For ambitious students and young professionals in accounting, finance, and consulting, a job offer from a "Big Four" firm is a coveted prize. Among them, PricewaterhouseCoopers (PwC) stands as a global titan, a beacon of professional prestige and a powerful launchpad for a successful career. But beyond the reputation and the unparalleled learning opportunities lies a critical question that every prospective candidate asks: "What is the real PwC Associate salary?"

Answering this question is not as simple as quoting a single number. The compensation for a PwC Associate is a complex package influenced by a multitude of factors, from your chosen service line to your city of residence. Landing this role is often the culmination of years of hard work, late-night study sessions, and relentless networking. It represents the transition from academic theory to high-stakes professional practice. The starting salary is more than just a paycheck; it's a validation of that effort and the first major step toward financial independence and a prosperous future. For many, it's the financial foundation upon which they will build their lives.

I recall mentoring a bright university student who was navigating the intense Big Four recruitment process. She was brilliant and driven but anxious about whether the demanding lifestyle would be "worth it" financially. We spent hours dissecting offer letters, comparing cost-of-living data, and mapping out the long-term earning potential. When she finally accepted her offer with PwC, the relief and excitement in her voice were palpable. It wasn't just about the number on the page; it was about the door that had just opened to a world of opportunity. This guide is built to give you that same clarity and confidence.

This comprehensive article will serve as your definitive resource, breaking down every component of a PwC Associate's compensation, the factors that dictate your earning potential, and the strategic steps you can take to maximize your salary and build a rewarding career at one of the world's most respected professional services firms.

### Table of Contents

- [What Does a PwC Associate Do?](#what-does-a-pwc-associate-do)

- [Average PwC Associate Salary: A Deep Dive](#average-pwc-associate-salary-a-deep-dive)

- [Key Factors That Influence Your PwC Associate Salary](#key-factors-that-influence-your-pwc-associate-salary)

- [Job Outlook and Career Growth at PwC](#job-outlook-and-career-growth-at-pwc)

- [How to Become a PwC Associate: Your Step-by-Step Guide](#how-to-become-a-pwc-associate-your-step-by-step-guide)

- [Conclusion: Is a PwC Associate Role Your Path to Success?](#conclusion-is-a-pwc-associate-role-your-path-to-success)

What Does a PwC Associate Do?

A PwC Associate is an entry-level professional who has recently graduated from university, typically with a degree in accounting, finance, business, economics, or a STEM-related field. This is the foundational role where new hires learn the ropes of the professional services world, develop core technical skills, and begin their journey toward becoming a seasoned expert. While the title is "Associate," the responsibilities can vary dramatically depending on the specific line of service you join.

PwC's primary business is structured into three main service lines:

1. Assurance (Audit): This is the largest and most well-known practice. Associates in Assurance work on audit engagements, examining clients' financial statements to ensure they are accurate, free from material misstatement, and compliant with relevant regulations (like GAAP or IFRS). Their work is fundamental to the trust and stability of the global financial markets.

2. Tax: Tax Associates help clients navigate the labyrinthine world of corporate and individual taxation. Their work involves tax compliance (preparing tax returns), tax strategy (advising on the tax implications of business decisions like mergers or international expansion), and specialization in areas like international tax, state and local tax, or M&A tax.

3. Advisory (Consulting): This is the broadest and often most varied line of service. Advisory is a large umbrella that covers a wide array of consulting services. Associates might work in Deals (helping with mergers, acquisitions, and restructuring), Cybersecurity & Privacy, Cloud & Digital, or Transformation (helping clients improve their business processes). The projects are often more strategic and project-based than the recurring nature of audit or tax work.

Typical Daily Tasks and Projects:

Regardless of the service line, an Associate's work is team-based and client-facing. Your days will be a mix of analytical tasks, collaboration, and learning.

- In Assurance: You might spend your day at the client's office "vouching" invoices to expense reports, "testing" internal controls, performing inventory counts, or using data analysis software to analyze large datasets of financial transactions.

- In Tax: Your day could involve researching complex tax codes, preparing workpapers for a corporate tax return, drafting memos on tax law changes, and liaising with the audit team to ensure the tax provision is correct.

- In Advisory: A project could involve building financial models for a potential acquisition, conducting market research for a new product launch, interviewing client employees to map out a business process, or helping to implement a new software system.

