For many professionals navigating the complex world of finance, securing a position at a major national bank represents a pinnacle of stability, opportunity, and financial reward. Among the titans of the U.S. banking industry, PNC Financial Services Group stands out as a formidable and respected institution. But beyond the brand recognition lies a crucial question for any prospective employee: What can you actually expect to earn? A "PNC Bank salary" isn't a single number but a complex equation influenced by your role, experience, location, and performance.

The allure of a career in banking often begins with the promise of a substantial income. At an institution like PNC, entry-level professionals can expect competitive starting salaries, while seasoned veterans in high-impact roles can command compensation packages well into the six figures, supplemented by robust bonuses and benefits. I once mentored a bright young finance graduate who was weighing an offer from a fintech startup against one from a large, established bank like PNC. While the startup dangled the potential of equity, the bank offered a transparent, structured career path with predictable salary growth, excellent training programs, and a comprehensive benefits package that provided immediate security. He chose the bank, and years later, he credits that decision with building the strong financial and professional foundation he now enjoys. This guide is designed to provide that same clarity for you.

This article serves as your definitive roadmap to understanding compensation at PNC Bank. We will move far beyond simple averages to dissect the intricate factors that determine your earning potential. We will explore specific roles, analyze the impact of geography and education, and lay out a clear path for how you can not only land a job at PNC but maximize your career and salary growth once you're there.

### Table of Contents

- [What Does a Career at PNC Bank Involve?](#what-does-a-career-at-pnc-bank-involve)

- [Average PNC Bank Salary: A Deep Dive](#average-pnc-bank-salary-a-deep-dive)

- [Key Factors That Influence Your PNC Bank Salary](#key-factors-that-influence-your-pnc-bank-salary)

- [Job Outlook and Career Growth in Banking](#job-outlook-and-career-growth-in-banking)

- [How to Start Your Career at PNC Bank](#how-to-start-your-career-at-pnc-bank)

- [Conclusion: Is a Career at PNC Bank Right for You?](#conclusion-is-a-career-at-pnc-bank-right-for-you)

What Does a Career at PNC Bank Involve?

Before we can talk about salary, it's crucial to understand that "working at PNC Bank" is not a monolithic experience. PNC is a vast, diversified financial services corporation with several distinct business segments, each containing a multitude of roles with unique responsibilities and skill requirements. Your daily tasks, career trajectory, and compensation will be fundamentally shaped by the division and specific role you occupy.

PNC's primary business segments include:

- Retail Banking: This is the most visible part of PNC, serving individual consumers and small businesses through its extensive network of branches and digital platforms. Roles here are client-facing and focus on providing exceptional service and financial solutions.

- Corporate & Institutional Banking (C&I): This division works with middle-market and large corporations, government entities, and non-profit organizations. It provides complex financial services like treasury management, credit and financing solutions, and capital markets advisory.

- Asset Management Group: This segment offers a wide range of wealth management, investment management, and estate planning services to high-net-worth individuals and families.

- Technology & Operations: This is the backbone of the bank. It encompasses all the roles that design, build, maintain, and secure the bank's technology infrastructure, from mobile banking apps to internal data systems and cybersecurity defenses.

Across these segments, a typical professional's work revolves around three core pillars: client management, risk analysis, and operational execution. Whether you're a Universal Banker helping a family open their first savings account or a C&I Relationship Manager structuring a multi-million dollar loan for a corporation, your goal is to understand client needs, assess the associated financial risks, and execute a solution that benefits both the client and the bank.

#### A "Day in the Life" Example: A Universal Banker

To make this tangible, let's consider a day in the life of a Universal Banker, a common and vital role in the Retail Banking division.

- 8:30 AM: Arrive at the branch, review overnight communications and team goals for the day. Check the appointment schedule for client meetings.

- 9:00 AM: The branch opens. The first hour is often busy with customers making deposits, withdrawals, and other routine transactions. You handle these efficiently while looking for opportunities to offer more value.

- 10:30 AM: A small business owner comes in to discuss a line of credit. You conduct a needs-based conversation, gather the necessary financial documents, and explain the application process, setting clear expectations.

- 12:00 PM: Lunch break.

- 1:00 PM: A scheduled appointment with a young couple looking to buy their first home. You introduce them to the branch's Mortgage Loan Officer, staying in the meeting to ensure a warm handoff and answer initial questions about checking and savings accounts that can support their goal.

