### A Note on the Topic

The query "prorated salary meaning" refers to a method of pay calculation, not a specific job title or career path. Therefore, instead of following a standard career profile structure (e.g., "What does a [Job Title] do?"), this article has been expertly adapted to provide a comprehensive guide on the *concept* of a prorated salary. This approach will give you, the professional, the most relevant and useful information to understand your own compensation.

Understanding Prorated Salary: A Comprehensive Guide for Professionals

Navigating a new job offer, a change in work hours, or your final paycheck can bring up unfamiliar terms. One of the most common is "prorated salary." While it may sound complex, understanding what it means is a crucial part of managing your career and finances effectively. It ensures you are paid fairly for the exact amount of time you work.

This guide will break down exactly what a prorated salary is, when it applies, how to calculate it, and what you need to look for in your employment contract.

What Does "Prorated Salary" Mean?

A prorated salary is a portion of your full annual salary that has been calculated to reflect the actual time you have worked within a specific pay period. The term itself comes from the Latin phrase *pro rata*, which means "in proportion."

In essence, if you are a salaried employee, you agree to a certain amount of compensation for a full year's work (e.g., $60,000 per year). However, if you don't work that full year—or even a full pay period—your employer won't pay you the full amount. Instead, they will prorate your pay, giving you the proportional amount you have earned.

This is a standard and fair practice used by virtually all employers to ensure accurate compensation for salaried-exempt and salaried-nonexempt employees who work partial pay periods.

When is Salary Prorated? Common Scenarios

You are most likely to encounter a prorated salary in the following situations:

- Starting a New Job: It's rare to start a new position on the very first day of a pay period. If your company pays bi-weekly and you start in the middle of the first week, your first paycheck will be prorated to cover only the days you actually worked.

- Leaving a Job: Similarly, when you resign, your final paycheck will be prorated to cover the days you worked in that final pay period up to your last day.

- Changing Work Status: If you transition from a full-time to a part-time position (or vice versa) mid-year, your annual salary will be adjusted and prorated to reflect your new schedule.

- Receiving a Mid-Year Raise: When you get a promotion or raise, your pay for the period in which the raise takes effect may be prorated. You'll earn at your old rate for the first part of the pay period and at your new, higher rate for the second part.

- Taking Unpaid Leave: If you take an extended, unpaid leave of absence (like FMLA leave that extends beyond paid time off), your salary will be prorated to exclude the days you did not work.

How to Calculate Your Prorated Salary

While your HR or payroll department will handle the official calculation, knowing how to do the math yourself is empowering. It allows you to check your pay stubs for accuracy and forecast your income. The most common method is based on a daily rate.

The Formula:

1. Calculate Your Daily Rate: `Annual Salary / Number of Working Days in the Year = Daily Rate`

2. Calculate Prorated Pay: `Daily Rate x Number of Days Worked in the Pay Period = Prorated Gross Pay`

The "Number of Working Days in the Year" is typically 260 (52 weeks x 5 workdays), although some companies may use the exact number of business days in a calendar year.

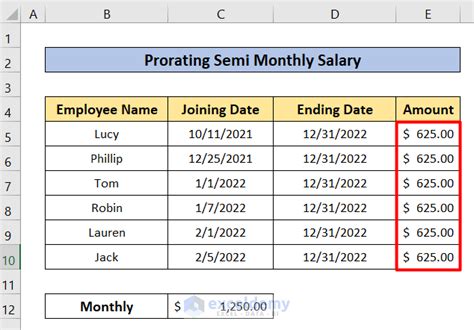

Example 1: Starting a Job Mid-Pay Period

Let's say a professional named Alex accepts a job with an annual salary of $75,000. The company pays semi-monthly (twice a month) and has 260 working days in the year.

- Alex's Daily Rate: $75,000 / 260 days = $288.46 per day

- Alex's first pay period runs from the 1st to the 15th of the month, which includes 11 workdays.

- However, Alex's start date is the 8th of the month. He will only work 6 days in this pay period (the 8th, 9th, 10th, 11th, 14th, and 15th).

- Alex's Prorated First Paycheck: $288.46 x 6 days = $1,730.76 (Gross Pay)

Example 2: Transitioning to Part-Time

Jordan earns an annual full-time salary of $90,000 for a 40-hour work week. He negotiates to switch to a part-time schedule of 24 hours per week (a 3-day week).

- Step 1: Find the Proportional Percentage: 24 hours (new schedule) / 40 hours (old schedule) = 0.60 or 60%

- Step 2: Calculate the New Prorated Annual Salary: $90,000 x 0.60 = $54,000

Jordan's new prorated annual salary will be $54,000, and all his subsequent paychecks will be based on this new figure.

Key Factors to Keep in Mind

Understanding the concept is the first step. Here are critical factors to consider when dealing with a prorated salary.

Review Your Offer Letter and Employment Contract

Your offer letter or employment contract should explicitly state your annual salary. If you have a start date that is not the beginning of a pay cycle, it may also mention that your first paycheck will be prorated. It's crucial to review this document carefully. If it's unclear, don't hesitate to ask your HR representative for clarification *before* you sign.

Understand Your Pay Stub

Once you receive a prorated paycheck, your pay stub is the key to understanding it. According to data from Payscale, employees who understand their pay are more likely to feel satisfied with their employer. Look for the "Gross Pay" amount and see if it aligns with your calculations. The pay stub should also detail the pay period dates, confirming the timeframe for which you were paid.

The Impact on Benefits

Changing your work status from full-time to part-time can have a significant impact on your benefits. Many companies, including those analyzed in reports by the U.S. Bureau of Labor Statistics (BLS), require a minimum number of weekly hours to be eligible for health insurance, dental, and retirement plans like a 401(k). If your prorated schedule drops you below this threshold, you could lose eligibility. Always discuss the impact on benefits with HR when negotiating a change in hours.

State and Federal Laws

Pay practices are regulated by law. The Fair Labor Standards Act (FLSA) sets federal rules for minimum wage and overtime. While proration for salaried employees is legal and standard, your employer cannot prorate your pay below the federal or state minimum wage for the hours worked. If you believe there is an error or discrepancy, the first step is to professionally address it with your payroll or HR department.

Conclusion: Empowerment Through Understanding

A prorated salary is not a penalty or a pay cut; it is a precise and fair system for compensating you for the exact proportion of time you work. By understanding how it's calculated and in which scenarios it applies, you can:

- Verify Paycheck Accuracy: Ensure you are being paid correctly from your very first paycheck to your last.

- Negotiate with Confidence: Make informed decisions when changing work hours or roles, fully aware of the financial implications.

- Plan Your Finances: Accurately forecast your income, especially during periods of job transition.

Ultimately, grasping the concept of a prorated salary is a small but vital piece of professional literacy. It empowers you to take control of your compensation and navigate your career with greater clarity and confidence.