---

### A Day in the Life of a First-Year Assurance Associate

7:30 AM: Wake up, grab a quick coffee, and check emails on your phone. You see a message from your Senior Associate with a few review notes on the workpapers you submitted last night.

8:30 AM: Arrive at the client site. Today, you're at the headquarters of a large retail company. You find your team in the designated "audit room" and set up your laptop.

9:00 AM: Team check-in. The Engagement Manager outlines the goals for the day. Your main task is to complete the testing for the "Accounts Payable" section of the audit.

9:30 AM - 12:30 PM: You dive into your work. This involves obtaining a list of all unpaid invoices from the client, selecting a sample using PwC's proprietary software, and then for each item in the sample, "vouching" it to supporting documentation like purchase orders and receiving reports. It's detailed, meticulous work. You communicate with the client's AP clerk via email to request missing documents.

12:30 PM - 1:30 PM: Lunch. The audit team—you, another associate, your Senior, and the Manager—all go out to a nearby cafe. This is a great time to build camaraderie, ask questions in a less formal setting, and learn from their experiences.

1:30 PM - 4:00 PM: Back to testing. You hit a snag: one of the invoices in your sample is for a huge amount but has no corresponding purchase order. You flag this, document it thoroughly, and walk over to your Senior Associate's desk. You explain the issue, and she advises you on the next steps, which involve a direct inquiry with the client's controller.

4:00 PM - 5:30 PM: You use PwC's data visualization tools, like Tableau, to create a chart that shows the aging of accounts payable over the last four quarters. This will be used in the final report to the audit committee.

5:30 PM - 6:30 PM: You wrap up for the day, carefully documenting your workpapers, updating your status on the project management software, and creating a to-do list for tomorrow. You submit your completed work to the Senior for review.

7:00 PM: Head home or, if it's "busy season" (typically January-March), you might stay later or meet the team for a firm-sponsored dinner. The days are long, but the learning curve is incredibly steep.

---

Average PwC Associate Salary: A Deep Dive

Let's get to the core of the matter: compensation. A PwC Associate's salary is competitive and designed to attract top-tier talent from universities. It's important to understand that the "salary" is just one part of the total compensation package.

Based on an aggregation of the most recent data, the national average base salary for a first-year PwC Associate in the United States falls into a distinct range depending on the service line and location.

- Average Base Salary Range (First-Year Associate): $70,000 to $95,000+

- Source Synthesis: This range is derived from analyzing hundreds of self-reported data points on platforms like Glassdoor, Payscale, and professional forums like Fishbowl and Wall Street Oasis, cross-referenced with PwC's known hiring patterns as of late 2023 and early 2024. For instance, Glassdoor reports an average total pay for a PwC Associate around $84,000, which includes base salary and other potential cash compensation.

It's crucial to break this down further, as the averages can be misleading. A Tax Associate in Kansas City will make significantly less than a Deals Advisory Associate in New York City.

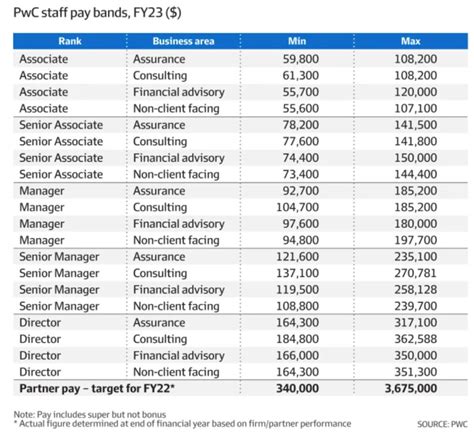

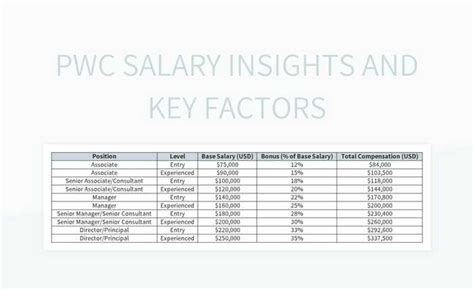

### Salary Progression by Experience Level

One of the most attractive aspects of a Big Four career is the structured and rapid career progression. Your salary is expected to increase substantially with each promotion.

