A career as a Reserve Bank of India (RBI) Grade B Officer is one of the most prestigious and sought-after paths in India's financial sector. It offers a unique blend of intellectual challenge, public service, and significant financial reward. For aspiring professionals, a primary question is often: what does this esteemed position pay? This article provides a data-driven, in-depth look at the RBI Grade B salary, the factors that influence it, and the long-term career outlook.

What Does an RBI Grade B Officer Do?

Before diving into the numbers, it's essential to understand the gravity of the role. An RBI Grade B Officer is a manager-level position within India's central banking institution. These officers are the intellectual backbone of the RBI, responsible for a wide range of critical functions that ensure the stability and health of the nation's economy.

Key responsibilities include:

- Managing Financial Supervision: Overseeing and regulating commercial banks and non-banking financial companies (NBFCs).

- Implementing Monetary Policy: Participating in the processes that control inflation, manage interest rates, and maintain liquidity in the financial system.

- Currency Management: Ensuring an adequate supply of clean currency notes and managing foreign exchange reserves.

- Policy Formulation: Contributing to research and analysis that shapes national economic policies.

Working across various departments, from supervision to foreign exchange, these officers play a direct role in safeguarding India's economic future.

Average RBI Grade B Officer Salary

The salary of an RBI Grade B Officer is not determined by market fluctuations like a private sector job. Instead, it is based on a well-defined pay scale set by the Reserve Bank of India. The structure is transparent, and the total compensation is significantly enhanced by a wide array of allowances and perks.

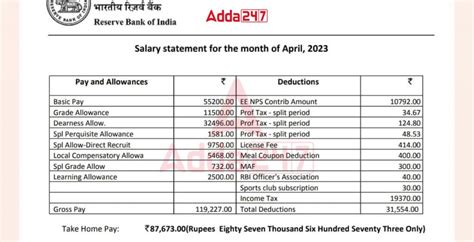

As per the official RBI Grade B Notification 2023, the remuneration structure is as follows:

- Pay Scale: The basic pay for a newly appointed Grade B officer starts at ₹55,200 per month. The scale is structured for consistent growth: ₹55200-2850(9)-80850-2850(2)-86550-3300(4)-99750 (16 years). This means an officer receives an annual increment of ₹2,850 for the first 9 years, followed by different increment structures for the subsequent years.

- Gross Monthly Emoluments: When you add the various allowances—such as Dearness Allowance, House Rent Allowance, and Grade Allowance—to the basic pay, the initial gross monthly salary is highly attractive. Currently, the starting gross emoluments are approximately ₹1,08,404 per month (subject to minor variations).

- Annual Cost to Company (CTC): The total compensation package, or CTC, is even more comprehensive. It includes the bank's contributions to the New Pension Scheme (NPS), medical insurance, subsidized loans, and other benefits. For a new officer, the annual CTC can be estimated to be in the range of ₹20 to ₹24 lakhs (approximately $24,000 to $29,000 USD).

*Source:* *Reserve Bank of India Services Board, RBI Grade B Officer Recruitment Notification, 2023.*

Key Factors That Influence Salary

While the basic pay scale is standardized, several factors can influence your in-hand salary and long-term earnings potential.

### Level of Education

While a bachelor's degree is the minimum requirement, higher educational qualifications can provide a direct financial advantage. As per RBI's policy, candidates with advanced degrees relevant to the RBI's work, such as an M.Phil. or Ph.D., may be eligible for advance increments in their pay scale. For instance, the RBI has a provision to grant up to four advance increments to candidates with a Ph.D. in a relevant field, giving them a significant head start in their career earnings.

### Years of Experience

Experience is the most direct factor influencing salary growth. The pay scale is designed to reward seniority and service length with assured annual increments. Furthermore, experience is a critical factor for promotions. An officer's career progression from Grade B to Grade C (Assistant General Manager), Grade D (Deputy General Manager), and beyond is based on years of service and performance. Each promotion comes with a substantial jump to a new, higher pay scale, leading to exponential growth in salary and responsibilities over a career.

### Geographic Location

Where you are posted in India has a direct impact on your monthly salary, primarily through the House Rent Allowance (HRA). The RBI provides HRA to officers who do not occupy bank-provided accommodation. The percentage of HRA is calculated on the basic pay and varies by city classification:

- Class X Cities (Metros): Posting in major metropolitan areas like Mumbai, Delhi, or Chennai typically qualifies for the highest HRA, currently 15% of basic pay.

- Class Y & Z Cities (Other Urban/Semi-Urban Centers): Postings in other cities will have a slightly lower HRA percentage, impacting the final in-hand salary.

Given that Mumbai is the RBI's headquarters, many officers spend a significant portion of their careers there, benefiting from the higher HRA.

### The RBI Advantage: Beyond the Paycheck

Instead of "Company Type," it's more relevant to discuss the unique benefits of working for the RBI. The overall compensation package extends far beyond the monthly salary. Compared to a private-sector role with a similar CTC, the RBI offers unparalleled benefits that enhance an officer's financial well-being:

- Housing: Bank-provided accommodation in prime locations is available in most cities.

- Subsidized Loans: Officers are eligible for loans for housing, vehicles, and personal needs at significantly lower interest rates than the market.

- Medical Benefits: Comprehensive medical coverage is provided for the officer and their dependents.

- Job Security & Prestige: The role offers immense job security and social prestige that is difficult to quantify but highly valuable.

### Area of Specialization

RBI Grade B officers are recruited into different streams, primarily General, DEPR (Department of Economic and Policy Research), and DSIM (Department of Statistics and Information Management). While the pay scale is the same across these streams, the nature of work differs. An officer in the DEPR stream will focus on economic research, while a Generalist officer may move between departments like banking supervision, currency management, or human resources. Over a long career, the expertise gained in a specific domain can influence opportunities for deputation to external bodies like the World Bank, IMF, or other regulatory agencies, which can offer unique experiences and compensation.

Job Outlook

It is important to note that career outlook data from sources like the U.S. Bureau of Labor Statistics (BLS) is not applicable, as this is a sovereign role within the Indian government.

The job outlook for an RBI Grade B Officer is best understood in terms of stability and growth. The RBI consistently recruits officers every year to manage its vast and expanding responsibilities. While the number of vacancies fluctuates annually, the need for top-tier talent to manage the country's economic apparatus is perpetual.

The career is recession-proof and offers a clear, structured path for growth up to the level of Deputy Governor. The combination of high demand for the role, immense job security, and a robust internal promotion policy makes the long-term career outlook exceptionally strong and secure for those who make it through the competitive selection process.

Conclusion

A career as an RBI Grade B Officer is more than just a job—it is a commitment to public service at the highest level. The financial compensation is a significant part of its appeal, with a starting gross monthly salary of over ₹1 lakh and an annual CTC upwards of ₹20 lakhs.

For aspiring candidates, the key takeaways are:

- High Starting Salary: The remuneration is among the best in the public sector and competitive with many private sector management roles.

- Structured Growth: Your salary increases predictably with experience and promotions.

- Comprehensive Benefits: Unmatched perks like housing, subsidized loans, and medical benefits provide immense financial security.

- Prestige and Stability: The role offers a level of job security and social respect that is second to none.

If you are a driven individual with a passion for economics and finance, the RBI Grade B career path offers an unparalleled opportunity to build a prosperous and impactful professional life.