So, you’re captivated by the New York real estate market. You see the gleaming skyscrapers of Manhattan, the historic brownstones of Brooklyn, and the sprawling estates of Long Island, and you don’t just see buildings—you see opportunity. You envision yourself at the center of the action, brokering the deals that shape the world's most iconic skyline and helping people achieve their ultimate dream. But beyond the prestige and the fast-paced lifestyle, a critical question looms: What is the reality of a real estate broker salary in New York?

This is not a simple question with a single answer. A broker's income in the Empire State is a complex tapestry woven from commissions, market dynamics, personal drive, and deep expertise. While some top-tier brokers make headlines with seven-figure annual incomes, the path to that level is paved with hard work, strategic decisions, and an unparalleled understanding of the market. The potential is immense, with average total compensation often falling between $100,000 and $150,000, and top earners pushing well beyond $300,000 to $500,000+ annually.

I once sat in on a final negotiation for a complex commercial lease in Midtown Manhattan. It wasn't just about the price per square foot; it was about navigating zoning laws, build-out clauses, and the clashing personalities of two corporate giants. The broker in the room wasn't merely a salesperson; she was a strategist, a legal navigator, a therapist, and a financial analyst all in one. Witnessing her close that deal, knowing it represented years of building relationships and expertise, solidified for me that a successful New York real estate broker isn't just selling space—they are building the very fabric of the city.

This guide is designed to be your comprehensive roadmap. We will dissect every facet of a real estate broker's salary in New York, from the core responsibilities and earning potential to the critical factors that separate the average earners from the top 1%. Whether you're a seasoned agent ready to take the next step or a newcomer dreaming of a career in real estate, this article will provide the authoritative, data-driven insights you need to succeed.

### Table of Contents

- [What Does a Real Estate Broker in New York Do?](#what-does-a-real-estate-broker-in-new-york-do)

- [Average Real Estate Broker Salary New York: A Deep Dive](#average-real-estate-broker-salary-new-york-a-deep-dive)

- [Key Factors That Influence a Broker's Salary](#key-factors-that-influence-a-brokers-salary)

- [Job Outlook and Career Growth for NY Brokers](#job-outlook-and-career-growth-for-ny-brokers)

- [How to Become a Real Estate Broker in New York](#how-to-become-a-real-estate-broker-in-new-york)

- [Conclusion: Is a Career as a New York Real Estate Broker Right for You?](#conclusion-is-a-career-as-a-new-york-real-estate-broker-right-for-you)

What Does a Real Estate Broker in New York Do?

Before we can talk about salary, it's crucial to understand that a real estate broker is not just an experienced real estate agent. While both help clients buy, sell, or rent properties, a broker holds a higher-level license that carries significantly more responsibility and authority. In New York, a broker can operate their own real estate firm and hire agents to work under their supervision. An agent, legally known as a "real estate salesperson" in New York, *must* work under a sponsoring broker.

This distinction is the foundation of their roles. While an agent is primarily focused on client-facing activities, a broker's responsibilities are multifaceted, encompassing client work, business management, legal compliance, and mentorship.

Core Responsibilities of a New York Real Estate Broker:

- Legal and Ethical Compliance: The broker is ultimately responsible for all transactions conducted by their brokerage and the agents working under them. They must ensure that all contracts, disclosures, and marketing materials comply with New York State laws, federal regulations (like the Fair Housing Act), and the ethical codes of organizations like the National Association of REALTORS® (NAR). This includes managing escrow accounts, where client funds are held in trust, which is a major legal and fiduciary duty.

- Business Operations and Management: If they run their own brokerage, brokers are entrepreneurs. They are responsible for everything from leasing office space and setting up business systems to marketing the firm, recruiting, and managing payroll. They create the business plan, set the company culture, and manage the profit and loss (P&L) statement.

- Agent Supervision and Training: A managing broker is a mentor and a manager. They train new agents on best practices, provide ongoing professional development, review contracts, help resolve disputes, and set performance goals for their team. Their success is directly tied to the success of their agents.

- High-Level Transaction Management: While they may delegate many day-to-day client interactions to their agents, brokers are often directly involved in the most complex and high-value transactions. They act as the lead negotiator, problem-solver, and senior advisor for VIP clients or on deals that require a sophisticated understanding of finance, law, and market strategy.

- Market Analysis and Strategy: Top brokers are market experts. They spend a significant amount of time analyzing market data, tracking economic trends, and understanding inventory levels. This expertise allows them to provide authoritative advice to clients and to position their brokerage strategically in the marketplace.

