Introduction

Embarking on a career in banking can be a gateway to financial stability, professional growth, and the opportunity to make a tangible impact on people's lives. For many, the role of a Personal Banker at a major institution like Wells Fargo is a highly sought-after starting point. It's a position that blends customer service, sales, and financial acumen, offering a dynamic and challenging work environment. But beyond the day-to-day responsibilities, a crucial question looms for any prospective candidate: What is the real earning potential? What does a Personal Banker Wells Fargo salary actually look like, and what factors can propel that number upward?

This guide is designed to be your definitive resource, pulling back the curtain on compensation, career trajectories, and the skills you need to thrive as a Personal Banker at Wells Fargo. We will move beyond simple salary averages to explore the intricate web of factors—from your geographic location and level of experience to the specific licenses you hold—that collectively determine your income. We’ll ground our analysis in data from authoritative sources like the U.S. Bureau of Labor Statistics, Glassdoor, and Salary.com to provide a realistic and actionable financial roadmap.

I remember early in my own career, a personal banker at my local branch took the time to explain the labyrinthine process of securing my first auto loan. It wasn't just a transaction; she acted as a guide, demystifying the terms and helping me understand the long-term implications for my credit. That single, positive interaction solidified my understanding of the role's importance; a great personal banker is not just an employee of the bank, but a trusted financial partner for the community. This guide will show you how to become that trusted partner—and be compensated well for it.

### Table of Contents

- [What Does a Personal Banker at Wells Fargo Do?](#what-does-a-personal-banker-at-wells-fargo-do)

- [Average Personal Banker Wells Fargo Salary: A Deep Dive](#average-personal-banker-wells-fargo-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Wells Fargo Personal Banker Career Right for You?](#conclusion)

What Does a Personal Banker at Wells Fargo Do?

At its core, the Personal Banker role at Wells Fargo is the primary, relationship-focused position within a retail branch. Unlike a bank teller who primarily handles quick transactions like deposits and withdrawals, a Personal Banker engages in more complex, needs-based conversations with customers. They are the financial architects for individuals and small business owners, tasked with understanding their clients' financial goals and connecting them with the right products and services to achieve them.

The position is a unique hybrid of customer service, sales, and financial guidance. Personal Bankers are expected to be proactive, identifying opportunities to "deepen the relationship" with existing clients and to attract new ones. This involves a consultative approach rather than a hard sell. Their goal is to uncover needs a customer may not even be aware of, such as planning for retirement, saving for a child's education, or securing a mortgage for a new home.

Core Responsibilities and Daily Tasks:

A Personal Banker's duties are varied and require a talent for multitasking and shifting priorities. Key responsibilities typically include:

- Client Relationship Management: Building and maintaining long-term relationships with a portfolio of clients. This includes regular check-ins and proactive outreach.

- Needs-Based Selling: Engaging clients in conversations to understand their financial situation, goals, and challenges. This leads to recommending and opening appropriate products like checking and savings accounts, credit cards, certificates of deposit (CDs), and personal loans.

- Referrals to Specialists: Identifying clients who could benefit from more specialized services and referring them to in-house partners, such as a Financial Advisor for investments, a Mortgage Loan Officer for home loans, or a Business Banker for commercial needs. This is a critical part of the role and often tied to performance metrics.

- Problem Resolution: Acting as a primary point of contact for complex customer issues that go beyond the scope of a teller, such as dealing with fraudulent activity, fee disputes, or complex account inquiries.

- Maintaining Compliance: Adhering strictly to all banking regulations and internal policies, including the Bank Secrecy Act (BSA), Know Your Customer (KYC) guidelines, and the SAFE Act for those who discuss mortgage products.

- Achieving Sales Goals: Meeting or exceeding individual and branch-level goals for new accounts, loan volume, and client referrals.

### A Day in the Life of a Wells Fargo Personal Banker

To make the role more tangible, here’s a snapshot of a typical day:

- 8:45 AM - The Morning Huddle: The day begins before the doors open. The branch manager leads a brief meeting to discuss the previous day's results, today's goals, any new promotions or product updates, and to share best practices.

- 9:00 AM - Doors Open: The first hour is often busy with scheduled appointments. A Personal Banker might meet with a young couple looking to open their first joint account and apply for a credit card. The conversation will focus on their saving habits and future goals.

