Introduction

In the intricate world of professional careers, the language of compensation can often feel like a code. You've landed a job offer, and the term "salaried" sounds fantastic—a stable, predictable paycheck. But then you see the words that follow: "non-exempt." Suddenly, clarity evaporates. Are you a salaried professional or an hourly worker? Do you get paid for that extra hour you stayed late to finish a project? This confusion is more than just a matter of semantics; it lies at the heart of your rights, your work-life balance, and your total earning potential. The national average base pay for roles often classified as salaried non-exempt, such as office managers or senior administrative assistants, can range from $55,000 to $75,000, with significant overtime potential on top of that.

I remember a mentee of mine, a brilliant junior graphic designer named Chloe, who accepted her first "salaried" job. For months, she worked 50-hour weeks, believing the long hours were just part of "paying her dues." It was only during a career coaching session that we dissected her employment agreement and realized she was classified as salaried non-exempt; she was owed hundreds of hours in back-paid overtime, a discovery that fundamentally changed her financial situation and her relationship with her employer. Her story underscores a critical truth: understanding your employment classification isn't just HR jargon—it's a cornerstone of professional self-advocacy.

This guide is designed to be your definitive resource for demystifying the "salaried non-exempt" classification. We will move beyond a simple definition to explore its practical implications for your paycheck, your career trajectory, and your legal rights. Whether you are an employee trying to understand your compensation, a manager classifying your team, or an aspiring professional evaluating an offer, this article will provide the clarity and confidence you need to navigate the modern workplace.

### Table of Contents

- [What Does Being Salaried Non-Exempt Actually Mean?](#what-does-being-salaried-non-exempt-actually-mean)

- [How Compensation Works for Salaried Non-Exempt Employees](#how-compensation-works-for-salaried-non-exempt-employees)

- [Key Factors That Determine and Influence Salaried Non-Exempt Status & Pay](#key-factors-that-determine-and-influence-salaried-non-exempt-status-pay)

- [Navigating Your Career as a Salaried Non-Exempt Employee](#navigating-your-career-as-a-salaried-non-exempt-employee)

- [Understanding Your Rights and Responsibilities](#understanding-your-rights-and-responsibilities)

- [Conclusion: Empowering Your Career Through Knowledge](#conclusion-empowering-your-career-through-knowledge)

What Does Being Salaried Non-Exempt Actually Mean?

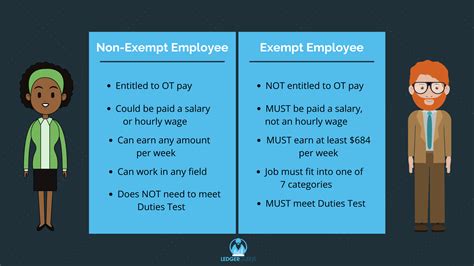

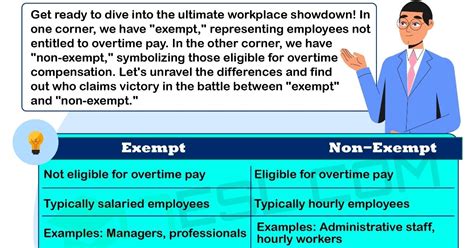

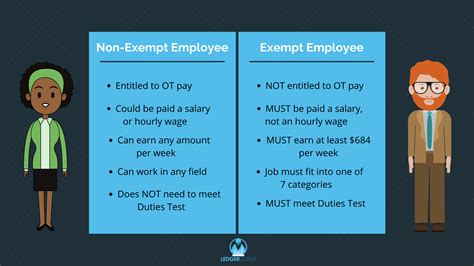

At its core, "salaried non-exempt" is a payroll classification, not a job title. It's a hybrid status defined by the U.S. Fair Labor Standards Act (FLSA), the federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards. To truly grasp its meaning, we must break down its two components: "salaried" and "non-exempt."

- Salaried: This refers to your method of payment. You receive a fixed, predetermined amount of money each pay period (e.g., weekly, bi-weekly). This base salary does not fluctuate based on the quantity or quality of your work in a given week, provided you work *any* part of that week. This offers predictability in your income, which is a key benefit.

