A career as a Payroll Administrator offers a stable and rewarding path for detail-oriented professionals who are crucial to the smooth operation of any business. But what does that stability translate to in terms of salary? If you're considering this career, understanding your potential earnings is a critical first step.

On average, a payroll administrator in the United States can expect to earn a salary ranging from $45,000 to over $75,000 annually. However, this figure is just the starting point. Your specific earnings can vary significantly based on a combination of factors, including your experience, location, and the type of company you work for.

This in-depth guide will break down the salary expectations for a payroll administrator, explore the key factors that influence your pay, and examine the future job outlook for this essential profession.

What Does a Payroll Administrator Do?

At its core, a payroll administrator ensures that every employee in an organization is paid accurately and on time. They are the guardians of the paycheck, managing a complex process that involves much more than just cutting checks. Their key responsibilities often include:

- Processing Payroll: Collecting timesheet data, calculating wages, and distributing payments via direct deposit or check.

- Ensuring Compliance: Calculating and withholding federal, state, and local taxes, as well as social security and other deductions.

- Managing Benefits: Handling deductions for retirement plans, health insurance, and other benefits.

- Record-Keeping and Reporting: Maintaining confidential payroll files and generating reports for accounting and management.

- Resolving Discrepancies: Investigating and correcting any errors in pay or deductions.

This role requires a unique blend of quantitative skill, exceptional attention to detail, and a deep understanding of tax law and labor regulations.

Average Payroll Administrator Salary

When we look at national data, the average salary for a Payroll Administrator in the United States typically falls between $58,000 and $68,000 per year.

However, different authoritative sources provide slightly different perspectives based on their data sets:

- Salary.com: As of early 2024, this aggregator reports the median salary for a Payroll Administrator I is approximately $65,581, with a typical range falling between $58,582 and $73,286.

- Glassdoor and Payscale: These platforms, which rely on user-submitted data, report similar national averages, generally in the $60,000 to $64,000 range.

- U.S. Bureau of Labor Statistics (BLS): The BLS groups this role under the broader category of "Payroll and Timekeeping Clerks," reporting a median annual wage of $50,560 in May 2023. It's important to note that this BLS figure often includes more entry-level clerk and data-entry positions, while the title "Payroll Administrator" often implies a higher level of responsibility and, consequently, higher pay.

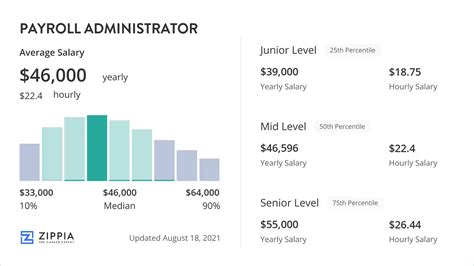

A more practical way to look at salary is through a range based on experience:

- Entry-Level (0-2 years): Typically earn between $45,000 and $55,000.

- Mid-Career (3-6 years): Can expect to earn between $55,000 and $70,000.

- Senior/Lead (7+ years): Can command salaries upwards of $75,000 to $85,000 or more, especially if they have specialized skills or supervisory duties.

Key Factors That Influence Salary

Your base salary is not set in stone. Several key factors can significantly increase your earning potential. Understanding them is key to maximizing your career trajectory.

Level of Education

While a four-year degree is not always a strict requirement, your educational background plays a definite role. Most positions require at least a high school diploma or an associate's degree in accounting, finance, or a related field. However, candidates with a bachelor's degree often have a competitive edge, command higher starting salaries, and find it easier to advance into payroll management roles.

Furthermore, professional certifications are highly valued. Earning a designation like the Certified Payroll Professional (CPP) from the American Payroll Association (APA) demonstrates a high level of expertise and can lead to a significant salary increase.

Years of Experience

Experience is arguably the single most significant factor in determining a payroll administrator's salary. As you gain experience, you move from processing routine payrolls to handling more complex, strategic tasks.

- Entry-Level (0-2 Years): You are primarily learning the systems, performing data entry, and handling basic payroll runs under supervision.

- Mid-Level (3-5 Years): You work with more autonomy, manage complex payroll issues (garnishments, multi-state taxes), and may help train junior staff. This is where salaries see a notable jump.

- Senior-Level (5+ Years): You are a subject matter expert. You may oversee payroll system implementations, ensure high-level compliance, manage a small team, and contribute to financial strategy. Your salary will be at the top end of the spectrum.

Geographic Location

Where you work matters. Salaries for payroll administrators vary widely across the country to reflect differences in the cost of living and demand for skilled professionals. Metropolitan areas with a high cost of living tend to offer the highest salaries.

- High-Paying States: California, New York, Washington, Massachusetts, and the District of Columbia typically offer salaries well above the national average. For example, a payroll administrator in San Francisco or New York City can expect to earn 20-30% more than their counterparts in a lower-cost state.

- Lower-Paying States: States in the Midwest and South generally offer salaries closer to or slightly below the national average, though the lower cost of living can offset this difference.

Company Type

The size and type of your employer will also impact your paycheck.

- Large Corporations: These companies often have large, complex payrolls (sometimes spanning multiple states or countries), leading to higher salaries and robust benefits packages. They also offer more structured paths for advancement into senior or management roles.

- Small to Medium-Sized Businesses (SMBs): While salaries might be slightly lower, working for an SMB can provide incredibly valuable, well-rounded experience. You might handle a broader range of tasks, potentially touching on HR and benefits administration.

- Payroll Service Providers (e.g., ADP, Paychex) & PEOs: Working for a company where payroll is the core business can be lucrative. These firms value expertise highly and often offer competitive compensation.

Area of Specialization

Developing expertise in a niche area of payroll can make you a highly sought-after and well-compensated professional.

- International Payroll: Managing payroll across different countries, currencies, and international tax laws is a complex skill that commands a premium salary.

- Certified Payroll: Professionals who can manage payroll for government-funded construction projects (which have strict reporting requirements) are in high demand.

- System Implementation: Expertise in specific payroll software platforms like Workday, Oracle, or SAP is a highly valuable technical skill that companies will pay more for.

Job Outlook

According to the U.S. Bureau of Labor Statistics (BLS), employment for "Payroll and Timekeeping Clerks" is projected to decline 3 percent from 2022 to 2032.

It is crucial to understand the context behind this statistic. This projected decline is primarily due to the automation of routine data entry and calculation tasks. However, this does not mean the profession is disappearing. Instead, it is evolving. The demand is shifting away from clerical work and toward skilled administrators who can manage and oversee these complex automated systems, ensure regulatory compliance, troubleshoot sophisticated issues, and provide strategic data analysis.

As long as businesses employ people, the need for skilled, knowledgeable payroll professionals to manage the process will remain constant.

Conclusion

A career as a payroll administrator offers a clear path to a solid, middle-class income with significant opportunities for growth. While the national average provides a good baseline, your true earning potential is in your hands. To maximize your salary, focus on these key takeaways:

1. Gain Experience: Progressing from an entry-level to a senior role will have the biggest impact on your salary.

2. Pursue Education & Certification: A bachelor’s degree and a CPP certification can open doors to higher-paying opportunities.

3. Specialize: Develop expertise in high-demand areas like international payroll or system implementation.

4. Be Strategic About Location & Company: Consider high-paying regions and larger companies if salary is your top priority.

For those with a knack for numbers, a passion for precision, and a desire for a stable and essential career, the role of a payroll administrator is an excellent choice with a bright and promising financial future.