For those who thrive at the intersection of mathematics, computer science, and finance, a career as a quantitative analyst—or "quant"—is one of the most intellectually stimulating and financially rewarding paths available. But what does that compensation actually look like? In a field known for its complexity and high stakes, salaries are equally dynamic.

This guide will break down the earning potential for a quantitative analyst, providing a data-driven look at average salaries and the crucial factors that can send your compensation into the stratosphere. While entry-level roles comfortably start in the six-figure range, seasoned professionals at top firms can see total compensation reach well into the seven figures.

What Does a Quantitative Analyst Do?

Before we talk numbers, let's clarify the role. A quantitative analyst is essentially a scientist of the financial world. They use advanced mathematical models, statistical analysis, and programming prowess to solve complex financial problems. Their responsibilities are critical and can include:

- Developing Trading Strategies: Building and testing automated, algorithm-based trading models.

- Pricing Derivatives: Creating sophisticated models to determine the value of complex financial instruments like options and futures.

- Risk Management: Quantifying and managing market and credit risk for large financial institutions.

- Data Analysis: Mining vast datasets for patterns, signals, and opportunities that can lead to profitable decisions.

In short, quants leverage data to identify opportunities and mitigate risk, giving their firms a competitive edge.

Average Quantitative Finance Salary

Quantitative finance is not a standard 9-to-5 job, and the compensation structure reflects that. It typically consists of a base salary plus a significant performance-based bonus.

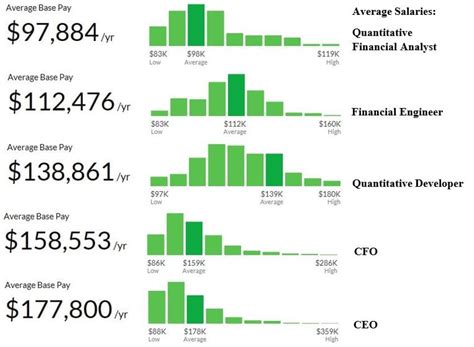

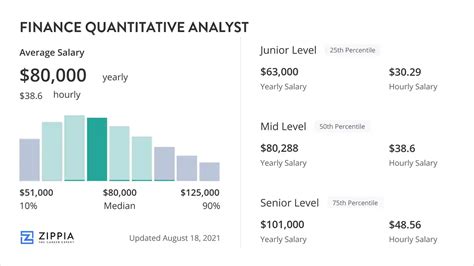

According to data from several leading sources, the average salary landscape for a quantitative analyst in the United States is exceptionally strong.

- Salary.com reports the median base salary for a Quantitative Analyst is $155,830 as of late 2023, with a typical range falling between $139,409 and $173,156.

- Glassdoor corroborates this, showing a median total pay (including bonuses and other compensation) of $173,651 per year, with the most likely range for total pay being between $127,000 and $238,000.

- Payscale notes an average base salary of around $124,500, but highlights that bonuses can add up to $60,000 or more, significantly impacting the final take-home pay.

It's crucial to understand that these figures represent a national average across all experience levels and company types. Let's break down the key variables.

- Entry-Level (0-2 years): Professionals with a Master's or PhD degree can expect a base salary between $100,000 and $150,000, with first-year bonuses potentially adding another 20-50%.

- Mid-Career (3-7 years): With a proven track record, base salaries can rise to $150,000 - $250,000+. Bonuses become a much larger component of total compensation and can easily match or exceed the base salary.

- Senior/Lead (8+ years): Senior quants, especially those managing teams or successful trading strategies, can command base salaries of $250,000 - $500,000+. Total compensation, driven by performance bonuses and profit-sharing, can regularly exceed $1,000,000 at top-tier firms.

Key Factors That Influence Salary

Your earning potential as a quant is not a single number but a range determined by several key factors.

###

Level of Education

In this field, education is paramount and directly correlates with starting salary and career trajectory.

- Bachelor's Degree: A bachelor's in a STEM field like mathematics, statistics, physics, or computer science is the minimum entry requirement, but it's rarely enough to land a top-tier quant role directly.

- Master's Degree: This is the most common entry point. A specialized Master's in Financial Engineering (MFE), Financial Mathematics, or a similar quantitative discipline is highly valued and often a prerequisite for interviews at major firms.