- Non-Exempt: This is the crucial part that defines your rights. "Non-exempt" means you are not exempt from the overtime provisions of the FLSA. Consequently, your employer is legally required to pay you overtime, typically at a rate of 1.5 times your regular rate of pay, for all hours worked over 40 in a single workweek.

Therefore, a salaried non-exempt employee is someone who enjoys the stability of a regular salary but is also legally entitled to overtime pay. This status is designed to protect workers in roles that may not meet the specific criteria for being "exempt" from overtime law, ensuring they are fairly compensated for all hours worked.

To provide further clarity, let's compare the three primary employee classifications:

| Classification | Payment Method | Overtime Eligibility | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Salaried Exempt | Fixed salary | No. Not eligible for overtime pay. | Must meet specific "duties tests" and a minimum salary threshold set by the DOL. Typically senior, managerial, or specialized professional roles. |

| Salaried Non-Exempt | Fixed salary | Yes. Must be paid overtime for hours over 40 in a workweek. | Receives a base salary but does not meet the strict duties tests for exemption. Must track all hours worked. |

| Hourly Non-Exempt | Paid per hour worked | Yes. Must be paid overtime for hours over 40 in a workweek. | Paycheck is directly tied to the number of hours worked. Must track all hours worked. |

### A "Day in the Life" of a Salaried Non-Exempt Employee

To make this concept tangible, let's imagine a day in the life of "Alex," a salaried non-exempt Office Manager at a mid-sized tech company.

- 8:45 AM: Alex arrives at the office and clocks in using the company's digital timekeeping software. This is a critical step, as accurate hour-tracking is mandatory for non-exempt employees.

- 9:00 AM - 12:00 PM: The morning is busy. Alex coordinates with vendors for an upcoming office event, onboards a new hire, and manages inventory for office supplies.

- 12:00 PM - 1:00 PM: Alex clocks out for an uninterrupted one-hour lunch break. Per company policy (and many state laws), this break time is unpaid and he is not expected to check emails or perform any work.

- 1:00 PM - 5:30 PM: Alex clocks back in. An urgent request comes from the CEO to prepare presentation materials for a board meeting the next morning. This requires extra research and formatting.

- 5:30 PM: Alex realizes finishing the presentation will take another two hours. He sends a quick message to his manager: "FYI, I'll need to work until about 7:30 PM to finish the board presentation. I'll log the overtime." His manager approves.

- 7:30 PM: Alex finishes the task, ensures his digital timesheet accurately reflects a 10-hour workday (minus the 1-hour lunch), and clocks out.

The Paycheck Impact: Alex's base salary covers his first 40 hours of work that week. For the extra hours he worked on the presentation and other tasks, he will be paid at 1.5 times his "regular rate of pay." This provides a direct, tangible reward for his extra effort, unlike a salaried exempt colleague who might work the same extra hours with no change in pay.

How Compensation Works for Salaried Non-Exempt Employees

Understanding the compensation structure for a salaried non-exempt role is vital for accurately projecting your income and ensuring you are paid correctly. It’s more complex than a simple annual salary figure because of the overtime component.

The foundation of your pay is your base salary. This is the fixed amount you are guaranteed each pay period for a standard 40-hour workweek. However, your *total* compensation can vary significantly from one paycheck to the next depending on the hours you work.

### The Overtime Calculation: Your "Regular Rate of Pay"

The FLSA mandates that overtime be paid at 1.5 times the employee's "regular rate of pay." For a salaried non-exempt employee, this rate isn't simply the hourly equivalent of your salary. It must be calculated for each workweek.

Here’s the formula:

Total Weekly Compensation (Salary + Other Earnings) / Total Hours Worked = Regular Rate of Pay

Let's illustrate with an example:

- Employee: Jamie, a Salaried Non-Exempt Communications Specialist.

- Annual Salary: $62,400

- Weekly Salary: $62,400 / 52 weeks = $1,200 per week

Scenario 1: A Standard 40-Hour Week

Jamie works exactly 40 hours. Her paycheck for that week is her standard $1,200.

Scenario 2: An Overtime Week

A major product launch requires Jamie to work 50 hours in one week. Here’s how her pay is calculated:

1. Calculate the Regular Rate of Pay: Her base salary of $1,200 covers all 50 hours she worked.

- $1,200 / 50 hours = $24.00 per hour (This is her "regular rate of pay" for *this specific week*).