| Career Level | Years of Experience | Typical Base Salary Range (National Average) | Key Responsibilities |

| --------------------- | ------------------- | --------------------------------------------- | ------------------------------------------------------------------------------------------- |

| Associate (A1/A2) | 0-2 years | $70,000 - $100,000 | Executing detailed tasks, testing, data gathering, learning core methodologies. |

| Experienced Associate | 1-3 years | $80,000 - $115,000 | Acknowledges 1-2 years of experience; often a title for experienced campus hires or A2s. |

| Senior Associate | 2-5 years | $100,000 - $145,000 | Leading small teams, reviewing Associate work, managing client relationships, project management. |

| Manager | 5-8 years | $140,000 - $190,000+ | Managing multiple projects, responsible for budgets and deadlines, staff development. |

| Senior Manager | 8-12 years | $180,000 - $250,000+ | Developing business, managing large client portfolios, expert in a specific niche. |

| Director/Partner | 12+ years | $300,000 - $1,000,000+ | Firm leadership, driving strategy, ultimate responsibility for client engagements. |

*Source Note: These salary bands are estimates compiled from industry reports and data aggregators like Salary.com and Glassdoor. They are subject to change based on market conditions, individual performance, and the factors discussed in the next section.*

### Beyond the Base Salary: Understanding Total Compensation

Your offer letter from PwC will detail a package that goes far beyond the base salary. Understanding these components is key to evaluating the true value of your offer.

- Signing Bonus: This is a one-time bonus paid upon signing your offer letter or starting your employment. For undergraduate campus hires, this typically ranges from $3,000 to $10,000. The amount can be higher for MBA or specialized master's degree hires and in more competitive service lines like consulting.

- Performance Bonus: While first-year associates may not receive a substantial performance bonus, from the second year onwards, an annual bonus becomes a significant part of compensation. This is tied to both individual performance (your ratings) and the firm's overall performance. For Senior Associates and Managers, bonuses can be 10-20% or more of their base salary.

- CPA Bonus & Exam Fee Reimbursement: This is a huge incentive. PwC, like other Big Four firms, heavily encourages its Assurance and Tax staff to earn their Certified Public Accountant (CPA) license. They typically offer a bonus for passing all four parts of the CPA exam within a certain timeframe (usually the first 1-2 years of employment). This bonus is often around $5,000. Furthermore, the firm will reimburse you for the cost of study materials (like Becker or Wiley) and the exam fees themselves, a value of several thousand dollars.

- Relocation Assistance: If you are hired into an office that requires you to move, PwC typically offers a relocation stipend to assist with the costs. This can range from $1,000 to $5,000 depending on the distance.

- Benefits and Perks: The value of these benefits can be substantial.

- Retirement Savings: A 401(k) plan with a generous company match. For example, PwC might contribute 6% of your salary to your 401(k), which is essentially an extra 6% in compensation.

- Health and Wellness: Comprehensive medical, dental, and vision insurance. PwC has also been a leader in offering "wellness stipends" (e.g., $1,000+ per year) that can be used for gym memberships, fitness classes, meditation apps, or home office equipment.

- Paid Time Off (PTO): A generous PTO policy, often starting with 3-4 weeks per year, plus firm-wide holidays and shutdown periods (e.g., the week between Christmas and New Year's).

- Parental Leave: Industry-leading paid parental leave policies for all new parents.

- Professional Development: The firm invests heavily in training, from new hire orientation ("The Vibe" in Orlando) to ongoing professional education to maintain certifications like the CPA.

When you add up the base salary, potential bonuses, and the cash value of benefits, the "total compensation" for a first-year PwC Associate can easily exceed $100,000 in a high-cost-of-living market.

Key Factors That Influence Your PwC Associate Salary

Your starting salary at PwC is not arbitrary. It's calculated based on a formula that weighs several key factors. Understanding these variables is crucial for negotiating (where possible) and for planning your career trajectory to maximize your earnings.

###

1. Service Line: Assurance vs. Tax vs. Advisory

This is arguably the most significant factor in your starting salary. The market pays a premium for different skills and services.

- Assurance (Audit): Historically, Assurance has been the entry point for the majority of campus hires. While essential to the firm, audit services are often seen as a commodity, leading to high price competition. As a result, starting salaries in Assurance are typically the baseline for the firm.

- *Estimated HCOL Starting Salary:* $75,000 - $85,000

- Tax: Tax is a more specialized field from day one. The skills required are distinct and in high demand. Therefore, Tax Associates often receive a slight salary premium over their Assurance counterparts.