- Ph.D.: A doctorate in a highly quantitative field (e.g., Physics, Mathematics, Computer Science) is the gold standard for quant research roles. These roles focus on creating entirely new models and strategies. PhDs often command the highest starting salaries and are sought after for their deep theoretical knowledge and research capabilities.

###

Years of Experience

As with any profession, experience pays. However, in quantitative finance, the growth is exponential. A quant's value is measured by their "P&L" (Profit and Loss)—the tangible profit they generate for the firm. An analyst who has a multi-year track record of developing profitable strategies is an incredibly valuable asset, and their compensation will reflect that directly through performance bonuses.

###

Geographic Location

Finance is a geographically concentrated industry. To earn a top salary, you need to be where the money is. The major financial hubs offer the highest concentration of high-paying quant jobs.

- New York City: The undisputed global capital of finance. It offers the highest salaries and the most opportunities, especially within investment banks and hedge funds.

- Chicago: A major hub for derivatives trading and proprietary trading firms.

- Boston: A center for asset management and mutual funds.

- San Francisco Bay Area: A growing hub where finance and technology intersect, with many fintech companies and West Coast-based funds.

Salaries in these hubs are significantly higher than the national average to compensate for the higher cost of living and intense competition for talent.

###

Company Type

The type of firm you work for is arguably the single biggest determinant of your total compensation.

- Hedge Funds and Proprietary Trading Firms: These firms, especially those focused on high-frequency trading (HFT), offer the highest earning potential. Compensation is directly tied to the firm's profitability. While base salaries are competitive, the bonuses can be astronomical, leading to seven-figure annual incomes for top performers.

- Investment Banks (Sell-Side): Large banks like Goldman Sachs, J.P. Morgan, and Morgan Stanley employ armies of quants for pricing, trading, and risk management. Compensation is excellent and more structured than at hedge funds, with a strong base salary and significant, but often capped, bonuses.

- Asset Management Firms (Buy-Side): Firms like BlackRock or Vanguard hire quants to help manage their massive portfolios. Salaries are very competitive, and the work-life balance is often considered better than at hedge funds or investment banks.

- Fintech & Big Tech: As companies like Amazon and Google enter the financial services space, they are also hiring quants. Compensation packages here are often heavy on stock options, which can be extremely lucrative.

###

Area of Specialization

Within the quant world, different roles carry different levels of risk and reward.

- Quant Trader: These "front-office" quants are closest to the money. They develop and execute trading strategies, and their compensation is tightly linked to their P&L. This is often the highest-paid specialization.

- Quant Researcher: These are the model-builders, often with PhDs, who research and develop the next generation of trading algorithms. They are highly valued and compensated accordingly.

- Quant Developer: These professionals have elite programming skills (often in C++) and build the ultra-low-latency infrastructure needed for high-speed trading. They are in extremely high demand.

- Risk Quant: Focused on compliance and risk modeling, these roles are critical for the stability of the firm. While their bonuses may be less directly tied to P&L, they are still highly compensated for their essential function.

Job Outlook

The demand for quantitative skills in finance is only growing. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial and Investment Analysts, the closest broad category to quants, will grow by 8% from 2022 to 2032, which is much faster than the average for all occupations.

The drivers for this growth are clear:

- Increasingly complex global markets.

- The continued "datafication" of finance, with a growing reliance on AI and machine learning.

- The constant need for firms to find a competitive, data-driven edge.

This robust outlook ensures that quantitative finance will remain a secure and lucrative career path for the foreseeable future.

Conclusion

A career in quantitative finance is not for the faint of heart. It demands an elite intellectual toolkit, a relentless drive, and the ability to perform under pressure. However, the rewards are commensurate with the challenges.

For prospective students and professionals, the path to a high salary is clear:

- Invest in Education: An advanced degree in a quantitative discipline is your ticket to entry.

- Develop Technical Skills: Master programming languages like Python and C++, and ground yourself in advanced statistics and mathematics.

- Be Strategic: Target roles in major financial hubs and understand the profound impact that company type and specialization will have on your earning potential.

For those who can meet the demands, quantitative finance offers an unparalleled opportunity to solve fascinating problems and build an exceptionally rewarding career.