Introduction

In the intricate machinery of any successful organization, there exists a role that is both critically important and often quietly overlooked: the Payroll Analyst. This is the professional who ensures that every employee, from the CEO to the newest intern, is paid accurately, on time, and in full compliance with a dizzying array of laws and regulations. If you're drawn to a career that blends analytical rigor with a tangible, human impact—a role where your precision directly affects the well-being of your colleagues—then a path as a Payroll Analyst might be your calling.

This career is far more than simple data entry; it's a strategic function that safeguards a company's financial integrity and its most valuable asset: its people. The demand for skilled analysts who can navigate complex payroll systems, tax laws, and data analytics is robust, leading to a career with significant stability and earning potential. The typical payroll analyst salary in the United States ranges from approximately $55,000 for entry-level positions to well over $100,000 for experienced senior or lead analysts in high-demand markets.

I was once consulting for a mid-sized tech firm that was experiencing rapid growth. A subtle error in their new payroll system configuration led to an entire department's overtime being miscalculated for two consecutive pay periods. The fallout wasn't just financial; it was a crisis of morale. Witnessing the skill and speed of the senior payroll analyst who untangled the mess, communicated transparently with anxious employees, and implemented a permanent fix was a profound lesson. It underscored for me that payroll isn't just about numbers on a spreadsheet; it's about trust, responsibility, and the fundamental promise a company makes to its team.

This guide is designed to be your definitive resource, whether you are a student contemplating your future, an accounting clerk looking to specialize, or a seasoned professional curious about this vital field. We will dissect every facet of the Payroll Analyst career, from daily responsibilities and salary expectations to the strategic steps you can take to build a prosperous and fulfilling career.

### Table of Contents

- [What Does a Payroll Analyst Do?](#what-does-a-payroll-analyst-do)

- [Average payroll analyst salary: A Deep Dive](#average-payroll-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Payroll Analyst Do?

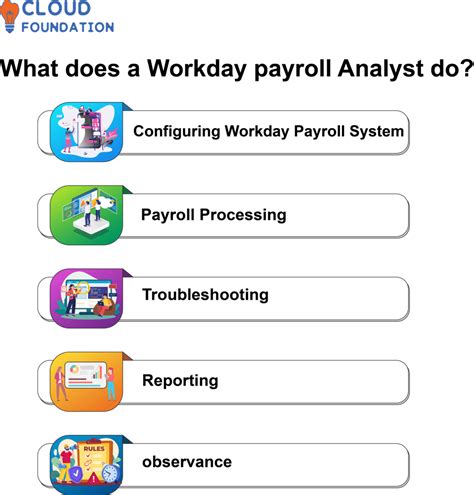

The title "Payroll Analyst" can be misleading if one assumes it's a purely administrative function. While processing payroll is a core component, the "Analyst" part of the title is where the real value lies. A Payroll Analyst is a financial detective, a compliance expert, a systems specialist, and a data storyteller all rolled into one. Their primary objective is to ensure the accuracy, compliance, and efficiency of the entire payroll process from end to end.

Unlike a payroll clerk or specialist who might focus on data entry and basic processing, the analyst takes a higher-level view. They are responsible for auditing and reconciling complex payroll data, analyzing discrepancies, generating sophisticated reports for management, and ensuring that all local, state, federal, and international tax and labor laws are strictly followed.

Core Responsibilities and Daily Tasks:

The work of a Payroll Analyst is a blend of routine cycles and unique, project-based challenges. Here’s a breakdown of their typical duties:

- Data Auditing and Reconciliation: Before a payroll is ever run, analysts meticulously audit timekeeping records, new hire data, salary changes, and benefit deductions. After the payroll is processed, they reconcile the output against financial records, ensuring every dollar is accounted for.

- Compliance and Taxation: This is a cornerstone of the role. Analysts are responsible for correctly calculating and remitting payroll taxes, including federal income tax, Social Security, Medicare (FICA), and state/local taxes. They prepare and file quarterly (941) and annual (W-2, W-3, 940) tax forms.

- Reporting and Analysis: Management relies on payroll analysts for critical business insights. They create reports on labor costs, overtime trends, headcount, paid time off (PTO) liability, and other key performance indicators (KPIs). This data helps inform budgeting, forecasting, and strategic decision-making.