- *Estimated HCOL Starting Salary:* $78,000 - $88,000

- Advisory (Consulting): This is where the highest entry-level salaries are typically found. Advisory roles often compete for talent with investment banks and other consulting firms. The project work, which can directly impact a client's profitability and strategy, commands higher fees and thus higher salaries for its practitioners. Within Advisory, there are further stratifications. A role in a highly technical field like Cybersecurity or a lucrative one like Deals Advisory will generally pay more than a role in a process-improvement practice.

- *Estimated HCOL Starting Salary:* $85,000 - $100,000+

Why the difference? It's a simple matter of supply, demand, and revenue generation. The skills needed for a tech consulting role (e.g., knowledge of cloud platforms, data science) are currently in higher demand and have a smaller talent pool than a traditional accounting background. Furthermore, a successful consulting project can generate millions in revenue for the firm and save a client tens of millions, justifying higher pay.

###

2. Geographic Location: The Cost-of-Living Adjustment

PwC adjusts its salary bands based on the cost of living and market competitiveness in different geographic areas. They group their offices into tiers, often categorized as High Cost of Living (HCOL), Medium Cost of Living (MCOL), and Low Cost of Living (LCOL).

| City Tier | Example Cities | Representative Starting Salary (Assurance) | Rationale |

| :-------- | :------------------------ | :--------------------------------------- | :------------------------------------------------------------------------------- |

| HCOL | New York City, San Francisco, San Jose, Boston, Los Angeles | $80,000 - $90,000+ | Extremely high housing costs and intense competition for talent from tech and finance. |

| MCOL | Chicago, Atlanta, Dallas, Houston, Philadelphia | $72,000 - $82,000 | Major metropolitan areas with strong business hubs but more moderate living costs. |

| LCOL | Kansas City, Charlotte, Cleveland, St. Louis | $68,000 - $75,000 | Lower housing and living expenses allow for a lower, yet still competitive, salary. |

*Source Note: Salary figures are illustrative estimates based on recent hiring data from sources like Glassdoor and community forums. Actual offers can vary.*

It's important to analyze a salary offer in the context of its location. A $70,000 salary in Kansas City provides a significantly higher quality of life and more disposable income than an $85,000 salary in Manhattan, where taxes and rent can consume a vast portion of your paycheck.

###

3. Level of Education & Certifications

While a Bachelor's degree is the standard entry requirement, advanced education and prestigious certifications can impact your starting position and salary.

- Bachelor's vs. Master's Degree: A candidate with a Master of Accountancy (MAcc), Master of Taxation (MTax), or a specialized Master's in a field like Data Analytics may receive a slightly higher starting salary (perhaps a $2,000 - $5,000 premium) than a candidate with only a Bachelor's degree. More importantly, a Master's degree is often a practical way to meet the 150-credit-hour requirement needed to sit for the CPA exam in most states.

- MBA Hires: Candidates hired out of a top MBA program do not enter as Associates. They are typically hired as Senior Associates or Managers and command significantly higher salaries, often in the $150,000 - $175,000+ range, especially in the Advisory practice.

- The CPA License: While you won't have your CPA when you start, having passed parts of the exam can be a positive signal to recruiters. As mentioned earlier, the primary financial benefit comes after you're hired, in the form of the CPA bonus (e.g., $5,000) and the firm's coverage of your study and exam costs. For your long-term salary growth in Assurance and Tax, obtaining the CPA is non-negotiable. It is a mandatory prerequisite for promotion to the Manager level.

- Other Certifications: In Advisory, other certifications hold weight. A Certified Information Systems Auditor (CISA) is valuable for IT audit and cybersecurity roles. A Chartered Financial Analyst (CFA) designation is highly respected in Deals and valuation practices. A Project Management Professional (PMP) can be beneficial in transformation and implementation consulting. Holding these can lead to faster promotions and higher pay within those specialized tracks.

###

4. In-Demand Skills: The Digital Acumen Premium

In today's professional services landscape, your technical accounting or finance knowledge is just the table stakes. The skills that truly differentiate candidates and can lead to higher starting offers and faster career progression are digital and analytical skills. PwC has heavily invested in "upskilling" its workforce, and they pay a premium for candidates who arrive with these skills already in hand.

High-Value Skills That Boost Your Worth:

- Data Analytics and Visualization: Proficiency in tools that allow you to manipulate, analyze, and visualize large datasets is paramount.

- Alteryx: A data blending and preparation tool used heavily in Tax and Assurance to automate what used to be manual Excel work.

