Understanding the structure of your compensation is a cornerstone of effective career management. For many professionals, securing a "salaried" position is a major goal, often associated with stability and career advancement. But what does it actually mean to be salaried? This classification involves more than just a steady paycheck; it has legal implications, affects your work-life balance, and is influenced by a host of professional factors.

Salaried roles offer predictable income and are typical for professional, administrative, and executive positions across countless industries. While there is no single "average salary"—as it depends entirely on the specific job—salaries for professional roles can range from approximately $60,000 for entry-level specialists to well over $200,000 for senior managers and executives.

This guide will demystify the concept of the salaried employee, explore the key factors that determine your salary's value, and help you understand your rights and potential earnings in the professional world.

What is a Salaried Employee?

A salaried employee is paid a fixed, predetermined amount of money each year, known as an annual salary. This amount is then paid out in regular increments, such as weekly, bi-weekly, or monthly, regardless of the exact number of hours worked during that pay period.

The key distinction for most salaried professionals in the United States lies in their classification under the Fair Labor Standards Act (FLSA). Most salaried employees are considered "exempt," which means they are exempt from federal overtime pay requirements.

To be classified as exempt, an employee must meet three criteria:

1. Be paid on a salary basis, not hourly.

2. Be paid at least the federal minimum salary threshold, which is $684 per week ($35,568 per year) as of 2024. Note that some states, like California and New York, have significantly higher minimum salary thresholds.

3. Perform specific job duties that fall under the FLSA's "executive," "administrative," or "professional" exemptions. These roles typically involve significant discretion, independent judgment, and management responsibilities.

This is why an entry-level administrative assistant and a CEO can both be salaried, but their roles, responsibilities, and exemption status under the law define the nature of their compensation.

Understanding Salary Benchmarks and Averages

There is no single "average salaried salary" because the term applies to nearly every professional occupation. Your salary is determined by your specific job title, industry, and qualifications.

To provide a clear picture, let's look at the median annual salaries for several common salaried professions, based on the latest data from the U.S. Bureau of Labor Statistics (BLS) as of May 2023.

| Job Title | Median Annual Salary (May 2023) | Typical Education |

| :--- | :--- | :--- |

| Software Developers | $131,900 | Bachelor's Degree |

| Marketing Managers | $156,580 | Bachelor's Degree |

| Financial Analysts | $99,740 | Bachelor's Degree |

| Accountants and Auditors | $79,880 | Bachelor's Degree |

| Human Resources Specialists | $67,650 | Bachelor's Degree |

*Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook (Data from May 2023).*

As you can see, the "average" is highly dependent on the field. Professionals should use resources like the BLS, Glassdoor, Payscale, and Salary.com to research the specific salary ranges for their desired role, location, and experience level.

Key Factors That Influence Salary

Your salary isn't a random number; it's a calculated figure based on the value you bring to an organization. Several key factors determine your earning potential.

###

Level of Education

Your educational background provides the foundational knowledge for your career and directly impacts your starting salary and long-term growth. BLS data consistently shows a strong correlation between education level and earnings. For example, professionals with a Master's degree earn a median of nearly $1,700 per week, compared to around $1,400 for a Bachelor's degree holder. A professional or doctoral degree pushes that figure even higher. For specialized roles in medicine, law, or research, an advanced degree isn't just a benefit—it's a requirement for high-paying positions.

###

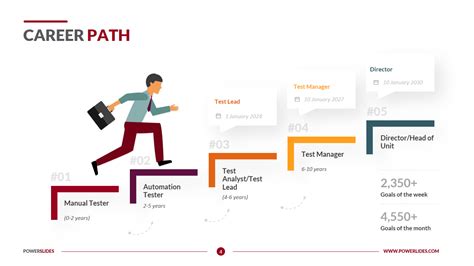

Years of Experience

Experience is a powerful driver of salary growth. As you move from an entry-level to a senior position, your compensation grows to reflect your expanded skills, proven track record, and increased responsibilities.

- Entry-Level (0-2 years): Focus is on learning and applying academic knowledge. Salary is at the lower end of the market range.

- Mid-Career (3-8 years): Professionals have developed expertise and can manage projects or teams. Salary sees significant growth.

- Senior/Lead (8+ years): These individuals are experts who drive strategy, mentor others, and hold significant organizational responsibility, commanding top-tier salaries.

###

Geographic Location

Where you work matters immensely. Salaries are often adjusted based on the local cost of living and the demand for talent. A marketing manager in a high-cost city like San Francisco or New York City will earn substantially more than a counterpart in a lower-cost city like Omaha, Nebraska, simply because housing, taxes, and general expenses are higher. Many companies use location-based pay scales to ensure their compensation remains competitive and fair across different regions.

###

Company Type and Industry

The type of organization you work for and its industry play a major role in its compensation philosophy.

- Large Tech Companies (e.g., Google, Microsoft): Often offer top-of-the-market salaries, stock options, and extensive benefits to attract the best talent.

- Startups: May offer lower base salaries but compensate with significant equity (stock options), which can have a high potential payoff if the company succeeds.

- Non-Profits and Government: Typically offer lower salaries than the private sector but often provide excellent benefits, job security, and a strong sense of mission.

- Industry: A software developer working in the high-margin FinTech or Health Tech industries will likely earn more than a developer with similar skills working in the non-profit sector.

###

Area of Specialization

Within any given profession, specialization can lead to a significant salary premium. This is driven by supply and demand. Roles requiring niche, highly technical, or in-demand skills command higher pay. For example, within accounting, a Forensic Accountant specializing in fraud detection will often earn more than a General Accountant. Similarly, within software engineering, a specialist in Artificial Intelligence or Cybersecurity will typically have a higher earning potential than a general web developer.

Salaried vs. Hourly: The Key Differences

Understanding the distinction between salaried and hourly work is crucial for career planning.

| Feature | Salaried Employee | Hourly Employee |

| :--- | :--- | :--- |

| Pay Structure | Receives a fixed annual salary paid in regular, predictable installments. | Paid a set rate for each hour worked. Paycheck can vary based on hours. |

| Overtime Pay | Typically "exempt" and not eligible for overtime pay. | "Non-exempt" and must be paid 1.5x their hourly rate for hours worked over 40 in a week. |

| Income Stability | High. Income is predictable and does not fluctuate with daily workload. | Variable. Income can fluctuate based on business needs, available shifts, or seasonal demand. |

| Benefits | Often includes a more comprehensive benefits package (PTO, health insurance, retirement plans). | Benefits can vary widely but are increasingly common, especially for full-time hourly roles. |

| Work-Life Balance | Can be a double-edged sword. Offers flexibility but can lead to working over 40 hours without extra pay. | A clearer line between work and personal time. When you clock out, you are off the clock. |

Conclusion: Empowering Your Career Path

Being a salaried employee signifies a commitment between you and your employer based on professional output rather than hours logged. It offers the stability and predictability that are essential for long-term financial and career planning.

Key Takeaways for Your Career:

- Understand Your Classification: Know whether you are an "exempt" or "non-exempt" salaried employee, as this affects your right to overtime pay.

- Know Your Worth: Your salary is not arbitrary. It is determined by your education, experience, location, industry, and specialization.

- Research and Negotiate: Use authoritative resources like the BLS and salary aggregators to benchmark your role. Don't be afraid to negotiate a salary that reflects your true market value.

By understanding the dynamics of salaried compensation, you empower yourself to make smarter career decisions, advocate for your worth, and build a financially secure and professionally rewarding future.