Decoding Your Worth: A Comprehensive Guide to PwC Salaries

Landing a role at PricewaterhouseCoopers (PwC), one of the prestigious "Big Four" professional services firms, is a significant career milestone. It promises challenging work, unparalleled networking opportunities, and a powerful launchpad for your future. But what about the compensation? Understanding the salary structure at a complex global firm like PwC is key to navigating your career path. While salaries are competitive, they are far from one-size-fits-all.

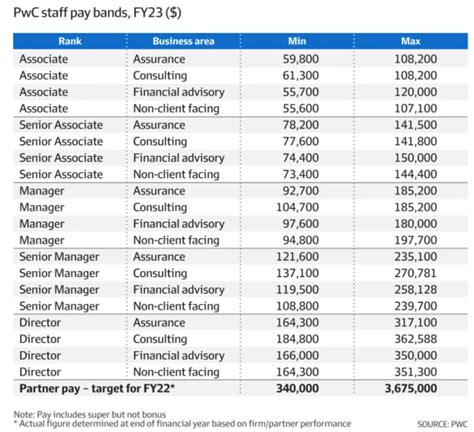

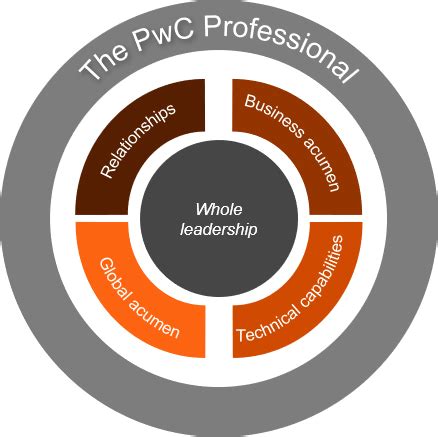

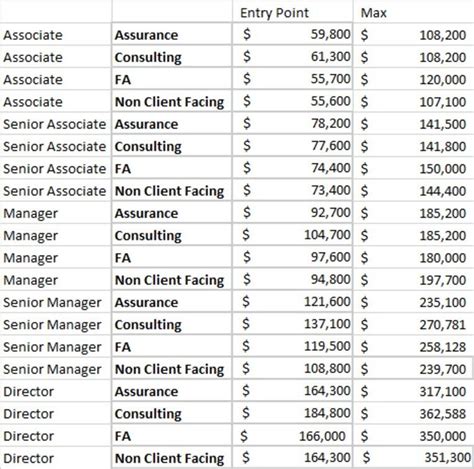

This guide will break down PwC's salary landscape, exploring the typical compensation ranges and the critical factors that will determine your earning potential. For entry-level associates, salaries often start in the $65,000 to $90,000 range, while experienced managers and directors can command well into the six figures, often exceeding $200,000 with bonuses.

What Does a PwC Professional Do?

Before diving into the numbers, it's crucial to understand that "PwC" is not a job title; it's the employer. The firm hires professionals for a vast array of roles across distinct lines of service. Your salary is fundamentally tied to the division you work in and the value you provide to clients.

The primary service lines at PwC include:

- Assurance (Audit): This is the traditional core of the business. Assurance professionals audit the financial statements of public and private companies, ensuring they are accurate and comply with regulations. They provide trust and transparency to the capital markets.

- Tax: Tax professionals help clients navigate the complexities of local, national, and international tax laws. Their work includes tax compliance (filing returns), tax planning, and advising on the tax implications of business decisions like mergers and acquisitions.

- Advisory (Consulting): This is a broad and high-growth area. PwC's advisory practice helps clients solve complex business problems. Consultants may work on deals, cybersecurity, digital transformation, forensics, strategy, and more. This line of service is often further broken down into specific consulting groups.

Average PwC Salary

There is no single "average PwC salary." Compensation is structured hierarchically based on your role and level within the firm. However, we can analyze data from authoritative sources to provide reliable estimates for common career levels in the United States.

- Associate (Entry-Level, 0-2 years): This is the starting point for most graduates. Responsibilities include performing foundational audit, tax, or consulting work under supervision.

- Typical Base Salary Range: $68,000 - $90,000.

- *Note:* Advisory associates often start at the higher end of this range compared to Assurance or Tax associates. (Source: Glassdoor, Payscale, 2023 data).

- Senior Associate (Mid-Level, 2-5 years): After a few years, associates are promoted to Senior Associate. They manage smaller projects, review the work of associates, and have more direct client interaction.

- Typical Base Salary Range: $85,000 - $125,000.

- *Note:* This level often sees a significant pay increase, reflecting a higher level of responsibility and expertise. (Source: Salary.com, Glassdoor, 2023 data).

