For the ambitious, analytical, and financially driven, a career in private equity (PE) represents the pinnacle of the finance world. It's a field shrouded in an aura of prestige, high stakes, and, of course, astronomical compensation. But beyond the headlines of multi-billion dollar deals and seven-figure bonuses lies a demanding, hyper-competitive industry that requires a unique blend of financial acumen, strategic thinking, and operational grit. The question on every aspiring professional's mind is not just "what is private equity?" but "what are private equity salaries really like?"

The answer is complex, but the potential is staggering. While entry-level analysts in other finance roles might start with strong six-figure salaries, the all-in compensation for a first-year private equity Associate can easily surpass $200,000 and climb into the millions at the partner level. As a career analyst, I once mentored a brilliant young investment banker who was navigating the grueling private equity recruitment cycle. She was exhausted, questioning if the endless financial modeling tests and back-to-back "superday" interviews were worth it. A year later, after landing a role at a respected middle-market firm, she called me not just to talk about her incredible compensation package, but about the profound impact she was having, working directly with the C-suite of a portfolio company to drive real growth. Her story encapsulates the essence of this career: the rewards, both financial and professional, are immense for those who can navigate the path.

This guide will demystify the world of private equity compensation. We will dissect every component of a PE salary, from base and bonus to the life-changing potential of "carried interest." We'll explore the key factors that dictate your earning potential and provide a clear, actionable roadmap for breaking into this exclusive field.

### Table of Contents

1. [What Does a Private Equity Professional Do?](#what-do-they-do)

2. [Average Private Equity Salary: A Deep Dive](#salary-deep-dive)

3. [Key Factors That Influence Salary](#key-factors)

4. [Job Outlook and Career Growth](#job-outlook)

5. [How to Get Started in This Career](#how-to-get-started)

6. [Conclusion](#conclusion)

What Does a Private Equity Professional Do?

At its core, a private equity professional is an investor and a business operator combined. Unlike public market investors who buy small stakes in publicly traded companies, PE firms raise capital from institutional investors (like pension funds, endowments, and sovereign wealth funds) to acquire controlling or significant minority stakes in private companies or take public companies private. The goal is not just to buy and hold, but to actively improve the company's performance over a 3-7 year holding period before selling it for a substantial profit—an event known as an "exit."

This active management is what truly defines the role. A PE professional's work revolves around the entire lifecycle of an investment, which can be broken down into four key stages:

1. Deal Sourcing & Screening: This is the hunt. Junior professionals spend considerable time identifying potential investment opportunities. This involves screening industries, attending conferences, building relationships with investment bankers and business brokers, and conducting initial analyses to see if a company fits the fund's investment thesis.

2. Due Diligence & Deal Execution: Once a promising target is identified, the real work begins. The team conducts an exhaustive investigation—due diligence—into every facet of the business: its financials, operations, market position, management team, and legal standing. This stage is dominated by intense financial modeling, particularly building a Leveraged Buyout (LBO) model, which analyzes the viability of acquiring a company using a significant amount of debt. If the deal looks good, the team will negotiate the terms, secure financing, and execute the transaction.

3. Portfolio Company Management & Value Creation: After the acquisition, the focus shifts from transaction to transformation. PE professionals work alongside the portfolio company's management team to implement strategic initiatives. This isn't passive ownership; it's hands-on. Activities can include optimizing pricing strategies, improving operational efficiency, entering new markets, hiring key executives, or sourcing bolt-on acquisitions to grow the business.

4. Exit: The final stage is monetizing the investment. The PE firm prepares the company for a sale to another company (a strategic buyer), another PE firm (a secondary buyout), or through an Initial Public Offering (IPO). The goal is to maximize the return for the firm's investors (Limited Partners, or LPs) and, by extension, for the PE professionals themselves.

### A Day in the Life of a Private Equity Associate

To make this more concrete, let's imagine a typical day for a second-year Associate working on a live deal and managing an existing portfolio company.

- 8:00 AM: Arrive at the office. Scan emails and news feeds for any updates on the market or portfolio companies. Review the financial model for "Project Titan," a potential acquisition in the industrial services sector, identifying key assumptions to stress-test today.

- 9:00 AM: Join an internal deal team meeting for Project Titan. The Vice President (VP) leads the discussion. You present your initial findings from the model and are tasked with building several new sensitivity analyses based on different economic scenarios.