- System Management and Improvement: Payroll Analysts are often super-users or administrators for Human Resource Information Systems (HRIS) and payroll platforms like ADP, Workday, SAP, or Oracle. They are involved in testing system upgrades, troubleshooting technical issues, and identifying opportunities to automate and improve processes.

- Problem Resolution: When employees have complex questions about their pay, deductions, or taxes that go beyond basic inquiries, the Payroll Analyst is the escalation point. They investigate the issue, explain the resolution, and ensure corrections are made accurately.

- Cross-Functional Collaboration: They work closely with Human Resources on benefits, new hires, and terminations; with Accounting on general ledger reconciliation; and with department managers on timekeeping and labor allocation.

---

### A Day in the Life of a Mid-Level Payroll Analyst

To make this more tangible, let's walk through a typical day for an analyst at a mid-sized company, mid-payroll cycle.

- 9:00 AM - 10:30 AM: The Morning Audit. The first task is to run and review pre-processing audit reports for the upcoming payroll. The analyst scans for red flags: an employee with unusually high hours, a new hire with a missing tax form, or a terminated employee still marked as active. They identify a discrepancy in a manager's bonus payout and email the HR Business Partner for clarification.

- 10:30 AM - 12:00 PM: Inquiry and Resolution. The analyst tackles escalated employee tickets. One employee is questioning their 401(k) deduction amount after a recent contribution change. The analyst pulls their records, verifies the change was implemented correctly in the system, and drafts a clear, empathetic email explaining the calculation, attaching a resource from the 401(k) provider.

- 12:00 PM - 1:00 PM: Lunch.

- 1:00 PM - 3:00 PM: Project Work - The New Garnishments Process. The company has recently updated its process for handling wage garnishments. The analyst is tasked with creating a new standard operating procedure (SOP) document. They spend this time mapping out the workflow, taking screenshots from the payroll system, and detailing the compliance checks required for each step.

- 3:00 PM - 4:30 PM: Reporting and Data Analysis. The Director of Finance has requested a report on overtime spending by department over the last quarter, compared to the same quarter last year. The analyst exports raw data from the payroll system into Excel, uses PivotTables to organize and summarize the information, creates charts to visualize the trends, and writes a brief summary of the key findings.

- 4:30 PM - 5:00 PM: Final Preparations. The analyst confirms the resolution of the morning's bonus discrepancy and makes the necessary adjustment in the payroll preview. They do one final check of their task list, respond to a few last-minute emails, and set a reminder to run the final payroll processing reports first thing tomorrow.

This example illustrates the dynamic nature of the role—a constant shift between routine checks, analytical deep dives, and strategic project work.

Average payroll analyst salary: A Deep Dive

Understanding the compensation landscape is paramount when evaluating any career path. For Payroll Analysts, the salary reflects the critical nature of their work, the specialized knowledge required, and their impact on a company's financial health and employee morale. Compensation is not just a single number; it's a comprehensive package that grows significantly with experience, skill, and strategic career choices.

### National Salary Averages and Ranges

To establish a baseline, we'll look at data from several authoritative sources. It's important to note that different platforms may report slightly different figures based on their unique datasets and methodologies, but they collectively paint a clear picture of earning potential.

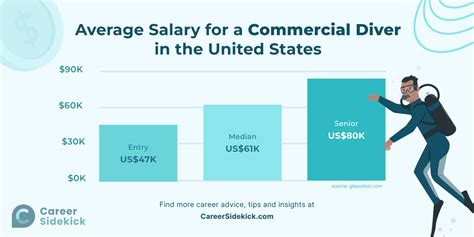

As of late 2023 and early 2024, the data indicates a strong and competitive salary range for Payroll Analysts in the United States.

- Salary.com: This platform provides one of the most detailed breakdowns. They report the median base salary for a Payroll Analyst in the U.S. to be approximately $70,500. The typical range falls between $62,800 and $79,200. However, this range expands dramatically based on experience, location, and other factors, with the top 10% of earners exceeding $87,000.

- Payscale: Payscale reports a slightly more conservative average base salary of around $64,000 per year. Their data highlights a broad range, from roughly $49,000 on the low end for entry-level roles to $83,000 on the high end for those with extensive experience and specialized skills.

- Glassdoor: Based on anonymously submitted user data, Glassdoor places the total pay for a Payroll Analyst at an average of $76,500 per year in the United States, with a likely range between $62,000 and $95,000. Their "total pay" figure includes base salary as well as additional cash compensation like bonuses.