---

#### A Day in the Life of a New York City Managing Broker

To make this tangible, let's walk through a hypothetical day for "Maria," a managing broker of a boutique residential firm in SoHo, Manhattan.

- 7:30 AM - 9:00 AM: Market Pulse & Team Prep. Maria starts her day not with showings, but with data. She reviews the latest MLS (Multiple Listing Service) hot sheets, reads industry news from *The Real Deal* and *Crain's New York Business*, and checks interest rate movements. She then prepares for her morning sales meeting, flagging a few key properties that have had price reductions for her team to target.

- 9:00 AM - 10:00 AM: Morning Sales Huddle. Maria leads a meeting with her 15 agents. They discuss current listings, share client challenges, and role-play difficult negotiation scenarios. She provides guidance to a junior agent struggling with a co-op board package and announces a new marketing incentive for the team.

- 10:00 AM - 12:00 PM: High-Stakes Negotiation. Maria gets on a conference call with attorneys for a buyer and seller on a $7 million penthouse deal. The negotiation has hit a snag over fixture exclusions and a closing date. As the broker, Maria acts as the calm, authoritative voice, proposing a compromise that satisfies both parties and keeps the deal moving forward.

- 12:00 PM - 1:30 PM: Networking Lunch. Maria meets with a mortgage banker from a major financial institution. Building and maintaining these relationships is critical for her business, as it provides a trusted source of financing for her clients and can be a source of referrals.

- 1:30 PM - 3:30 PM: Compliance and Operations. Back in the office, Maria reviews and signs off on three contracts submitted by her agents, ensuring all disclosures are correct. She then meets with her marketing director to approve the budget for a new digital ad campaign targeting international buyers. She also reviews the brokerage's escrow account records with her bookkeeper.

- 3:30 PM - 5:00 PM: Mentorship and Problem-Solving. An agent comes to her office, panicked because a buyer's financing just fell through days before closing. Maria calmly walks the agent through the contingency clauses in the contract, brainstorms alternative lenders, and helps craft the delicate communication to the seller's agent.

- 5:00 PM onwards: Client & Business Development. Maria attends an exclusive open house for a new luxury development in Chelsea, not to sell it herself, but to network with other top brokers and developers. The day often ends with a late dinner with a potential high-net-worth client or a top agent she is trying to recruit to her firm.

As this example illustrates, the broker's role transcends simple sales. It is a dynamic blend of leadership, legal oversight, and high-level strategy, which directly commands a higher level of compensation.

Average Real Estate Broker Salary New York: A Deep Dive

The single most important thing to understand about a real estate broker salary in New York is that it is almost entirely commission-based. There is no traditional, fixed "salary" in the corporate sense. A broker's income is a direct result of the sales revenue they and their agents generate. This performance-based model is what creates such a vast potential range in earnings.

A broker earns money in two primary ways:

1. Personal Commissions: From deals they personally originate and close.

2. Brokerage "Split" or "Desk Fees": From every transaction closed by the salespersons working under them. The brokerage receives a percentage of the agent's commission.

This structure means that a broker's income, or Gross Commission Income (GCI), is highly variable year to year, depending on the number and value of transactions closed. After GCI, the broker must pay all their business expenses—office rent, marketing, salaries for administrative staff, insurance, and taxes—to arrive at their net income.

#### Salary Data: National vs. New York

To establish a baseline, let's look at the national data and then zoom into the lucrative New York market.

The U.S. Bureau of Labor Statistics (BLS) groups real estate brokers and sales agents together. For the occupational group 41-9022, the median annual wage was $52,030 as of May 2022. However, the BLS notes a huge disparity in earnings, with the lowest 10 percent earning less than $31,580 and the top 10 percent earning more than $160,560. This data is useful for a national overview but significantly underrepresents the potential in a high-cost, high-value market like New York.

Data from salary aggregators that can filter by location and job title provide a more accurate picture for brokers in New York.

- Salary.com (as of late 2023/early 2024) reports that the average Real Estate Broker salary in New York, NY is $109,256, but the range typically falls between $88,966 and $145,206. This often represents a "base" draw or salary component for managing brokers, with total compensation being much higher. Their total compensation estimates, including bonuses and commissions, often push the average into the $150,000 - $200,000+ range.

- Glassdoor reports a similar figure, with the average total pay for a Real Estate Broker in the New York, NY Area being around $139,000 per year, with likely pay ranging from $83,000 to $233,000.

