Chicago stands as a city of immense economic opportunity, and at the foundation of its workforce compensation is a commitment to a living wage. Unlike the static federal minimum wage, Chicago's minimum wage is a dynamic figure that reflects the city's cost of living, offering a more robust starting point for hourly workers. As of 2024, the standard minimum wage in Chicago is $15.80 per hour, a rate significantly higher than both state and federal mandates.

This article provides a detailed analysis of the minimum wage in Chicago, exploring the different rates, the factors that determine them, and what the future holds for hourly compensation in the Windy City.

Understanding the Chicago Minimum Wage: More Than Just a Number

The "salario mínimo," or minimum wage, in Chicago is not a single, flat rate. It is a tiered system established by the Chicago Minimum Wage Ordinance. The primary goal of this ordinance is to ensure that wages for low-income workers keep pace with inflation, providing a baseline income that better supports individuals and families living in a major metropolitan area.

The law applies to nearly all employees working within the city's geographical boundaries for at least two hours in any two-week period. It sets different rates based on the size of the employer and the employee's status as a tipped or non-tipped worker, ensuring a nuanced approach to the city's diverse economic landscape.

Current Minimum Wage Rates in Chicago (2024)

Understanding your correct pay rate starts with knowing which category you fall into. The City of Chicago mandates different wage floors, which are adjusted annually based on the Consumer Price Index (CPI).

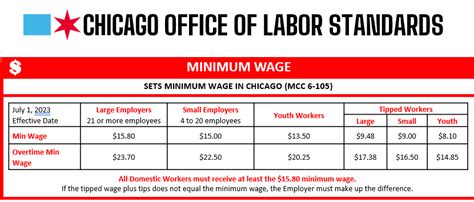

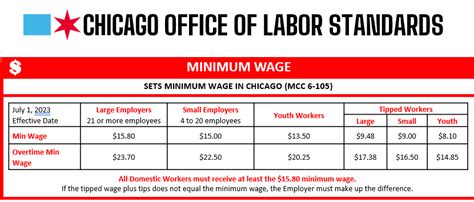

As of July 1, 2023, the rates are as follows:

- Large Employers (21 or more employees): The minimum wage is $15.80 per hour.

- Small Employers (4 to 20 employees): The minimum wage is $15.00 per hour.

- Tipped Employees (Large Employers): The minimum wage is $9.48 per hour. Employers can use a "tip credit" of up to $6.32, but if the employee's wages plus tips do not equal at least $15.80 per hour, the employer must make up the difference.

- Tipped Employees (Small Employers): The minimum wage is $9.00 per hour. Employers can use a tip credit of up to $6.00, with the same requirement that total compensation must meet the standard minimum wage of $15.00 per hour.

*(Source: City of Chicago, Business Affairs and Consumer Protection)*

Key Factors That Influence Your Applicable Minimum Wage

While a professional's salary is influenced by factors like education and experience, the legal minimum wage is determined by a different set of clear, legal-based factors.

###

Employer Size

This is the primary factor in Chicago's tiered system. The ordinance distinguishes between large and small employers to balance the need for a living wage with the financial realities faced by smaller businesses.

- Large Employers (21+ workers): Subject to the highest tier of the minimum wage ($15.80/hour). This category includes most major corporations, retail chains, and large service providers.

- Small Employers (4-20 workers): Have a slightly lower minimum wage ($15.00/hour) to ease the payroll burden. Businesses with fewer than four employees are typically subject to the Illinois state minimum wage, not the Chicago ordinance.

###

Employee Status: Tipped vs. Non-Tipped Workers

Your role significantly impacts your base pay if you earn tips. A "tipped employee" is defined as someone who customarily and regularly receives more than $30 per month in tips.

- Non-Tipped Workers: Must be paid the full applicable minimum wage ($15.80 or $15.00) directly by their employer.