- 10:30 AM: Conference call with an industry expert to diligence Project Titan's competitive landscape. You take detailed notes, probing the expert on market share, pricing power, and potential disruptors.

- 12:00 PM: Quick lunch at your desk while reviewing the monthly financial performance package from "Acuity Corp," an existing portfolio company. You notice a slight dip in gross margin and flag it for follow-up.

- 1:00 PM: Call with the CFO of Acuity Corp. You walk through the financials, asking pointed questions about the margin compression. The CFO explains it's due to a temporary rise in raw material costs. You discuss mitigation strategies they are implementing.

- 2:30 PM: Back to the Project Titan model. You spend the next three hours deep in Excel, building out the requested sensitivities (e.g., "What happens to our returns if interest rates rise by 200 basis points?").

- 5:30 PM: The VP stops by your desk. You walk him through the updated model, explaining your findings. He asks you to incorporate these findings into a few new slides for the investment committee presentation deck.

- 7:00 PM: Work on the PowerPoint deck, creating clear, concise charts and summaries. This requires not just financial skill, but the ability to tell a compelling story with data.

- 9:00 PM: The draft of the slides is sent to the team for review. You order dinner to the office, check emails one last time, and begin preparing a list of questions for tomorrow's call with the lenders for Project Titan. Depending on the deal's urgency, the night could end here or extend past midnight.

This example illustrates the intensity and variety of the work. It's a demanding blend of quantitative analysis, strategic thinking, and interpersonal communication.

Average Private Equity Salary: A Deep Dive

Private equity compensation is legendary for a reason. It is structured to reward performance heavily and is composed of three main elements: a base salary, an annual bonus, and the most coveted component, carried interest. Total compensation, often referred to as "all-in comp," grows exponentially as you climb the career ladder.

According to the 2023 North American Private Equity Compensation Report from Heidrick & Struggles, a leading executive search and advisory firm, compensation remains robust across the industry. While the dealmaking environment can cause year-over-year fluctuations in bonuses, the overall structure ensures that PE remains one of the most lucrative career paths in the world.

Let's break down the typical compensation by seniority level. Note that these figures can vary significantly based on the factors discussed in the next section (especially firm size and location), but they provide an authoritative baseline.

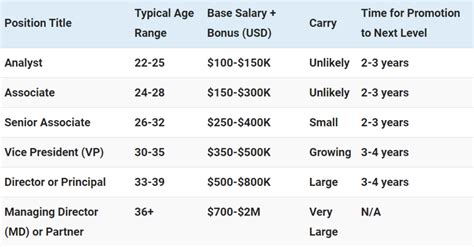

Private Equity Compensation by Seniority (All-in Cash Compensation: Base + Bonus)

| Title | Years of Experience | Typical Base Salary Range (USD) | Typical Annual Bonus (% of Base) | Typical All-in Cash Compensation (USD) |

| :--- | :--- | :--- | :--- | :--- |

| Analyst | 0-2 | $110,000 - $175,000 | 75% - 125% | $190,000 - $350,000 |

| Associate | 2-5 (post-IB/Consulting) | $175,000 - $225,000 | 100% - 150% | $350,000 - $550,000+ |

| Senior Associate | 4-7 | $200,000 - $275,000 | 125% - 175% | $450,000 - $700,000+ |

| Vice President (VP) | 6-10 | $275,000 - $375,000 | 150% - 200%+ | $700,000 - $1,200,000+ |

| Principal / Director| 9-14 | $350,000 - $500,000 | 150% - 200%+ | $1,000,000 - $2,500,000+ |

| Partner / Managing Director (MD) | 13+ | $500,000 - $1,000,000+ | Varies Widely | $2,000,000 - $10,000,000+ |

*(Source: Data compiled and synthesized from 2023-2024 reports by Heidrick & Struggles, Preqin, and Burtch Works, as well as publicly available data from Wall Street Oasis.)*

### Deconstructing the Compensation Components

Understanding the numbers in the table requires knowing what each component means.

#### 1. Base Salary

This is the fixed, guaranteed portion of your annual income. It is highly competitive and designed to be attractive on its own, especially when compared to corporate roles. As you can see, the base salary increases steadily with seniority, providing a stable foundation for your earnings. However, in the world of private equity, the base salary quickly becomes the smallest part of your total compensation.