- Indeed data places the average base salary for a broker in New York State at approximately $103,115 per year, but this figure can be misleading without factoring in the massive impact of commission earnings.

Synthesized View: Taking a holistic view of the available data and industry knowledge, a realistic expectation for a competent, full-time real estate broker in New York is an all-in compensation package that averages $125,000 per year. However, this average is just a midpoint on an incredibly wide spectrum.

#### Compensation by Experience Level in New York

A broker's income is not static; it grows significantly with experience, reputation, and the size of their business.

| Experience Level | Typical Role | Estimated Annual Compensation Range (NY) | Key Drivers |

| :--- | :--- | :--- | :--- |

| Entry-Level Broker (0-3 years) | Associate Broker at a large firm; a newly independent broker with few agents. | $70,000 - $120,000 | Building a client base, learning to manage transactions, generating personal GCI, recruiting first agents. |

| Mid-Career Broker (4-10 years) | Managing Broker at a mid-sized firm; Broker-Owner with a small team (5-15 agents). | $120,000 - $250,000 | Strong referral network, consistent deal flow, income from agent commission splits, established brand presence. |

| Senior/Top-Tier Broker (10+ years)| Broker-Owner of a successful brokerage; Top Managing Broker at a major firm. | $250,000 - $1,000,000+ | Significant revenue from a large team of high-producing agents, personal involvement in luxury/commercial deals, strong market influence. |

#### Breaking Down the Compensation Components

It's not just a salary; it's a mix of revenue streams and benefits.

- Commission Splits: This is the lifeblood of a brokerage. If an agent closes a deal with a $30,000 commission, and their split with the brokerage is 70/30, the agent takes home $21,000 (before their own expenses), and the brokerage receives $9,000. For a broker with 20 agents all closing multiple deals a year, this income stream becomes substantial.

- Personal Sales Commission: Many broker-owners continue to work with their own clients, especially high-net-worth individuals. A single large commercial or luxury residential sale can bring in a six-figure commission, significantly boosting annual income.

- Desk Fees / Office Fees: Some brokerage models charge agents a flat monthly "desk fee" in exchange for a higher commission split (e.g., 90% or even 100%). This creates a more stable, recurring revenue stream for the broker, independent of market fluctuations.

- Bonuses and Profit Sharing: Managing brokers at large national firms (like Compass, Douglas Elliman, or Corcoran) may receive a base salary plus significant performance bonuses tied to the office's profitability, agent recruitment, and total sales volume.

- Ancillary Services: Savvy brokers may also generate income from ancillary businesses, such as an in-house mortgage brokerage, title insurance company, or property management division (all subject to strict legal and disclosure requirements).

Understanding these components is key. A broker's salary isn't just about selling property; it's about building a business engine that generates revenue from multiple streams.

Key Factors That Influence a Broker's Salary

Two brokers can have the exact same license and work in the same city, yet one can earn $80,000 while the other earns $800,000. This disparity is not luck; it's the result of several key variables. This section will provide an exhaustive breakdown of the factors that have the most significant impact on a real estate broker salary in New York.

###

Geographic Location Within New York State

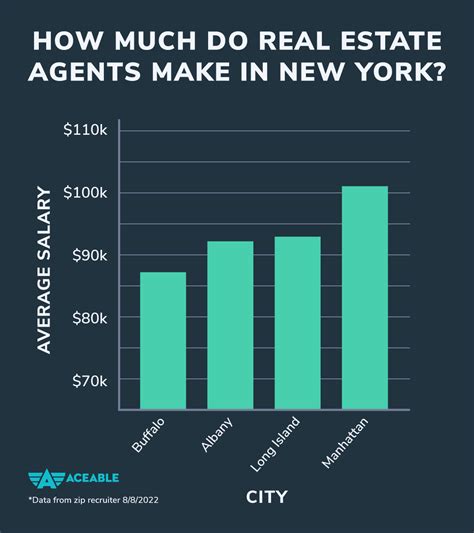

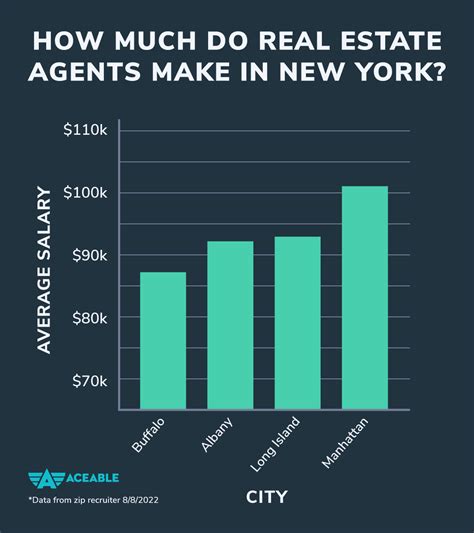

Nowhere is the real estate mantra "location, location, location" more true than when it comes to broker income. New York is not a monolithic market; it's a collection of diverse micro-markets with vastly different property values and transaction volumes.