- 10:30 AM - Proactive Outreach: During a lull, the banker reviews their client portfolio in the bank's CRM (Customer Relationship Management) system. They notice a client with a large sum in a low-yield savings account and make a call to schedule a meeting to discuss higher-yield options like a CD or a referral to a Financial Advisor.

- 12:00 PM - Walk-In Client: A small business owner walks in needing to open a business checking account. The Personal Banker spends the next hour gathering the necessary documentation, understanding the business's cash flow, and identifying future needs like a business line of credit or merchant services.

- 1:00 PM - Lunch Break.

- 2:00 PM - Problem Solving: A long-time client comes in, distressed about a series of unauthorized charges on their debit card. The banker patiently walks them through the dispute process, orders a new card, and provides reassurance, turning a negative experience into a moment of trust-building.

- 3:30 PM - Follow-Up and Paperwork: The banker dedicates time to administrative tasks: completing applications from earlier appointments, sending follow-up emails, and documenting client interactions in the CRM. They also complete mandatory compliance training modules.

- 4:45 PM - Final Preparations: As the branch prepares to close, the banker reviews their calendar for the next day, confirms appointments, and tidies their desk, ensuring all sensitive client information is securely stored.

- 5:15 PM - End of Day: The banker meets their core goals for the day and leaves, already thinking about the client meeting scheduled for tomorrow morning.

This role is far from monotonous. It requires a constant blend of interpersonal skills, product knowledge, and a genuine desire to help people navigate their financial journeys.

Average Personal Banker Wells Fargo Salary: A Deep Dive

Understanding the compensation for a Wells Fargo Personal Banker requires looking beyond a single number. The total earnings are a combination of a base salary, which provides stability, and variable pay (incentives and bonuses), which rewards performance. This structure is designed to motivate bankers to actively seek out opportunities and grow their client relationships.

### National Average and Salary Range

Based on data aggregated from thousands of employee-submitted reports, the compensation for a Personal Banker at Wells Fargo shows a clear and competitive range.

According to Salary.com, as of late 2023, the typical salary range for a Personal Banker I (an entry-to-intermediate level role) at Wells Fargo in the United States falls between $41,652 and $52,190, with a median base salary of around $46,163.

Glassdoor provides a slightly broader and more inclusive figure that often incorporates aspects of variable pay. Their data from 2023 indicates a total pay estimate for a Wells Fargo Personal Banker is around $61,778 per year, with a likely range between $49,000 and $79,000. This total pay figure is composed of an estimated base salary of approximately $48,820 and additional pay (cash bonuses, commission, etc.) of around $12,958 per year.

It's crucial to interpret this data correctly:

- The base salary is the guaranteed hourly wage or annual salary. Wells Fargo, like many large employers, has moved towards a higher minimum wage, with a corporate-wide minimum of $18-$22 per hour depending on the location, which translates to a base salary of roughly $37,440 to $45,760 for a full-time employee. Most Personal Banker roles will start at or above this level.

- The total compensation is where top performers differentiate themselves. This includes incentive pay tied directly to meeting and exceeding sales and referral goals.

### Compensation by Experience Level

Salary progression is a key motivator. As a Personal Banker gains experience, develops a strong client portfolio, and potentially acquires additional licenses, their earning potential increases significantly. While Wells Fargo uses internal titling like Personal Banker 1, 2, and 3 or Senior/Lead Banker, we can generalize the progression as follows:

| Experience Level | Typical Title | Average Base Salary Range | Estimated Total Compensation Range (with incentives) | Notes |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Personal Banker 1 | $40,000 - $48,000 | $45,000 - $65,000 | Focus is on learning products, procedures, and building initial client relationships. NMLS registration is often required. |

| Mid-Career (2-5 years) | Personal Banker 2 / Senior Personal Banker | $48,000 - $58,000 | $60,000 - $85,000 | Handles more complex client needs, may mentor junior bankers, and consistently meets or exceeds goals. |

| Experienced/Senior (5+ years) | Senior / Lead Personal Banker / Premier Banker | $55,000 - $70,000+ | $75,000 - $100,000+ | Manages a portfolio of high-value clients, may hold investment licenses (e.g., Series 6 & 63), and is a top performer in referrals and sales. |

*(Salary data is an aggregation and estimate based on figures from Glassdoor, Salary.com, and Payscale, updated for 2023-2024. Ranges are highly dependent on location and individual performance.)*

### Deconstructing the Compensation Package: Beyond the Base Salary

A Personal Banker's W-2 is more than just their salary. A comprehensive compensation package at a large corporation like Wells Fargo includes several valuable components:

- Incentive Compensation Plan (ICP): This is the most significant part of variable pay. It is typically structured quarterly and based on achieving specific metrics. These can include the number of new checking accounts opened, credit cards issued, consumer loans funded, and, most importantly, qualified referrals to partners in wealth management, mortgage, and business banking. High-performing bankers who build strong partnerships with their internal specialists can see substantial payouts from this plan.