Consensus View: Synthesizing this data, a realistic expectation for a mid-level Payroll Analyst is a base salary in the $65,000 to $75,000 range, with significant upward mobility.

### Salary by Experience Level

A Payroll Analyst's salary is not static; it follows a clear upward trajectory as they accumulate experience, master complex systems, and take on greater responsibility.

Here is a typical salary progression, combining data from Salary.com and Payscale:

| Experience Level | Typical Title(s) | Years of Experience | Typical Base Salary Range | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Payroll Analyst I, Payroll Specialist | 0-2 years | $52,000 - $65,000 | Data entry, running standard reports, basic audits, answering employee questions, learning payroll systems (e.g., ADP, Workday). |

| Mid-Career | Payroll Analyst II, Payroll Analyst | 3-5 years | $65,000 - $78,000 | Full-cycle payroll processing, tax reconciliation, complex discrepancy analysis, system testing, generating ad-hoc reports, mentoring junior staff. |

| Senior/Lead | Senior Payroll Analyst, Lead Payroll Analyst | 5-8 years | $78,000 - $95,000 | Managing complex payrolls (e.g., multi-state, executive, international), leading system implementations/upgrades, advanced compliance research, training, developing SOPs. |

| Principal/Manager | Payroll Manager, Principal Payroll Analyst | 8+ years | $95,000 - $120,000+ | Overseeing the entire payroll function, strategic planning, vendor management, internal controls and audits, team leadership, high-level reporting to executives. |

*Disclaimer: These salary figures are national averages and can vary significantly based on the factors discussed in the next section.*

### Beyond the Base Salary: Understanding Total Compensation

A savvy professional evaluates the entire compensation package, not just the base salary. For Payroll Analysts, these additional components can add substantial value.

- Annual Bonuses: This is the most common form of variable pay. Bonuses are often tied to individual performance (meeting accuracy and deadline targets) and company performance (profitability). An annual bonus can range from 3% to 15% of the base salary, with senior-level roles commanding the higher end of that range. According to Payscale, the average bonus for a Payroll Analyst is around $2,500 per year, but this can be much higher at large corporations.

- Profit Sharing: Some companies, particularly privately-held or smaller firms, offer profit-sharing plans. A portion of the company's annual profits is distributed among employees, which can be a significant financial boon in good years.

- Stock Options/RSUs: While more common in the tech industry and for publicly traded companies, receiving Restricted Stock Units (RSUs) or stock options can be a highly lucrative part of a compensation package, especially if the company's stock performs well. This is more typical for senior or lead analyst roles within such companies.

- Retirement Benefits: A strong 401(k) or 403(b) plan with a generous company match is a critical component of total compensation. A typical match might be 50% of your contribution up to 6% of your salary, which is essentially a guaranteed return on your investment.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a given. However, companies also compete on the quality and cost of these plans. Look for low-deductible plans, Health Savings Accounts (HSAs) with employer contributions, and wellness stipends (e.g., for gym memberships).

- Paid Time Off (PTO): A generous PTO policy (including vacation, sick leave, and personal days) and a flexible work environment (hybrid or remote options) have immense value, contributing to work-life balance and overall job satisfaction.

- Professional Development: Many employers will pay for the cost of obtaining and maintaining professional certifications, such as the Certified Payroll Professional (CPP), and may offer a budget for attending conferences or taking relevant courses. This investment in your growth is a valuable, non-cash benefit.

When evaluating a job offer, it's crucial to calculate the value of these benefits to understand the full scope of your payroll analyst salary and compensation.

Key Factors That Influence Salary

The national average salary provides a useful benchmark, but an individual's actual earnings as a Payroll Analyst are determined by a complex interplay of several key factors. Understanding these variables is crucial for maximizing your earning potential throughout your career. This section provides an exhaustive breakdown of what drives salary differences in the field.

###

1. Level of Education and Professional Certifications

Your educational background and professional credentials are the foundation of your career and have a direct impact on your starting salary and long-term growth.

- Educational Foundation: A Bachelor's degree is the standard requirement for most Payroll Analyst positions. The most relevant and sought-after degrees are in:

- Accounting: This is often considered the gold standard, as it provides a deep understanding of general ledgers, reconciliation, auditing, and financial controls—all central to the analyst role.

- Finance: A finance degree equips candidates with strong analytical and quantitative skills, beneficial for reporting, forecasting labor costs, and data analysis.