#### 2. Annual Bonus

The bonus is the variable, performance-based cash payment you receive at the end of the year. It's a direct reflection of both your individual performance and the firm's overall success in a given year (e.g., how many deals were closed, how well the portfolio is performing). For junior professionals like Analysts and Associates, the bonus is typically a percentage of their base salary and can often exceed 100%. A strong year with successful deal closes can lead to bonuses on the higher end of the range, while a slower year might result in lower, though still substantial, payouts.

#### 3. Carried Interest ("Carry")

This is the holy grail of private equity compensation and the primary driver of long-term wealth creation. Carried interest is the share of the profits from a fund's investments that is paid out to the firm's partners and senior employees.

Here’s a simplified explanation:

- A PE firm raises a fund, say $1 billion, from Limited Partners (LPs).

- The firm invests this capital in companies.

- Over time, they sell these companies for, let's say, a total of $3 billion.

- First, the initial $1 billion in capital is returned to the LPs.

- Then, the LPs typically receive a "preferred return," usually around 8% per year, on their investment.

- Any profit remaining after this is split. A common arrangement is an "80/20 split," where 80% of the profits go to the LPs and 20% goes to the PE firm's professionals. This 20% is the carried interest.

Carry is granted in the form of "carry points" or a percentage allocation. It's not liquid cash; it's a long-term incentive that only pays out when investments are successfully exited for a profit. It often vests over several years, encouraging employees to stay with the firm and focus on the long-term success of the portfolio.

While Analysts and junior Associates typically do not receive carry, it starts to become a part of the compensation package at the Senior Associate or, more commonly, the VP level. At the Principal and Partner levels, carry becomes the single largest and most significant component of their potential earnings, capable of generating millions or even tens of millions of dollars from a single successful fund.

#### 4. Other Benefits

Beyond these three core components, private equity professionals enjoy top-tier benefits packages, including:

- Co-investment Opportunities: The chance to invest your own money directly into the fund's deals alongside the LPs, often with no or reduced management fees. This is another powerful wealth-building mechanism.

- Excellent Healthcare: Premium health, dental, and vision insurance plans.

- Generous 401(k) Plans: With significant employer matching contributions.

- Perks: Meal allowances for late nights, car services, wellness stipends, and more.

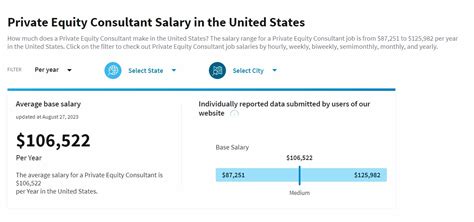

Key Factors That Influence Salary

While the averages provide a great starting point, private equity salaries are anything but standard. Your specific compensation can swing by hundreds of thousands of dollars based on a handful of critical factors. As an expert analyst, this is where the real nuance lies. Understanding these variables is key to maximizing your earning potential.

###

Level of Education

In private equity, your educational background serves as a critical signaling mechanism, especially early in your career.

- Undergraduate Degree & Institution: The path to private equity almost exclusively begins at a "target" or "semi-target" university. These include Ivy League schools (Harvard, Princeton, Wharton/UPenn), other elite private institutions (Stanford, MIT, Duke, UChicago), and top public universities (UVA, Michigan, UC Berkeley). A degree in Finance, Economics, or a STEM field is most common. While a prestigious degree doesn't guarantee a higher salary at the same firm, it is the key that unlocks the door to the interviews that lead to these high-paying jobs in the first place.

- Master of Business Administration (MBA): The MBA is a traditional and powerful inflection point in a PE career. Many investment banking or consulting analysts who don't get a direct promotion to a PE associate role will attend a top-tier MBA program to "reset" their careers and re-recruit for post-MBA associate or senior associate positions. An MBA from an elite program like Harvard Business School (HBS), Stanford Graduate School of Business (GSB), or Wharton is a powerful stamp of approval. Post-MBA associates often command higher starting base salaries and may be on a faster track to VP than their non-MBA peers. According to Salary.com, professionals with an MBA in a finance-related field can see a salary premium of 15-25% over their non-MBA counterparts, an effect that is even more pronounced in the exclusive world of PE.