- Annual Bonuses/Profit Sharing: While less common at the branch level than the ICP, some discretionary annual bonuses may be available based on overall branch and company performance.

- Comprehensive Benefits: This is a major, often undervalued, part of total compensation. Wells Fargo offers a robust benefits package that includes:

- Health and Wellness: Medical, dental, and vision insurance.

- Retirement Savings: A 401(k) plan with a generous company match (e.g., dollar-for-dollar match up to 6% of eligible pay). This is a powerful wealth-building tool.

- Paid Time Off (PTO): A competitive PTO and holiday schedule.

- Tuition Reimbursement: Programs to help employees pay for further education, which can directly lead to career advancement.

- Parental Leave: Paid leave for new parents.

- Employee Discounts: Preferred rates on banking products, including mortgages and loans.

When evaluating a Personal Banker Wells Fargo salary, it is essential to factor in the full value of this comprehensive package, as it can add tens of thousands of dollars in effective value each year.

Key Factors That Influence Salary

The salary ranges provided above are a starting point. Your actual earnings as a Wells Fargo Personal Banker will be influenced by a dynamic interplay of several key factors. Mastering these elements is the key to maximizing your income and accelerating your career growth. This section provides a detailed breakdown of what truly drives compensation in this role.

###

Level of Education and Certifications

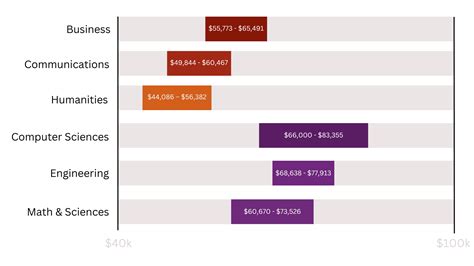

While a four-year bachelor's degree is not always a strict requirement to become a Personal Banker, it significantly impacts both starting salary and long-term career trajectory.

- Minimum Education: A high school diploma or GED is the baseline requirement, often coupled with 1-2 years of relevant experience in customer service or sales.

- Associate's Degree: An A.A. or A.S. in business, finance, or a related field can give a candidate a competitive edge over those with only a high school diploma, potentially leading to a slightly higher starting offer.

- Bachelor's Degree: This is the preferred qualification. A B.A. or B.S. in Finance, Economics, Business Administration, or Marketing signals a higher level of foundational knowledge and analytical ability. Candidates with a bachelor's degree are often seen as having greater potential for advancement into leadership roles like Branch Manager, Financial Advisor, or corporate positions. This can translate to a starting base salary that is 5-15% higher than non-degreed counterparts.

- Master's Degree (MBA): While an MBA is overkill for a Personal Banker role, it is a significant asset for those on a management track. An internal candidate with an MBA would be a prime contender for Branch Manager or regional leadership roles, which come with substantially higher salaries.

Crucial Certifications and Licenses:

This is where you can directly and significantly impact your value and income.

- NMLS Registration (SAFE Act): The Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act requires any employee who acts as a Mortgage Loan Originator (MLO) to register with the Nationwide Mortgage Licensing System & Registry (NMLS). Since Personal Bankers often discuss home equity lines of credit (HELOCs) and refer for mortgages, this registration is non-negotiable for most Personal Banker positions at Wells Fargo. Having an existing NMLS number can make you a more attractive candidate, though the bank will sponsor you for registration if needed.

- FINRA Licenses (Series 6, 7, 63, 66): This is the single most significant specialization that elevates a Personal Banker's role and earning potential.

- Series 6 & 63: These licenses allow a banker to sell "packaged" investment products like mutual funds and variable annuities. A Personal Banker who becomes licensed is often designated as a "Premier Banker" or a similar title. They can handle more of the client's financial needs directly and earn commissions or higher incentive pay on these products. This can add $15,000 to $30,000+ to annual total compensation.