- Manhattan (New York, NY): The Epicenter. This is the pinnacle of the US real estate market. With average apartment prices consistently in the millions and a high concentration of ultra-luxury properties (penthouses, townhouses) and high-value commercial assets (office towers, retail flagships), the commission potential per deal is astronomical. A standard 2-3% co-broke commission on a $5 million apartment is $100,000-$150,000. Brokers operating here are at the top of the food chain, but they also face the most ferocious competition. Top Manhattan brokers regularly earn well into the seven figures.

- Brooklyn & Queens: Once considered secondary markets, these boroughs are now powerhouses. Brooklyn, with its trendy neighborhoods like Williamsburg and historic areas like Brooklyn Heights, boasts property values that rival parts of Manhattan. Queens offers a diverse mix of housing stock and a burgeoning luxury condo market in areas like Long Island City. Brokers here can build extremely successful businesses with slightly lower overhead than in Manhattan, with top earners comfortably in the $250,000 - $600,000+ range.

- The Hamptons & Long Island: The Hamptons is a world-renowned luxury and second-home market. A broker specializing in Southampton or East Hampton can close deals on $10 million, $20 million, and even $50+ million waterfront estates. While the market is seasonal, the commissions are massive. A single blockbuster summer sale can define a broker's entire year. The rest of Long Island (Nassau and Suffolk counties) offers a robust and high-priced suburban market, providing consistent, high-volume business for successful brokers.

- Westchester County: As a wealthy suburban enclave bordering NYC, Westchester (Scarsdale, Rye, Chappaqua) has some of the highest property taxes and home prices in the country. Brokers here serve affluent clients looking for large homes, good schools, and a direct commute to the city. Success here requires a deep understanding of the local communities and a polished, service-oriented approach. Top Westchester brokers can easily earn $200,000 - $500,000+.

- Upstate New York (Albany, Buffalo, Rochester, Syracuse): These markets are vastly different. Property values are significantly lower, meaning the commission per transaction is smaller. A broker in Buffalo might need to close 10-15 deals to match the GCI of a single mid-range deal in Brooklyn. However, the cost of living and running a business is also much lower, and there is often less competition. A successful broker-owner in an upstate market can still build a very profitable business and a comfortable lifestyle, with typical earnings for successful brokers falling in the $80,000 - $150,000 range.

###

Area of Specialization

Just as doctors specialize, so do the most successful real estate brokers. A "generalist" broker is often a master of none. Specialization allows a broker to develop deep domain expertise, which builds credibility, attracts a specific type of client, and ultimately commands higher fees.

- Residential Real Estate: This is the most common specialization.

- Luxury Residential (>$3M): This is a relationship-based niche. Brokers deal with high-net-worth individuals, celebrities, and international buyers. It requires discretion, impeccable service, and a powerful network. The commissions are huge, but the sales cycle can be very long.

- New Developments: These brokers work directly with developers to market and sell entire condominium or townhouse projects. This involves creating a marketing strategy, setting up a sales gallery, and managing a sales team. It's project-based and can be extremely lucrative.

- Co-ops and Condos: Navigating the world of NYC co-op boards is a specialization in itself. A broker who is an expert in preparing board packages and navigating the approval process is invaluable.

- Commercial Real Estate (CRE): This is a different universe from residential, often with even higher earning potential. CRE is more analytical and business-focused.

- Investment Sales: These brokers help clients buy and sell income-producing properties like apartment buildings, office towers, and shopping centers. They need strong financial modeling skills to analyze cap rates, net operating income (NOI), and return on investment (ROI). Commissions on these large assets can easily be in the high six or even seven figures.

- Office Leasing: These brokers represent either tenants (tenant reps) looking for office space or landlords (landlord reps) looking to fill their buildings. Deals are complex, with long-term leases valued in the millions of dollars.

- Retail Leasing: This is a highly specialized niche, focused on placing tenants in storefronts, shopping centers, and malls. It requires a deep understanding of foot traffic, consumer demographics, and brand synergy.