- 2:30 PM: You notice a customer in your portfolio has a large sum of money sitting in a low-interest checking account. You proactively call them to schedule a meeting to discuss higher-yield savings options or a potential referral to a PNC Investments Financial Advisor.

- 4:00 PM: The branch is quieter. You use this time for outbound calls, follow-ups on pending applications, and completing required compliance training modules.

- 5:15 PM: After the branch closes to the public, you balance your cash drawer, finalize paperwork, and participate in a brief team huddle to celebrate the day's wins and discuss challenges.

This example illustrates the blend of transactional service, proactive sales, and administrative diligence that defines many roles at PNC. For a technology or corporate role, the "client" might be internal and the "product" might be a piece of software or a risk model, but the underlying principles of service, analysis, and execution remain the same.

Average PNC Bank Salary: A Deep Dive

Now, let's get to the core of the matter: compensation. Analyzing the salary structure at a company as large as PNC requires looking at aggregated data from multiple sources and understanding that these figures represent a blend of different roles, locations, and experience levels.

According to data aggregated from sources like Payscale and Glassdoor in late 2023 and early 2024, the average base salary at PNC Bank falls somewhere in the range of $75,000 to $90,000 per year. However, this single number can be misleading. A more accurate picture emerges when we break down salaries by job function and experience level.

A software engineer will earn significantly more than a bank teller, and a Senior Vice President in wealth management will have a compensation package that looks entirely different from that of an entry-level branch banker.

Here is a more illustrative breakdown of estimated salary ranges for common roles at PNC, reflecting different stages of a career.

#### Estimated PNC Bank Salary Brackets by Job Title and Experience

| Job Title | Entry-Level (0-2 Yrs) | Mid-Career (3-8 Yrs) | Senior (8+ Yrs) | Primary Data Source(s) |

| :--- | :--- | :--- | :--- | :--- |

| Universal Banker / Teller | $38,000 - $48,000 | $45,000 - $55,000 | $50,000 - $65,000 (e.g., Senior Teller) | Glassdoor, Payscale |

| Branch Manager | N/A (requires experience) | $70,000 - $95,000 | $90,000 - $125,000+ | Salary.com, Glassdoor |

| Financial Advisor | $55,000 - $75,000 (Base) | $80,000 - $150,000+ (Base + Commission) | $150,000 - $300,000+ (Base + Commission) | Payscale, Industry Reports |

| Credit Analyst | $65,000 - $85,000 | $80,000 - $110,000 | $105,000 - $140,000+ | Glassdoor, Robert Half |

| Relationship Manager (C&I)| N/A (requires experience) | $100,000 - $150,000 | $140,000 - $250,000+ | Glassdoor, Industry Reports |

| Software Engineer | $80,000 - $105,000 | $100,000 - $145,000 | $140,000 - $190,000+ | Glassdoor, Levels.fyi |

| Data Scientist / Analyst | $85,000 - $110,000 | $110,000 - $150,000 | $145,000 - $200,000+ | Glassdoor, Burtch Works |

| Risk Manager | $90,000 - $120,000 | $115,000 - $160,000 | $150,000 - $220,000+ | Salary.com, GARP |

*Disclaimer: These are estimates based on publicly available, self-reported data and can vary significantly based on the factors discussed in the next section. They are intended for illustrative purposes.*

### Beyond the Base Salary: Understanding Total Compensation

A crucial mistake many job seekers make is focusing solely on the base salary. At a sophisticated employer like PNC, total compensation is a more meaningful metric. It encompasses several key components:

1. Base Salary: This is your guaranteed, fixed annual pay. It's the foundation of your compensation and is determined by your role's "grade" or "level" within the company's internal structure.

2. Annual Bonus / Incentive Pay: This is the variable, performance-based component of your pay. At PNC, this often comes in the form of the Management Incentive Plan (MIP) or other role-specific bonus structures.

- For retail roles: Bonuses are often tied to achieving specific sales goals (e.g., number of new accounts, loan volume) and customer satisfaction scores.

- For corporate and tech roles: Bonuses are typically linked to a combination of individual performance, business unit success, and the overall profitability of the bank. A target bonus might be expressed as a percentage of your base salary (e.g., 10% for an analyst, 20-30% for a manager, and 50%+ for senior leadership).

