Table of Contents

- [What Does a Relationship Banker at Chase Do?](#what-does-a-relationship-banker-at-chase-do)

- [Average Relationship Banker Chase Salary: A Deep Dive](#average-relationship-banker-chase-salary-a-deep-dive)

- [Key Factors That Influence a Relationship Banker's Salary](#key-factors-that-influence-a-relationship-bankers-salary)

- [Job Outlook and Career Growth for Relationship Bankers](#job-outlook-and-career-growth-for-relationship-bankers)

- [How to Become a Relationship Banker](#how-to-become-a-relationship-banker)

- [Is a Career as a Relationship Banker Right for You?](#is-a-career-as-a-relationship-banker-right-for-you)

The world of finance can often seem like an impenetrable fortress, a maze of complex products and abstract figures. Yet, at its very core, banking is about people. It's about helping a young family secure a mortgage for their first home, guiding a small business owner through the process of getting a crucial loan, or advising a recent graduate on how to start investing for retirement. The professional at the heart of these pivotal life moments is the Relationship Banker. If you are a natural connector, possess a sharp mind for finance, and are driven by the desire to make a tangible impact on people's lives, this career path—particularly at an institution like JPMorgan Chase—could be your calling.

The financial rewards are equally compelling. While compensation varies, the average total pay for a Relationship Banker in the United States falls within a strong range, often between $55,000 and $85,000 per year, with top performers at major banks like Chase potentially exceeding six figures when performance-based incentives are factored in. This article serves as your definitive guide to understanding not just the salary, but the entire ecosystem of a Relationship Banker career. I remember when my parents were navigating the complexities of estate planning; it wasn't a brochure or a website that helped them, but a dedicated relationship banker who patiently walked them through their options, translating financial jargon into a language of security and peace of mind. That human touch is the irreplaceable value of this role. We will dissect the compensation, explore the factors that drive your earning potential, and lay out a clear, actionable roadmap to help you launch and advance in this dynamic and rewarding profession.

What Does a Relationship Banker at Chase Do?

A Relationship Banker is far more than a glorified teller or a simple customer service representative. They are the primary point of contact for a portfolio of bank clients, acting as a financial concierge, a trusted advisor, and a strategic problem-solver. At a major institution like JPMorgan Chase, this role is a critical engine for growth, responsible for both retaining and deepening customer relationships.

The core mandate of a Relationship Banker is to move beyond transactional interactions and build long-term, holistic financial partnerships. Instead of just cashing a check, they engage clients in conversations to understand their complete financial picture—their short-term needs, long-term aspirations, and life goals. Are they saving for a child's education? Planning to buy a new car? Worried about retirement? Based on this understanding, the Relationship Banker proactively identifies and recommends appropriate products and services from the bank's extensive portfolio.

This is a role that perfectly blends sales and service. The "service" aspect involves providing exceptional day-to-day support, resolving complex issues, and ensuring the client feels valued and understood. The "sales" aspect involves meeting specific goals by connecting clients with solutions like new checking or savings accounts, credit cards, auto loans, mortgages, or investment services. At Chase, this often means working closely with specialists, such as Financial Advisors or Home Lending Advisors, to provide expert guidance in more complex areas.

### A Breakdown of Daily Responsibilities:

A Relationship Banker's day is dynamic and rarely monotonous. Key tasks include:

- Proactive Client Outreach: Contacting existing clients to conduct financial health check-ups, review their accounts, and discuss potential new needs. This can be driven by data-driven insights provided by the bank's CRM (Customer Relationship Management) systems.

- Needs-Based Selling: Engaging with branch walk-in customers to understand the purpose of their visit and uncover deeper financial needs. A simple deposit could lead to a conversation about high-yield savings accounts or investment options.

- Problem Resolution: Acting as an escalation point for complex customer issues that tellers cannot resolve, such as dealing with fraudulent activity, complex wire transfers, or fee disputes.

- Product Expertise: Maintaining a deep and current knowledge of all bank products, services, and ongoing promotions. This includes everything from the nuances of different credit card rewards programs to the eligibility criteria for various loan products.

- Onboarding New Clients: Opening new accounts and ensuring new customers have a smooth and positive initial experience with the bank, setting them up with online banking, mobile apps, and other essential services.

- Collaboration and Referrals: Identifying opportunities to refer clients to internal partners. For example, a conversation with a high-net-worth individual might lead to a referral to a Private Client Banker, or a discussion with a business owner would warrant a referral to a Business Relationship Manager.