- Tipped Workers: Can be paid a lower base wage by their employer, with the legal expectation that tips will bring their total hourly earnings up to or above the standard minimum wage. It is crucial for tipped workers to track their earnings to ensure they are being compensated fairly.

###

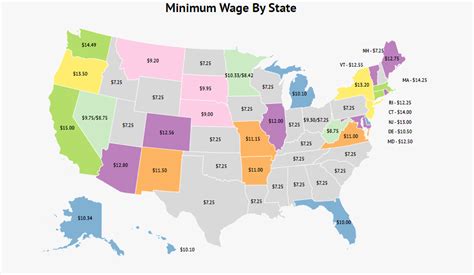

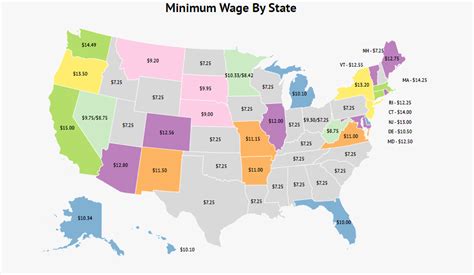

Geographic Location: Chicago vs. Cook County vs. Illinois

Where you work is paramount. An employee working in a Chicago suburb may be subject to a different minimum wage than someone working downtown.

| Geographic Area | Standard Minimum Wage (2024) | Tipped Minimum Wage (2024) | Source |

| :--- | :--- | :--- | :--- |

| City of Chicago | $15.80 / $15.00 | $9.48 / $9.00 | City of Chicago |

| Cook County | $13.70 | $8.40 | Cook County |

| State of Illinois | $14.00 | $8.40 | IL Dept. of Labor |

| Federal | $7.25 | $2.13 | U.S. Dept. of Labor |

*Note: The State of Illinois minimum wage increased to $14.00 on January 1, 2024. Cook County's wage is adjusted each July. Some municipalities within Cook County have opted out of the county ordinance and adhere to the state minimum wage.*

###

Special Ordinances and Exemptions

Certain categories of workers may have different pay structures. For instance, the Chicago Minimum Wage Ordinance includes provisions for Youth Employment. Workers under the age of 18 may be paid a minimum wage of $13.50 per hour for the first 90 days of employment, after which they must be paid the standard minimum wage for their employer's size.

Job Outlook and Future Trajectory

The concept of a "minimum wage job" spans nearly every industry, from hospitality and retail to healthcare support and administration. According to the U.S. Bureau of Labor Statistics (BLS), sectors that heavily rely on hourly workers, such as Accommodation and Food Services, are projected to see continued job growth.

More importantly, the future outlook for the minimum wage itself in Chicago is one of consistent growth. The ordinance ties annual increases to the Consumer Price Index (CPI), or 2.5%, whichever is lower. This mechanism ensures that as the cost of living in the city rises, the minimum wage will also be adjusted, preventing the erosion of purchasing power that has plagued the stagnant federal minimum wage. Workers in Chicago can expect their base pay to continue climbing in the coming years.

Conclusion: Key Takeaways for Chicago's Workforce

For anyone working or considering employment in Chicago, understanding the "salario mínimo" is a critical piece of financial literacy. The key takeaways are:

- Chicago Leads the Way: At $15.80 (for large employers), Chicago's minimum wage is more than double the federal rate and higher than both Cook County and Illinois state rates.

- Your Wage Depends on Key Factors: The size of your employer, your status as a tipped worker, and your precise work location are the primary determinants of your legal minimum pay.

- Know Your Rights: You are legally entitled to the wage set by the ordinance. If you believe you are being underpaid, you can file a complaint with the City of Chicago's Office of Labor Standards.

- The Future is Upward: Thanks to its link with the CPI, Chicago's minimum wage is designed to grow, providing a more stable and predictable financial foundation for the city's essential hourly workforce.

This commitment to a living wage makes Chicago an attractive and promising place for individuals building their careers from the ground up.