3. Long-Term Incentives (LTI): For senior-level employees (typically Vice President and above), a significant portion of compensation may come from LTI awards, such as restricted stock units (RSUs) or performance shares. These awards vest over several years, aligning the employee's long-term interests with those of the shareholders and encouraging retention.

4. Benefits and Perks: This is an incredibly valuable, yet often underestimated, part of the package. PNC is known for its comprehensive benefits, which can be worth tens of thousands of dollars annually. These typically include:

- Health Insurance: Medical, dental, and vision plans.

- Retirement Savings: A 401(k) plan with a generous company match. PNC has historically offered a dollar-for-dollar match up to a certain percentage of an employee's salary, which is a powerful wealth-building tool.

- Paid Time Off (PTO): A competitive allotment of vacation days, sick days, and personal days.

- Parental Leave: Paid leave for new parents.

- Tuition Reimbursement: Financial assistance for employees pursuing further education or certifications relevant to their careers.

- Employee Wellness Programs: Resources for mental and physical health, financial wellness coaching, and more.

When evaluating a PNC Bank salary offer, you must consider all these elements together. A slightly lower base salary might be more than offset by a higher bonus potential and a top-tier benefits package.

Key Factors That Influence Your PNC Bank Salary

Your compensation at PNC is not arbitrary. It is the output of a sophisticated model that weighs numerous factors to determine your market value. Understanding these levers is the key to negotiating a better offer and maximizing your earning potential throughout your career. This section, the most detailed in our guide, will break down each of these critical factors.

###

1. Level of Education and Certifications

Your educational background serves as the entry ticket to many professional roles at PNC. While a bachelor's degree is the standard requirement for most corporate and analytical positions, the type of degree and any advanced qualifications you possess can significantly impact your starting salary and career ceiling.

- Bachelor's Degree: For roles in finance, corporate banking, and wealth management, degrees in Finance, Economics, Accounting, or Business Administration are most common and valued. They provide the foundational knowledge of financial principles, markets, and analysis that is essential for success. For technology roles, a degree in Computer Science, Information Systems, or Engineering is the gold standard. A candidate with a relevant degree from a highly-regarded "target school" for banking may command a slight premium or have access to more competitive development programs.

- Master's Degree: Pursuing a master's degree can unlock higher-level positions and accelerate your career.

- Master of Business Administration (MBA): An MBA is the most powerful advanced degree for a career in banking leadership. Graduates, particularly from top-tier programs, are often hired into senior associate or management development programs with starting salaries that can be $30,000 to $60,000 higher than their pre-MBA peers. An MBA signals advanced knowledge in strategy, leadership, and finance, making you a prime candidate for relationship management, corporate strategy, or product management roles.

- Specialized Master's: Degrees like a Master of Science in Finance (MSF), Master in Financial Engineering (MFE), or Master in Data Science are highly valued for quantitative and technical roles. An MFE graduate, for instance, would be a top candidate for a quantitative risk modeling or derivatives trading support role, commanding a salary commensurate with their specialized, in-demand skills.

- Professional Certifications: In banking, certifications are a clear signal of expertise and commitment to your craft. They can lead to higher pay, greater responsibilities, and enhanced credibility with clients and colleagues.

- Chartered Financial Analyst (CFA): The gold standard for investment management and equity research. Earning the CFA charter often results in a significant salary bump and is practically a prerequisite for senior roles in the Asset Management Group.

- Certified Financial Planner (CFP): Essential for financial advisors and wealth managers. It demonstrates proficiency in all aspects of personal financial planning and can directly lead to a larger client base and higher commission-based earnings.

- Certified Public Accountant (CPA): While associated with accounting firms, a CPA is highly valuable for roles in corporate finance, internal audit, and credit analysis within a bank.

- Project Management Professional (PMP): Critical for professionals in technology and operations who manage large-scale projects, such as system integrations or new product launches.

- Cloud Certifications (e.g., AWS Certified Solutions Architect, Azure Fundamentals): For technology professionals, certifications from major cloud providers are becoming non-negotiable and can add a 5-15% premium to your salary as banks aggressively migrate their infrastructure to the cloud.

###

2. Years of Experience and Career Trajectory

Experience is perhaps the single most significant determinant of salary. PNC, like other large corporations, has a well-defined career ladder with corresponding salary bands for each level. As you gain experience, demonstrate results, and take on more responsibility, you advance up this ladder.

