. Compensation is competitive and often includes strong performance-based incentives.

###

Area of Specialization

Within the payroll accounting field, developing specialized expertise can make you a more valuable and higher-paid professional.

- Global/Expat Payroll: Managing payroll for employees in multiple countries is extremely complex due to varying tax laws, currencies, and labor regulations. Professionals with this expertise are in high demand and command premium salaries.

- Systems Implementation: Being an expert in a specific, popular HRIS/payroll platform like Workday, SAP SuccessFactors, or Oracle is a highly marketable skill. Companies pay top dollar for professionals who can lead the implementation or optimization of these complex systems.

- Equity Compensation: In the tech and finance industries, managing payroll that includes restricted stock units (RSUs), stock options, and employee stock purchase plans (ESPPs) requires specialized knowledge of tax implications and reporting. This is a lucrative niche.

- Union/Certified Payroll: In industries like construction and manufacturing, dealing with union contracts, prevailing wage laws (Davis-Bacon Act), and certified payroll reporting is a highly specialized skill set that is always in demand.

###

In-Demand Skills

Beyond your formal qualifications, a specific set of skills will directly impact your salary negotiations and career growth.

Technical/Hard Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a power user, comfortable with PivotTables, VLOOKUP/HLOOKUP/XLOOKUP, INDEX/MATCH, SUMIFs, and other advanced formulas for reconciliation and analysis.

- Payroll Software Proficiency: Deep knowledge of at least one major payroll platform (e.g., ADP Workforce Now, Workday, Paylocity, UKG) is critical. The more systems you know, the more marketable you are.

- Data Analysis & SQL: The ability to query databases using SQL to pull custom reports or analyze payroll data is a growing requirement, especially in larger companies. It allows you to move beyond reporting into true business intelligence.

- GAAP & Accounting Principles: A rock-solid understanding of accounting principles is what separates a payroll *accountant* from a processor. This includes knowledge of accruals, liabilities, and financial statement impacts.

Soft Skills:

- Meticulous Attention to Detail: An error of a single decimal point can have massive consequences. This is the most crucial soft skill.

- Problem-Solving: You will constantly be investigating discrepancies and finding solutions to unique payroll challenges.

- Discretion and Confidentiality: You handle some of the most sensitive data in a company. Unwavering integrity is mandatory.

- Communication: You must be able to clearly explain complex payroll and tax issues to employees, managers, and executives who do not have a financial background.

Job Outlook and Career Growth

Choosing a career is an investment in your future, so understanding its long-term viability is paramount. For payroll accountants, the future is stable, with consistent demand and an evolving set of responsibilities that offer significant opportunities for growth.

### A Stable and Growing Profession

The U.S. Bureau of Labor Statistics (BLS), in its 2022 projections for the decade ahead (2022-2032), forecasts positive growth for the broader "Accountants and Auditors" category.

- Job Growth: The BLS projects employment in this field to grow by 4 percent from 2022 to 2032. While this is about as fast as the average for all occupations, it translates to a significant number of job openings.

- Job Openings: This growth is expected to result in about 126,500 openings for accountants and auditors each year, on average, over the decade. Many of these openings will stem from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

Why is the demand so consistent?

1. Regulatory Complexity: Tax codes and labor laws are constantly changing at the federal, state, and even city level. Businesses need knowledgeable professionals to navigate this complexity, avoid costly penalties, and ensure compliance. The rise of remote work has only amplified this, creating multi-state tax nexus issues for many companies.

2. Economic Growth: As the economy grows, businesses are created, and existing ones expand. More businesses mean more employees, which directly translates to a greater need for payroll and accounting services.

3. Data-Driven Decision Making: Companies are increasingly looking to their payroll data as a source of strategic insight. Payroll accountants who can analyze trends in labor costs, overtime, and turnover are becoming valuable strategic partners to leadership.

4. Globalization: As more companies operate internationally, the need for experts in global payroll, who can handle the complexities of different currencies, tax treaties, and international labor laws, continues to rise.

### Emerging Trends and Future Challenges

The role of the payroll accountant is not static. Technology and changing business practices are reshaping the profession. To thrive, you must adapt to these trends.

Key Trend #1: Automation and AI

- **Challenge