- Tableau / Power BI: Visualization tools that turn raw data into insightful dashboards for clients and audit committees. Knowing how to build a dynamic dashboard is a far more valuable skill than knowing how to build a basic pivot table.

- Programming and Scripting: While you don't need to be a full-fledged software developer, basic proficiency can set you apart.

- Python: Used for data analysis (with libraries like Pandas) and automating repetitive tasks.

- SQL: The language of databases. The ability to query databases directly is a powerful skill for any associate dealing with client data.

- Automation Technologies: Understanding Robotic Process Automation (RPA) tools like UiPath or Automation Anywhere shows you have a mindset geared towards efficiency and innovation.

- Enterprise Resource Planning (ERP) System Knowledge: Familiarity with major ERP systems like SAP, Oracle, or Workday is a huge plus, as these are the systems most clients use and from which you will be extracting data.

- Industry-Specific Knowledge: If you have prior internship experience or have taken coursework related to a specific industry (e.g., Financial Services, Energy, Technology), it can make you a more attractive candidate for teams that specialize in those areas.

Candidates who can demonstrate these skills on their resume and in interviews—for example, by talking about a class project where they used Python to analyze a dataset or an internship where they built a Tableau dashboard—are signaling that they can add value from day one and are aligned with the firm's future direction. This can absolutely translate into being placed in a more specialized (and higher-paying) group or even receiving a slightly better offer.

Job Outlook and Career Growth at PwC

A career at PwC isn't just a job; it's an investment in your future. The outlook for roles related to PwC's core businesses is robust, and the firm provides a well-defined path for advancement.

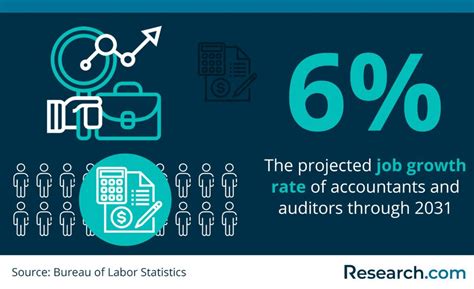

### Broader Profession Job Outlook

To understand the demand for PwC professionals, we can look at the projections for the wider industries they represent. The U.S. Bureau of Labor Statistics (BLS) provides authoritative data on this.

- Accountants and Auditors: The BLS projects employment for accountants and auditors to grow by 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. The BLS notes, "Globalization, a growing economy, and a complex tax and regulatory environment are expected to continue to lead to strong demand for accountants and auditors." This stable demand forms the bedrock of PwC's Assurance and Tax practices. The median annual wage for accountants and auditors was $78,000 in May 2022, but this includes a wide range of roles outside the high-paying Big Four environment.

- Management Analysts (Consultants): The outlook here is even stronger. The BLS projects employment for management analysts to grow by 10 percent from 2022 to 2032, much faster than the average for all occupations. The BLS states that "demand for consulting services is expected to grow as organizations seek ways to improve efficiency and control costs." This directly fuels the growth of PwC's Advisory practice. The median annual wage for management analysts was $95,290 in May 2022, with top earners in firms like PwC making substantially more.

What this data tells us is that the core skills you develop at PwC—financial analysis, regulatory compliance, and process improvement—are in high and growing demand across the entire economy.

### Career Growth and Trajectory within PwC

PwC operates on a structured, merit-based promotion system. The path is clear, and the timelines are relatively predictable for high performers.

- Associate to Senior Associate: This is the first major promotion, typically occurring after 2 to 3 years. To achieve this, you must demonstrate technical proficiency, reliability, and the ability to coach new associates. This promotion comes with a significant salary jump (often 20-30%+) and a shift in responsibility from "doing" to "reviewing and leading."

- Senior Associate to Manager: This leap, usually happening around the 5-6 year mark, is more challenging. It requires not only technical expertise but also strong project management, client relationship skills, and the ability to manage budgets and staff. This is where the CPA license becomes a mandatory hurdle in Assurance and Tax. The financial rewards are substantial.

- The Path to Partner/Director: For those who choose to stay for the long haul, the ultimate goal is making Partner or Managing Director. This is a highly competitive process that occurs around the 12-15 year mark and requires a proven track record of bringing in new business, leading large teams, and being a recognized expert in your field. The compensation at this level is in the high six to seven figures.

### Emerging Trends and Future-Proofing Your Career

The professional