- Compliance and Documentation: Meticulously adhering to all banking regulations, policies, and procedures, including KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. This involves precise and thorough documentation for all new accounts and transactions.

### A "Day in the Life" of a Relationship Banker at Chase

8:45 AM: Arrive at the branch. Huddle with the Branch Manager and fellow bankers to discuss the day's goals, review any new promotions, and share client success stories from the previous day.

9:00 AM: Branch opens. The first hour is busy with walk-in traffic. A client comes in to deposit a large check. You use this opportunity to ask about their savings goals, discover they are saving for a down payment, and schedule a follow-up appointment to discuss mortgage pre-approval.

10:30 AM: You begin your scheduled outreach calls. Using the bank's CRM, you see a client's certificate of deposit (CD) is maturing next week. You call them to discuss their reinvestment options, including a new high-yield savings account or a potential consultation with a Financial Advisor.

12:00 PM: Lunch break.

1:00 PM: A scheduled appointment with a young couple arrives. They are getting married and want to merge their finances. You guide them through opening a joint checking account, discuss the benefits of a shared high-rewards credit card for wedding expenses, and provide a basic overview of saving for their future together.

2:30 PM: You notice a lull in foot traffic and use the time to follow up on paperwork from the morning's appointments, ensuring all compliance documentation is perfectly in order. You also respond to a few client emails regarding their accounts.

3:30 PM: A small business owner, a long-time client, comes in frustrated about a declined transaction on their business credit card. You patiently investigate the issue, identify it as a fraud-prevention flag due to an unusual purchase, and work with the back-office team to resolve it quickly. While they are there, you ask about their business growth and identify a potential need for a business line of credit, scheduling a meeting with a Business Relationship Manager for the following week.

4:45 PM: As the branch prepares to close, you update your CRM with detailed notes from all your day's interactions and plan your key follow-up calls for tomorrow.

5:00 PM: You review your performance against your daily and weekly goals before heading home, feeling accomplished after helping multiple clients take a positive step forward in their financial journey.

Average Relationship Banker Chase Salary: A Deep Dive

Understanding the compensation for a Relationship Banker is not as simple as looking at a single number. The pay structure is multifaceted, typically composed of a stable base salary combined with a significant variable component tied directly to performance. This model is designed to reward high-achievers who excel at building relationships and meeting sales targets.

While we use JPMorgan Chase as a primary benchmark due to its status as a leading employer in this field, the figures presented here are also reflective of the broader industry at large national banks.

### National Averages and Typical Salary Ranges

According to a comprehensive analysis of data from multiple authoritative sources, the compensation for a Relationship Banker in the United States is highly competitive.

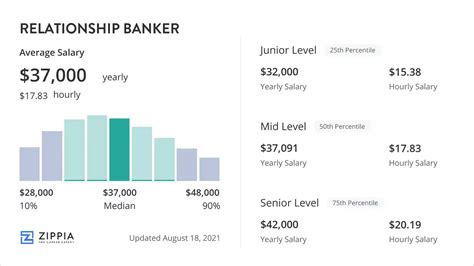

- Base Salary: The foundation of a Relationship Banker's pay is their base salary. Salary.com, as of late 2023, reports the median base salary for a Relationship Banker I (entry-level to a few years of experience) in the U.S. to be approximately $45,980. The typical range for this base salary falls between $40,495 and $51,895.

- Total Compensation (Base + Incentives): The real story is told by the total compensation, which includes bonuses, commissions, and other incentives. Glassdoor data for "Relationship Banker at JPMorgan Chase" shows an estimated total pay range of $61,000 to $98,000 per year, with an estimated average of $77,500. This figure includes an average base salary of around $58,000 and additional pay (cash bonus, commission, etc.) of nearly $20,000.

- Payscale.com corroborates this, reporting an average base salary for a Relationship Banker of around $51,000, with bonuses potentially adding another $10,000 or more annually, bringing total pay into a similar range.

It's crucial to understand that these figures are national averages. As we will explore in the next section, factors like geographic location, experience level, and individual performance can cause significant variations.

### Salary Progression by Experience Level

Your earning potential as a Relationship Banker grows substantially as you gain experience, build a client portfolio, and demonstrate consistent performance. The career ladder often includes tiered roles like Relationship Banker I, II, and Senior Relationship Banker, each with a corresponding increase in compensation.

| Experience Level | Typical Title(s) | Average Base Salary Range (U.S.) | Average Total Compensation Range (U.S.) |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Relationship Banker I, Personal Banker | $40,000 - $50,000 | $50,000 - $70,000 |

| Mid-Career (2-5 years) | Relationship Banker II, Senior Personal Banker | $50,000 - $65,000 | $65,000 - $90,000 |

| Senior-Level (5+ years) | Senior Relationship Banker, Lead Relationship Banker | $60,000 - $75,000+ | $85,000 - $115,000+ |

*Sources: Synthesized data from Salary.com, Glassdoor, and Payscale for Q4 2023/Q1 2024.*

An Entry-Level Relationship Banker I is typically learning the ropes, focusing on foundational product knowledge and building initial client relationships. Their incentive pay might be more modest as they ramp up.