- Certifications (CFA, CAIA): While not mandatory, certifications can add value. The Chartered Financial Analyst (CFA) designation is highly respected and demonstrates a deep mastery of financial analysis, valuation, and portfolio management. It is more of a "nice-to-have" than a "need-to-have" in PE but can be a differentiator, particularly for candidates from non-traditional backgrounds. The Chartered Alternative Investment Analyst (CAIA) charter is also relevant, focusing specifically on asset classes like private equity and hedge funds. These won't necessarily lead to a direct salary bump but strengthen your resume and demonstrate a serious commitment to the field.

###

Years and Type of Experience

Experience is arguably the most significant driver of salary growth. However, in private equity, *what* you did before and *how* you progress is just as important as the number of years.

- The Pre-PE Track (The "2 and 2" Model): The most common path into private equity is completing a two-year analyst program at a top-tier investment bank (e.g., Goldman Sachs, Morgan Stanley, Evercore, Lazard) or a top management consulting firm (McKinsey, Bain, BCG). This pre-PE experience is considered essential training. The skills learned—financial modeling, valuation, slide-deck creation, and intense work ethic—are directly transferable. Candidates coming from these backgrounds start at the Associate level with the high compensation figures previously detailed.

- Salary Growth by Career Stage:

- Analyst/Associate (Years 0-5): This is the "learning" phase. Your salary growth is significant but primarily driven by predictable increases in base and a consistently high bonus multiple. All-in cash comp can realistically double from your first year to your last year as an associate.

- Vice President (Years 6-10): This is the first major leap. VPs take on significant deal responsibility and begin managing junior team members. Their base and bonus jump substantially, but the real game-changer is receiving their first allocation of carried interest. While this carry won't be realized for years, its potential value dramatically increases total long-term compensation.

- Principal/Director (Years 9-14): At this stage, you are a senior deal-maker and a leader within the firm. Your cash compensation crosses the seven-figure threshold, and your carried interest allocation becomes much more significant. Your performance is now judged not just on your analytical skills but on your ability to source deals, win bids, and effectively manage portfolio companies.

- Partner/Managing Director (Years 13+): This is the top of the pyramid. Compensation is heavily weighted towards carry and a share of the firm's overall profits. Their cash compensation provides a very comfortable lifestyle, but their true wealth is built through the successful exits of the fund's investments, which can lead to eight-figure paydays.

###

Geographic Location

Where you work has a direct and significant impact on your cash compensation (base + bonus), largely due to variations in cost of living and the concentration of firms.

- Top-Tier Hubs (Highest Pay): New York City is the undisputed epicenter of the finance world, and private equity is no exception. Firms in NYC typically pay the highest salaries to attract and retain top talent in a highly competitive market. Other major hubs like San Francisco/Bay Area (driven by tech-focused PE and VC), Boston, and London also offer top-of-market compensation.

- Major Hubs (Slightly Lower Pay): Cities like Chicago, Los Angeles, and Dallas have robust and growing private equity scenes. While compensation is still extremely high, it may be slightly discounted (5-15%) compared to New York, though this is often offset by a lower cost of living.

- Regional Markets: Smaller cities and regional markets may have lower-end middle-market or smaller PE funds where cash compensation can be 20-30% lower than in NYC. However, these roles may offer a better work-life balance and still provide significant financial rewards relative to other local industries.

Illustrative Location-Based Salary Comparison (Associate Level - All-in Cash)

| Location | Estimated Annual Compensation (USD) |

| :--- | :--- |

| New York, NY | $400,000 - $550,000 |

| San Francisco, CA| $380,000 - $525,000 |

| Chicago, IL | $350,000 - $480,000 |

| Dallas, TX | $330,000 - $460,000 |

*(Source: Internal analysis based on data from Glassdoor, Salary.com, and industry discussions. These are estimates for illustrative purposes.)*

###

Company Type & Size

This is perhaps the single most important factor in determining your compensation package. The size of the fund you work for—measured by Assets Under Management (AUM)—creates distinct tiers within the industry.

- Mega-Funds (MF): These are the giants of the industry (e.g., Blackstone, KKR, Carlyle, TPG). They manage funds in the tens of billions of dollars ($20B+).

- Salary Impact: Mega-funds pay the absolute highest cash compensation (base + bonus) at all levels. Their deal sizes are enormous, and they can afford to pay top-dollar for the best talent.

- Pros: Highest pay, largest and most complex deals, strongest brand name on a resume.

- Cons: Often more bureaucratic, highly specialized roles (you might only focus on industrials in North America), and a very competitive, often "up-or-out" culture. Carry might be spread more thinly among a larger pool of professionals.