- Entry-Level (0-3 years): Analyst / Associate: This is the foundational stage. You are learning the business, developing core technical skills (like financial modeling or coding), and supporting senior team members. The focus is on execution and learning. Salaries are competitive but are the lowest on the professional scale. Growth comes from proving your competence and work ethic.

- *Example Salary Growth:* A Credit Analyst might start at $75,000. After two years of strong performance, they might be promoted to Senior Analyst with a salary of $90,000.

- Mid-Career (4-10 years): Assistant Vice President (AVP) / Vice President (VP): At this stage, you have transitioned from a pure doer to a manager and strategic thinker. You may be leading small teams, managing your own portfolio of clients, or owning significant projects. Your impact is more direct and measurable. This is where compensation begins to accelerate, with the bonus component becoming a much larger part of your total pay.

- *Example Salary Growth:* A Software Engineer II earning $120,000 might be promoted to a Lead Engineer or Engineering Manager (often at the VP level in bank titling) with a base salary of $155,000 and a target bonus of 20-25%.

- Senior-Level (10+ years): Senior Vice President (SVP) / Director / Managing Director (MD): At this level, you are a senior leader responsible for the strategy and performance of a business line or department. Your work involves setting direction, managing large teams, and bearing P&L (Profit & Loss) responsibility. Compensation is heavily weighted towards variable pay (bonuses, LTI) tied to the results you deliver for the bank. Base salaries are high, but the real wealth creation comes from performance incentives.

- *Example Salary Growth:* A VP Relationship Manager in C&I earning a total compensation of $220,000 could be promoted to SVP, leading a team of RMs, with a potential total compensation package of $350,000+, with a significant portion being at-risk performance pay.

###

3. Geographic Location

Where you work matters immensely. PNC operates a "location-based pay" strategy, meaning they adjust salary bands to reflect the local cost of labor and cost of living. A role in a major metropolitan hub will pay significantly more than the exact same role in a smaller, rural market.

- High-Cost-of-Living (HCOL) Tiers: Major financial and tech centers like New York City, Washington D.C., Chicago, and Boston will have the highest salary bands. A role that pays $100,000 in a baseline market might pay $115,000 to $130,000 in these cities to remain competitive.

- Mid-Cost-of-Living (MCOL) Tiers: This includes many of PNC's key corporate hubs and large markets, such as Pittsburgh (HQ), Philadelphia, Cleveland, Charlotte, and Atlanta. Salaries here are strong and represent the "benchmark" for many roles.

- Low-Cost-of-Living (LCOL) Tiers: Smaller cities and more rural areas will have lower salary bands. The same role that pays $100,000 in a benchmark city might pay $85,000 to $90,000 in a lower-cost market. While the nominal dollar amount is less, the employee's purchasing power may be equivalent or even greater.

It's important to research the cost of living in a location alongside the salary. A higher salary in an HCOL city might not result in more disposable income than a lower salary in an LCOL area.

###

4. Company Type & Size: PNC vs. The Competition

While this guide focuses on PNC, it's insightful to understand how a PNC Bank salary compares to other types of employers in the financial landscape.

- PNC (Large National Bank): Offers a balance of strong, competitive salaries, excellent benefits, and relative job stability. Work-life balance is generally better than at elite investment banks. Compensation is structured, transparent, and grows predictably with performance and tenure.

- Wall Street Investment Banks (e.g., Goldman Sachs, J.P. Morgan Investment Bank): These firms typically offer the highest starting salaries and bonus potential, especially in their investment banking (IBD) and sales & trading (S&T) divisions. However, this comes at the cost of extremely long hours and a high-pressure "up or out" culture.

- Fintech Startups (e.g., Chime, Stripe): Compensation here is often a mix of a competitive base salary and significant equity (stock options). The cash component might be slightly lower than at PNC, but the potential upside from an IPO or acquisition can be enormous (though highly speculative). The culture is typically faster-paced and less structured.

- Regional & Community Banks: These smaller institutions generally offer lower base salaries and bonuses than a large national player like PNC. They often compete on the basis of better work-life balance, a strong connection to the local community, and a less corporate culture.

###

5. Area of Specialization (Business Line)

As shown in the salary table earlier, the business line you work in is a massive driver of your pay. The fundamental reason is revenue generation and required skill scarcity.