2. Calculate the Overtime Premium: The "premium" is the extra "half-time" pay she gets for the overtime hours, since the "straight-time" is already included in her salary.

- Overtime Hours: 50 hours worked - 40 hours standard = 10 overtime hours.

- Half-Time Premium Rate: $24.00 / 2 = $12.00 per hour.

- Total Overtime Premium Pay: 10 hours * $12.00/hour = $120.00.

3. Calculate Total Weekly Pay:

- Base Salary + Overtime Premium = Total Pay

- $1,200 + $120.00 = $1,320.00

In this week, Jamie earned an extra $120 for her additional work. This demonstrates how total cash compensation can be significantly higher than the base salary suggests.

### Common Job Titles and Salary Ranges

While "salaried non-exempt" is a classification, it is most common in certain types of roles. These are typically positions that require a high level of skill and responsibility but don't meet the specific managerial, administrative, or professional "duties tests" for exemption (which we will cover in the next section).

Here are some common salaried non-exempt job titles and their typical national average base salary ranges, according to recent data. Note that these figures represent the *base salary* and do not include potential overtime earnings.

| Job Title | Entry-Level (0-2 Yrs) | Mid-Career (5-9 Yrs) | Senior (15+ Yrs) | Data Source(s) |

| :--- | :--- | :--- | :--- | :--- |

| Executive Assistant | $50,000 - $65,000 | $68,000 - $85,000 | $90,000 - $115,000+ | Salary.com, Glassdoor (as of late 2023) |

| Office Manager | $48,000 - $60,000 | $62,000 - $78,000 | $80,000 - $95,000+ | Payscale, BLS (OES data for Admins) |

| Inside Sales Representative| $45,000 - $58,000 | $60,000 - $75,000 | $78,000 - $90,000+ | Glassdoor, Payscale (Note: Often includes commission) |

| Paralegal / Legal Assistant | $47,000 - $59,000 | $60,000 - $77,000 | $80,000 - $100,000+ | BLS, American Bar Association reports |

| IT Help Desk / Support (Tier 2/3) | $52,000 - $65,000 | $68,000 - $82,000 | $85,000 - $105,000+ | Robert Half Tech Salary Guide, Dice.com |

| Loan Officer / Processor | $42,000 - $55,000 | $60,000 - $80,000 | $85,000 - $110,000+ | BLS, Mortgage Bankers Association |

| Non-Supervisory Accountant| $55,000 - $68,000 | $70,000 - $88,000 | $90,000 - $110,000+ | AICPA, Robert Half Finance & Accounting |

*Disclaimer: Salary data is subject to frequent change and varies widely based on the factors discussed in the next section. The figures above are national averages intended for illustrative purposes.*

### Other Compensation Components

Beyond salary and overtime, salaried non-exempt employees are often eligible for the same benefits and bonus structures as their exempt counterparts. These can include:

- Bonuses: Discretionary bonuses, performance bonuses, or annual bonuses may be part of the compensation package. Important Note: Under the FLSA, non-discretionary bonuses (those promised based on achieving set metrics) must be included in the "regular rate of pay" calculation for overtime purposes, which can increase your overtime rate in the pay periods they are earned.

- Commissions: Common in inside sales roles, commissions are also typically included in the regular rate of pay calculation.

- Profit-Sharing: Some companies offer a share of company profits to employees, which can add a significant amount to total annual compensation.

- Benefits: These employees are almost always eligible for standard company benefits, including health, dental, and vision insurance; retirement plans like a 401(k) (often with a company match); paid time off (PTO); and paid holidays.

Key Factors That Determine and Influence Salaried Non-Exempt Status & Pay

The decision to classify an employee as salaried non-exempt versus salaried exempt is not arbitrary. It is a legal determination based on strict criteria set by the U.S. Department of Labor (DOL) under the FLSA. Understanding these factors is crucial for both employees who want to verify their status and employers who need to ensure compliance.