A Mid-Career Relationship Banker II has a proven track record of meeting goals. They handle more complex client needs and may begin to mentor newer bankers. Their base salary is higher, and they have a greater capacity to earn significant incentive pay.

A Senior Relationship Banker is a top performer and a leader within the branch. They often manage the most valuable client relationships, handle the most complex financial situations, and may have supervisory responsibilities. Their compensation reflects this expertise, with total earnings often pushing into the low six figures, especially in high-cost-of-living areas.

### Deconstructing the Compensation Package

To fully appreciate the earning potential, it's essential to break down the different components of the compensation package offered by institutions like Chase.

1. Base Salary: This is the guaranteed, fixed portion of your pay, paid bi-weekly or monthly. It provides financial stability and is determined by factors like your experience, location, and specific role tier (e.g., RB I vs. RB II).

2. Variable Incentive Pay (Bonus/Commission): This is the performance-driven component and is where top earners truly differentiate themselves. It is typically paid out monthly or quarterly. This incentive plan is carefully structured and tied to a scorecard of Key Performance Indicators (KPIs). These KPIs often include:

- Net New Household Growth: Attracting new clients to the bank.

- Deepening Relationships: The number of products or services per client (e.g., adding a credit card, auto loan, or investment account to an existing checking client).

- Investment and Lending Referrals: The quantity and quality of referrals made to licensed partners (Financial Advisors, Mortgage Lenders) that result in closed business.

- Client Satisfaction Scores: Measured through surveys and direct feedback.

- Team Performance: A portion of the incentive may be tied to the overall performance of the branch.

3. Benefits Package: The value of the benefits package at a large corporation like JPMorgan Chase should not be underestimated and can be worth tens of thousands of dollars annually. This is a significant part of the total compensation. Common benefits include:

- Health Insurance: Comprehensive medical, dental, and vision plans for employees and their families.

- Retirement Savings: A robust 401(k) plan, often with a generous company match (e.g., Chase often offers a dollar-for-dollar match up to 5% of pay).

- Paid Time Off (PTO): A generous allotment of vacation days, sick leave, and personal days.

- Parental Leave: Often includes paid leave for new parents.

- Tuition Assistance: Programs to help employees pursue further education, such as completing a bachelor's degree or obtaining professional certifications.

- Employee Banking Perks: Preferred rates on mortgages and loans, waived fees on bank accounts, and other employee-exclusive benefits.

When evaluating a job offer, it's critical to look at the entire compensation package—base, incentive potential, and benefits—to understand the full value proposition of the role.

Key Factors That Influence a Relationship Banker's Salary

While we've established a baseline for a Relationship Banker's salary, your specific earnings can vary dramatically. Several key factors interact to determine your precise position on the pay scale. Mastering these elements is the key to maximizing your income in this profession. This section provides a granular analysis of the most influential variables.

### `

` Level of Education and Professional Certifications

While a specific degree is not always a rigid requirement, your educational background and professional credentials create the foundation for your career and can significantly impact your starting salary and long-term growth trajectory.

Educational Background:

A bachelor's degree is strongly preferred by major banks like Chase and is often a prerequisite for advancement into management or more specialized roles. Degrees in fields like Finance, Business Administration, Economics, or Marketing are most relevant. They equip you with a fundamental understanding of financial principles, market dynamics, and business acumen that are directly applicable to the role. Candidates with these degrees may command a higher starting salary than those without a degree or with a degree in an unrelated field.

Furthermore, a strong academic record (a high GPA) from a reputable university can make you a more attractive candidate and give you leverage in initial salary negotiations. Some relationship bankers may also pursue a Master of Business Administration (MBA), which is typically a pathway to senior leadership roles like a Private Client Advisor or Regional Director, where compensation can be substantially higher.

Professional Certifications and Licensing:

This is arguably the most critical educational factor for salary growth within the Relationship Banker role itself. While you can be hired without them, obtaining specific financial licenses is the gateway to discussing and selling a wider range of products, which directly translates to higher incentive pay.