- Technology & Quantitative Roles (Highest Earning Potential): Roles like Data Scientist, AI/ML Engineer, Cybersecurity Expert, and Software Engineer are currently in a war for talent. Banks are technology companies, and they must pay top dollar to compete with Big Tech and fintechs for these skills. These roles often have some of the highest base salaries within the bank, outside of senior revenue-generating positions.

- Corporate & Institutional Banking / Asset Management (High Revenue-Generating): Front-office roles that directly generate revenue, such as Relationship Managers, Investment Bankers (PNC has a subsidiary, Harris Williams), and Wealth Managers, have very high earning potential. Their compensation is heavily leveraged, with a large bonus or commission component directly tied to the revenue they bring in.

- Risk Management & Compliance (Critical Function): In the post-2008 world, risk and compliance are paramount. Professionals who can navigate complex regulatory environments (e.g., Basel III/IV, Anti-Money Laundering) and quantify risk (credit risk, market risk, operational risk) are highly valued and well-compensated.

- Retail Banking (Volume and Scale): Roles in the retail branches, while essential to the bank's mission and footprint, are compensated at a lower level. The skills are less specialized, and the revenue per employee is lower than in the corporate or tech divisions. However, top-performing Branch Managers in large, successful branches can still earn excellent incomes.

###

6. In-Demand Skills

Beyond your job title, the specific skills you possess can create a salary premium. Cultivating these skills is the most direct way to increase your value.

- Technical Skills:

- Data Analysis & Programming: Proficiency in SQL (for data extraction), Python or R (for statistical analysis and modeling), and data visualization tools like Tableau or Power BI is in high demand across nearly every division, from marketing to risk.

- Financial Modeling: The ability to build complex, three-statement financial models in Excel is the bedrock skill for corporate finance, credit analysis, and investment banking roles.

- Cloud Computing: As mentioned, expertise in AWS, Azure, or Google Cloud Platform is critical for technology roles.

- Soft Skills / Business Acumen:

- Client Relationship Management: The ability to build trust, understand client needs, and act as a strategic advisor is what separates top-performing relationship managers and financial advisors. This is an art that commands a premium.

- Strategic Thinking: Moving beyond day-to-day tasks to understand the bigger picture, identify opportunities, and anticipate threats is a hallmark of leadership and a key driver of promotion.

- Communication & Presentation Skills: Being able to clearly articulate complex ideas to diverse audiences—from a tech team to the board of directors—is a universal accelerator for any career.

Job Outlook and Career Growth in Banking

A competitive salary is only one part of the equation; long-term career viability is equally important. The banking industry is undergoing a profound transformation, but the outlook for skilled professionals remains strong, particularly for those who adapt to emerging trends.

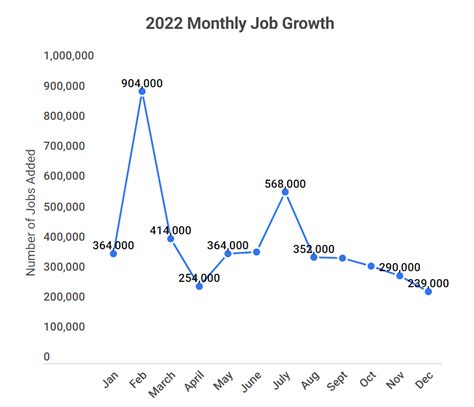

According to the U.S. Bureau of Labor Statistics (BLS), employment in "Business and Financial Occupations" is projected to grow 7 percent from 2021 to 2031, faster than the average for all occupations. This is expected to result in about 715,100 new jobs over the decade. This growth is driven by a greater need for services like cash management, financial planning, and risk analysis in an increasingly complex global economy.

Specifically for roles common in banking:

- Financial Analysts: The BLS projects 9% growth through 2031, much faster than average.

- Personal Financial Advisors: An even more robust projection of 15% growth, reflecting an aging population and a greater need for retirement planning.

- Software Developers: A staggering 25% projected growth, highlighting the insatiable demand for tech talent across all industries, including finance.

While these statistics are promising, they mask a significant shift within the industry. The jobs of the future at PNC will look different from the jobs of the past.

### Emerging Trends and Future Challenges

1. Digital Transformation and AI: The most significant trend is the shift from physical branches to digital channels. This means fewer traditional teller roles but a massive increase in demand for professionals who can build, manage, and secure