- Upper Middle-Market (UMM): These firms manage funds typically ranging from $5 billion to $20 billion.

- Salary Impact: Cash compensation is very strong, often approaching mega-fund levels, but might be a small step below.

- Pros: Still work on large, interesting deals with significant resources. The culture can be slightly better than at mega-funds, with more opportunities for responsibility.

- Cons: Still a very high-pressure environment.

- Middle-Market (MM) & Lower Middle-Market (LMM): These are the most numerous firms, managing funds from a few hundred million up to around $5 billion.

- Salary Impact: Cash compensation is lower than at MFs and UMMs, but still exceptionally high compared to almost any other industry. The real difference can be in the upside.

- Pros: Associates and VPs often get much broader experience, working on all aspects of a deal. There's often more direct exposure to senior partners and portfolio company management. Crucially, a smaller team means that carry points can be more concentrated, offering potentially massive upside on a successful fund.

- Cons: Lower cash comp, smaller deals, and less brand-name prestige.

- Venture Capital (VC) & Growth Equity: These are related but distinct fields. VC firms invest in early-stage startups, while growth equity firms invest in more mature, but still rapidly growing, companies.

- Salary Impact: Cash compensation, especially at the junior levels, is often lower than in traditional buyout PE. Base salaries might be comparable, but bonuses are typically smaller. The big trade-off is for potentially enormous carry upside, as a successful early-stage investment can return 50x or 100x the initial capital, whereas a successful buyout might return 3-5x.

###

Area of Specialization

Your area of focus within private equity can also influence your pay, often tied to the "hot" sectors of the economy.

- Sector Focus: Professionals who specialize in high-growth, technically complex sectors like technology (especially software/SaaS), healthcare, and fintech may command a premium. Firms need genuine expertise to diligence these companies, and they are willing to pay for it.

- Strategy Focus: The firm's investment strategy matters.

- Buyout: The traditional model of taking control of mature companies. This is the largest segment and forms the basis for most of the salary data here.

- Growth Equity: As mentioned, this can have a slightly different compensation structure (lower cash, higher potential carry).

- Distressed / Special Situations: These funds invest in companies facing bankruptcy or other complex financial challenges. This is a highly specialized skill set, and successful professionals in this niche can be compensated exceptionally well due to the high risk and high potential returns.

- Private Credit: A rapidly growing area where firms lend money directly to companies instead of buying them. Compensation is strong but generally follows a slightly different model, often with a bonus structure more tied to originated deal volume and less reliance on carry.

###

In-Demand Skills

Finally, beyond your resume, the specific skills you demonstrate will dictate your success and, ultimately, your pay.

- Advanced Financial Modeling: This is table stakes. You must be an absolute expert in Excel and be able to build a complex, three-statement LBO model from scratch, under pressure.

- Valuation Expertise: Deep understanding of all valuation methodologies (DCF, Public Comps, Precedent Transactions) and the ability to defend your assumptions.

- Deal Execution & Negotiation: The ability to manage the complex process of a deal, from due diligence to closing, and possessing the soft skills to negotiate effectively with sellers, lawyers, and lenders.

- Operational Value Creation: This is increasingly important. Firms are looking for professionals who can do more than just financial engineering. Experience in operations, strategy, or having a deep understanding of how a business actually runs is a huge plus.

- Communication & Presentation Skills: You must be able to distill vast amounts of complex information into a clear, persuasive narrative for investment committees, LPs, and company management.

Job Outlook and Career Growth

While specific data for "private equity analyst" is not tracked by the U.S. Bureau of Labor Statistics (BLS), we can look at the broader category of "Financial Analysts" for a directional trend. The BLS projects an 8% growth for financial analysts from 2022 to 2032, which is much faster than the average for all occupations. This growth is driven by a growing range of financial products and the need for in-depth analysis of investment opportunities.

However, it is critical to apply context here. The job outlook for private equity specifically is far more nuanced and competitive than this broad statistic suggests. The number of seats at PE firms is extremely limited and does not grow linearly with the economy. The industry is highly cyclical; hiring accelerates during boom times when deal activity is high and can freeze or even reverse (through layoffs) during economic downturns.

Despite the limited number of positions, the amount of capital flowing into private markets continues to grow. According to Preqin, a leading industry data provider, global private equity assets under management (AUM) are projected to reach **