- Business Administration/Management: This degree provides a broad business context, useful for understanding how payroll fits into the larger organizational strategy.

- Human Resources: While less common for pure *analyst* roles, an HR degree can be advantageous, especially in positions that are a hybrid of payroll and HR generalist functions.

- An Associate's degree in accounting or a related field can be a stepping stone to an entry-level payroll specialist or clerk role, from which one can advance to an analyst position with experience and further education.

- The Power of Certifications: This is arguably the single most impactful way to increase your authority, credibility, and salary in the payroll profession. The American Payroll Association (APA) is the leading body for these credentials.

- Fundamental Payroll Certification (FPC): This is the entry-level certification, ideal for those new to the field. It demonstrates a baseline competency in payroll fundamentals. Holding an FPC can differentiate you from other entry-level candidates and may lead to a starting salary that is 5-10% higher.

- Certified Payroll Professional (CPP): This is the undisputed gold standard for payroll professionals. Earning the CPP requires significant experience (typically 3-5 years) and passing a rigorous exam covering advanced topics like taxation, compliance, accounting, and systems management. Holding a CPP designation can increase your salary by an average of $10,000 to $20,000 per year. It signals a high level of expertise and is often a prerequisite for senior, lead, and management positions. Employers actively seek out CPPs for roles requiring high-level analysis and compliance oversight.

###

2. Years and Quality of Experience

Experience is the most significant driver of salary growth. As you progress, you move from executing tasks to managing processes and finally to shaping strategy.

- 0-2 Years (Entry-Level): At this stage, you are learning the ropes. Your focus is on accuracy, mastering the payroll system, and understanding the company's specific policies. Salary growth is modest but consistent as you prove your reliability.

- *Salary Impact:* You are likely in the 10th-25th percentile of the salary range (approx. $52,000 - $65,000).

- 3-5 Years (Mid-Career): You now operate independently, handle full-cycle payrolls, and are the go-to person for complex employee issues. You begin to take on project work, like system testing or report development.

- *Salary Impact:* You move firmly into the median range (approx. $65,000 - $78,000). This is often the point where professionals earn their CPP, triggering a significant salary jump.

- 5-8+ Years (Senior/Lead): You are a subject matter expert. You're not just processing payroll; you're improving it. You may lead projects, mentor junior analysts, handle the most complex payrolls (e.g., executive compensation, international assignments, stock options), and serve as the primary liaison with auditors and government agencies.

- *Salary Impact:* You command a salary in the 75th-90th percentile (approx. $78,000 - $95,000+). Your value is in your deep institutional knowledge and your ability to mitigate risk.

- Beyond the Analyst Role (Manager/Director): With 8-10+ years of experience, a CPP, and leadership skills, you can move into management. A Payroll Manager overseeing a team can earn from $95,000 to over $130,000, with Directors of Payroll at large corporations earning well into the mid-$100s.

###

3. Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted for the local cost of labor and cost of living. High-cost-of-living (HCOL) metropolitan areas offer significantly higher salaries to attract talent.

- Top-Paying Metropolitan Areas: Cities with major corporate headquarters and thriving tech or finance sectors consistently pay the most. According to data from Salary.com and the BLS, some of the highest-paying regions include:

- San Jose, CA: Can be 30-40% above the national average.

- San Francisco, CA: 25-35% above average.

- New York, NY: 20-30% above average.

- Boston, MA: 15-25% above average.

- Seattle, WA: 15-20% above average.

- Washington, D.C.: 10-20% above average.

An analyst earning $70,000 nationally could potentially earn over $95,000 in San Francisco for the same role.

- Average and Lower-Paying Regions: Salaries in the Midwest and Southeast tend to be closer to or slightly below the national average. While the dollar amount is lower, the purchasing power may be equivalent or even greater due to a lower cost of living.

- An analyst role that pays $85,000 in New York City might pay $65,000 in St. Louis, MO, or $62,000 in Mobile, AL.

- The Rise of Remote Work: The post-pandemic shift to remote work has complicated geographic pay. Some companies have adopted location-agnostic pay, while others use a tiered system based on the employee's location. This is a critical point of negotiation for remote roles.

###

4. Company Type, Size, and Industry

The type of organization you work for is a major salary determinant.

- Company Size:

- Large Corporations (10,000+ employees): These companies typically offer the highest base salaries, structured bonus programs, and comprehensive benefits. Payroll is often complex (multi-state, union, international), justifying the higher pay for skilled analysts.