- Series 7 & 66: The Series 7 is the "General Securities Representative" license, allowing for the sale of a much broader range of securities. This, combined with the Series 66, effectively turns a Personal Banker into a Financial Advisor. This is a distinct career path, but one that many successful bankers transition into, with earnings potential well into the six figures. Wells Fargo has programs to help successful bankers study for and obtain these licenses.

- State Insurance Licenses: A license to sell life, health, and disability insurance can also add another revenue stream and increase your value to the bank and its clients.

###

Years of Experience

Experience is a powerful driver of salary growth. As you progress, you move from learning the ropes to becoming a trusted expert and, eventually, a leader.

- 0-2 Years (Personal Banker 1): In this stage, you are focused on mastering the bank's systems, understanding the product suite, and building confidence in client conversations. Your base salary will be at the lower end of the scale, and your incentive pay will grow as you become more proficient at identifying customer needs. Estimated Total Compensation: $45,000 - $65,000.

- 2-5 Years (Personal Banker 2 / Senior Banker): You are now a fully proficient banker. You have a solid book of business, strong relationships with internal partners, and can handle complex client issues with ease. You may begin mentoring new hires. Your base salary sees a notable increase, and your incentive compensation becomes more consistent and substantial as you have mastered the art of the referral. Estimated Total Compensation: $60,000 - $85,000.

- 5+ Years (Lead / Premier Banker): At this level, you are a top performer. You likely manage relationships with the branch's most valuable clients. If you have obtained FINRA licenses, you are operating as a Premier Banker, handling both banking and basic investment needs. Your base salary is at the top of the scale for the role, and your incentive/commission earnings are significant, forming a large portion of your total pay. You are a key player in the branch's success. Estimated Total Compensation: $75,000 - $100,000+.

###

Geographic Location

Where you work is one of the most critical factors determining your base salary. Wells Fargo, like all major corporations, uses geographic pay differentials to adjust salaries based on the local cost of labor and cost of living. A higher salary in a major city is not necessarily "better" if the cost of living consumes the entire difference.

Examples of Salary Variation by Location:

- High Cost of Living (HCOL) Areas: In cities like San Francisco, CA; San Jose, CA; New York, NY; and Boston, MA, you can expect base salaries to be at the highest end of the spectrum to remain competitive. A Personal Banker's base salary in these markets could easily be 15-30% higher than the national average. A starting salary might be closer to $55,000 - $60,000, with total compensation potential well over $80,000 for experienced bankers.

- Medium Cost of Living (MCOL) Areas: Cities like Dallas, TX; Charlotte, NC (a major hub for Wells Fargo); Atlanta, GA; and Phoenix, AZ, will have salaries that are closer to the national average. These locations often offer a great balance of strong earning potential and a more manageable cost of living. The national average data from Glassdoor and Salary.com is most reflective of these types of markets.

- Low Cost of Living (LCOL) Areas: In smaller cities and rural communities in states like Alabama, Iowa, or Ohio, base salaries will be on the lower end of the national range. A starting base might be closer to the corporate minimum wage tier, perhaps in the $40,000 - $45,000 range. However, the significantly lower cost of housing, transportation, and goods means that the purchasing power of this salary can still be quite strong.

###

Branch Performance & Tier (A Proxy for Company Size)

Since we are focused on one company, Wells Fargo, the "Company Size" factor can be reinterpreted as the size, type, and performance of the specific branch you work in. Not all branches are created equal.

- High-Traffic Urban Branches: A flagship branch in downtown Manhattan will have significantly more foot traffic and a higher concentration of high-net-worth individuals and businesses. This presents far more opportunities for opening accounts, funding large loans, and making lucrative referrals to wealth management. The sales goals will be higher, but the potential for incentive compensation is also dramatically greater.

- Suburban Community Branches: These branches build deep roots in the community. While the volume of new clients may be lower, the emphasis is on deepening relationships with existing families and local businesses. Success here depends on building long-term trust.

- Wealth Management-Focused Branches: Some branches are located in affluent areas and are more integrated with the Wells Fargo Advisors division. Bankers in these locations (often called "Premier Bankers") will work almost exclusively with clients who have significant assets, requiring a higher level of sophistication and, often, investment licenses. The compensation structure here is heavily weighted towards incentives and bonuses derived from asset growth and referrals.

###

In-Demand Skills

Beyond formal qualifications, a specific set of skills can make you a more effective—and thus, a higher-earning—Personal Banker.