The classification hinges on three primary tests:

1. The Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work.

2. The Salary Level Test: The employee's salary must meet a minimum specified amount. As of January 1, 2020, the federal threshold is $684 per week (equivalent to $35,568 per year). Employees earning less than this are automatically non-exempt, regardless of their job duties. *Note: The DOL has proposed significant increases to this threshold, which could make millions more workers eligible for overtime in the near future.*

3. The Duties Test: This is the most complex factor. The employee’s specific, primary job duties must fit into one of the FLSA’s defined exemption categories. If an employee is paid above the salary threshold but their job duties do *not* align with these tests, they must be classified as non-exempt.

Let's explore the key factors that stem from these legal tests and influence both classification and pay.

### ### Level of Education and the "Learned Professional" Exemption

Education is a primary component of the Learned Professional Exemption. To qualify for this exemption, an employee's primary duty must be work requiring advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction.

- Impact on Classification: This typically means jobs that require a specific advanced degree are often exempt. For example, lawyers, doctors, certified public accountants (CPAs), and engineers usually fall under this exemption. A non-supervisory staff accountant with a bachelor's degree might be non-exempt, while a licensed CPA in the same company performing higher-level analysis could be exempt.

- Impact on Salary: The very nature of requiring an advanced degree (Master's, Ph.D., J.D., M.D.) commands a higher salary. The salary for a "Learned Professional" will almost always far exceed the minimum FLSA threshold. Certifications can also play a role. While a PMP (Project Management Professional) certification can boost pay, it doesn't automatically make a project coordinator exempt; their day-to-day duties are what matter. However, it can be a stepping stone to a truly exempt project manager role.

### ### Years of Experience and the "Executive" and "Administrative" Exemptions

Experience is a powerful driver of both responsibility and salary, and it directly correlates with two other major duties tests.

- The Executive Exemption: This applies to employees whose primary duty is managing the enterprise or a recognized department. They must customarily and regularly direct the work of at least two full-time employees and have the authority to hire, fire, or make influential recommendations on these matters.

- Salary Growth Trajectory: An entry-level team member will be non-exempt. After several years, they may be promoted to "Team Lead." At this point, they might still be non-exempt if their primary duty is still doing the work alongside the team. The promotion to "Manager," where their primary duty shifts to performance reviews, hiring, and strategic direction, is what triggers the potential move to exempt status. This promotion path directly correlates with significant salary increases. For example, a senior non-exempt IT support technician earning $90,000 might be promoted to an exempt IT Manager role earning $120,000.

- The Administrative Exemption: This is one of the most frequently misunderstood exemptions. It applies to employees whose primary duty is performing office or non-manual work directly related to the management or general business operations of the employer or its customers. Crucially, their duties must include the exercise of discretion and independent judgment with respect to matters of significance.

- Salary Growth Trajectory: An entry-level Administrative Assistant who schedules meetings and makes travel arrangements based on clear instructions is performing routine tasks and is correctly classified as non-exempt. An Executive Assistant to a C-suite leader, who manages complex calendars with competing priorities, prepares confidential reports, and makes independent decisions about vendor management, may qualify for the Administrative Exemption. This higher level of responsibility and judgment commands a higher salary. A non-exempt Administrative Assistant might earn $55,000, while the exempt Executive Assistant could earn $95,000 or more.

### ### Geographic Location

Location impacts both salary levels and the legal rules for classification.

- Salary Variation: A salaried non-exempt Paralegal in New York City or San Francisco can expect a significantly higher base salary than one in Omaha, Nebraska, due to vast differences in cost of living and market demand. According to Salary.com (as of late 2023), the median salary for a Paralegal II in NYC is around $81,000, while in Omaha it's closer to $64,000. This market-rate salary difference directly impacts the overtime rate.

- State-Level Laws: This is a critical factor. Many states have their own wage and hour laws that are more protective of employees than the federal FLSA.

- Higher Salary Thresholds: States like California, New York, and Washington have much higher minimum salary thresholds for an employee to be classified as exempt. For instance, in 2024, California's minimum salary for exemption is $66,560 per year, nearly double the federal level. An employee in California earning $50,000 is automatically non-exempt, no matter their job duties.

- Stricter Duties Tests: Some states have more rigorous definitions for the duties tests. California, for example, requires that an exempt employee spend more than 50% of their time performing exempt duties.

- Daily Overtime: Unlike the FLSA, which only mandates overtime for hours over 40 in a *week*, some states like California, Alaska, and Nevada require overtime pay for hours worked over 8 in a *day*. A salaried non-exempt employee in California who works a 10-hour day would be owed 2 hours of overtime, even if they only work 40 hours that week.