- Mid-Sized Companies (500-10,000 employees): Salaries are competitive, and analysts often have broader responsibilities, providing excellent learning opportunities.

- Startups and Small Businesses (<500 employees): Base salaries may be slightly lower, but this can be offset by a more dynamic work environment and potentially lucrative equity options (stock). A single analyst might handle all payroll and benefits functions, leading to rapid skill development.

- Industry:

- Technology & Software: Often the highest-paying industry due to high revenue per employee and competition for talent. Payroll can be complex with stock options and various bonus structures.

- Finance & Insurance: Strong salaries and bonuses, with a heavy emphasis on compliance and internal controls.

- Healthcare: Large hospital systems and healthcare companies offer competitive salaries and excellent benefits, often dealing with complex union rules and 24/7 shift differentials.

- Professional, Scientific, and Technical Services: This sector, including consulting and law firms, pays well for analysts who can handle complex partner draws and billing structures.

- Government & Non-Profit: Base salaries are typically lower than in the private sector. However, this is often balanced by exceptional job security, generous pension plans, and superior work-life balance.

###

5. Area of Specialization

As you advance, you can develop specializations that make you a more valuable—and higher-paid—asset.

- Systems Payroll Analyst: Specializes in the implementation, maintenance, and optimization of payroll/HRIS software (Workday, SAP, Oracle). These roles are highly technical, involve project management, and are in high demand. They command a premium salary.

- Global/Expat Payroll Analyst: Manages payroll for employees in multiple countries or for expatriates. This requires expertise in international tax treaties, currency conversions, and diverse labor laws, making it a highly specialized and lucrative niche.

- Compliance/Audit Payroll Analyst: Focuses purely on ensuring compliance with all regulations and conducting internal audits. This role is critical in highly regulated industries like finance and healthcare.

- Executive Compensation Analyst: A niche role dealing with the complex and confidential payroll of top executives, including deferred compensation, stock awards, and perks.

###

6. In-Demand Skills

Beyond degrees and certifications, a specific set of technical and soft skills can directly boost your earning potential.

- Technical Skills:

- Advanced HRIS/Payroll Software Proficiency: Expertise in a major platform like Workday, SAP, Oracle PeopleSoft, or ADP Vantage is a major salary driver. Being a "super-user" or implementation expert is highly valuable.

- Advanced Microsoft Excel: This is non-negotiable. You must be a master of VLOOKUP/INDEX(MATCH), PivotTables, conditional formatting, and complex formulas to analyze and reconcile large datasets. Macro/VBA knowledge is a significant plus.

- SQL (Structured Query Language): The ability to query databases directly to pull and analyze data sets you apart from most payroll professionals. This skill is increasingly sought after for reporting and analytics roles and can lead to a significant salary bump.

- Data Visualization Tools (e.g., Tableau, Power BI): The ability to turn raw payroll data into insightful dashboards for leadership is a high-value skill that moves you from a processor to a strategic partner.

- Soft Skills:

- Extreme Attention to Detail: One misplaced decimal can cause a crisis. This is the bedrock skill of the profession.

- Analytical and Problem-Solving Skills: You must be able to identify the root cause of a discrepancy, not just fix the symptom.

- Strong Communication: You need to be able to explain complex pay issues to employees with empathy and clarity, and present data to executives with confidence.

- Discretion and Ethical Judgment: You are handling highly sensitive personal and financial information. Unwavering integrity is mandatory.

By strategically developing these factors—pursuing a CPP, gaining experience in a high-paying industry or location, and mastering in-demand technical skills—a Payroll Analyst can actively shape their career and maximize their lifelong earning potential.

Job Outlook and Career Growth

When investing in a career path, understanding its long-term viability is just as important as the initial salary. The field of payroll analysis, while undergoing significant transformation, offers a stable and promising future for those who are willing to adapt and evolve. The core function—paying people correctly and on time—is recession-proof and fundamental to every business.

### A Stable and Evolving Demand

The U.S. Bureau of Labor Statistics (BLS) provides key insights into the future of the profession. While the BLS doesn't have a standalone category for "Payroll Analyst," they are typically classified under the broader category of "Compensation, Benefits, and Job Analysis Specialists" or sometimes "Accountants and Auditors."

For "Compensation, Benefits, and Job Analysis Specialists," the BLS projects a job growth of 7 percent from 2022 to 2032, which is faster than the average for all