- Bilingual Ability: In many parts of the country, fluency in a second language (especially Spanish) is a massive advantage. Wells Fargo often offers a pay differential or "language premium" for bilingual employees in customer-facing roles. It also opens up a larger client base, leading to more sales opportunities.

- Sales and Persuasion Skills: The ability to use a consultative, non-aggressive approach to uncover needs and present solutions is paramount. This is a skill, not just an innate talent, and it can be developed. Those who master it will consistently outperform their peers in incentive earnings.

- CRM Software Proficiency: Expertise in using CRM platforms like Salesforce (which many banks use or have proprietary versions of) to manage client pipelines, track interactions, and identify opportunities is essential for staying organized and effective.

- Strong Financial Acumen: You don't need to be a Wall Street analyst, but a solid understanding of personal finance concepts—budgeting, credit scores, interest rates, basic investment principles, retirement planning—allows you to have more credible and impactful conversations with clients.

- Digital Fluency: As banking becomes more digital, the ability to confidently guide clients through the bank's mobile app, online banking platform, and Zelle is crucial. This helps clients become more self-sufficient and demonstrates the value of the bank's technology.

By strategically developing these skills, pursuing relevant licenses, and understanding how location and branch type affect your role, you can take active control of your career and salary progression as a Personal Banker at Wells Fargo.

Job Outlook and Career Growth

When considering a career, salary is only one part of the equation; long-term stability and opportunities for advancement are equally important. The landscape of retail banking is undergoing a significant transformation, which presents both challenges and exciting opportunities for the Personal Banker role.

### The Evolving Job Outlook

The U.S. Bureau of Labor Statistics (BLS) provides projections for occupations, and while there isn't a direct category for "Personal Banker," we can infer the outlook by looking at related roles. The BLS projects that employment of Tellers is expected to decline by 12% from 2022 to 2032. This decline is largely attributed to the rise of online and mobile banking, which has automated many of the simple transactions that tellers traditionally handle.

However, it would be a mistake to equate the role of a Personal Banker with that of a Teller. The decline of transactional roles actually highlights the increasing importance of the relationship-based, advisory role that a Personal Banker fulfills. As customers can handle deposits and transfers on their phones, their reasons for visiting a branch have changed. They now come in for complex problem-solving, significant life-event planning (like buying a home or starting a business), and personalized financial advice—precisely the domain of the Personal Banker.

The outlook for Personal Financial Advisors, a common next step for licensed bankers, is much brighter. The BLS projects a 13% growth for this profession from 2022 to 2032, much faster than the average for all occupations. This indicates a strong and growing demand for personalized financial guidance.

Therefore, the future for a successful Personal Banker is one of evolution. The role will become less transactional and more focused on:

- Holistic Financial Wellness: Discussing a client's entire financial picture, not just selling a single product.

- Digital Integration: Acting as a human guide to the bank's digital tools, helping clients bridge the gap between technology and personal finance.

- Complex Problem-Solving: Serving as the go-to expert for issues that cannot be resolved by an app or a chatbot.

### Emerging Trends and Future Challenges

- Fintech Competition: Banks are no longer just competing with each other. Financial technology ("fintech") startups offer slick apps for everything from investing to lending. Successful personal bankers will need to be able to articulate the value proposition of a full-service bank, which includes security, a wide range of integrated products, and the power of a personal relationship.

- Artificial Intelligence (AI): AI will likely augment, not replace, the personal banker. AI tools can help bankers analyze a client's financial data to identify needs and suggest next steps, freeing up the banker to focus on the human-to-human connection and building trust.

- Focus on Underserved Communities: There is a growing emphasis in the banking industry on providing financial services and education to historically underserved populations. Bankers who are culturally competent and passionate about financial literacy can find immense purpose and opportunity in this area.

### Career Path and Advancement Opportunities

A Personal Banker position at Wells Fargo is not a terminal role; it is a launchpad. The skills and experience gained open doors to numerous career paths, both within the branch network and in the wider corporate structure.

Typical Career Progression:

1. Personal Banker (1-3 years): Master the fundamentals, build a client base, and consistently meet performance goals.

2. Senior / Premier Banker (3-5+ years): Obtain investment licenses (Series 6/63). Manage a portfolio of affluent clients and handle more complex banking and investment needs. Mentor junior bankers.

3.