### ### Company Type & Size

The environment in which you work plays a significant role in compensation and classification practices.

- Startups: Early-stage startups may offer lower base salaries but supplement them with stock options. They may also be less experienced with proper FLSA classifications, sometimes misclassifying employees as exempt to avoid overtime costs—a significant compliance risk.

- Large Corporations (Fortune 500): These companies typically have very structured compensation bands and dedicated HR and legal departments that are meticulous about FLSA classifications. Salaries are often competitive, and benefits packages are robust. A salaried non-exempt role at a large corporation is likely to be clearly defined with strict time-tracking policies.

- Non-Profits: Non-profits often operate with tighter budgets, which can translate to lower base salaries compared to the for-profit sector. However, they may offer richer benefits in other areas, such as more generous paid time off.

- Government: Government roles (federal, state, and local) are known for their highly defined pay scales (like the GS scale for federal jobs) and transparent classification systems. While base salaries may sometimes lag behind the top-tier private sector, they often provide exceptional job security and benefits, including pensions.

### ### Area of Specialization (Industry)

The industry you work in is a massive determinant of pay for salaried non-exempt roles. An administrative professional's value—and thus their pay—is tied to the value of the industry they support.

- Technology & Finance: Salaried non-exempt roles in these high-paying sectors, such as an Executive Assistant supporting a tech CEO or a loan processor at an investment bank, will command top-dollar salaries due to the high-stakes, fast-paced nature of the work.

- Healthcare: With complex regulations and critical operations, experienced medical billing specialists or patient coordinators in a hospital setting (often salaried non-exempt) are valuable and compensated accordingly.

- Retail & Hospitality: These industries often have a higher proportion of non-exempt roles. While store managers may be exempt, assistant managers or department supervisors are often salaried non-exempt. Salaries in this sector are typically lower than in tech or finance.

- Manufacturing: Roles like production planners, logistics coordinators, and quality control technicians are frequently salaried non-exempt. Their pay is tied to the technical complexity of the products and the overall health of the manufacturing industry.

### ### In-Demand Skills That Increase Value

Even within a non-exempt classification, certain skills can dramatically increase your base salary and make you a more valuable employee. These skills often hint at your potential to eventually take on an exempt-level role.

- Advanced Software Proficiency: Mastery of complex software beyond the basic Microsoft Office suite—such as Salesforce (for sales ops), advanced Excel (VLOOKUP, pivot tables, macros), project management tools (Asana, Jira), or industry-specific ERP systems (SAP, Oracle)—can add thousands to your salary.

- Project Coordination & Management: The ability to independently manage small-to-medium-sized projects, track budgets, and coordinate between departments is highly valued and demonstrates a step towards administrative or executive exemption.

- Data Analysis & Reporting: Being able to not just pull data but also analyze it and create insightful reports for management shows a level of independent judgment that is highly compensated.

- Executive-Level Communication: The ability to draft clear, concise, and professional communications on behalf of senior leaders is a hallmark of top-tier executive assistants and communications specialists.

- Vendor Management & Negotiation: Experience in sourcing vendors, negotiating contracts, and managing relationships can directly save the company money and demonstrates significant business acumen.

Navigating Your Career as a Salaried Non-Exempt Employee

Being in a salaried non-exempt role is not a temporary layover or a "lesser" position; for many, it's a strategic and financially rewarding career choice. Understanding the landscape, including its growth potential and future trends, allows you to leverage this status to your advantage.

The U.S. Bureau of Labor Statistics (BLS) does not provide a job outlook for a "classification," but it does for the typical professions that fall under it. For example:

- Paralegals and Legal Assistants: Job growth is projected at 12% from 2021 to 2031, much faster than the average for all occupations. The demand for legal services drives this growth.

- Administrative Services and Facilities Managers: Projected growth is 7% from 2021 to 2031, about as fast as average.

- Bookkeeping, Accounting, and Auditing Clerks: This field is projected to see a decline of 5%, as technology and automation take over more routine tasks. This highlights the importance of upskilling.

These varying outlooks show that career growth depends entirely on the specific job function, not the pay classification itself.