- Manager / Senior Manager (Experienced, 5-10+ years): Managers are responsible for overseeing entire projects, managing teams of associates, and maintaining key client relationships. Senior Managers take on larger, more complex engagements and begin to focus on business development.

- Typical Base Salary Range: $120,000 - $190,000+.

- *Note:* Bonuses at this level become a significant component of total compensation. (Source: Payscale, Glassdoor, 2023 data).

- Director / Partner (Leadership): Directors and Partners are senior leaders in the firm responsible for driving business strategy, managing large client portfolios, and contributing to the firm's profitability.

- Typical Compensation: Total compensation is highly variable, often starting above $250,000 and reaching well into the seven figures for equity partners, who receive a share of the firm's profits.

Key Factors That Influence Salary

Your position on the salary spectrum is influenced by several key variables. Understanding these factors is essential for maximizing your earning potential at PwC.

###

Years of Experience & Career Level

This is the most significant determinant of salary at PwC. The firm has a well-defined career progression ladder (Associate → Senior Associate → Manager → Senior Manager → Director → Partner/Principal). Each promotion comes with a substantial increase in both base salary and bonus potential. The structure is designed to reward loyalty, skill development, and the assumption of greater responsibility.

###

Service Line or Division

The line of service you work in directly impacts your pay. Historically and currently, Advisory roles tend to offer the highest compensation at every level. This is driven by the high-margin, project-based nature of consulting work. While Assurance and Tax offer highly competitive and stable career paths, their salary bands are typically more moderate compared to their Advisory counterparts at the same career level. For example, an entry-level Deals Advisory Associate may earn $10,000-$15,000 more per year than an entry-level Audit Associate.

###

Geographic Location

PwC adjusts its salaries based on the cost of living in different metropolitan areas. An employee in a High Cost of Living (HCOL) area like New York City, San Francisco, or Boston will earn a significantly higher base salary than an employee with the exact same role in a Lower Cost of Living (LCOL) area like Omaha or St. Louis. This "geographic differential" ensures that employees can afford a comparable standard of living regardless of their office location.

###

Level of Education & Professional Certifications

While a bachelor's degree is the standard requirement for entry-level roles, advanced degrees and certifications can unlock higher starting salaries and faster promotions.

- MBA: An MBA from a top-tier business school is often a prerequisite for experienced hires into Manager-level consulting roles and can command a substantial salary premium.

- Master of Accountancy (MAcc): This degree is common in Assurance and Tax and is often required to meet the 150-credit-hour rule to sit for the CPA exam.

- Certifications: The Certified Public Accountant (CPA) license is the gold standard in Assurance and Tax and is essential for advancement to Manager and above. Other valuable certifications include the Chartered Financial Analyst (CFA) for deals and valuation roles or a Certified Information Systems Auditor (CISA) for technology risk professionals. PwC often provides financial bonuses for passing these exams.

###

Area of Specialization

Within each service line, specialization matters. Niche, in-demand skills command higher pay. For instance, within the broad Advisory practice, a consultant specializing in cybersecurity, cloud transformation, or M&A strategy will likely earn more than a generalist. Similarly, a Tax professional specializing in complex international tax law or transfer pricing may have higher earning potential than one focused on domestic compliance for small businesses.

Job Outlook

The demand for the services PwC provides remains robust. According to the U.S. Bureau of Labor Statistics (BLS), the outlook for the core professions at PwC is positive.

- Accountants and Auditors: Employment is projected to grow 4 percent from 2022 to 2032, about as fast as the average for all occupations. The BLS notes the continued need for these professionals due to a complex tax and regulatory environment and the need for financial accountability.

- Management Analysts (Consultants): Employment is projected to grow 10 percent from 2022 to 2032, much faster than the average for all occupations. The BLS attributes this growth to the increasing need for organizations to improve efficiency and control costs.

This strong demand ensures that a career starting at PwC provides a skillset that will remain valuable and sought-after in the broader market.

Conclusion

A career at PwC offers more than just a salary; it's an investment in your professional future. The compensation is highly competitive and structured to reward growth, expertise, and performance.

Key Takeaways:

- Salaries are Role-Dependent: Your earnings are tied to your level (Associate, Manager, etc.) and your service line (Assurance, Tax, or Advisory).

- Experience is King: The clearest path to a higher salary at PwC is through promotion and gaining experience.

- Location and Specialization Matter: Where you live and the specific skills you develop can significantly impact your paycheck.

- Advisory Pays a Premium: Generally, consulting roles within the Advisory practice offer the highest salary potential.

- The Future is Bright: The skills you gain at PwC are in high demand, pointing to a strong career outlook both within the firm and beyond.

For anyone considering a career in accounting, finance, or consulting, PwC represents a top-tier opportunity with a compensation structure to match its prestigious reputation.