- FINRA Licenses (Series 6 and Series 63): These are the most common and vital licenses for a Relationship Banker.

- The Series 6 license (Investment Company and Variable Contracts Products Representative) allows you to sell "packaged" investment products like mutual funds, variable annuities, and unit investment trusts (UITs).

- The Series 63 license (Uniform Securities Agent State Law Examination) is required by most states and allows you to solicit orders for any type of security in that state.

- Relationship Bankers who are "dually licensed" can have much richer conversations with clients about their investment goals and directly facilitate certain investment product sales, dramatically increasing their bonus potential. Banks like Chase heavily invest in helping their bankers study for and pass these exams.

- NMLS Registration (SAFE Act): The Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) requires anyone who acts as a mortgage loan originator to be registered with the Nationwide Multistate Licensing System & Registry (NMLS). As a Relationship Banker, you will frequently discuss home loans with clients. Being NMLS registered allows you to take a loan application and discuss rates and terms, which is a critical part of the mortgage referral process and is often tied to your incentive plan.

- Life & Health Insurance License: Some states require this license to sell life insurance and annuity products. Holding this further broadens the scope of solutions you can offer to clients for estate planning and wealth protection, again boosting your earning potential.

Holding these licenses not only increases your direct compensation but also makes you a far more valuable and versatile asset to the bank, paving the way for promotions to more senior and specialized roles.

### `

` Years of Experience

Experience is a powerful determinant of salary in almost any profession, but in a performance-based role like a Relationship Banker, its impact is magnified. Experience correlates directly with skill, client trust, and efficiency.

- 0-2 Years (Entry-Level): In this stage, you are primarily in a learning phase. Your focus is on mastering product knowledge, understanding compliance, and developing your sales and communication skills. Your client portfolio is small or non-existent. Your compensation will be heavily weighted towards your base salary, with a more modest incentive component as you build momentum.

- *Estimated Total Compensation: $50,000 - $70,000*

- 2-5 Years (Mid-Career): You have a proven track record. You can independently manage a growing portfolio of clients who trust you and seek you out for advice. You are efficient in identifying needs and closing sales. Your referral partnerships with specialists are well-established. Your incentive compensation becomes a much more significant portion of your total pay. You may be designated as a "Relationship Banker II" or a similar title, with a corresponding bump in base pay.

- *Estimated Total Compensation: $65,000 - $90,000*

- 5-10+ Years (Senior/Expert): You are a top performer and a pillar of the branch. You likely manage a book of high-value clients and may have informal leadership responsibilities, mentoring junior bankers. Your understanding of complex financial situations is deep, and you navigate the bank's internal network with ease. Your name is synonymous with trust and results. At this level, particularly if you are licensed, your total compensation can consistently push past the $100,000 mark, with incentive pay potentially equaling or exceeding your base salary.

- *Estimated Total Compensation: $85,000 - $115,000+*

### `

` Geographic Location

Where you work is one of the most significant factors influencing your salary. Banks adjust their pay scales to account for vast differences in the cost of living and the competitiveness of the local labor market. A Relationship Banker in a major metropolitan hub will earn significantly more in base salary than one in a rural area to afford the higher cost of housing, transportation, and daily life.

Here’s a comparative look at estimated total compensation for a mid-career Relationship Banker across different U.S. cities, based on data from salary aggregators and cost-of-living adjustments:

| City/Region | Estimated Average Total Compensation | Commentary |

| :--- | :--- | :--- |

| New York, NY | $95,000 - $125,000+ | Very high cost of living and intense competition for talent drive salaries to the top of the national scale. |

| San Francisco, CA | $90,000 - $120,000+ | Similar to NYC, the Bay Area's high cost of living necessitates premium pay scales. |

| Chicago, IL | $75,000 - $100,000 | A major financial center with a lower cost of living than the coasts, offering strong salaries. |

| Dallas, TX | $70,000 - $95,000 | A rapidly growing business hub with a strong demand for banking professionals and a moderate cost of living. |

| Atlanta, GA | $68,000 - $90,000 | A key regional financial center in the Southeast with competitive salaries. |

| Phoenix, AZ | $65,000 - $88,000 | Reflects a market with a growing population and a moderate cost of living. |

| Rural Midwest/South | $55,000 - $75,000 | Lower cost of living and less competition for roles result in salaries that are closer to the lower end of the national average. |

When considering a job offer, it's essential to analyze the salary in the context of the local cost of living. A higher salary in New York City might not provide the same quality of life as a slightly lower salary in Dallas.