A top commercial broker in Manhattan can consistently earn more than a top residential broker, but the barrier to entry is higher, requiring a more sophisticated financial and analytical skill set.

###

Brokerage Model and Company Type

The type of firm a broker works for—or builds—profoundly affects their income structure and potential.

- Large National/International Firm (e.g., Compass, Douglas Elliman, Corcoran, Sotheby's International Realty):

- Pros: Instant brand recognition, vast marketing resources, advanced technology platforms, a built-in referral network, and often excellent training programs.

- Cons: Less autonomy. Commission splits are often less favorable to the broker-manager compared to owning their own firm, as a significant portion of the revenue goes to the corporate parent. Managing brokers at these firms often receive a base salary plus a performance bonus.

- Boutique Brokerage:

- Pros: Greater agility, a specialized focus (e.g., luxury lofts, Brooklyn townhouses), a strong local brand, and a more intimate company culture. A broker-owner of a successful boutique firm keeps 100% of the brokerage's profits.

- Cons: Limited resources compared to large firms, less brand recognition outside their niche, and the broker-owner bears all the risk and administrative burden.

- 100% Commission / Desk Fee Model (e.g., RE/MAX, eXp Realty):

- Pros: This model is attractive to entrepreneurial agents who want to keep more of their commission. The sponsoring broker-owner earns a stable income from monthly desk fees and transaction fees, regardless of the agent's sales volume.

- Cons: This model provides less hands-on support and mentorship, attracting more experienced, self-sufficient agents. The broker's role is more administrative and less focused on training.

- Independent Broker-Owner:

- The highest risk, highest reward path. The broker is the boss, makes all the rules, and keeps all the profits (after expenses). Their income is limited only by their ability to recruit top agents and grow a profitable business. This path requires significant capital, business acumen, and leadership skills.

###

Years of Experience and Reputation

In a trust-based industry like real estate, experience and reputation are currency.

- 0-3 Years (The Foundation Phase): A new associate broker is still primarily focused on building their personal client list and reputation. Their income is heavily reliant on their own sales, and they are learning the ropes of management and compliance.

- 4-10 Years (The Growth Phase): By this stage, a successful broker has a strong referral-based business. If they are a managing broker, they've built a solid team of agents whose production contributes significantly to their bottom line. Their name begins to carry weight in their local market.

- 10+ Years (The Legacy Phase): A veteran broker is a market leader. Their reputation precedes them. Clients and top agents seek them out. Their income is heavily weighted towards the profits of their brokerage rather than their personal sales. They are influencers in their industry, often quoted in the press and sitting on industry boards. This is where seven-figure incomes become a reality.

###

In-Demand Skills and Advanced Certifications

Your license gets you in the door; your skills determine how high you climb.

- Negotiation and Deal Structuring: This is the single most critical skill. The ability to navigate complex, multi-party negotiations and structure creative deals that solve client problems is what separates good brokers from great ones.

- Digital Marketing and Personal Branding: In the 21st century, you are your brand. Brokers who are masters of social media marketing (Instagram, LinkedIn), content creation (video tours, market reports), and SEO can generate a continuous pipeline of inbound leads, reducing their reliance on cold calling.

- Financial Acumen: Especially in commercial real estate, the ability to read a P&L statement, create a financial model in Excel, and talk intelligently about ROI and capital markets is non-negotiable.

- Networking and Relationship Management: Real estate is a contact sport. A broker's "Rolodex" (or CRM, today) of attorneys, mortgage brokers, contractors, and wealthy clients is one of their most valuable assets.

- Legal Expertise: While not attorneys, top brokers have a near-encyclopedic knowledge of New York real estate law, co-op/condo rules, and contract intricacies.

Advanced Certifications that Increase Earning Potential:

- CRS (Certified Residential Specialist): This NAR designation is considered the PhD of residential real estate, requiring a high volume of transactions and advanced coursework. It signals a high level of experience and expertise.

- GRI (Graduate, REALTOR® Institute): A comprehensive designation covering technical subjects and the fundamentals of real estate.

- CCIM (Certified Commercial Investment Member): The gold standard in commercial real estate. Earning a CCIM designation requires an extensive portfolio of qualifying experience and a graduate-level curriculum. CCIMs are recognized as leading experts in commercial investment.

- ABR (Accredited Buyer's Representative): A designation for brokers and agents who specialize in working with buyers, signaling a higher level of service and expertise.

Holding these designations can directly lead to higher income by increasing credibility,