### `

` Company Type & Size

While this article focuses on Chase, a large national bank, it's useful to understand how compensation can differ across the banking landscape.

- Large National Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These institutions typically offer the highest potential for total compensation. They have the resources for higher base salaries, sophisticated and potentially lucrative incentive plans, and comprehensive benefits packages. They also offer structured career paths and significant opportunities for internal mobility. The trade-off can be higher pressure, more bureaucracy, and very specific sales targets.

- Regional and Community Banks: These smaller banks may offer slightly lower base salaries and less aggressive bonus structures. However, they can provide a better work-life balance, a more intimate and collaborative company culture, and a stronger connection to the local community. The role might be broader, with less specialization.

- Credit Unions: As non-profit, member-owned institutions, credit unions often have a culture that is more focused on service than on high-pressure sales. Compensation may be more heavily weighted towards base salary, with more modest incentive plans. The benefits and work environment are often highly rated by employees.

### `

` Area of Specialization

Within the broader "Relationship Banker" title, opportunities to specialize can lead to higher pay. This isn't about formal titles as much as it is about the client segment you focus on.

- Small Business Focus: Some Relationship Bankers develop a niche in serving small business owners. They become experts in business checking accounts, merchant services (payment processing), business credit cards, and SBA loans. Given that business clients can be highly profitable, excelling in this area often leads to higher incentive pay. This can be a direct stepping stone to a Business Relationship Manager role, which carries a significantly higher salary.

- Affluent Client Focus: At some branches, certain Relationship Bankers are designated to work with "mass affluent" clients (e.g., those with $100,000 - $250,000 in investable assets). This requires a higher level of financial acumen and often involves more referrals for managed money and wealth planning. Success with this client base is highly rewarded and is the primary pathway to becoming a Private Client Banker or Financial Advisor.

- Mortgage Expertise: A Relationship Banker who becomes the branch's go-to expert for mortgage questions and generates a high volume of quality lending referrals will see a direct positive impact on their incentive pay.

### `

` In-Demand Skills

Beyond your degrees and licenses, a specific set of skills will make you a more effective—and thus, a better-paid—Relationship Banker.

Hard Skills:

- Financial Acumen: The ability to read and understand financial statements, calculate loan payments, and explain the features and benefits of complex investment products.

- CRM Software Proficiency: Expertise in using platforms like Salesforce to manage client relationships, track interactions, and identify opportunities.

- Digital Literacy: The ability to confidently guide clients through the bank's online and mobile banking platforms, as this is a key strategic priority for all major banks.

Soft Skills (The Real Differentiators):

- Relationship Building & Empathy: The ability to build genuine rapport and trust with clients from all walks of life. This is the absolute core of the role.

- Needs-Based Selling: Moving beyond pushing products to a consultative approach where you listen first, understand the client's life goals, and then connect them to the right solutions.

- Communication Skills: The ability to explain complex financial topics in simple, clear, and compelling language. This includes both verbal and written communication.

- Resilience and Persistence: The ability to handle rejection, stay motivated in the face of challenging goals, and maintain a positive attitude.

- Problem-Solving: A proactive and creative approach to resolving client issues, turning a negative experience into a positive, relationship-strengthening one.

Developing and demonstrating mastery of these skills will not only help you excel in your current role but will also make you a prime candidate for promotion and higher earnings.

Job Outlook and Career Growth for Relationship Bankers

Choosing a career is an investment in your future, so understanding its long-term viability is just as important as knowing the starting salary. The role of the Relationship Banker is currently at a fascinating and pivotal juncture, shaped by technological disruption and evolving customer expectations. While some aspects of traditional banking are shrinking, the advisory and relationship-management functions are becoming more critical than ever.

### Job Growth and Industry Outlook

The U.S. Bureau of Labor Statistics (BLS) provides projections for various occupations, and the most relevant categories for Relationship Bankers offer a nuanced picture. The role is a hybrid, blending elements of "Tellers," "Financial Services Sales Agents," and "Personal Financial Advisors."

- Tellers (SOC 43-3071): The BLS projects a 12% decline in employment for tellers from 2022 to 2032. This reflects the increasing consumer adoption of mobile and online banking for routine transactions.

- Personal Financial Advisors (SOC 13-2052): In stark contrast, the BLS projects a 13% growth for this profession, which is much faster than the average for all occupations. This indicates a strong and growing demand for personalized financial advice.

The future of the Relationship Banker lies in bridging this gap. As routine transactions become automated, the value of the physical bank branch and its staff is shifting decisively away from transaction processing and toward in-person, high-value advice and relationship management. Banks like Chase are re-imag